The Market

BTC finally broke the $100K price level last week, encouraged by Fed chairman Powell’s acknowledgement of BTC as “digital gold” and President Putin’s endorsement of BTC as a superior foreign exchange reserve asset. As more mainstream pundits express positive views on BTC, ETF inflows are following suit.

According to the most recent 13F filings, institutional holdings in BTC ETFs increased by an impressive 75.4% from Q2 to Q3. We expect this strong momentum to persist in Q4, especially given the election results, which have paved a more favorable policy and regulatory environment for institutional crypto ownership.

To contextualize institutional vs. retail ownership, institutions currently own approximately 64% of SPY, the largest US equity ETF. If BTC becomes a mainstream portfolio building block, we foresee significant potential for institutions to narrow the ownership gap with retail investors.

Source: 21 Shares

While $100K is a critical psychological level, with over 95% of the BTC supply now in profit, most selling since the election has occurred in the $56K to $76K price range. This suggests that profit-takers are predominantly newer participants from this cycle, whereas long-standing “OG whales” are still hodling.

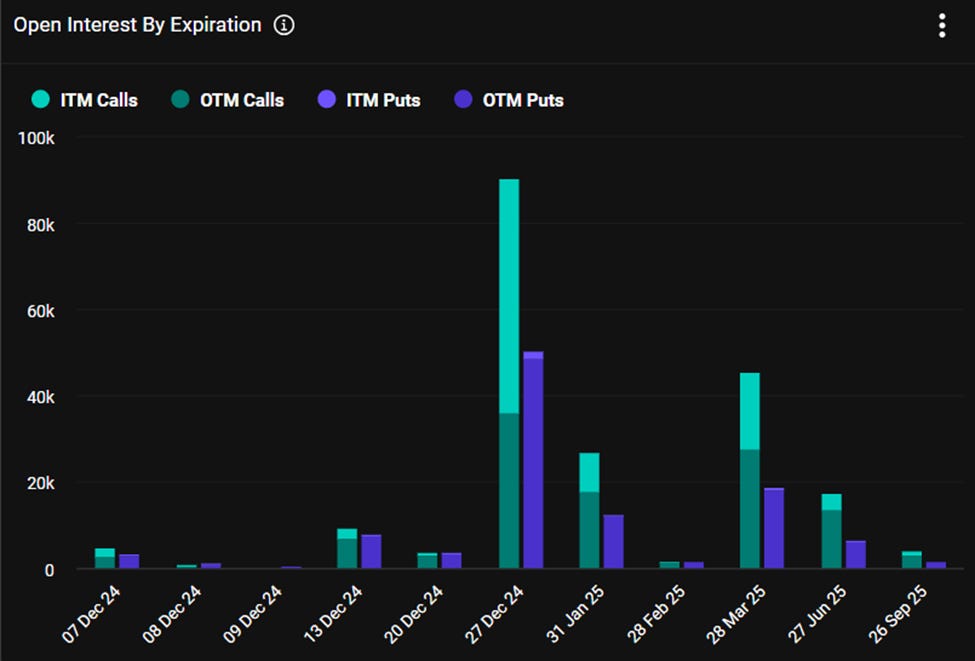

BTC options open interest is currently skewed toward calls over puts for both year-end and Q1 2025 expiry dates, signaling bullish market sentiment.

BTC’s performance from trough to peak in the current cycle (black) closely mirrors the trajectories of the 2015-2018 (blue) and the 2018-2022 (green) cycles. If history repeats, there could be an additional 20-30% upside in BTC’s price by year-end.

DeFi Update

The Altseason index crossed the critical 75 threshold last week, indicating a broad-based rally, as over 75% of the top 100 tokens outperformed BTC over the past 90 days.

To delve deeper into this rally, we analyzed the performance of tokens with market cap exceeding $1B market cap and listed on Binance or Coinbase. Based on Messari’s data, excluding stablecoins and synthetic assets, 95 tokens met this criteria. Of these, only 4 have underperformed BTC since the election. Among the top 10 outperformers, aside from the well-known political memecoin "Peanut the Squirrel”, the remainder consists of tokens created in the last cycles–many considered “Zombie coins” with limited development activity.

Source: Messari, 12/7/2024. Breakeven multiple equals current price over ATH. Sectors are defined by DPC.

Conversely, notable underperformers include some of this cycle’s darlings, such as Solana and DeFi tokens within its ecosystem, as well as TON.

Source: Messari, 12/7/2024. Breakeven multiple is current price over ATH. The Sector is defined by DPC.

This rally appears to be a “hated rally,” where token fundamentals seem to play a minimal role. Tokens from the previous cycle with limited ongoing development have rallied the hardest, while this cycle’s stronger-performing tokens underperformed, despite their robust fundamentals. Indeed, the correlation between post-election performance and performance earlier in this cycle is -15%. Meanwhile, the correlation between post-election performance and the breakeven multiple (i.e., the return needed to reach the ATH) is +2%. This suggests that tokens underperforming before the election have seen the sharpest rallies since.

Several factors underpin this hated rally:

Overcrowded Trades: Projects with strong fundamentals have become overcrowded, limiting their upside as valuations reach stretched levels.

Retail Investment Preferences: Retail investors, particularly those new to recent crypto trends, often gravitate toward liquid, established names, many of which are rebounding from last cycle’s lows.

Regulatory Optimism: The potential for a favorable regulatory environment has reignited interest in original “blue-chip” tokens, especially those previously targeted by SEC enforcement.

Inflation Risk: Older tokens, which are largely fully distributed, face less inflation risk compared to newer tokens still undergoing significant supply unlocks.

Despite skepticism from many seasoned investors, the rally is only one month into the new regulatory regime. Initially driven by valuation, future phases are likely to focus more on narratives and fundamentals as investors assess opportunities. While many zombie tokens may not sustain this rally, one OG token could still have room to run: Ethereum (ETH).

Ethereum has lagged, with its price return against BTC at just 11%, the second-worst among OG tokens issued before 2020, trailing only BNB. ETH has faced an identity crisis this cycle as activity has shifted to Layer 2 solutions and newer, faster Layer 1 chains like Solana. However, from a valuation perspective, the ETH/BTC ratio has held firm above the 20% support level, and a 50% rally would be required to reach the recent cycle high of 34%.

Additionally, Ethereum could benefit from regulatory tailwinds if ETH ETFs begin offering staking yields to investors. November saw meaningful inflows into ETH ETFs, mirroring trends observed during BTC ETF launches. Until a Solana ETF is approved, ETH could continue to benefit from mainstream retail adoption via ETFs.

Top 100 MCAP Winners

Hedera (+98.06%)

Curve (+97.20%)

JasmyCoin (+76.16%)

IOTA (+74.67%)

Bitget (+70.50%)

Top 100 MCAP Losers

Core (-16.65%)

Virtuals (-6.96%)

Stellar (-6.87%)

Raydium (-6.37%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Co-Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.