In The Weeds #4

Why you should care about interchain security, the modular blockchain thesis, and data availability.

Welcome to Decentral Park’s new research sub-newsletter: In The Weeds.

This weekly instalment will focus solely on key technical developments and themes within Web3, keeping you ahead of the game on upcoming trends.

Let’s get stuck into this week’s key highlights.

1: Interchain Security (ICS)

What is it?: Cosmos itself is not a blockchain, but rather a blueprint for deploying application-specific blockchains, dubbed Zones. Over the past year, Cosmos has cemented itself as the leading application-specific blockchain platform, with individual chains such as Osmosis climbing into the top 15 chains by TVL. Cosmos’ success stems from its ability to provide superior scalability, configurability, and sovereign offerings within its application-specific chains to simply deploying a dApp on a smart contract platform such as Ethereum.

Historically, Cosmos chains have been required to generate a valuable staking token, and distributed validator set in order to secure their own sovereign app-chain. As the number of application-specific blockchains within the Cosmos ecosystem continues to grow, securing each blockchain becomes increasingly challenging. In order to grow its ecosystem, Cosmos needed to implement the concept of shared security, that being the ability to secure multiple execution environments with a single, shared validator set.

The solution to this issue was produced by Informal Systems, the developers behind Cosmos’ SDK, Tendermint, the IBC and CosmWasm, and was dubbed ‘Interchain Security (IBC)’.

ICS is a shared-security model native to Cosmos, that allows developer chains to tap into the Cosmos Hub’s validator set, and it’s full $2.74B staked ATOM security. This is applicable to developers building chains running EVM-based, CosmWasm-based or Cosmos-SDK-based applications.

The primary goal of the ICS is simple: to lower the barrier and technical burden of launching an application-specific blockchain with high security guarantees.

In simple terms, trust within ICS is derived from the fact that the exact same validator set builds blocks on both provider (Cosmos Hub) and consumer (application-specific chain leveraging Cosmos Hub validator set) chains. This means that the state and security of each consumer chain is recorded directly on the Cosmos Hub, enhancing not only security, but also interoperability via the IBC.

Note, the ICS is not entirely permissionless. In order for a consumer chain to be included in ICS, they must be approved via a governance proposal. Within this process chains are assessed on whether it would be economically viable for the Cosmos Hub to support the chain, as well as whether the goals and vision of the chain align with that of the Cosmos Hub.

Why is it important?: Historically, the requirement to be secured by a decentralised validator set with a valuable staking token has acted as a considerable bottleneck for Cosmos-based app-chain development.

Looking at the distributed validator set first, we can instantly see that the need to incentivise node operators runs as a direct conflict with incentivising a comunity of engaged users on-chain. With limited resources, including both financial incentives and the labour that goes in to marketing and maintaining an ecosystem and community, a trade-off arises between establishing a sufficiently large validator set, and establishing a sufficient community. Given security is crucial, this often results in slow community growth for app-chains.

There are also complications when it comes to tokenomics. Given tokens are leveraged to incentivise validator participation, this requires projects launch their tokens with a focus primarily on staking yield. This often results in heavy inflation and a lack of value accrual to the token securing the network.

There are other potential issues too. The chains security is directly tied to the market capitalisation of the token itself, which leads to security complications in the early stages of sovereign blockchains.

ICS is a highly effective solution to offset the costs associated with being a sovereign blockchain, enabling new application-specific chains to focus their resources on building use cases and strong community engagement.

Beyond removing the security-related headache associated with launching a sovereign chain, ICS allows app-chains to keep the majority of gas fees on their chain. This is crucial, because while still paying the Cosmos Hub for the security service, the app-chain is able to maintain and grow value within their ecosystem. ICS also gives app-chains fully Cosmos Hub alignment, meaning they can outsource further functionality to the Cosmos Hub if needed.

You may be wondering whether this defeats the purpose of launching a sovereign blockchain, since after all… it’s no longer strictly sovereign. And if you are, this would be true. But what’s important to highlight is that at any point in the future, app-chains leveraging ICS can elect to become completely independent with their own validator sets. This effectively turns the ICS into a app-chain bootstrapping service, that enables app-chains to focus on community, technology and use case development before ultimately becoming fully sovereign.

Where does it go from here?: ICS is nearing the end of its deployment cycle, having conducted an incentivised testnet in November 2022. The next stage, which is underway, is its progressive rollout with their first cohort of approved ICS consumer chains, including Neutron, Stride and Duality.

Given the developer benefits of leveraging the ICS, it is expected to act as a significant catalyst for app-chain development within the Cosmos ecosystem over the coming 12-18 months. The result being increased use cases and general maturity within the Cosmos and IBC ecosystem. Competition will also increase as these new use cases deploy, which should act to enhance both new and existing Cosmos offerings.

There will of course be quality control on these ecosystem additions, in the form of governance approval for ICS participants. This could limit the extent to which the Cosmos ecosystem grows, but ultimately will enhance offerings and reduce risk of bad actors.

The combination of ICS, interoperability solutions, and Cosmos-based data availability solutions launching and enhancing over the coming 12-18 months will act as a material catalyst for Cosmos user and value accrual.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

2: The Modular Blockchain Thesis

What is it?: Blockchains are typically assessed on three overarching features, scalability, security and decentralisation. To-date, technical limitations have dictated that blockchains face a trade-off in which one of these features must be sacrificed in order to achieve sufficient success in the other two. This issue was infamously dubbed the ‘blockchain trilemma’ by Ethereum co-founder Vitalik Buterin.

The reason that the blockchain trilemma exists is simple: a large number of blockchains have historically been monolithic.

To fully understand this, it’s important to understand that blockchains have three core functions: executing transactions, reaching consensus on these transactions (i.e. nodes confirm that transactions are legitimate and the order in which they will occur), and then publishing and storing the data from these transactions on the network.

Within a monolithic blockchain, all three of these capabilities are performed on a single chain. The result being the blockchain trilemma, because resource constraints dictate that a single chain can only optimise for up-to two of the overarching features. Higher throughput (i.e scalability) will result in either lower security and/or lower decentralisation.

One solution to the blockchain trilemma is to modularise each of the three core functions of a blockchain. In simple terms, this means creating an individual chain or environment in which execution, consensus and data availability are specialised modules. By separating the three functions, they no longer compete for resources, and can be optimised to best perform their specialised function.

To illustrate the difference with an example, historically Ethereum was monolithic, meaning that execution, consensus and security were all exclusively offered by the mainnet chain. In a modular blockchain world, this could evolve into an approach in which transactions are able to execute faster on Fuel, reach consensus and settle on Ethereum, and leverage Celestia’s data availability solution.

Why is it important?: Monolithic blockchains such as Ethereum simply cannot afford to allocate sufficient resources to security. Without security, a network is worthless. This means that ultimately in practical terms the blockchain trilemma comes down to a trade-off between decentralisation and scalability.

Select networks, such as Ethereum, place high importance on their network being decentralised, meaning that for these networks, scalability is a considerable issue. This can be seen clearly when looking at the surge in Ethereum mainnet gas costs, as the mainnet chain became virtually unusable for average users.

Therefore the only way to scale Ethereum, and other networks that value decentralisation, to global pervasiveness with far greater TPS and cheaper transactions, is to leverage blockchain modularity. Leveraging specialised modules has the ability to bring 100x to 10,000x efficiency enhancements in terms of blockchain scalability. These scalability levels are required if blockchain technology is to be adopted as the rails on which all transactions, both financial and non-financial are processed and recorded.

Where does it go from here?: 2023 is expected to be a big year for the modular blockchain thesis. While it has been discussed ad nauseam throughout the past year, we have seen the development of protocols that will ultimately facilitate this vision, such as Celestia, Laconic Network, Polygon Avail and EigenDA. It is anticipated that these protocols will gain traction in 2023, pushing the modular blockchain thesis into practical use.

One implication of this is that we may see consolidation around the strongest offering at the security layer, Ethereum. As it currently stands, Ethereum has a staked market capitalisation of $27.7B, over 2.8x the staked market capitalisation of the second most secure blockchain network. The modular blockchain thesis can therefore be thought of as a catalyst for an Ethereum-centric future, in which competition is fought at the execution and data availability layer.

The competition at both the execution and data availability layers will likely result in specialisation, such as institutional KYC-compliant execution layers, or low-cost data availability designs.

3: Data Availability Sampling

What is it?: Having explained the modular blockchain thesis, lets dive a little deeper into one of the areas with the most innovation and practical implementation expected this year: data availability.

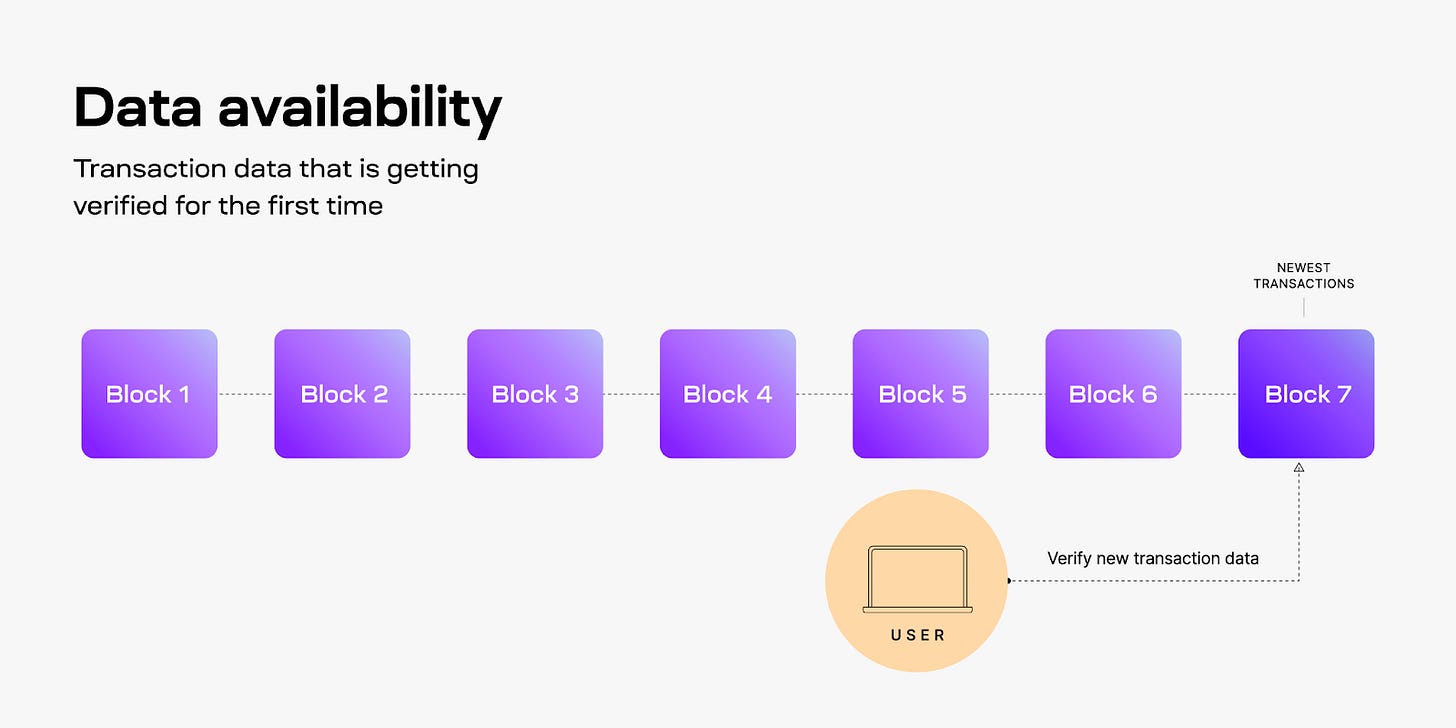

In layman terms, data availability is the idea that all transaction data on a blockchain should be available to every node securing that blockchain. This is important because it ties directly into a core value proposition for blockchains, the ability to be trustless.

By having readily available data on all transactions within a network, each node is able to independently verify transactions without the need to trust other nodes. So essentially, data availability enables anyone to inspect the ledger of transactions within a network and verify it.

As mentioned within the ‘Modular Blockchain Thesis’ section, data availability becomes increasingly problematic as blockchains look to scale, which has historically contributed to the blockchain trilemma. You can think of this from a pure capacity viewpoint, as blockchain usage increased and blocks get bigger, it becomes increasingly impractical for users to download all of the data required to verify the ledger and state of the chain.

Standalone data availability chains have developed primitives that fit within a modular blockchain to solve for this. The solution has been dubbed ‘Data Availability Sampling’ (or DAS), which is a mechanism for light nodes to verify data availability without having to download all of the data associated with a block.

DAS leverages a network of light nodes that perform multiple rounds of random sampling for sub-sections of block data. The light nodes will continue to check random sub-sections of this data until they have reached a predetermined threshold of confidence that the entire data set is available.

The result being a far greater resource efficient data availability solution, that acts as a standalone chain, reducing burden on the execution and consensus modules, but also with a specialised and more efficient sampling technique.

Why is it important?: As mentioned within the ‘Modular Blockchain Thesis’ section, the importance of blockchain modularity, and the data availability module, is that it enables networks to scale. Fees for using modular data availability solutions are lower for two reasons, the first being that due to lower hardware requirements, nodes require lower revenue levels to recover hardware expenses. Secondly, standalone data availability networks can increase block size at their own discretion, meaning thei capacity to include transactions is increases versus monolithic data availability.

While scalability is clearly the primary reason for DAS importance, it’s also worth highlighting that leveraging modular data availability solutions results in faster development cycles. Developers now have access to out-of-the-box DAS solutions, such as Celestia, allowing them to focus on the development of execution and/or settlement modules. This should increase competition at the execution layer, assuming settlement consolidates around the most secure offering.

Where does it go from here?: Many data availability solutions are expected to launch in 2023, with arguably the most anticipated project, Celestia, planning an incentivised testnet in the coming months. Other projects worth keeping an eye on include Laconic Network, Polygon Avail and EigenDA.

As these projects launch, we will likely see an explosion in deployment of networks leveraging a modular approach such as app-chains and rollups, due to the reduction in technical burden.

This is further fuel on the fire of enhancing Ethereum-based use cases, though also extends out to the Cosmos-ecosystem and beyond. Ultimately, it is anticipated that data availability providers will become specialised offerings, optimising for various factors such as storage size, speed, and cost.

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.