The Market

Spot BTC price started its steep ascent last Monday as it broke through the resistance level at around $53,000. As we mentioned in the past weekly, once this level is breached, there is little resistance for BTC to rise to ATH. Indeed, BTC briefly reached $64,000 last Wednesday, before settling down to the $62,000 range by the end of the week.

Animal spirits seem to have returned to the market, with the funding rate rising above the high level last seen in December 2023 when traders were positioning for the ETF approval.

Source: Coinglass

As leverage picks up in the market, we expect more volatility ahead for Bitcoin, as the implied volatility has risen toward the level seen in December 2023 as well.

There are reasons to be bullish about Bitcoin. The daily issuance is about 800 BTC per day, while the spot BTC inflow has stabilized around $500M, or about 8,000 BTC. The demand for BTC from ETF alone is 10X the supply from new issues. With the halving in April, that number will approach 20X, assuming demand remains constant. As mentioned in the last weekly, institutional demand for the BTC ETF hasn’t fully kicked in yet due to the platform due diligence process. There is a strong imbalance between supply and demand that provides a tailwind for the BTC rally.

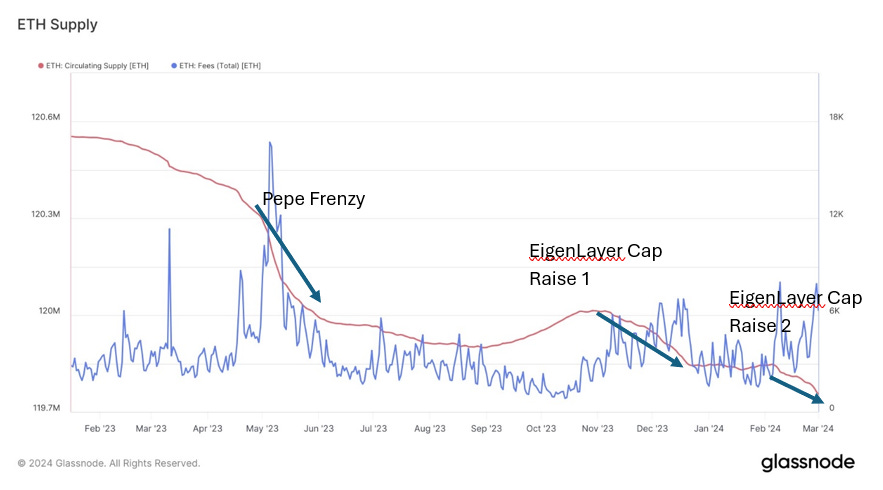

ETH is also experiencing tailwinds in supply reduction, thanks to the EigenLayer fueled staking growth. ETH circulating supply has been reduced by about 11% YTD as a result of increased transaction fees and ETH staking has grown ~9% YTD further reducing liquid ETH supply in the market.

EigenLayer has inspired new ways for protocols to attract ETH holders. Blast, an Ethereum L2, set the first example by opening up ETH staking, allowing ETH holders to earn staking yield while accumulating BLAST points for future airdrops. Its TVL grew to $2B in merely three months before its TGE. Morpheus, an open source AI agent protocol, has started a fair launch process where users can lock up their staked ETH and forgo staking yield to earn Morpheus token. It has gathered close to $200M worth of ETH within weeks of launch.

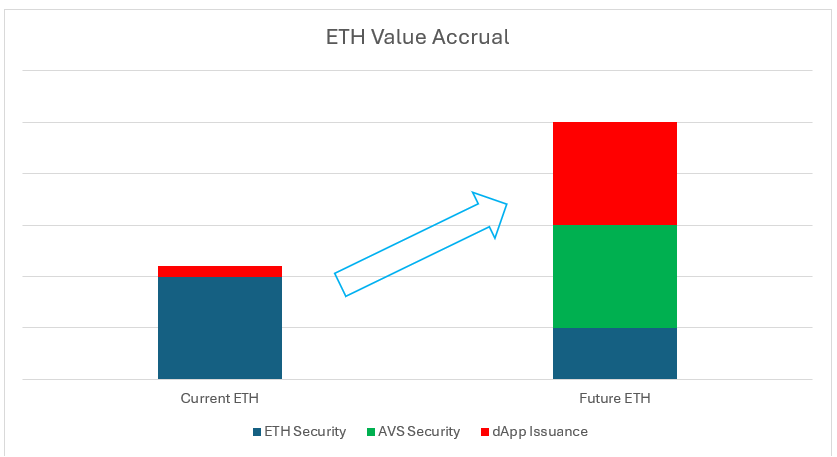

We believe these innovations have expanded the TAM for ETH. It’s no longer just securing the ethereum network but also providing security to many other AVSs through EigenLayer. Furthermore, it’s serving as the launchpad for other dApps; locking up ETH gives holders the right to earn airdrops. The last use case can be seen as a “primary issuance” cost for dApps built on the Ethereum ecosystem to bootstrap capital and a user base. We were previously concerned about ETH’s valuation on its revenue multiple, as the network becomes cheaper and volumes might not catch up quickly. With the expansion of ETH’s potential TAM, ETH holders have more venues to earn return by charging security fees for securing other networks or taking a cut in other dApps’ primary launch.

Source: Decentral Park Capital, for illustrative purposes

DeFi Update

I came back from ETH Denver energized by the projects builders are working on and the bullish market sentiment shared by both investors and builders. What encouraged me most is the fierce competition among blockchains, not only on the technology side but also on the ecosystem side. Those who can attract good builders will attract users and win over the long term. With high-performing blockchains comes dApp innovation, especially those targeting real consumers that have a chance to onboard the next billion users. Here are a few of my hot takes:

Alt L1s are trying to align more with Ethereum

Many blockchains are positioning themselves as Ethereum killers, claiming better performance. However, Ethereum's moat lies in its network of users and builders. For chains to quickly build network effects, they need a flywheel that turns narrative into users. Staying aligned with Ethereum is the fastest way to tap into Ethereum’s user base and liquidity. We see creative ways for chains to stay aligned with Ethereum, whether it’s using EVM or tapping into or converting into part of Ethereum’s modular stack, or attracting users to stake/restake ETH for future rewards.

Source: Decentral Park Capital, for illustrative purposes

Bitcoin ecosystem is not a fad but its technology is not mature

Bitcoin purists may argue BTC’s sole purpose is an alternative storage of value. However, the bitcoin network is open and permissionless, allowing anyone with a different opinion to build on it differently. We saw Ordinals start as a fad last year but evolve into a $1.4B NFTs built on top of the bitcoin chain, more than doubling the NFT market on Solana. We also see strong financial incentives from miners, an important stakeholder in the bitcoin ecosystem, to increase bitcoin's utility to generate more revenue from transaction fees as the block reward continues to decrease with each halving. Marathon has initiated its own Bitcoin L2 effort using merge mining, aiming to build institutional use cases given their regulated status. As for investors, if there is a secure way of generating return on the BTC holdings natively on the bitcoin chain, why not? Especially for newer investors that bought BTC at $60,000 rather than $6.

There are currently about 10-20 L2s on Bitcoin, plus Babylon, which allows Bitcoin staking to secure Cosmos appchains, the EigenLayer style. The biggest challenge remains on the trust assumptions for these solutions, as there is no perfect way to achieve the same security assumptions on Bitcoin. However, new developments such as BitVM might get us closer.

AI is entering the FOMO mode

Many projects related to the AI narrative got a huge rally since OpenAI launched Sora. At the Decentralized AI day at ETH Denver, I met several interesting AI projects and saw startups getting oversubscribed right at the event or raising a second round that doubled the valuation of the first round in just a month. Not only are investors feeling the FOMO, different chains are competing for AI projects to build on their ecosystem.

As a former quant, I strongly believe in blockchain’s potential to make AI cheaper and safer. However, good AI models require substantial computing resources and a high level of modeling expertise, giving centralized players an advantage as they can afford the hardware and talent. I'm encouraged by DePin models democratizing the supply of computing resources, but the model development part is still challenging. While the market rewards general platforms enabling decentralized model building, projects focusing on solving specific tasks might have a better chance of delivering successful commercial results in the near term.

DePin has a real chance to onboard the next billion users

The DePin narrative is gaining strength this year, and I believe 2024 will be the year that DePin finds its product-market fit. In DePin 1.0, every project was trying to disrupt AWS; in DePin 2.0, there are many use cases that DePin projects are aiming to disrupt.

Source: Messari

The biggest challenge for DePin is whether projects can generate enough demand before their inflationary tokenomics to bootstrap supply runs out of steam. We see three areas of promising development that could boost the demand side:

The emergence of SLA middle layer that addresses the gap between the decentralized provider and user support needs

Increased demand from Web3 and AI startups that prefer decentralized solutions for cost and privacy

Unique use cases that Web2 cannot do, such as Dimo’s car data collection agnostic of car models.

Bonus - my favorite swags from ETH Denver. Gotta dress the part for success!

Top 7d Gainers and Losers

Top 100 MCAP Winners - It’s a meme coin week!

FLOKI (+252.14%)

Dogwifhat (+250.29%)

Pepe (+231.42%)

Shiba Inu (+128.52%)

Arweave (+99.93%)

Top 100 MCAP Losers

Bitget (-8.38%)

Blur (-7.21%)

Worldcoin (-5.66%)

SUI (-3.02%)

Starknet (-3.02%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.