Welcome to Decentral Park’s new research sub-newsletter: In The Weeds.

This weekly instalment will focus solely on key technical developments and themes within Web3, keeping you ahead of the game on upcoming trends.

So, without further ado, let's get stuck in!

1: Avalanche Warp Messaging

What is it?: Subnets on Avalanche are a dynamic subset of Avalanche validators that reach consensus on their own blockchain(s) with customisable rules regarding membership and tokenomics. The best way to think about this is a ‘blockchain-as-a-service’ offering.

On the 22nd of December ‘Banff 5’ went live, Avalanche’s software upgrade that introduced Avalanche Warp Messaging (AWM), a seamless native communication protocol that allows subnets to communicate and share data with each other, including the transfer of assets.

AWM is akin to the Cosmos Hub’s Inter-Blockchain Communication (IBC) Protocol and dramatically enhances the Avalanche app-chain ecosystem.

Why is it important?: Prior to the introduction of AWM, subnet interoperability was facilitated by complex bridge systems, susceptible to hacks. In 2022 alone, the five largest bridge hacks within the entire crypto space exceeded $1.4B.

Relying on trusted bridging systems heavily disincentives the flow of liquidity between subnets. Trustless interoperability between subnets, in the form of AWM, is crucial as it removes the bottlenecks of fragmented liquidity within the subnet ecosystem.

With this in mind, to-date the value-add of subnets has been somewhat irrelevant. Full subnet customizability (albeit a highly compelling feature) seems pointless if users are deterred by complex bridging systems, rendering the assets on the subnet isolated. AWM makes the value-add of these subnets usable, in the same way that IBC did for Cosmos-based app-chains.

Arguably, the introduction of AWM places Avalanche as a competitor to Cosmos. Both chains have fully customizable app-chain-like offerings, are Rust language enabled, and have ties to the EVM (Avalanche C-chain forked the Ethereum Geth client to add EVM support).

This is not to be downplayed. In a world where alternative blockchains generally compete on TPS and gas fees, those with genuine and usable value-adds that the king (Ethereum) can’t currently offer have a real shot at capital and user activity accrual. Both Avalanche and Cosmos are examples of such networks, with their fully customisable parameters and rulesets.

Where does it go from here?: Rust developers have been migrating from the Solana ecosystem given recent events, landing in alternative Rust ecosystems such as NEAR and Kusama. I believe that the introduction of AWM is sufficient incentive for Rust developers to explore Avalanche subnets, and that we will see an explosion of various subnet use cases: DEXs, lending protocols, cross-chain staking protocols.

These subnets will consist of new protocols, existing Avalanche-based protocols, and existing protocols across the broader ecosystem deploying to Avalanche. The bottom line being that high-quality use cases attract users and capital.

Given AWM enables new use cases, I also believe we’ll see a wave of innovation within the Avalanche ecosystem. We can look to the Cosmos ecosystem for inspiration here, such as cross-chain staking solutions like Stride, MEV products like Skip Protocol, or data availability solutions such as Laconic Network.

AWM also strengthens Avalanche’s case for being included within the modular blockchain conversation. Subnets could theoretically facilitate the execution/settlement layer of a modular blockchain, while data availability and consensus are facilitated elsewhere.

Topic 2: Distributed Validator Technology

What is it?: If you’ve been paying attention to Vitalik’s Ethereum roadmap updates, you would have noticed that ‘The Merge’ segment sees the completed merge succeeded by both ‘withdrawals’ and ‘distributed validators’. Withdrawals are receiving due attention, with a pencilled-in date of March, but what does ‘distributed validators’ refer to?

Distributed validator technology (DVT) allows an Ethereum validator to be run on one or more node. This essentially takes the current model of one node equaling one validator, and splits it across a cluster of nodes that act together as a single validator. Each node holds a share of the complete validator key, though the full validator key never exists on a single node at any one time.

Each node within the cluster attests using their key share to generate partial BLS attestations. If a threshold of active validator nodes is met, the cluster will attest as a full validator. This means the cluster will operate as a full validator even in the event that several nodes go offline, so long as a sufficient number of nodes are active to pass a predetermined threshold.

Why is it important?: The overarching reason that DVT is important is that single-node validators create single points of failure within blockchain consensus layers. Removing these single points of failure ultimately enhances the stability of a network.

DVT mitigates the risks associated with hardware. Anyone who’s dealt with node hardware knows it isn’t perfect, and there are a host of reasons why validators could unexpectedly go offline. In a single-node validator world, this equates to missing rewards and lower network stability, but in a DVT world, this risk is negligible.

To avoid the downtime associated with hardware issues select validators run active-passive setups, in which a backup node kicks in to replace any faulty node. This has occasionally led to double attestation, resulting in validators being slashed. DVT removes the need to run active-passive setups and materially reduces slashing risks.

Validator hot keys stored on a single-node validator are vulnerable through a single attack route, meaning if the single node is compromised, the entire validator and its 32ETH stake is compromised. DVT on the other hand requires compromising all nodes within a DVT cluster. Depending on geographical and technical distribution, this makes hot key compromisation theoretically magnitudes more difficult.

From a community and home-staking perspective, DVT is essential. In a DVT-enabled world, multiple nodes are able to pool assets in a trustless manner, facilitating a higher home-staking participation rate through the reduced financial barrier to entry.

This barrier has of course been removed by liquid staking derivative providers, though home-staking enables the ultimate level of decentralisation, and maximises staking rewards. DVT further enhances home-staking participation by removing the technical fear of validators going offline or being slashed in the event home node hardware fails.

DVT will also solve issues with stake centralisation within liquid staking protocols, as well as diversification issues associated with client types on validators. The importance of DVT impacts all validator types: institutional validators, liquid staking protocols, community validators, and solo validators.

Where does it go from here?: Liquid staking protocols already have DVT on their radar, with Lido conducting an initial pilot integration on testnet alongside SSV Network. I believe that over the coming 12 months we will see the major liquid staking providers adopt DVT for at least 25% of their validators within the Ethereum network.

The stigma around home-staking for non-technical people will likely act as a headwind for the adoption of retail, non-liquid staking provider-led, DVT use. Institutional staking on the hand is a prime candidate for DVT. Regulatory-compliant DVT clusters could ultimately dominate the validator makeup of the Ethereum network once regulatory clarity is achieved, though this is likely a long way off.

It seems inevitable to me that we’ll see the development of DVT providers outside of the Ethereum network.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Topic 3: Account Abstraction

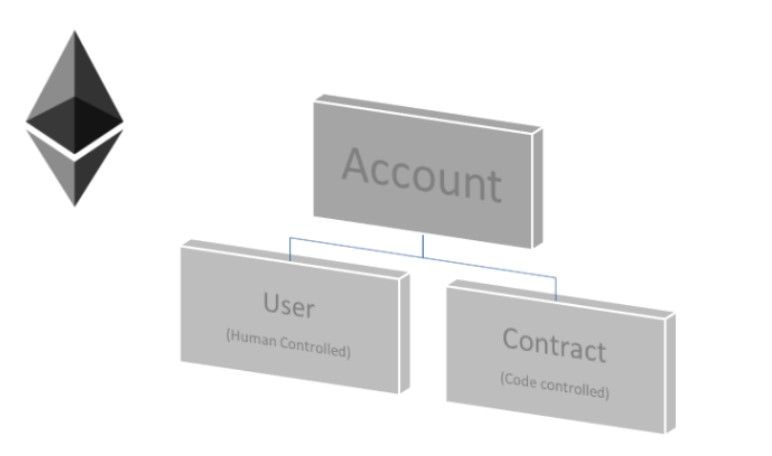

What is it?: The majority of wallets used on Ethereum today are Externally Owned Accounts (EOAs), meaning they're controlled by a private key alone. The key is the account.

Account abstraction (AA) essentially turns a wallet into a smart contract that can be programmed by logical code, in just the same way a traditional smart contract can be. This can be thought of as a bank account that it will perform actions for you, for example, paying your bills to specific vendors on a specific date, or limiting your spending at specific vendors within a prespecified timeframe.

AA has been implemented on select Ethereum L2s, such as zkSync and StarkNet, and has certain features that are inherent to Cosmos wallets. Note also that some protocols such as Safe have roadmaps that aim to facilitate the features of AA.

Why is it important?: AA facilitates two enhancements to both user experience and security. User experience has always been crypto’s crux, and unfortunately, it remains poor to this day. The wallet experience is a key part of that problem.

Embedding custom logic within the wallet creates a myriad of use cases. These use cases mitigate the friction points that lead to this poor wallet UX by automating repetitive, laborious processes. Examples include batching and automating signing so users don't have to keep signing the same transaction, integrating automatic asset swaps to enable the payment of gas fees in any asset, or automating transactions when predetermined conditions have been met.

From a security perspective, we can leverage this custom logic to minimise unwanted transactions. For example, wallets could authorise isolated keys to sign transactions on specific devices, which will be particularly important as crypto moves to a mobile-first environment. These keys could be set to only transact up to certain values, or only allow interaction with certain contracts/functions. AA also utilizes social recovery by default, a wallet recovery method that leverages other Ethereum accounts you trust without needing seed phrases or centralisation.

Where does it go from here?: The use cases that AA unlocks are endless and will seep into all corners of web3. To this end, I expect as AA wallets become the new norm, we will see an explosion of innovative applications in all AA-enabled ecosystems.

More importantly, I am of the opinion that improving UX to give protocols a familiar web2 feel, amongst other contributors, will play a key role in ultimately onboarding users to the space.

If this is true, then it seems the blockchains utilizing AA, such as zkSync and StarkNet, have a competitive advantage in the near term from a use-case perspective. Note also that blockchains such as Cosmos have built-in features of AA, such as the ability to automate transactions based on predetermined conditions. I expect that ultimately all networks will be forced to implement a variation of AA that enables custom logic within wallets.

DISCLAIMER: This does not constitute legal, tax, or accounting advice of any kind and should not be relied upon as such. All links are open source and property of the respective creator, not the author of this material. This is for discussion purposes only. You should consult your own legal counsel and independent advisors with respect to any and all matters. The ideas and concepts are presented here by the author and are views of his own and not that of any other person or entity.

Although the material contained in this material was prepared based on information from public and private sources that the author believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and the author who prepared this material and the information herein expressly disclaim any liability for the accuracy and completeness of information contained in this material.

This material is distributed for general informational and educational purposes only and is not intended to constitute investment advice. The information, opinions and views contained herein have not been tailored to the investment objectives of any one individual, are current only as of the date hereof and may be subject to change at any time without prior notice. Nothing contained in this material should be construed as investment advice. Any reference to an asset’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal objectives, needs and risk tolerance. The author who prepared this material and the information herein expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.

The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any assets or securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service.