The Weekly #236

Liquidity concerns upon a debt ceiling agreement may cause near-term headwinds but net positive growth of liquidity within the market cycle is around the corner - and that's all that matters.

Join the 1000’s founders, investors, crypto funds, brokerage firms, and developers in getting free cutting-edge crypto research by subscribing below:

All In Good Time

Another week, another period of chopping around without clear momentum. The crypto markets continue to show wait-and-see characteristics.

The MCAP index hovers around the $1.1T mark using previous support and nearer-term resistance. However, the broader uptrend is what matters more and allows for a 3-4% drop from here to still not invalidate the more general move.

BTC stays below $27k while ETH keeps above $1.8k.

Debt, Debt, Debt

With sideways action, not many crypto headlines are moving markets nowadays. If there’s one thing investors care about - it’s the debt ceiling.

After a negotiation walkout over the weekend, talks are poised to resume. A default is not necessarily a high-probability event but investors don’t like uncertainty.

Dollar weakness helped crypto (which can often trade as an anti-dollar market) until the end of March when things flipped…

We can see the same for Gold too…

Right now, crypto appears to be trading more like a commodity that may be more sensitive to higher real rates - inflation down, rates elevated.

Crypto’s lack of momentum illustrates that investors for the large part still de-emphasise disinflation signals (incl. base effect) while emphasising the need for higher rates for longer to ensure inflation doesn’t come back.

Zooming out though and we think the dollar’s move higher is merely a corrective move that coincides with more recent debt ceiling worry. Another factor to consider is the reduction of liquidity after a debt ceiling agreement is reached when the TGA starts re-stocking its general account.

Increased market liquidity has buoyed risk assets YTD as the Treasury General Account (TGA) has been drained. The treasury issuing more bills can pull cash out of the private sector and into the TGA.

Therefore, near-term headwinds for risk assets (incl. crypto) could mainly stem from this TGA refill effort. After all, liquidity is the single most important measure to analyze.

However, it’s not even clear whether the TGA re-stock may even be a net negative for liquidity. The reverse repurchase agreement facility (RRP) may drop if the Fed chooses to lower the rate so that the drain on private sector reserves is lower.

Even if the rate changes, the money fund’s tendency to keep cash in RRPs may persist. In any case, we don’t see the Treasury as restocking its cash balance too quickly as it monitors markets for potential stress.

Over an extended period (3-5 months), we see the liquidity headwinds being trumped by recession-induced rate cuts that coincide with inflation much closer to the Fed’s 2% target.

The US2Y yields remain below Fed funds by 60 BPS and continue to tick higher. The bond market is perceiving forward-looking inflation lower than the Fed.

So central bank dynamic seems clearer - the fight against inflation resolves as cracks in the financial system persist. The attention moves from price stability to financial stability.

Unemployment may also be moving in the Fed’s direction with jobless claims now rolling over. Next jobless claims will be released on the 25th May (Thursday) as investors look for further evidence of a broader momentum shift.

And all of this feeds back into liquidity. The ISM leads global liquidity by ~15 months where economic contraction will inevitably lead to central banks taking their foot off the brake…

Intra Crypto Market Signals

Regional bank indices (e.g. KRE) were overextended on the sell side. Yelle’s recent remarks on the need for further consolidation have paused the relief rally

Bitcoin dominance has remained the most sticky at the 47-49% zone since it became range-bound in May 2021. Dominance has recently strengthened in times of banking stress and the fractured regional bank industry may keep Bitcoin dominance elevated.

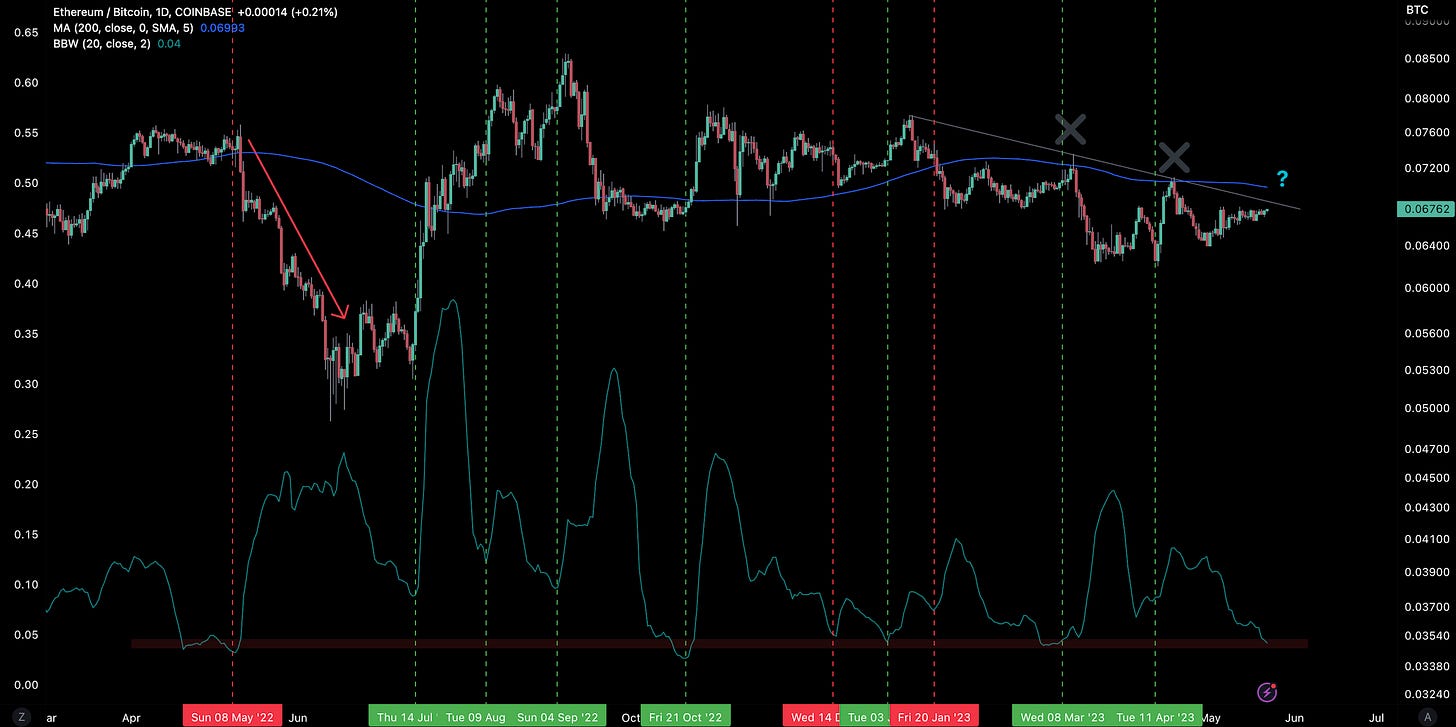

ETH has started to gain steam vs. BTC over the past week and eyes its 200d MA once again (which has previously been rejected YTD).

We expect a volatility spike within a week or two. We see this spike as being the 200d MA breakthrough or rejection and we place a higher probability on the latter if markets continue to consolidate in a more cautious environment.

Higher-risk areas in the market like DeFi have rejected their previous support and suggest the sector will continue to face material headwinds for the time being.

SOL looks broadly constructive with its 200d MA being used as support likely levelling out as SOL consolidates around $20-$22.

While SOL/BTC is still not out of the woods yet…

Performant thematic plays like liquid staking derivatives over the past few weeks (+21% LDO/USD vs. -2% ETH/USD) remain resilient and demonstrate these names don’t have to just be high beta plays for their respective L1.

We can also see the RPL/LDO ratio ticking higher when ETH rallies with RPL being a higher beta alternative to the more established higher cap name.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Revisiting Oracle Network Valuations

Thanks for reading Decentral Park Research! Subscribe for free to receive new posts and support my work. This article is an update on Oracle Network Valuations: The VSPT Ratio - first published on January 29th, 2022.

Global Market Cap

$1.09T; Markets are still within the uptrend YTD with dollar strength pulling MCAP index closer to support than resistance.

DeFi MCAP

$43B; DeFi sector remains above 200d MA and continues to oscillate around the $40-$50B mark.

Trader Positioning

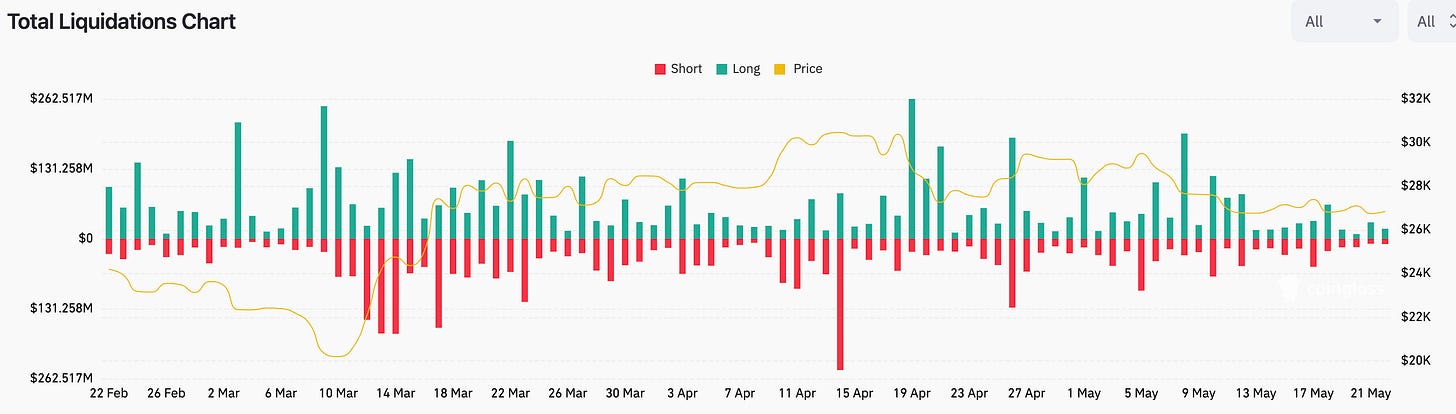

Funding rates remain positive indicating bullish positioning by traders overall despite BTC’s break of $26.7k on Monday.

Low nominal levels of liquidations over the past week.

Grayscale Trusts

GBTC discount to NAV ~41-42% as BTC consolidates below $30k. No specific catalyst for GBTC discount to narrow aside from broader spot action.

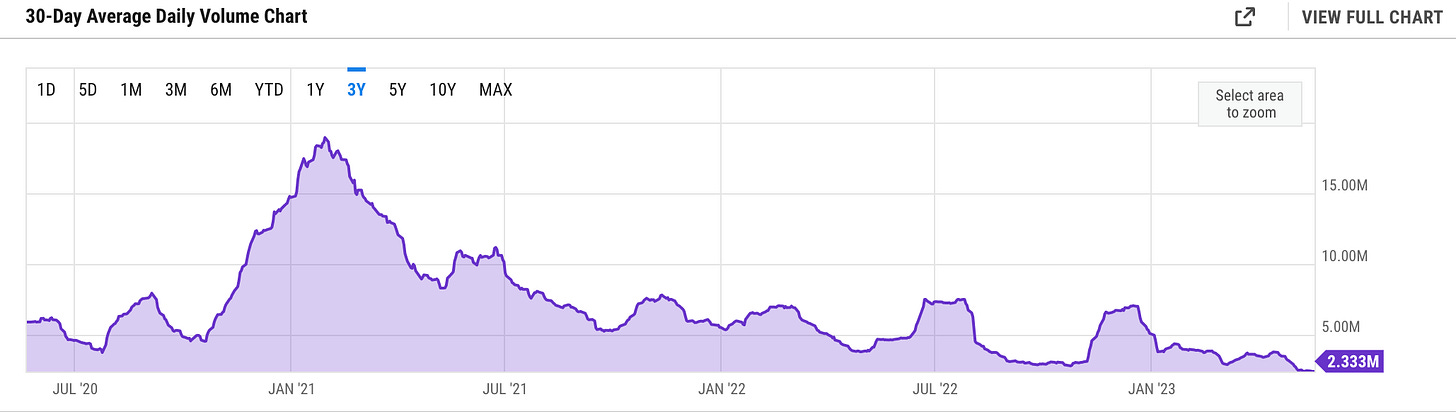

GBTC volumes (30D) are dropping to 3-year lows (2.3m) with little interest in the product by investors who do not want to take premium/discount risk on BTC.

ETHE’s discount to NAV also widening and is now at 53.23%. Same story as above with investors now possibly being able to trade an Ethereum futures ETF.

Grayscale’s Filecoin Trust (FILG) is trading at 2023 highs (207%) despite the SEC placing a security label on the FIL token.

BTC/USD Aggregate Order Books

Order books look slightly heavier on the bid side. Heavier resistance up to $27.6k.

Miners

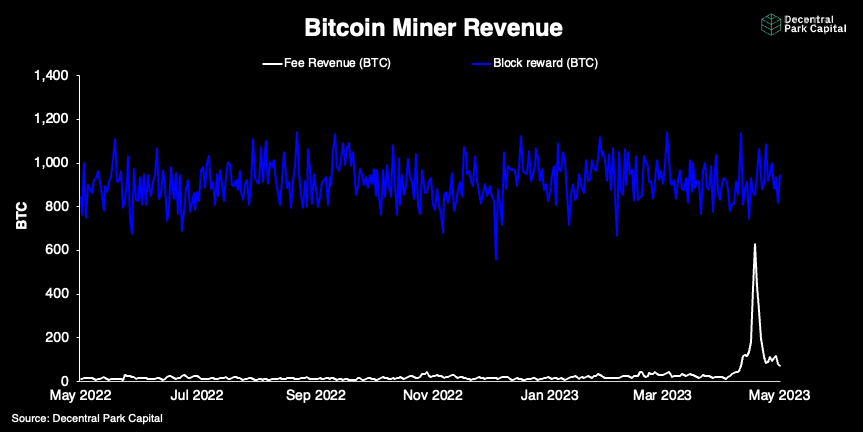

Bitcoin hash rate continues to edge higher once again (353m TH/s for 30d MA) with miners committing more resources to the network (+1% W).

Bitcoin miner revenue from fees peaked at 600+ but has since dropped off closer to the 1Y average.

The decline in miner fees excl. block rewards are due to the collapse in BRC-20 inscriptions over the past week, falling from 250 BTC/daily to <15/daily.

Last week, we forecasted a drop in activity due to it being the latest playground craze without clear paths to sustainability or for utility.

Miners have seen their non-issuance fees surge to $17.5m/daily due to on-chain activity relating to BRC-20s.

Bitcoin hashprice is rolling over after we believe was the peak in January 2023, marking the end of the miner capitulation cycle.

And the end of miner capitulation cycle is supportive of price action…

Render continues to leader the top-ranked cap names with the AI/rendering narrative keeping strong:

Top 100 (7d %):

Render (+32.2%)

Synthetix Network (+14.1%)

Tron (+11.1%)

XRP (+8.1%)

Injective (+7.5%)

Bottom Top 100 MCAPs (7d %):

Sui (-12.6%)

Toncoin (-9.7%)

Arbitrum (-7.7%)

Pepe (-7.6%)

Aptos (-7.5%)

> Why We Need a Digital Dollar [Bankless]

> Tokenizing Real-World Experiences [Between2Chains]

> From Compressed NFTs to the Saga Phone [Real Vision]

> Should Protocols Share Revenue With Token Holders [Bell Curve]

> Weekly Roundup 05/19/23 [On The Brink]

> Gemini Says DCG Missed $630M Genesis Loan Payment [Decrypt]

> Highlights from Bitcoin Miami [Ram Ahluwalia]

> Market Liquidity [Frank Chaparro]

> Vega Token Rallies Ahead of Protocol Possibly Going Live Monday [Coindesk]

> Starknet Token [ETH_Daily]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.