Oracle Network Valuations: The VSPT Ratio

A new valuation framework for a critical market in Web3 (01/29/2022)

Relevant Materials

Exchange Token Valuations: The PA Ratio (Elias Simos)

The Current Oracle Landscape

At the highest level, oracles networks provide external data to blockchains. Solutions like Chainlink seek to decentralize the oracle layer by introducing a network of nodes that facilitate data transfers between off-chain data sources and smart contracts.

Blockchains rely on oracle networks to come to a deterministic value of truth from the outside world.

As we see in other parts of Web3 tech stack, oracle networks attempt to remove single and centralized points of failure. After all, using centralized oracles nullifies the advantages of smart contracts.

Therefore, oracles are both necessary and value accretive to blockchains longer-term. The scope of the endeavour is vital with whole markets like Decentralized Finance relying on this very construct.

Today, the oracle market is valued at $16.2B or just 0.9% of the global crypto market cap. Since September 2017, Chainlink has helped drive decentralized oracle networks forward and has been invaluable in attracting attention from investors and developers to the oracle problem.

However, there is still much more room for innovation with new entrants like API3, Pyth, and DIA coming to market.

On New Valuation Frameworks

With oracle networks and their respective market only becoming more valuable over time, there has been surprisingly little research on valuation methodologies applied to them. Attempts to analyze value drivers for oracle networks have included Metcalfe’s Law and two-factor models encompassing wider market dynamics.

While these have been useful initial valuation frameworks for oracle networks, such methodologies often fail to consider use case-specific drivers (e.g. oracle feed-based metrics).

One type of network within a niche may have idiosyncratic value drivers to another network within another niche.

Arguably, one of the most important idiosyncratic metrics for any oracle network is to measure the total value secured by its respective data feeds. The value of an oracle network should increase proportionally to the total value secured by its oracle feeds.

This is in line with viewing cryptonetwork governance as capital:

“The value of a system’s capital is proportional to the value of the resources it governs”.

Joel Monegro (2019)

For oracle networks, one definition of ‘governed resources’ can be the total value secured by data feeds. Although oracle networks don’t govern the value directly, the work performed by their node operators is indirectly governing value downstream. In other words, the reliability and usability of Web3 applications are dependent on the accuracy of the data they consume.

In most cases, ownership of a decentralized oracle network can be expressed through a native cryptoasset meaning changes in a network’s resource value (e.g. value secured) may be reflected in the underlying cryptoasset price by the market.

Introducing The VSPT Ratio

The VSPT ratio takes inspiration from Elias Simos’ research on Exchange Token Valuations (2020).

A ‘value secured per token’ (VSPT) ratio is presented as a new composite metric that ascribes a fair market value to an oracle network’s native cryptoasset.

The VSPT ratio considers the value secured by oracle feeds on a per-token basis. The VSPT ratio can be calculated as:

where VS (‘value secured’) equals the total value within an application that relies on an oracle network’s data feeds and t equals the total supply of the oracle network’s native cryptoasset.

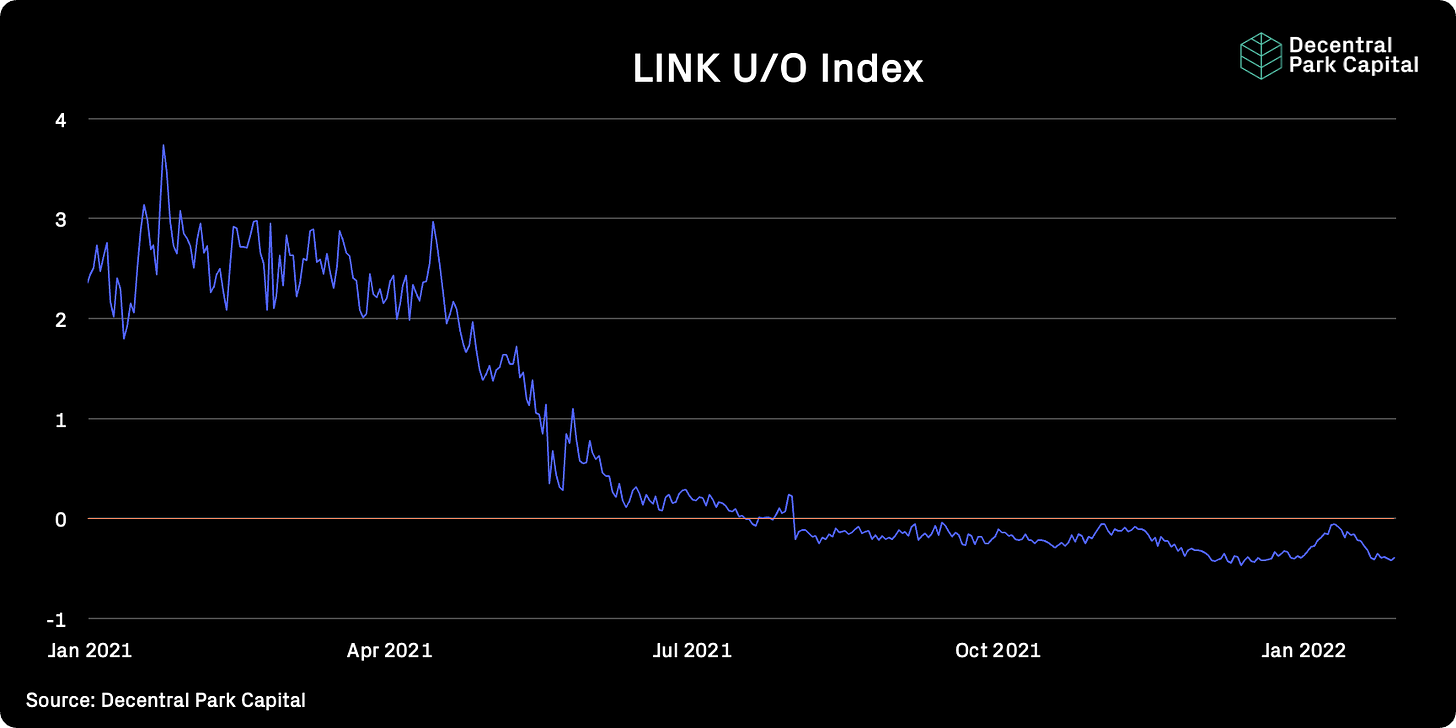

An undervalued/overvalued (U/O index) can then be constructed to compare the relative difference between the actual market value of the cryptoasset and its VSPT fair market value:

where a value of >0 may indicate an overvalued cryptoasset relative to its VSPT fair value and the opposite for values of <0 (i.e. negative).

Chainlink serves several protocols across a wide range of primitives including credit markets, stablecoins, and synthetics.

Each VS value may be calculated differently depending on the type of network in question. For example, an appropriate VS for a lending protocol may be the total credit market value reliant on oracle feeds. For stablecoin-centric protocol like Frax this might be the total monetary supply of the stablecoin itself (which sometimes relies on these data feeds to factor in peg dynamics).

Continued integrations with DeFi protocols in 2021 (e.g. Compound, Frax Finance, and Liquity) have led to accelerated VSPT growth over the years.

Until April 2021, LINK’s market value had been trading at a ~300-400% premium to the total value secured by its oracle feeds.

This may not be too surprising given that:

Chainlink network was still very much in its bootstrapping phase

Chainlink had garnered one of the strongest communities since its inception which has undeniably aided in putting oracles on the map for developers, investors, and users globally

However, as Chainlink has matured as a network, we see LINK market value and its VSPT have started to converge.

In July 2021, LINK traded below its VSPT fair value for the first time and since August 2021, has yet to trade back above it.

Plotting LINK’s U/O index shows the ratio of its market value and VSPT. Today, LINK trades at ~40% discount to its VSPT fair market value.

To understand why we now see this divergence, we can look to wider market dynamics. The week when LINK first traded below its VSPT ratio was the period when several DeFi asset prices fell relative hard relative to underlying fundamentals.

For example, using the APT ratio valuation methodology for lending protocols, we can see that large-cap DeFi names were printing record-breaking oversold signals (e.g. AAVE U/O -70% and COMP U/O -68%).

Therefore, LINK’s discount to its VSPT fair market value appears in line with other divergences seen across the market - fundamentals hold firm relative to price action.

These valuation methodologies would also imply asset prices have yet to catch up to their underlying fundamental growth.

Oracle Network TAMs Through The Lens of VSPT

As existing value within DeFi protocols grow and new protocols come to market, the TAM for oracle networks grows proportionally.

Note, this only accounts for endogenous value within crypto but oracle networks can equally provide value for the value that sits outside of crypto like Open Banking data.

If the total value overseen by oracle feeds is a value of driver oracle network valuations, one proxy measure for their TAM could simply be the total-value-locked (TVL) within DeFi. Today, over $188B is now contributed to DeFi protocols, showing an 8% average MoM growth over the past 6 months.

Through the lens of the VSPT ratio, it is important for oracle networks to service a meaningful portion of the value stored within the DeFi market.

At $188B, the implied TAM for oracle networks is already significant. Even if oracles is a winner-take-all market, it is unlikely that the leader services all value within DeFi.

One approach to evaluating the growth potential of emergent oracle networks is to assess their ability to service DeFi protocols across different TVL brackets.

Newer entrants within the oracle market will likely have to prove their price feed resilience and security with lower-tier protocols before servicing the higher-tier networks.

This still presents a great opportunity for those networks. Assuming a steady state, Oracle network data feeds can service value between ~$5-$16B for mid-tier protocols. At lower tiers, total value serviced is still ~$3-5B.

This is relatively high if you consider that soon-to-go-live oracle networks like API3 have valuations of less than $180m.

The implication is that if these early-stage oracle networks can capture a small segment of the lower-tier DeFi market, the accumulated value serviced by their oracle feeds would start driving clear quantifiable value to that network.

Through extensive testing and pure lindy effect, these new oracle networks can look to service higher-tier protocols over time.

Scratching The Surface

We are only beginning to understand how we apply fundamental valuation methodologies to oracle networks. However, much work is to be done.

Some key questions include:

How will protocol revenue/fee mechanics inform valuation methodologies for an oracle network?

How might VSPT apply for a first-party oracle solution vs. a third-party oracle solution?

How can oracle network valuations account for value not secured by price-based data feeds (e.g. banking credit scores or verifiable random functions)?

Will the market mature whereby it places a premium on the total value secured by its price feeds?

The VSPT ratio represents just one valuation framework for oracle networks and we look forward to seeing more complex valuation models develop over time.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.