Welcome to Decentral Park’s new research sub-newsletter: In The Weeds.

This weekly instalment will focus solely on key technical developments and themes within Web3, keeping you ahead of the game on upcoming trends.

Let’s get stuck into this week’s key highlights.

1: Shared Sequencer Sets

What is it? Validators are essential components of a blockchain. Native to proof-of-stake systems, validators are nodes responsible for storing data, processing transactions, and adding new blocks to the blockchain. Simply put, they verify blockchain data to ensure things are as the blockchain says they are.

Validators are typically utilized by layer 1 blockchains, while the nuanced network designs of rollups, such as Optimism, require them to leverage sequencers instead of validators. Much like a validator, sequencers process transactions and produce blocks for the rollup, but they also submit rollup transactions to the layer 1 blockchain.

As it stands, the majority of rollups use a single sequencer, meaning they are entirely dependent upon this single-source of block production. This is a major issue from a censorship resistance and decentralization standpoint, given the single-point of failure arising from this standalone sequencer.

Theoretically rollups could alleviate the risks associated with a single sequencer by expanding to a decentralized set of sequencers, though in reality the costs associated with this would push a rollup into similar territory to simply deploying a layer 1. This is not a practical solution given the vision of a vast ecosystem of specialized, sovereign rollups.

A solution that has surfaced in recent months is to leverage shared, aggregated sequencer sets. This is the idea that multiple rollups are able to share sequencer sets simultaneously, where sequencers are constantly producing blocks across every rollup leveraging the shared set.

Shared sequencer sets (SSSs) are enabled by running a middleware blockchain with a decentralized sequencer set that each rollup is able to plug into. This blockchain receives transactions from users across the associated rollups, and submits them to the settlement layer in a single batch.

What this blockchain wouldn’t do is perform state transitions, transaction processing and state proving mechanisms. Instead, these processes are handled post-settlement transaction submission by ‘lazy’ rollup full nodes.

Why is it important? SSSs are crucial to rollup decentralization. They enable the censorship resistant properties associated with a decentralized sequencer set, without the overhead requirements of bootstrapping a personal set.

More importantly though, SSSs actually reduce the technical burden of deploying a decentralized sovereign rollup, since rollup teams are able to plug directly into sequencer networks without the need to develop a sequencer in-house.

An implication of sharing block producers with an ecosystem of rollups is that it enables atomic cross-chain composability. While the possibilities of this haven’t yet been fully realized, a potential framework for this is to think of the benefits of Cosmos’ IBC. Atomic cross-chain composability has the potential to bring inherent cross-rollup communication and bridging capabilities in a fully trustless manner, given blocks across the chains are being produced simultaneously, and by the same machines.

Where does it go from here? SSSs are currently very much a work-in-progress, though has been gaining traction within research circles over the past few months. One project that has been vocal on the topic is Celestia which aims to ‘empower the social consensus of communities with the ability to create their own secure and sovereign blockchains’...Celestia shared-sequencer-as-a-service announcement inbound?!

Once live and practically implemented, the result seems obvious. Given SSSs enable trivial sovereign blockchain deployment in a decentralized manner, SSSs should result in further rollup deployment. This is just another piece in the ever-expanding puzzle that points towards future rollup growth.

An interesting angle to look at the future of SSSs from is to consider MEV. While SSSs can technically be separated from MEV given limited to no transaction ordering control, they do in fact have some influence over which transactions will be included in a block.

This opens up a host of MEV use cases specific to blockchain networks leveraging SSSs. Taking this a step further we could even see MEV product providers, such as Flashbots SUAVE and Skip Protocol launching their own SSS offerings, optimized from an MEV perspective.

You may remember in the first ever ‘In the Weeds’ we touched on distributed validator technology. This being technology that allows a validator to be run across one or more distributed nodes.

While still likely a long way out, this concept could theoretically be applied directly to SSSs, in which sequencers are not only shared across rollups, but also distributed across hardware machines, further enhancing decentralization while reducing risks associated with non-distributed technologies.

A prediction from the Decentral Park team is that we will see Distributed Shared Sequencer Technology (DSST) within 24 months.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

2: OPStack

What is it? On the day that the Optimism Foundation has formally proposed Bedrock as the first upgrade to the Optimism Collective, and having introduced the modular blockchain thesis in last weeks ‘In the Weeds’, it seems appropriate to dive into the culmination of these two topics: OPStack.

OPStack can be thought of as Optimism’s future. It is a modular, open-source architecture for highly scalable, highly interoperable blockchains. By blockchains this refers to all blockchain designs, not just rollups, and certainly not just optimistic rollups. Given OPStack is open-sourced, it will materially reduce the friction associated with deploying one’s own blockchain.

Now you may initially be thinking, why does Optimism wish to create a blueprint for deploying modular blockchains? Isn’t that just creating further competition for Optimism itself? The answer is simple, these modular blockchains will sit on the layer above Optimism. If you think of these networks as a stack, a settlement layer, or layer 1 such as Ethereum, lays the foundations.

Upon that sits the rollup, in this case Optimism, which acts as the layer 2. OPStack enables the development of app-chains, or as Optimism calls them ‘Op-chains’, which sit on top of Optimism as layer 3s. These Op-chains will be highly specialized, application-specific chains.

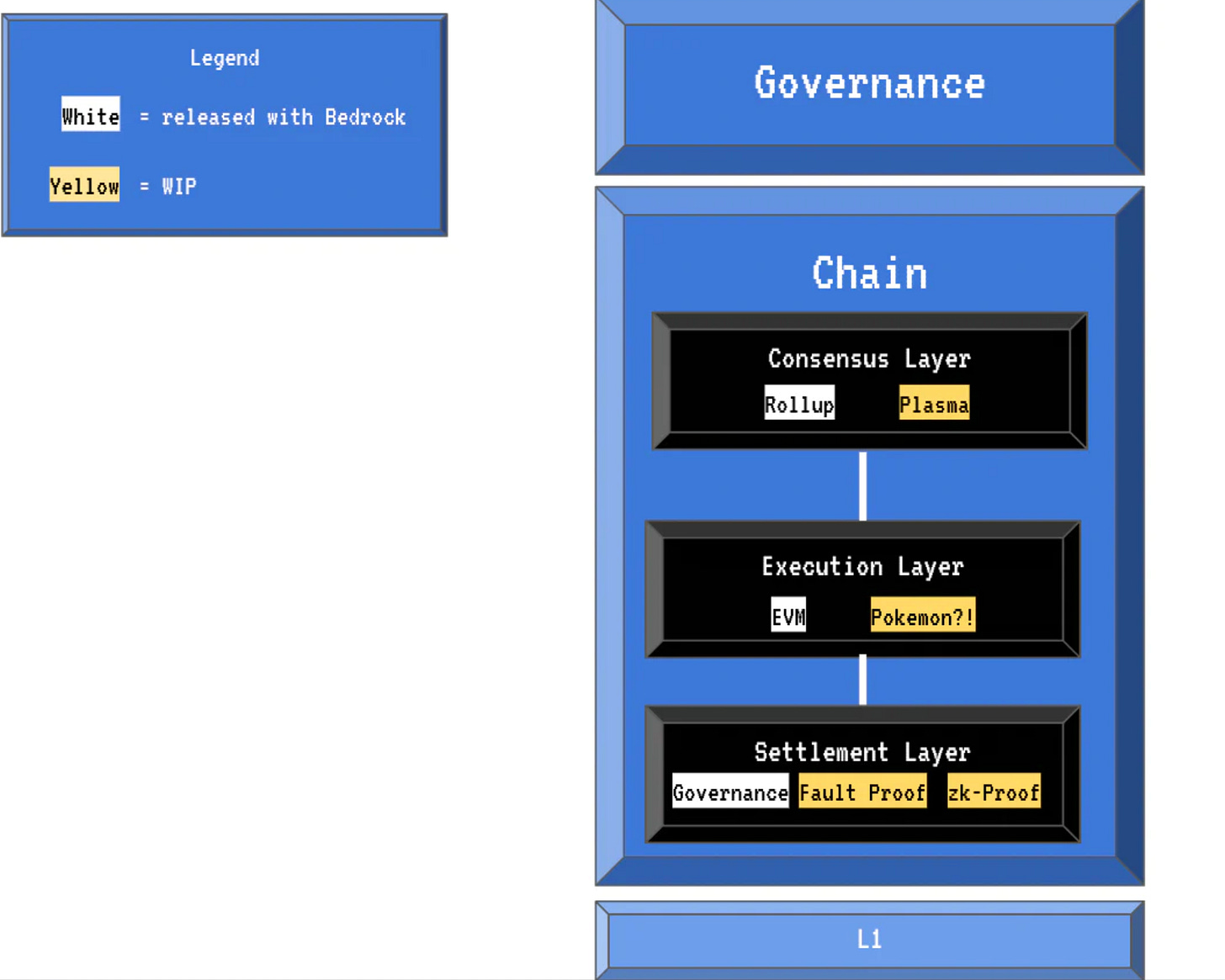

So, OPStack is essentially a code base powering the development of Optimism’s next-generation architecture. Given its modular nature, OPStack is separated into three components: consensus, execution and settlement. Each of these modules work coherently to form op-chains.

The beauty of OPStack is revealed when looking at its composability. We’re not quite talking about Cosmos’ full-stack level of composability, but this does mean that existing modules can be modified, or entirely new modules can be created according to the needs of each specific Op-chain. For example, an Op-chain could leverage Celestia as a data availability layer, or even Bitcoin as an execution layer!

Why is it important? The OPStack is important because it can be seen as a strategy to future-proof the Optimism ecosystem. OPStack essentially positions itself as settlement layer agnostic, via the abstraction of the proof layer when settling funds onto another chain. In no way does this mean that Optimism is moving away from its Ethereum-based roots, but rather that it is expanding its core offering.

If successfully implemented, this could theoretically see Optimism become an aggregator ecosystem, in which settlement layers are aggregated up to one highly integrated network of Op-chains, optimized for user experience in each specialized modular-blockchain. Optimism refers to this as the ‘Superchain’.

Further to this, the Superchain inherently offers a shared message-passing format that enables these Op-chains to communicate without the need for custom adapters. This is akin to an Optimism-native IBC protocol.

How is this achieved? You guessed it…shared sequencer sets. Shared sequencer sets enable atomic cross-chain composability, since the sequencers produce blocks on multiple chains at the same time. This completely dissolves the boundaries between Op-chains, with the result being a user-experience that feels like a single logical chain, the Superchain.

Where does it go from here? As it currency stands OPStack is still very much in its early stages. However, the introduction of the bedrock proposal signals that OPStack development could be ramping up over the coming months. Eventually, the Bedrock codebase will be completely refined into an OPStack release.

To date, Optimism is the most forked optimistic rollup, with Metis and Boba Network both basing their codebase on that of Optimism. This trend is expected to continue as Optimism continues to innovate, and is strengthened by Optimism pledging to open-source the OPStack in an attempt to incentivise developer activity.

Fundamentally, the act of open-sourcing code undeniably encourages an army of developers to build within an ecosystem, and should result in continuous forking and reinstating of modular-blockchains on top of Optimism's layer 2.

What’s interesting about this is that it could create a liquidity moat dynamic in which use cases and value floods to the Optimism ecosystem, and an aversion to venture outside of the Superchain’s inherent atomic cross-chain composability bridging system retains this value.

The full release of the OPStack will trigger an explosion of Op-chains and kick start the aggregation of settlement layers.

3: Lens Protocol: On-Chain Social Blueprint

What is it? The application layer of blockchains is currently dominated by DeFi offerings and NFT platforms. One growing sub-sector that is often overlooked however, is that of on-chain messaging and social media. Decentral Park covered on-chain social graphs in the second instalment of In the Weeds’ with Skiff Protocol, but there is far more to be explored within this sub-sector within Web3.

Fully on-chain messaging and social media has a distinct advantage over the platforms used today within the web2 world, communication is inherently cryptographically encoded and self-custodied by storing messaging history directly within wallets, with no need for third-party storage solutions.

On-chain messaging is a huge value-add, not just for retail, but also for professional use cases. Considering further the concept of combining on-chain messaging and social with transactions breeds a host of potential use cases, such as on-chain verbal negotiation and reconciliation services.

Lens Protocol, produced by the same team that brought us the DeFi blue-chip Aave, is a permissionless, composable and decentralized social graph enabling the development of on-chain social media applications.

Social graph refers to the fact that Lens has produced the underlying tooling, i.e. likes, profiles etc., that developers can leverage out-of-the-box to develop social media applications.

To date, the most successful applications built upon Lens Protocol include Lenster, which can be thought of as a decentralized Twitter and Lenstube, which can be thought of as a decentralized YouTube. Interestingly though, we’ve seen mobile-first applications developed in the past few months, with the introduction of Orb, a mobile-first decentralized Twitter, and Lensta, a mobile-first decentralized Instagram.

Why is it important? The importance of Lens Protocol as the leading on-chain messaging and social protocol can be rolled up into the importance of the sub-sector as a whole.

The first piece to explore here is onboarding. As it stands, onboarding users to web3 is difficult since it requires an initial financial commitment. Be that purchasing assets to participate in governance or community, either governance tokens or NFTs, or purchasing assets to pay for transaction fees.The bottom line is that requiring financial commitment deters potential users.

On-chain messaging and social media platforms represent a path by which a user’s first interaction with web3 can be social, and importantly, require no financial commitment. This has the potential to incentivise a vastly wider audience to utilize web3. Of course, once users have entered there is a direct route to them feeling more comfortable utilizing financial services on-chain.

Secondly, and more specific to messaging and social media, Lens Protocol’s profile architecture gives content and community ownership back to the users. The result is a censorship-resistant communication channel between users and content creators. The implications for news delivery and community management are enormous once this censorship threat is removed.

Where does it go from here? Lens Protocol has seen extreme growth since exception, having reached over 100k registered profiles and consistent month-over-month user engagement growth. This is due in part to the questions that arose from the ‘Twitter Files’ drama, but also due to the commitment of the Lens Protocol grant system to incentivise use case development.

It is expected that use cases on Lens continue to expand rapidly over the coming 12 months, driven by their open-sourced code base, easy-to-use API and generous grant system. A prediction from Decentral Park is that Lens use cases will continue to grow towards catering for web2 user wants by expanding their mobile-first product offerings.

Looking further ahead, it’s clear that privacy will be paramount for use cases beyond social media. Leveraging technologies such as zero-knowledge cryptographic encodings will be required to develop use cases in professional capacities and realize the ultimate potential of on-chain messaging and social.

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.