The Market

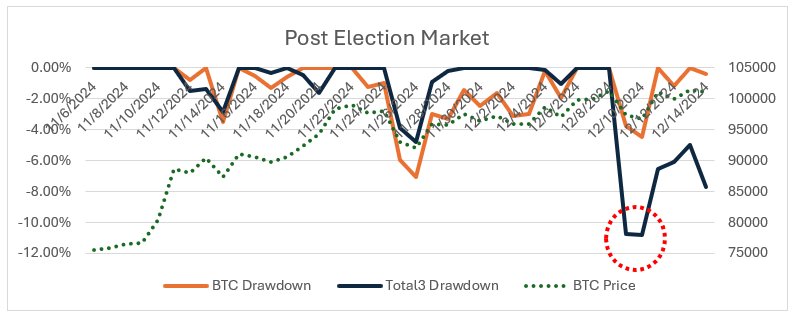

We have witnessed the first major market correction since the post-election euphoria. BTC briefly dipped below $95K before recovering to over $100K. Altcoins experienced a drawdown of more than 10% last week, staged a partial recovery, but remain approximately 8% below their ATH reached on December 8.

On December 8, we observed the largest long futures liquidation since June, coinciding with a rise in funding rates during the first week of December. This leverage flush has brought funding rates back to healthier levels, establishing a solid foundation for a potential continuation of the rally.

Source: Coinglass

Looking at past bull markets, corrections of 10-20% in both BTC and altcoins are typical. What distinguishes a bull market from other conditions is the magnitude of selloffs—rarely exceeding 20%—and the speed of recovery. For example, during the 2020-2021 bull run, from the start of DeFi summer to the April 2021 peak, altcoins typically took an average of 15 days to recover to previous ATHs. Similarly, in the 2017 bull run, the average recovery time was also around 15 days.

Of course, larger and longer selloffs remain possible. In the bull year of 2021, China's ban on crypto mining triggered a 50% correction between the April peak and the eventual top in November. Similarly, in 2017, China’s ICO ban led to a 40% drawdown between September and November. However, the current macro and regulatory dynamics driving the market differ significantly. On the regulatory front, we are witnessing a major regime change, with a pro-crypt government embracing BTC, potentially even as a reserve currency, and committing to positioning the US as the global crypto capital. The risk here lies in the potential for over-promising and under-delivering, which will become clearer after the inauguration.

From a macro perspective, the November CPI figures align with the market expectations, reducing uncertainty for the December FOMC meeting. The market is pricing in a 25bps rate cut in December, followed by a hold in January. The biggest risk is balancing inflation and growth, and whether the new administration can effectively implement pro-business policies and regulations to stimulate the economy without triggering hyperinflation.

Another key factor to watch is China’s shift to looser monetary policy–the first in 14 years–and its ability to revive its struggling economy. A recession in China could significantly impact the global economy. Conversely, we are already observing liquidity injections from other regions, such as the ECB and Canada last week, as they cut rates to prepare for potential economic slowdowns.

DeFi Update

As mentioned in last week’s newsletter, Solana has underperformed other large liquid tokens in the post-election rally. The SOL/ETH ratio has declined from its peak on November 21 to levels last seen in October 2023, just before SOL’s price began its significant ascent. Although SOL has still delivered a fantastic 7X rally since last October, its ratio to ETH has completed a round trip.This is a critical level to monitor, as we anticipate the SOL/ETH ratio to find support soon if the bull market continues.

Similarly, ETH/BTC ratio has finally found support at 0.23, a level last seen in April 2021, right before ETH emerged as the top performer in the previous cycle. As the bull market progresses, we expect ETH/BTC ratio to continue recovering as risk capital rotates down the curve.

SOL has been one of the most crowded trades this year due to its exceptional rally. The recent weakness in price action reflects profit-taking and the competition from other ecosystems such as Base, SUI, Hyperliquid and the growing narratives around AI agents. Despite this, there are still plenty of reasons to be optimistic about Solana’s continued growth in this cycle. On a one-month basis, Solana remains ranked second in net inflows.

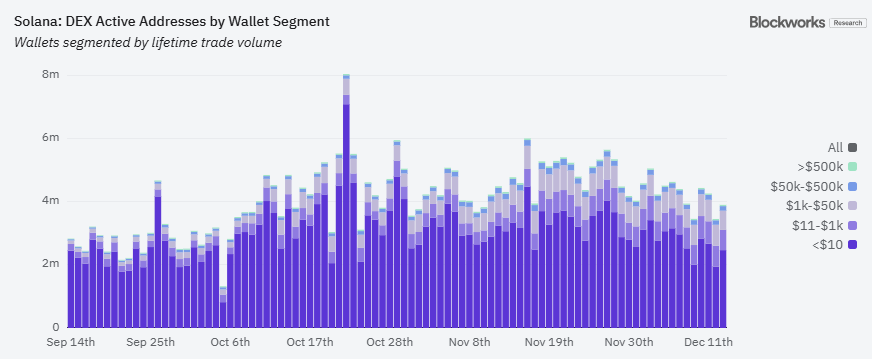

Solana’s daily active address and DEX trading volumes continue to outpace its peers, reaffirming its position as the most active chain.

While December saw a decline in active addresses, excluding wallets with below $10–typically associated with tourists or bots–the number of active addresses with higher wallet balances has remained resilient.

The robust activities on Solana is also reflected in the bottom line of Metaplex, a core infrastructure project on Solana that powers over 90% fungible and non-fungible token mints. Metaplex’s revenue doubled in November, driven by surging activities across memecoins, fungible tokens, and other digital assets issued on Solana.

Furthermore, according to the latest crypto developer report, Solana has overtaken Ethereum as the leading ecosystem for new developers in 2024. While SOL’s price has lagged other altcoins in this early stage of the rally, its strong user and developer activities show no signs of slowing down. We expect the price action to catch up with the fundamentals accordingly.

Top 100 MCAP Winners

Virtuals (+52.77%)

AAVE (+29.69%)

Chainlink (+18.86%)

Ondo (+8.31%)

Bitget (+8.10%)

Top 100 MCAP Losers

WIF (-29.33%)

Bonk (-24.52%)

Worldcoin (-23.92%)

Brett (-23.68%)

Jupiter (-23.32%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Co-Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.