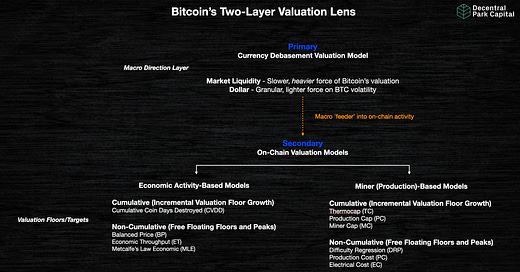

Bitcoin’s Two-Layer Valuation Framework

Since my inaugural Glassnode guest research report on the state of Bitcoin three years ago, there has been much progress in how we think about value drivers and measures for the network.

This piece revisits long-standing valuation methodologies as well as introduces more novel valuation models for Bitcoin to form a two-layer valuation framework.

Primary Model: Currency Debasement

The notion of currency debasement and central bank mistrust has been inscribed into Bitcoin from its inception.

“The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible.”

Since Bitcoin’s inception, we can see two (connected) variables that have had the largest impact on BTC’s price: market liquidity and dollar strength/weakness.

Market liquidity is the slower but heavier force at play that speaks to a broader momentum.

BTC’s price appears to move positively to an inverted dollar (BTC strength with dollar weakness. Yet, notice how the dollar is up 19% from its 2018 low to today while BTC is up 45% over the same period.

The framing of dollar influence on Bitcoin should, therefore, be different to market liquidity: the dollar is a granular but lighter force at play for BTC volatility. If the dollar weakens the value of the key denominator for Bitcoin declines.

Therefore, a primary lens through which to think about Bitcoin’s valuation is to understand the trajectories of both market liquidity and the dollar.

Both can act independently of one another but often move in line with each other.

Liquidity expansion mark periods of conditions easing and a weaker dollar while liquidity being sucked out from the system means fewer dollars to go around, fueling its strength given its central role in the global financial system.

Periods, where market liquidity increases while the dollar weakens, are often the most performant periods for BTC and risk assets more generally (green). The reverse dynamic also appears true (red).

A currency debasement valuation model can therefore be constructed as a primary framework to price Bitcoin. Market liquidity is given some arbitrarily heavier effect weighting due to its ability to direct the broader price momentum of Bitcoin.

However, while useful as a primary framework, using this model in isolation doesn’t seem to capture the whole valuation picture:

For example, the 2018-2019 bottom for BTC was put in before declines in global liquidity measures plateaued towards the end of 2019 - the crypto market seems to be a good leading indicator of market liquidity.

Yet, it still begs the broader question of why the market chooses to put in the bottom and peaks at specific levels. Liquidity and the dollar can only be one part of the puzzle.

Put differently, macro models don’t speak to BTC valuations per se. Instead, they seem to highlight the main forces behind its performance such as from a currency debasement perspective.

On-Chain Valuation Frameworks

We can look to more crypto-native tools and methodologies using on-chain data to supplement the (off-chain) currency debasement model. Specifically, their ability to speak to fair values can complement a primary currency debasement valuation model to provide a more comprehensive evaluation.

Economic Activity-Based Valuation Models

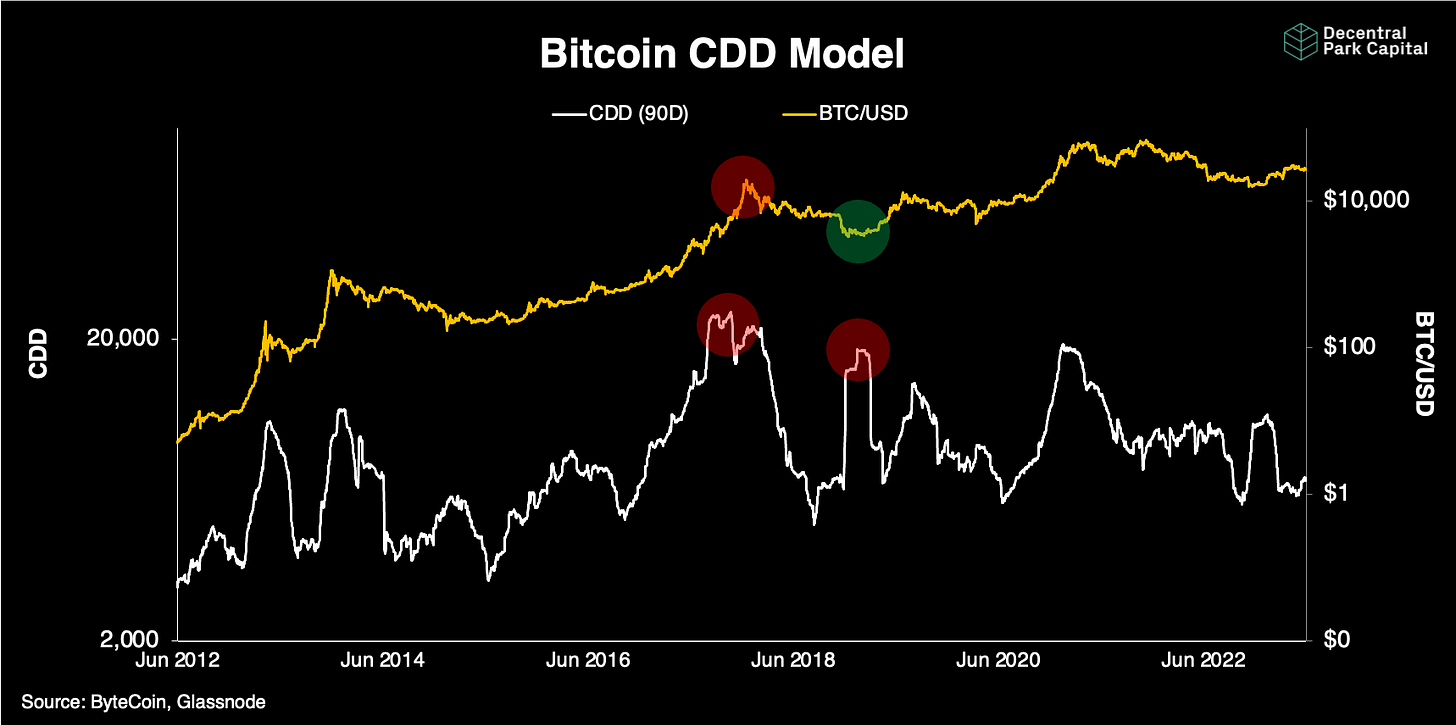

Cumulative Coin Days Destroyed (CVDD)

Coin Days Destroyed (CDD) measures coins moved on-chain as a function of time since those coins were last moved (UTXOs). The valuation theory of CDD is to determine when investors with large amounts of BTC and/or aged coins move to other wallets as they look to sell (CDD spikes).

These larger, longer-standing holders are often deemed ‘sophisticated investors’ where large peaks in CDD are taken to precede market tops.

The problem here is that CDD says nothing about a Bitcoin valuation per se. Only the price at which larger and/or longer-standing investors are willing to sell - which may ultimately turn out to be prudent or not. After all, CDD may spike at market bottoms due to capitulation by longer-term holders.

A revised CDD-based model could be revised so that it can more easily speak to a fair valuation for BTC.

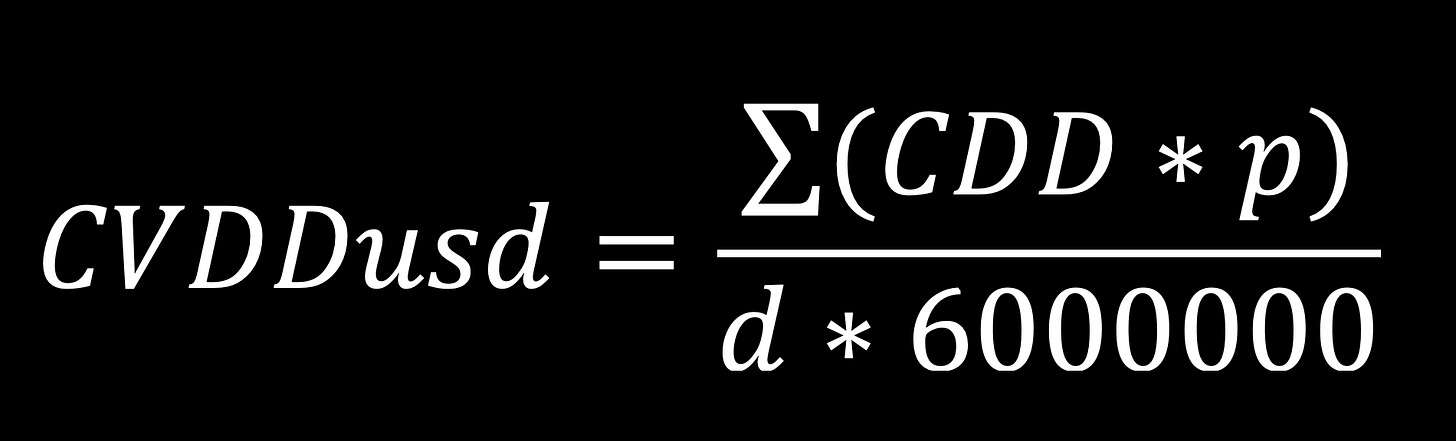

One approach is to take the cumulative value of coin days destroyed (i.e. days) to infer a valuation floor from investors taking new positions in BTC (Willy Woo, 2019).

For CVDD, both buy/sell price and time between investor buys/sells are necessary and equal inputs into the model. Note, the CVDD model uses an arbitrary calibration number of 6m where p denotes price and d denotes BTC market age in days:

So far, CVDD has been a useful measure for a Bitcoin price floor where the cumulative volume of lifespan destruction by the market appears to be the floor for investors during market bottoms/distress.

Balanced Price

Another framework related to CVDD could be to measure the difference between the inception-to-date average price paid for all coins in the market with the inception-to-date average price spent to arrive at a fair value:

Measuring the inception-to-date average cost basis for investors

Realized Price (RP) - the value of each coin in the supply at the time it was last moved on-chain (as a proxy measure for average sell price).

Measuring the inception-to-date average spent price for investors

Transfer Price (TP) - measures the coin days destroyed adjusted by coin supply.

Transfer price is an extension of the CDD model above but swaps out a calibration value to circulating supply (cs):

Both Realized Price and Transfer Price naturally move independently of each other.

A ‘Balanced Price (BP) can then be computed by subtracting the Transfer Price (TP) from the Realized Price (RP) to find the value where what was paid with what was spent is matched up (Glassnode):

Market bottoms have been historically formed when BTC’s market price meets the difference between the value paid and spent by investors. Periods of more extreme market capitulation can also be categorized when the market price falls below its balanced price.

Bitcoin Economic Throughput Model

To many, Bitcoin can be seen as a value-transfer system. Valuing such a system would naturally require measuring the financial bandwidth of the network per unit of time.

An example is to multiply the average transaction size (TVusd) by transaction count (TC) o create a composite model called Economic Throughput (ET; Nic Carter, 2018):

Over the years, the value placed on BTC has moved in line with its economic throughput (cointegration).

Note that, unlike CCVD or the Balanced models, ET can be used to forecast the future value of Bitcoin based on the forecasted growth rates of the variables within the model’s equation.

Bitcoin Metcalfe’s Law Economic Model

A revised model is to factor in the active user base of the Bitcoin network that is ultimately driving the economic activity on-chain. Metcalfe’s Law Economic Model (MLE) works off the theory that greater value is placed on a growing set of users participating in the network transacting a greater value between them.

MLE multiplies global transaction value (TVusd) by the square of daily active addresses (DAA^2):

For deeper coverage on Metcalfe valuation methodologies as well as their applicability to Layer 2 networks, see my latest piece: On Blockchain Valuations (2023).

We see that MLE has also historically trended in line with Bitcoin’s market value.

Similar to Bitcoin’s ET model, MLE can also be useful as a forecasting model to arrive at BTC's fair value given its cointegration with the market price. Divergences between market price and these models may be useful data points to note for investors.

In general, Economic Throughput and Metcalfe’s Law-based models do not imply a cumulative lower valuation floor for Bitcoin. The market price would reflect the collapse in active users and value transferred between them which could be lower than the previous market trough.

Decentral Park’s Thematic Research Spotlight:

Mining (Production)-Based Valuation Models

Blocks on the Bitcoin network are ordered by miners who expend resources to give themselves the ability to receive BTC rewards (subsidy and transaction fees) every block.

Miners are also involved in the defence against block reorgs that threaten certain network guarantees and transaction inclusion.

Therefore, it seems reasonable that Bitcoin’s valuation should be supported by the total resource expenditure by miners (i.e. the total resources committed on the production market to mint BTC into production).

Difficulty Regression Price

The Difficulty Regression Model (Glassnode, 2023) hypothesizes that mining difficulty is a useful proxy measure for mining ‘price’. The reason this is a compelling framework is that it’s reasonable to think BTC should oscillate around the estimated production cost of mining BTC itself.

A Difficulty Regression Price (DRP) can be calculated:

where A and B are regression constants, D is the Difficulty, C is the Bitcoin difficulty adjustment factor, and cs is the circulating supply.

Log-log regression analysis between the difficulty model and BTC market price has an R2 value of >0.95. BTC’s valuation moves in line with the level of mining competition or resource expenditure.

One of the benefits of the difficulty regression model is it simplifies the average production cost calculation without considering the power costs, equipment purchase/maintenance, staff etc.

This is because the DRP should naturally reflect the net effect of these variables together.

More bottom-up production cost models have factored in key inputs such as electricity costs and consumption data from Cambridge University with a key assumption being that electricity is the primary cost of operations for miners:

An example of a Production Cost Model would be:

(Daily cost to mine a Bitcoin)/(Daily cost to mine a Bitcoin/Daily cost of running a Bitcoin mining business).

Bitcoin’s production cost can provide the level at which miners start to become unprofitable. These periods are often short-lived as higher-cost miners retract resources and hash rate/difficulty adjusts, making it relatively easier to mine each block.

However, the total electricity cost to mine each BTC at any given point may provide a clearer valuation floor. As we can see, BTC has never traded below its Electricity Cost.

Note that, unlike some of the models above, the Production Cost and Electrical Cost Price models do not work off of cumulative values. A key implication being a floor price may eventually be lower than the previous floor price (not always higher).

Thermocap

The alternative framework is to look at cumulative-based expenditure models where an incrementally higher price floor is implied every day.

Thermocap (TC) aggregates the total BTC paid to miners and is used as a proxy measure of the total resources spent to mine BTC from inception. The model effectively puts the miners’ realized revenue as a true valuation floor.

A revised Thermocap index is put forward which includes Bitcoin transaction fees (TF) along with block subsidy (BS):

Bitcoin’s valuation has only touched Thermocap once in late 2011 and it’s not clear if this lower bound fair value estimate will be met again.

Instead of just looking at the realized revenue for miners, we can also factor in the input aggregate expense (Production Cap) to calculate a blended index of the two measures.

Here, Production Cap is equal to the cumulative sum of the Difficulty Regression Price (DRP) times issuance (I):

When Thermocap > Production Cap, miners are operating at an operating profit (and vice versa).

A final Miner Cap (MC) can then be constructed, equal to the average between Thermocap and Miner Cap (equal weighting):

Miner Cap represents the midpoint between Thermocap and Production Cap to approximate the cumulative aggregate expense expenditure by miners.

It remains to be seen whether BTC will ever reach so low as to hit MC but could conceivably act as a fair valuation floor should BTC ever see excessive downside price pressure.

Final Thoughts

As with virtually all markets, there is not one single correct ‘framework’ to evaluate an asset with. Bitcoin and other blockchain networks are likely no different.

However, valuing cryptoassets is more novel as blockchain networks bring a rich set of open-source on-chain data that can be used as model inputs.

Bitcoin’s crypto-native models mentioned in this piece can help supplement a primary currency debasement (macro) model for the network:

The currency debasement model can speak to the broader direction expectation while the on-chain models can provide valuation floors and targets due to the cointegration of certain variables. The above cumulative and non-cumulative measures have yet to be invalidated in previous market cycles.

Exploring these areas more deeply may help inform what we mean by intrinsic value.

The macro and the on-chain are inextricably linked. For example, higher broad market liquidity likely translates into higher economic activity or throughput on Bitcoin which can then be priced with on-chain-based models.

For the cumulative models, it is also unclear how the time value of money plays into valuations - whether x amount of expenditure by miners or price paid by investors is discounted forward (e.g. where $1 in 2018 is worth less than in 2023).

New tools and capabilities are also likely to emerge that can measure economic activity within more black box circuits like Lightning Network that are hard to evaluate today. Valuation work for blockchain networks will likely need to adapt as Bitcoin evolves too.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

Thanks for reading Decentral Park Research! Subscribe for free to receive new posts and support my work.