The Weekly #244

Crypto remains sluggish in the face of several tailwinds reflects trader PTSD and caution.

Join the 1000’s founders, investors, crypto funds, brokerage firms, and developers in getting free cutting-edge crypto research by subscribing below:

Looking For Direction

From last week, not much has changed. I’ve had many reach out stating they are confused and wonder where the momentum has gone. I think it’s actually straightforward. Let’s start with price.

Traders appear to be remaining cautious with BTC still consolidating just below the $30k level at $29,290. Put simply, it looks like it wants to break and head lower.

BTC is now down 6.9% from the Ripple ruling whereby district judge Analisa Torres ruled that XRP, the token that powers the Ripple network, is “not necessarily a security on its face” - except for instances when it was sold to institutions to raise funds.

On the one hand, positive news not being met with positive price action is bearish. On the other, the Ripple ruling is good for XRP but unclear how BTC directly benefits from this outcome as most believe Bitcoin is the clearest example of a digital commodity in the US.

Rather, BTC is more likely to move on spot ETF news whereby new asset flows can have a direct on price (i.e. demand > supply).

Inertia In the Face of Tailwinds

We can look to the dollar as a headwind/tailwind variable.

As I’ve said in my previous work, the dollar acts as the faster, minute driver of BTC price action (denominator volatility) while market liquidity acts as the slower, momentum drive of price action (denominator debasement). Both are of course linked together.

DXY’s break of 100 to the downside was always on the cards when the Fed is approaching its rate hike cycle off the back of disinflation signals.

Dollar’s subsequent rebound in recent days has possibly hampered BTC’s upside but equally, its 100-level break didn’t translate into a vol spike for BTC to the upside. Something else is going on.

On Monday morning, the SEC alleged that some Binance.US crypto trading was inflated. The release of this ties in with BTC fall to the $29.3k level which seems to confirm that Binance remains a key market overhang for nervous investors.

It’s also particularly unusual for crypto to lag NDX in a bullish period. And while tech stocks are far from being in a mania, NDX is only just 4% from making new ATHs. AI-driven narratives only translate so much into crypto…

So what’s happening? It’s likely a combination of both uncertainty and PTSD. For the former, the SEC’s hint at appealing the Ripple ruling complicates matters. There are also wide forecasts for when a spot BTC ETF will go live.

For the latter, it’s the unattractive entry points within the range that deters traders that have already missed the YTD move and not deployed. But it’s the waiting-for-the-dip mentality that may be why BTC doesn’t fall much lower.

Every trader will be targetting levels from current levels to the 200d MA + YTD support areas.

Crypto traders may be more sensitive to liquidity measures within their models than their equity counterparts which are breaking away from these measures (bullish divergence).

Zoom out, It’s a Process…

And while BTC has struggled in recent weeks relative to tech equities, the BTC/NDX ratio says it’s business as usual and we’re at levels where the RR is attractive to the upside…

And for the dollar, it’s already starting its move down as it does towards the end/after of the hike cycle. As I’ve highlighted in recent weeks, dollar leads the ISM by ~120 days and it’s forecasting an ISM of 60 by YE. Growth, growth, growth.

For the upcoming FOMC, a 25 bps increase is fully baked in as part of a final two predicted rate hikes.

And the vol coil is being wound ready to move hard and fast - in need of direction.

We’ve also started to see the market dominance of alt indices pick up last week. Unlike previous times, this has come from the expense of BTC and ETH dominance indicating clear capital rotation from beta to alpha strategies.

And while it’s unclear whether this momentum will continue in the near-term we do see key breakouts to the upside on key alt indices over the past week…

Project developments are still impacting price volatility. Examples in recent weeks include blue chip names:

Uniswap: launching of Uniswap 4 + UniswapX that addresses customisability of AMM pools and efficiency by introducing cross pool fillers.

Chainlink: launch of CCIP after 3 years of development. Chainlink looking to leverage its oracle node infra and brand to compete in the cross-chain messaging arena (a la LayerZero).

Synthetix: launch of a front-end DEX called Infinex that taps into the back end that has been built for several years.

These names are re-rating most of their moves - as we’ve said earlier, traders remain opportunistic and cautious…

And through the more sceptical lens, these moves are completely in line with the range pattern put in since early 2022. Until we see higher highs, the momentum bias is to the downside…

We are also seeing bright spots within DeFi that are getting unnoticed.

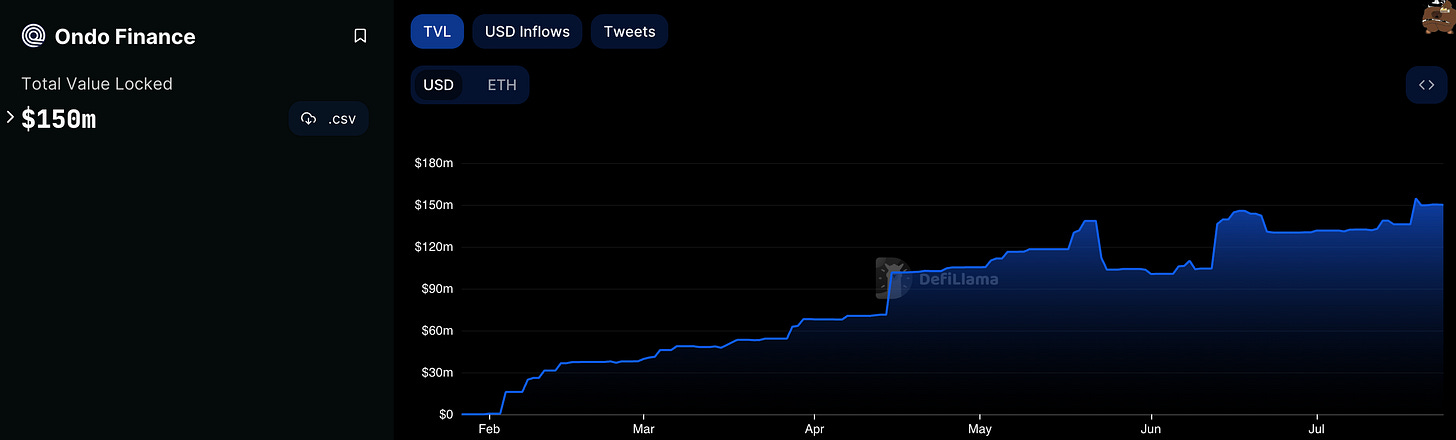

Real-world assets (RWA) are one of them with global TVL now climbing to nearly $1B for the first time ($950m).

This comes at a time when more projects are looking to leverage RWAs into DeFi including Leshner’s Superstate and Ondo Finance which commands 15% of the total market today.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

ICYMI: Market Note - The Bitcoin Spot ETF

Global Market Cap

$1.115T; Markets relatively flat at $1.15T. Markets printing higher lows with no technical divergences on the daily.

Alts (DeFi)

$42.5B; DeFi MCAP gravitating towards the 200d MA with the resistance to test being $55B (upper channel line). DeFi market now up 41% YTD.

Trader Positioning

BTC OI weighted funding rates remain positive at ~0.006 indicating traders are taking a predominantly bullish stance. The estimated leverage ratio of perpetual OI/market cap remains relatively low vs. June indicating traders are still cautious - speaks to the consolidating price action.

For ETH, there have been a few rate resets over the past week but remain positive with a likely chop ~$1.18k mark for the time being.

Relatively low volume of liquidations (global) over the past week.

Grayscale Trusts

GBTC discount to NAV still hovering around the 28% level. Investors are unlikely to take the discount below 30% unless a Bitcoin spot ETF is rejected.

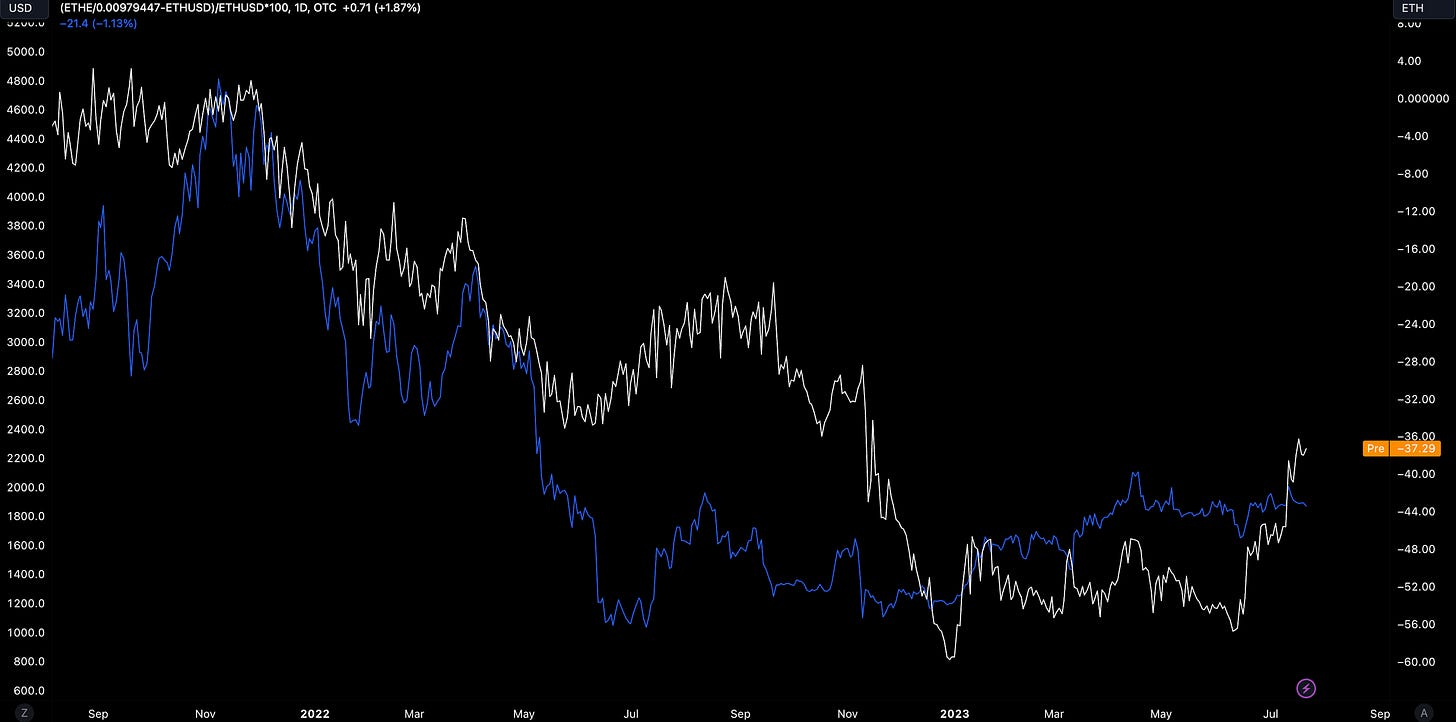

ETHE discount to NAV at ~37% and declined from ~55% in June. This reflects a shift in trader positioning despite a flat spot likely due to the Ripple ruling increasing the probability of an ETH spot ETF approval and possibly including an ETHE trust conversion despite being a longer playbook.

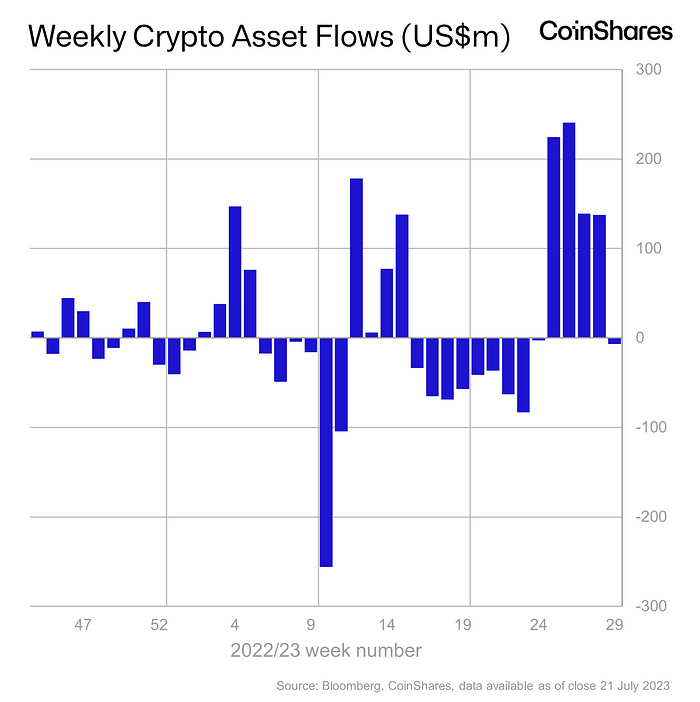

Digital asset investment products saw minor outflows totalling US$6.5m, following 4 prior weeks of inflows that totalled US$742m.

BTC/USD Aggregate Order Books

Order books slightly heavier on the bid side. Heavier resistance up to ~$30.3k.

Miners

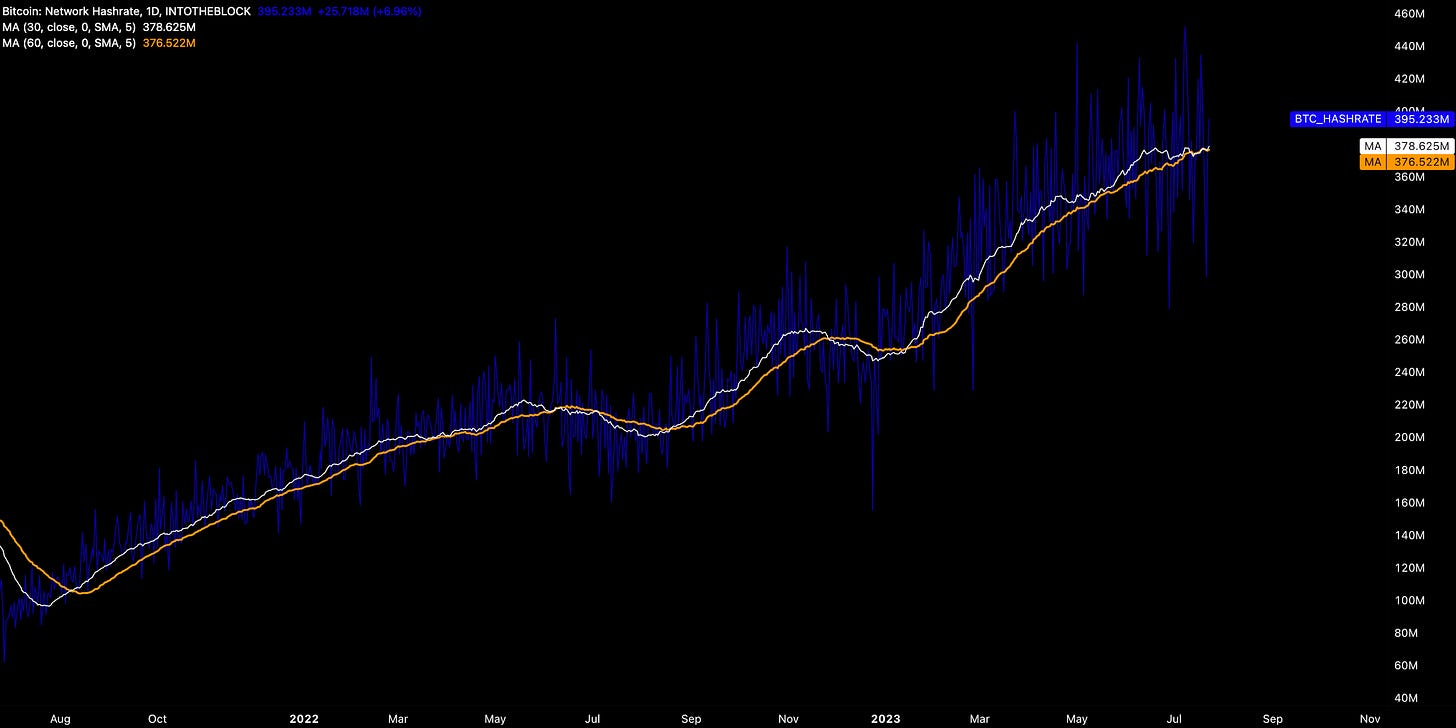

Bitcoin hash rate still climbing with miner resource commitment up 1.6% MTD.

Hash ribbons confirming a capitulation signal which reflects hash rate growth slowdown. Not necessarily a sell signal but not a buy signal either. Key to watch for a buy signal once hash rate and price momentum swing positive.

Top performers are a mixture of alt L1s and blue chip DeFi names with bottom performers being predominately alternative L1s:

Top 100 (7d %):

XDC Network (+42.6%)

FLEX Coin (+19.4%)

Kaspa (+18.9%)

Stellar (+15.8%)

Chainlink (+15.6%)

Bottom Top 100 MCAPs (7d %):

Rocket Pool (-15.7%)

MultiverseX (-11.8%)

Solana (-10.7%)

Terra Luna Classic (-10.5%)

Compound (-8.9%)

> Uncommon Core The Reboot [Uncommon Core 2.0]

> Crypto Gathering Day 3 [Real Vision]

> The Big Tech Bull Market [On The Margin]

> Chainlink CCIP Bomb, UniswapX, & Synthetix [Bell Curve]

> Solana DeFi 2.0 [Lightspeed]

> Synthetix and Uniswap: Build a next-gen DEX with CEX appeal [Blockworks]

> Polygon ID comes to Ethereum thanks to Rarimo integration, more chains to come [Blockworks]

> Jito TVL [Delphi]

> Polygon zkEVM [Narb]

> Coinbase Earn Is Particularly Vulnerable to Being Defined as a Security: Berenberg [Coinbase]

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.