The Market

It’s the last week before Christmas, and the crypto market is on sale. Both BTC and altcoins (Total3) have given up their December gains after the Fed’s FOMC meeting last Wednesday. BTC has found support around $92K, higher than the previous $90K support level reached on November 26. Meanwhile, the altcoin market cap has also stabilized around $850B, the same level held up on November 26.

With last week’s selloff, the drawdown since the election has exceeded 8% for BTC and 17% for alts, remaining within the 10-20% bull market drawdown range mentioned in our last weekly newsletter.

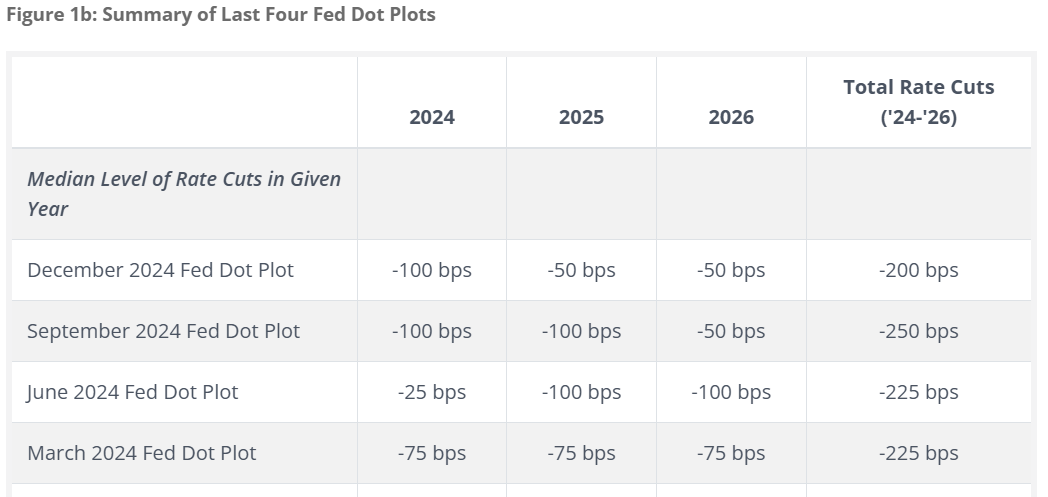

The Fed’s hawkish stance on future monetary policy is the primary driver for the selloff. While the Fed met market expectations with a 25bps rate cut in December, the newly published dot plot–showing 2 cuts instead of the four indicated in the September FOMC meeting–caught the market by surprise.

Source: Bondsavvy

The Fed's updated forecasts for inflation and growth by the end of the year have improved, reducing the urgency for additional rate cuts. Furthermore, the Fed also acknowledged that uncertainty surrounding Trump's policies limits their ability to take further action or provide longer-term guidance, heightening uncertainty around the near-term monetary policy trajectory.

In response to the Fed’s updated macro outlook, the market is repricing the macroeconomic and political risks. Investors—particularly from TradFi—are pulling back, awaiting policy clarity from the new administration. Worse than crypto, SPY has relinquished all gains made since the election. Interestingly, the 10Y Treasury yield has surged past the post-election high of 4.5%, nearing levels last seen in May, before the first rate cut in September 2024.

We believe the market may have overreacted to the Fed’s Hawkish. The November PCE report, published last Friday, revealed below-expectation inflation. As we continue to monitor growth and inflation trajectories, the Fed still has multiple tools to influence liquidity conditions, including additional rate cuts and a potential shift from QT to QE. Moreover, with year-end debt ceiling discussion heating up, the Treasury still has a healthy TGA balance of approximately $800B that could be used to provide liquid support.

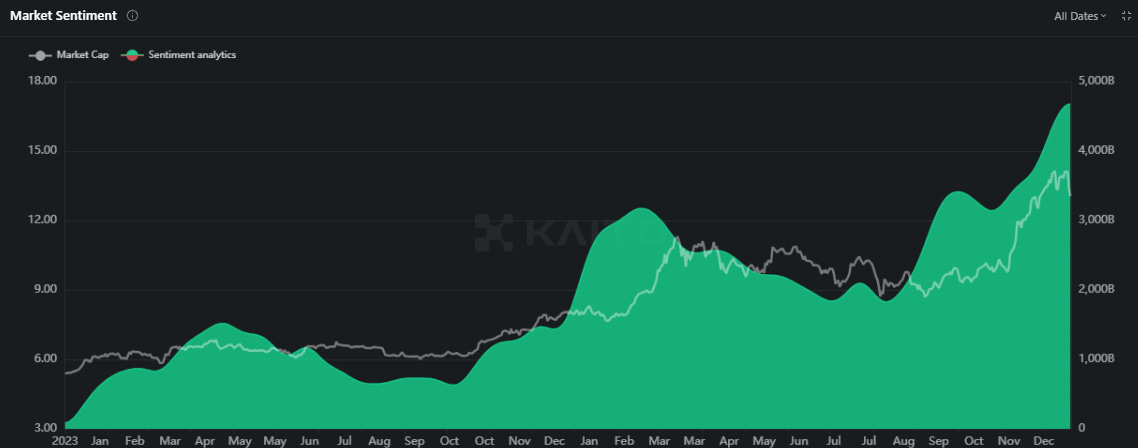

Within the crypto market, the top three stablecoins–USDT, USDC and USDe–are still attracting significant inflows, indicating sustained fiat movement into crypto. Despite the recent two-week selloff, the sentiment index remains resilient, reflecting continued optimism.

The bounce-back performance of this cycle’s popular coins is also noteworthy. Hyperliquid, Fartcoin and Aixbt have all reached new ATHs following the FOMC selloff.

So far, we remain on track with the 2015-2018 cycle. As the holiday season begins, there might still be time for bargain shopping in crypto. Not financial advice, but for discount shoppers, below are 20 most discounted tokens (as measured by since election return) that meet the following criteria:

Trade on the top 5 exchanges: Binance, Bybit, Coinbase, OKX and Upbit

Market cap above $1B

Have made higher highs than Q1 after the election

Many of these tokens have experienced substantial drawdowns during the recent selloff. If you believe the bull market peak is yet to come and those projects demonstrate strong fundamentals, they could be attractive bargains for your shopping list..

Source: Messari Screener, 12/21/2024.

Top 100 MCAP Winners

Pudgy Penguins (+484.51%)

Movement (+61.14%)

Hyperliquid (+48.57%)

Bitget Token (+38.41%)

Ethena (+4.28%)

Top 100 MCAP Losers

WIF (-30.57%)

FLOKI (-30.07%)

dYdX (-29.79%)

Curve (-28.83%)

Aptos (-28.00%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Co-Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.