The Market

Just as discussed in the last weekly, BTC quickly broke through the $47,000 resistance level and reached the $52,400 resistance level last week. If this uptrend continues, there is little resistance for BTC to head to the previous ATH.

Unlike the year-end rally in 2023, which was mostly driven by speculative bets on the spot ETF approval, the funding rate for BTC perps is still at a healthy level. This indicates the rally is less driven by speculative leverage from long positions.

Source: Coinglass

Flows into spot ETFs are still steadily increasing. In fact the inflows into the 9 new ETFs (excluding the GBTC) has exceeded $10B twenty days since their inception, already outpacing Microstrategy’s holdings. With the accounting rule change in December 2023, corporations can now hold crypto assets at fair value, allowing them recognize gains rather than just impairment loss. This change could pave the way for more corporations to hold BTC as a strategic asset for their treasuries.

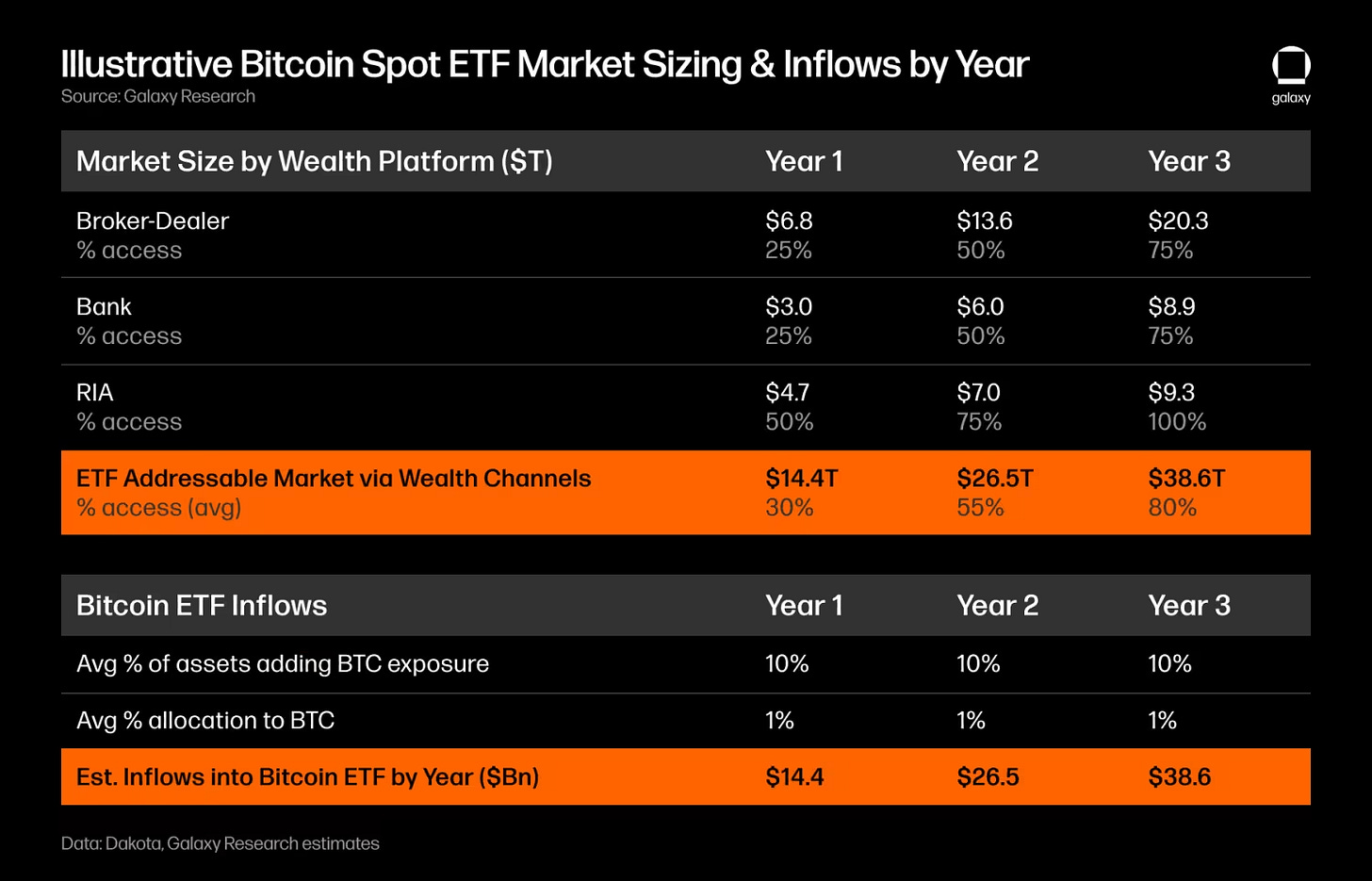

Looking back at Galaxy’s BTC ETF inflow forecast, we have already achieved ~$5B in net inflows in five weeks. As ETF issuers ramp up their marketing and sales efforts, with thought leadership pieces from reputable institutions such as Fidelity and Blackrock, we anticipate larger inflows from RIAs and wealth management platforms once the gatekeepers have completed their due diligence. We believe that the $14.4B inflow within one year is already a conservative estimation.

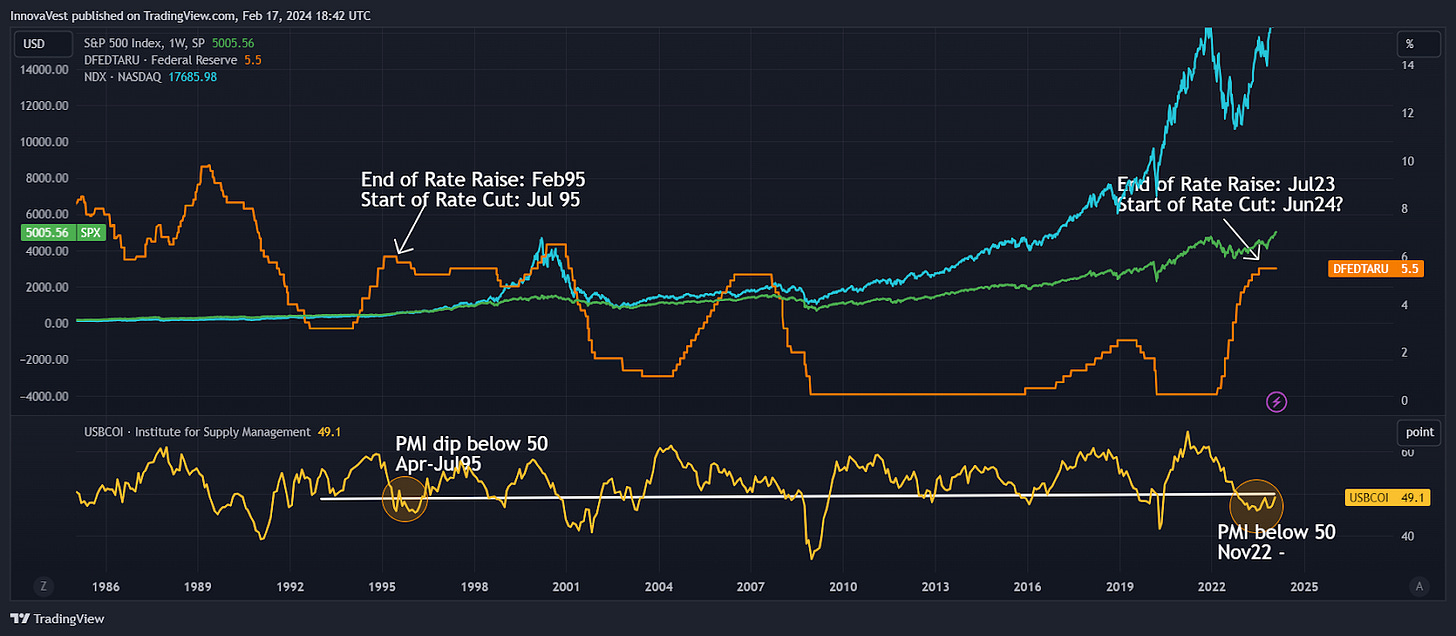

The macro environment is increasingly resembling that of 1995, when the Fed paused rate hikes in February 1995 and began cutting rates in June, leading to the Tech boom of the late 90s. In the five-year period leading up to the peak of the tech bubble, the Nasdaq index returned ~750%. Given that crypto trades 24X7, the average market cycle for crypto is about one-fifth that of the equities market. One could argue we are about one year away from the peak, if we use the stock market trajectory between 1995-2000 as an analogy. In fact, a top tech stock analyst has predicted that we are likely “on the doorstep of the internet” moment already.

We might also still be in the early stages of a crypto bull market, based on the rankings of the Coinbase app ranking and BTC google trends. The level of search interest has not yet reached the peak level seen in 2021-2022.

DeFi Update

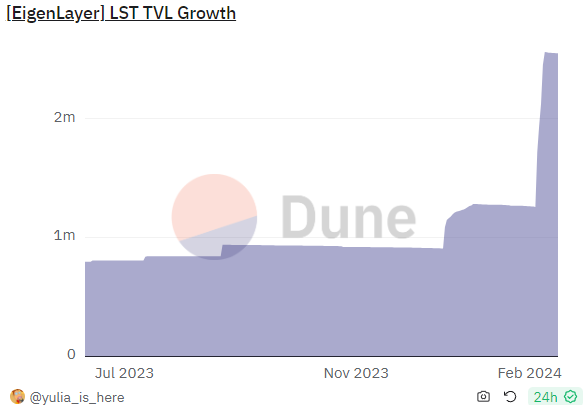

The ETH staking queue has started climbing again in February, thanks to the EigenLayer cap raise on Feb 5th. In just two weeks, EigenLayer’s TVL has increased by almost $5B.

From a technical standpoint, EigenLayer is a significant innovation that creates a marketplace for “trust” by leveraging the security of the Ethereum network. Instead of bootstrapping their own consensus network, any Actively Validated Service (AVS) can source security from EigenLayer, effectively renting security from Ethereum’s extensive network of stakers. EigenDA is one such AVS that uses EigenLayer to provide Data Availability Solutions for other blockchains. Currently, 13 AVS have announced building on EigenLayer. In theory, any distributed validator network requiring a decentralized way of building consensus could use EigenLayer, expanding its potential TAM beyond just DA solutions.

From a practical perspective, EigenLayer is already becoming the new wealth creation engine for the Ethereum ecosystem. Those who restake ETH into EigenLayer has five potential sources of income:

ETH staking yield - earned by staking ETH

Restaking yield by providing service to AVS using EigenLayer

Earning points for potential airdrop from EigenLayer

Earning points for potential airdrop from the delegators (Liquid Restaking Procol)

Airdrop from dApps/AVS that sources security from EigenLayer

Bankless has estimated that each ETH deposited in EigenLayer could yield between $907-$1814 due to the EigenLayer airdrop alone. It’s no wonder the EigenLayer cap is consistently filled within 24 hours each time it raises.

There are concerns on EigenLayer creating systematic risk in the Ethereum ecosystem. Ultimately, the risk is related to the value created by the AVS service versus the amount at stake. Only if the value created by the AVS service significantly exceeds the amount at stake, would there be incentive for the validators to collude. Currently there are $84.5B ETH staked to secure the Ethereum network. This represents 25% of the total ETH in circulation, which is lower than many PoS chains. While we don’t yet have time and data to access EigenLayer’s adoption, it will undoubtedly increase Ethereum’s staking ratio, benefiting LSD providers the most in the near term.

Top 7d Gainers and Losers

Top 100 MCAP Winners

Siacoin (+60.29%)

Bitget Token (+55.91%)

VeChain (+51.03%)

Arweave (+49.35%)

Stacks (+38.91%)

Top 100 MCAP Losers

Astar(-10.71%)

Celestia (-7.89%)

Pendle (-5.81%)

Bonk (-5.65%)

Osmosis (-4.96%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.