The Weekly #245

Shorter-term investors wait for market dips as lack of catalysts have prices consolidating further. Long-term investors are already well positioned at these key inflection point moments.

Join the 1000’s founders, investors, crypto funds, brokerage firms, and developers in getting free cutting-edge crypto research by subscribing below:

Investors Keeping to the Sideline

To avoid burying the headline, markets are still in consolidation mode. After briefly breaching $31k, BTC has trended back towards the $29k level where it has found good support over the past week.

Overall, it seems BTC is just mirroring the April-June trend back to YTD support.

On the monthly, we see the trend towards $29.3k was due to BTC losing the higher low. As we head towards the end of the month, BTC closing above $29.3k could be the reset prior to challenging the mid-30’s.

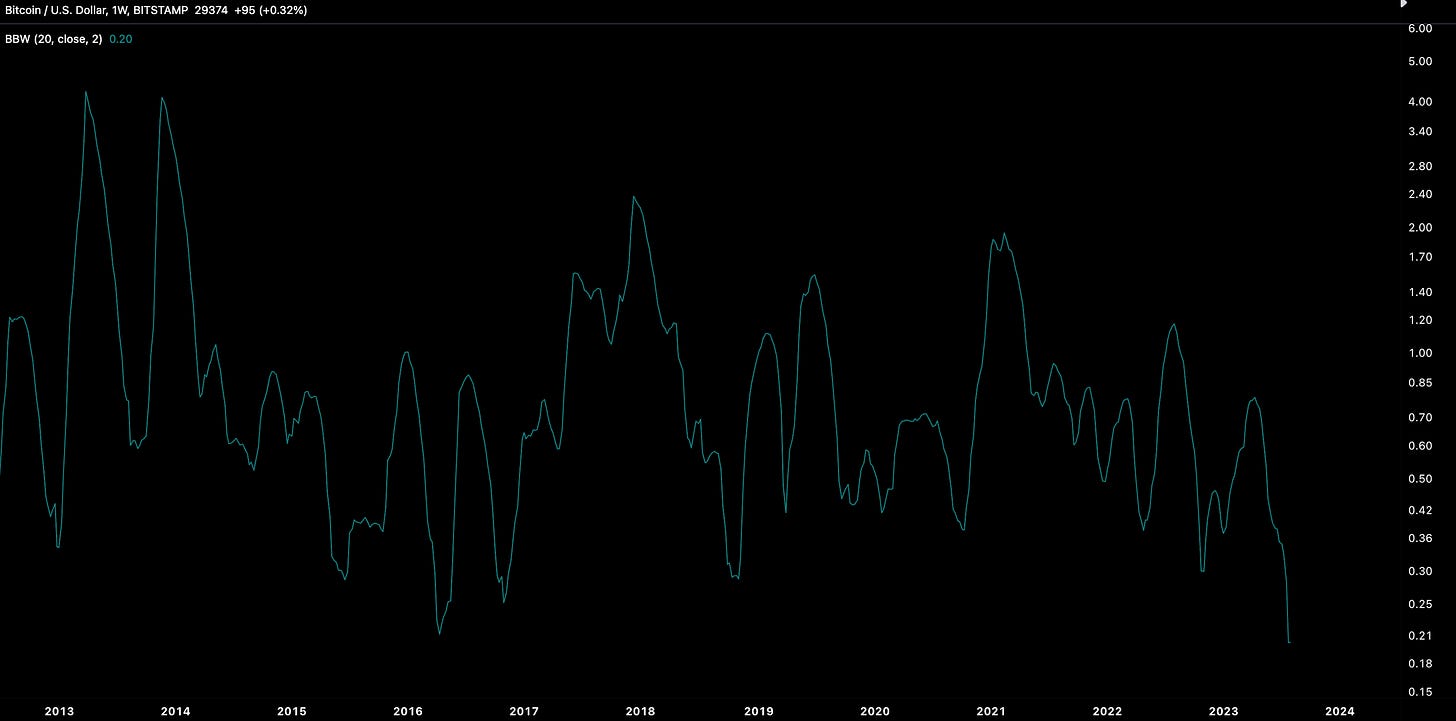

Volatility impulse inbound

But consolidation isn’t a bad thing. It only sets up for a more significant move as the coil gets wound up. BTC’s weekly volatility remains at all-time-lows…

And consolidation means market values trending closer to increasing MAs such as the 200d MA. As we noted last week, traders are likely cautious due to 1) PTSD from the previous 18 months and 2) lack of clarity surrounding key crypto-related developments (e.g. Ripple ruling, Binance DoJ, BTC spot ETF timelines/probabilities).

For the bulls, buying close to the 200d MA in accumulation phases is the golden zone.

Note, the next touch of the 200d MA comes as Cathie Wood’s ARK, where its application is first in line for SEC’s approval, potentially receiving a SEC decision (August).

This lines up with outlooks from other analysts. QCP Capital stated in their last update they anticipate a rise in volatility and a possible significant BTC price increase by year-end due to several factors such as spot ETF and Bitcoin halving.

The only thing I would add here is the broader macro liquidity cycle which has always lined up with the Bitcoin halving cycle (since 2008). This is because BTC’s price is more driven by demand > than supply.

But it’s not just long-term holders on the demand side. Key on-chain indicators for Bitcoin’s short-term holder base also point to a more constructive outlook base on historical patterns in previous cycles.

BTC market value is bouncing off its STH-RP where traders look to re-enter close to their cost basis.

And from a momentum perspective, BTC’s mid-cycle top is not yet put in and could come as early as Q1 2024 depending on price momentum until YE.

The ETH/BTC ratio has consolidated further with realised vol spread also falling. We think a bullish wedge is potentially forming.

However, note the 1st innings of a bull cycle prior to the mid-cycle top. In 2019, ETH/BTC declined for a further 74 days until putting its bottom in. BTC lead the recovery and the mid-cycle top was a time when investors should start considering rotating down the risk continuum.

This time around, it seems reasonable that an approval for a BTC spot ETF would be the catalyst for Bitcoin’s mid-cycle top and that some opportunistic traders would look to this event as a sell-the-news event into ETH.

What may also be different in this cycle is the emergence of alternative ecosystems outside of Ethereum that have been under duress several times since November 2022.

SOL/BTC has found a bottom twice at 0.000492 and has now recouped its 200d MA.

Another Day, Another DeFi Hack

Curve faced an exploit on Sunday evening where $100m of assets were at risk due to a ‘re-entrancy’ bug in Vyper - a programming language that is integral to parts of the Curve system.

Specifically, several stablecoin pools which are used for pricing and liquidity on a number of DeFi applications and services were drained.

Sentiment around Curve inevitably took a hit, expressed by a 21% decline for CRV/USD on Sunday. This had a knock-on effect on other DeFi applications such as lending protocols which have CRV as a material collateral token ($100m liquidation position).

CRV reached its YTD support zone of $0.5.3-$0.58.

CRV’s funding rates remain slightly positive but reduced from previous days indicating that traders are simply moving from the DEX but falling short of shorting the asset - likely due to the token being at YTD support.

While an ongoing situation, I see a few takeaways worth noting already:

Oracle networks need to aggregate several price feeds (both CEXs and DEXs) which is what oracle projects like Chainlink and API3 are providing.

Older versions of applications such as AAVE v2 are vulnerable but more recent versions like v3 are not affected. Stresses the importance of migrating to new versions asap if the newer version is deemed suitable.

And speaking of LINK, it was rejected at the diagonal line for the 5th time in one year and seems that it is to remain within the range for the time being.

And finally, UNI/CRV may be shaping up as the next RV play following the exploit as the pair looks to potentially break out of its wedge to the upside.

Following the launch of V4 and UniswapX, investors may expect Uniswap to start gaining market share against the stablecoin exchange which already stands at 92% for global volumes.

A fairer comparison is adjusting for non-stablecoin activity. Comparing Uniswap’s USDC/USDT pool volume on V3 vs. Curve’s 3pool shows the gap is closing. Uniswap volumes range anywhere between $20-$100m daily volumes, often surpassing Curve’s average of $40m-$60m.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

ICYMI: Market Note - The Bitcoin Spot ETF

Global Market Cap

$1.149T; Markets fell 1.84% over the past week. Appears that market valuations are finding YTD support with a ‘fall-back’ level being its 200d MA. Technicals are neutral.

Alts (DeFi)

$42.66B; DeFi MCAP still gravitating towards the 200d MA with the resistance to test being $55B (upper channel line). DeFi market oscillating around the $42B-$43B zone.

Trader Positioning

BTC OI weighted funding rates remained positive with a slight decline over the weekend as BTC chopped around $29.1k. Traders continue to take a predominantly bullish stance as prices consolidate above the 200d MA.

ETH’s structure different with a full reset in FRs occurring on Monday morning as ETH declined slightly from $1.87k to $1.54k.

Implieds for both BTC and ETH suggest lower vol across all tenures. Vol continued to be cheap allowing traders to capitalise on buying calls trades.

Grayscale Trusts

GBTC discount to NAV widening back above 30% after eclipsing 26% in mid-July. Spots steady decline towards $29k and limited ETF-related headlines to act as catalysts have likely been key factors.

We see a similar dynamic with ETHE too suggesting discount dynamics for GBTC adding weight to the above.

Digital asset investment products saw minor outflows totalling US$6.5m, following 4 prior weeks of inflows that totalled US$742m.

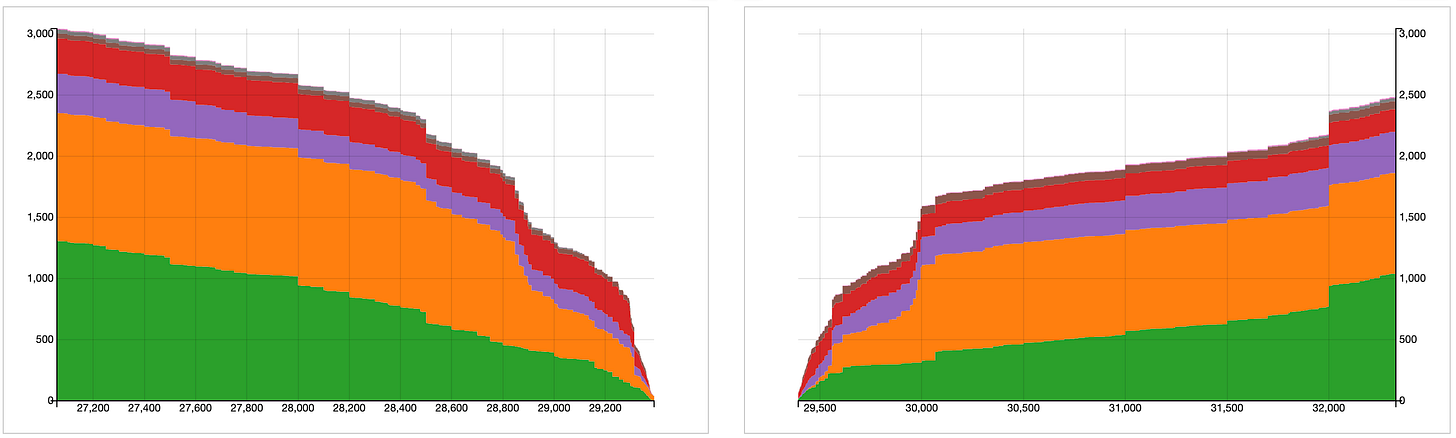

BTC/USD Aggregate Order Books

Order books heavier on the bid side. Heavier resistance up to ~$30k. Supports the idea that I spoke about last week of traders waiting on lower levels to be hit.

Miners

Bitcoin hash rate still climbing and bouncing off its 60d MA as I’ve pointed out before as being a support area for miner commitment. Hash rate is now up 52.3% YTD.

Just like the liquidity cycle, miner commitment to the Bitcoin network also takes the form of a cycle. Bitcoin hash price is set to have negative growth relative to BTC which shapes up for the next constructive phase for the orange coin.

Top performers are a mixture of alt L1s and blue chip DeFi names with bottom performers being predominately alternative L1s:

Top 100 (7d %):

FLEX Coin (+33.2%)

Maker (+24.2%)

XDC Network (+21.3%)

Compound (+11.2%)

Optimism (+10.9%)

Bottom Top 100 MCAPs (7d %):

Curve (-14.5%)

Toncoin (-14.3%)

Pepe (-11.9%)

ApeCoin (-11.6%)

GALA (-9.7%)

> Building Collective Intelligence Tools for Human Alignment with Nicholas Brigham [Green Pill]

> The Intersection of Restaking and Liquid Staking [Bell Curve]

> Visa’s network-of-networks strategy and vision for Web3 commerce [The Fintech Blueprint]

> Centralized Builders Bull Case, Bear Market Conference, zkEVM Problems [Empire]

> Reimagining Traditional Telco with Web3 and the Metaverse [The Metaverse Podcast]

> Crypto funding: A $44M week for up-and-coming Web3, blockchain scalers [Blockworks]

> Lending Protocols and managing collateral liquidations [Vance Spencer]

> Optimism stats [Sandra]

> On Tether Dominance [Alex Thorn]

> SEC Told Coinbase to Stop Trading in all Cryptos Except Bitcoin Before Suing: FT [Coindesk]

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.