This article is an update on Oracle Network Valuations: The VSPT Ratio - first published on January 29th, 2022.

Last year, I published a novel oracle network valuation framework specific to the sector: The VSPT ratio.

Since its release, VSPT has helped shape the way we now understand, track, and analyze oracle networks within Web3 (DeFi Llama has since included total-value-secured (TVS) for Chainlink).

As a refresher, one of the most important valuation metrics for any oracle network is to measure the total value secured by its respective data feeds. The value of an oracle network should increase proportionally to the total value secured by its oracle feeds.

Joel Monegro’s work on valuing cryptonetwork governance as capital was invaluable in shaping this view. The value of Chainlink’s native cryptoasset, LINK, should, in theory, be driven by the value secured by its data feeds.

Put differently, the value of an oracle network should increase proportionally to the total value secured by its oracle feeds.

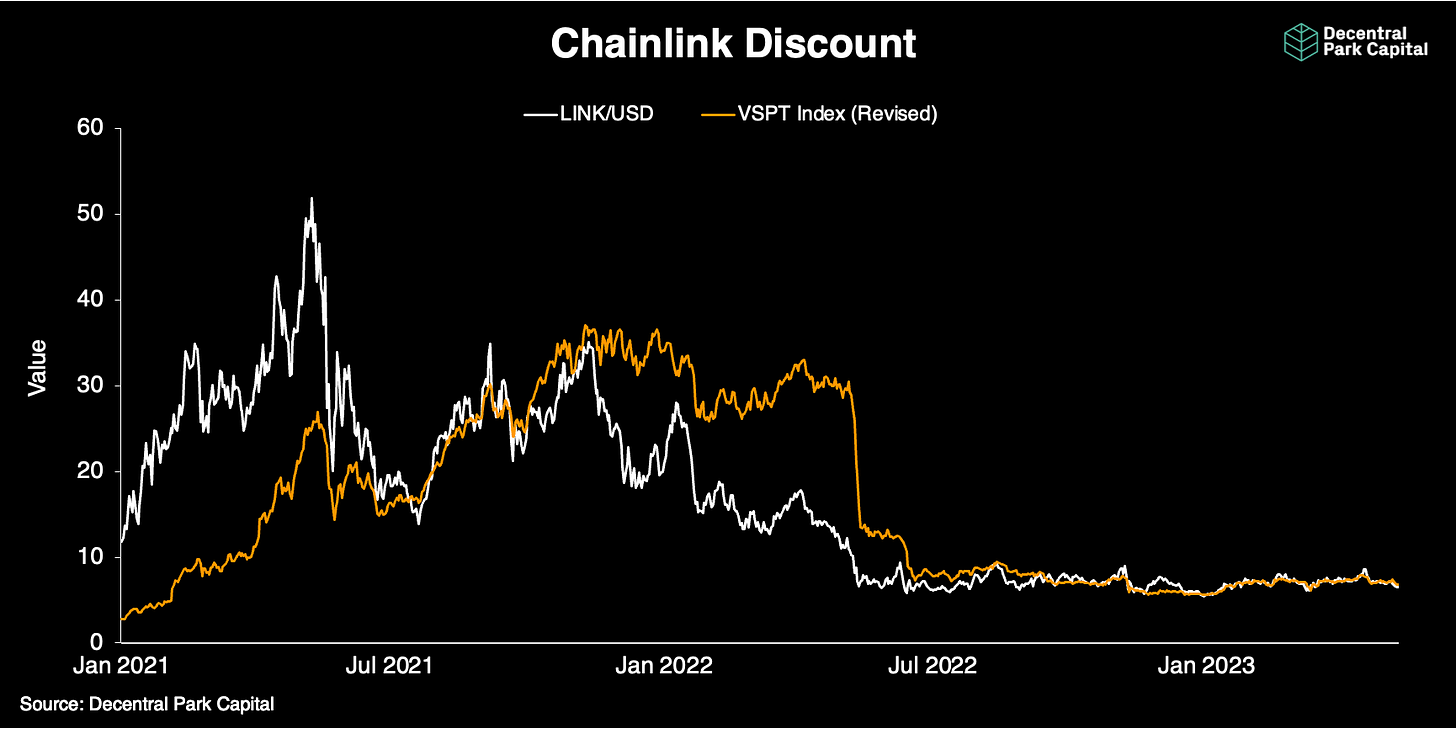

More than one year on and Chainlink’s VSPT Index has been tracking Chainlink’s market valuation poorly aside from the Q2 2021 period.

In the original essay, I noted LINK was trading at a ~40% discount to its VSPT fair market value which still stands true today.

This led me to consider whether the market would place a discount (not a premium) on the total value secured (VS) by its oracle feeds to price LINK.

It may not be the VSPT framework that’s invalid but rather how I understood the market to be using the valuation lens.

A discount factor (DF) was added to the original VSPT model:

Applying several discount factors to VSPT showed that a 40% discount factor (DF = 0.4) - the average discount since mid-2021 (i.e. network maturity) - tracked the market value of LINK more effectively.

Even with the discount, it appears LINK/USD still traded below its VSPT fair value by some margin during H1 2022.

After the collapse of Terra, 3AC, Celsius which help drove down the VSPT index settled in between the 7-8 mark.

Remarkably, LINK’s recovery off its 2022 summer bottom was able to use its north start (VSPT) to then start tracking once again as well as act as a reliant valuation ceiling for the token - LINK has since rarely traded above 100% of its VSPT value.

The number of days that LINK trades within either 10%, 5%, or 2% within its VSPT value has increased significantly compared to the legacy model…

Of course, with further market and network maturity, it remains to be seen over time whether a higher or lower discount factor will be used by the market.

On Blockchain Valuations

Join the 1000’s founders, investors, crypto funds, brokerage firms, and developers in getting free cutting-edge crypto research by subscribing below:Thanks for reading Decentral Park Research! Subscribe for free to receive new posts and support my work.

Oracle Networks As Beta Plays For DeFi

These more experimental models show that, just like DCF models needing to use discount rates to find the present value of expected future cash flows, the market may be starting to apply discounts to more crypto-specific valuation methodologies.

Again, the framing will likely differ between protocols depending on the network or sector in question. Do investors apply a discount to an insurance’s capital pool or active cover book depending on cover expiration dates?

Mature oracle networks like Chainlink are likely beta plays for the DeFi sector. The logic is simple: LINK tracks the value secured by its data feeds which (in part) can be driven by the performance of the DeFi sector more broadly.

It’s no surprise that Chainlink’s VSPT fair value tracks the DeFi market almost perfectly…

Many questions posed at the end of the original essay are still largely outstanding. For example, we have yet to find a way to effectively incorporate non-price-based data (e.g. verifiable random functions) in an oracle network valuation model.

New questions have since emerged too. Oracle-extractible value (OEV) is a framework whereby oracle networks extract value for themselves and their integrated dApps that would have otherwise gone to third parties.

Will OEV end up being an important input into the valuation model if extracted value ends up being a significant source of revenue?

However, with the full launch of alternative oracle networks like API3 in 2023, we should be able to start exploring these more effectively over the coming months and years.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.