Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

Sit Tight

It’s been another tumultuous week in the crypto markets as market participants put ears to the ground on what is and what isn’t occurring. As expected, we are continuing to see new contagion on a day-by-day basis but these equally provides those prudent investors time to think about long-term allocation.

Crypto markets fell 2.3% last week and already 1.5% on Monday morning.

Cryptocap’s Global market capitalization index is now looking to break below key support of $760B which marks the peak in Q1 2018.

Note, we have never seen markets fall below their previous cycle peak. Market structure has clearly changed and assets face pressure left, right, and center.

BTC has briefly broken below the $16k ($15,870) but compared to previous cycle drawdowns, the declines have not been comparative just yet.

While history doesn’t repeat, looking at historical cycles can provide useful framing. Taking the previous 84-87% drawdowns, BTC’s implied price bottom would be ~$11,100 (-30%).

BTC’s realized volatility spiked in recent weeks but normalized around 26 on Bitmex’s 7D vol index as the orange coin consolidates around the $16k level.

However, the vol print is nothing extreme if we look at previous high vol swings post prolonged consolidation patterns. Realized vol cannot capture the scale of a future move but at the same time the index has been compressed for some time.

Analysts have also pointed to higher Bitcoin network activity as being fundamentally bullish despite the FTX fallout. After all, we can see higher lows for Bitcoin daily active addresses in recent months.

But there’s another side to it. We should expect higher rates of active wallets when volatility increases - especially when what has caused the volatility was related to centralized exchange security and assurances. Context is everything.

That said, other on-chain metrics *do* indicate BTC is in ‘deep-value’ territory. Ratios like MVRV are at yearly lows which have always marked more constructive periods (even if the scores themselves are arbitrary and prices continue to decline in the near-term).

This brings us to recent price action.

Markets are buckling further over the past 24 hours from news of the FTX ‘hacker’ who was one of the largest holders of ETH.

Now, it seems that same actor is selling ETH to other assets such as renBTC. The original thought was that this person is capturing an arb opportunity but given the size of total holdings vs. liquidity there may be another motive at play:

This selling also gives a reason for the market to front run this potential future selling, creating a negative feedback loop that could extend over the coming days.

The impact on the market has been already felt. ETH, which was holding up vs. BTC well over the FTX drama, has now underperformed by 6% (7D). ETH/BTC has initially found support at 0.694 and remains above the 200d MA for now.

For entry levels, BBs indicate a lower bound zone of $950-$1k. Whether prices reach these levels near-term - time will tell. Note, ETH/USD rarely stays at the lower BB levels for more than ~2 days.

Concerns have also been raised on Alameda supposedly having 417k stETH from the Celsius bankruptcy.

For Tether, its peg hasn’t quite managed to get back up to par reflecting an ongoing concern about Tether’s connection with Alameda and the minting of USDT.

For DeFi, we can see a comparatively bleak outlook for the sector right now. DeFi’s MCAP index have broken support of $34B with largest 24Hrs losers being SNX, DPX, and YFI.

The sector continues to face an identity crisis knowing that the barbell approach of either being fully regulated infra vs. decentralization (stateless) is the only path forward. Those caught out in the middle (which is the vast majority of projects today) are at the most risk from a survival standpoint.

Coming out of the FTX saga, the time to expect higher regulatory scrutiny is now. The seemingly arbitrary selection of LBRY by the SEC has no doubt also sent shockwaves to founders across the industry.

So where do we go from here? DeFi’s bear market has arguably started since 2021 where it has failed to capture prolonged momentum vs. beta (ETH). Until we see higher peak and lower lows, the trajectory remains down.

Others take a more cynical stance, and suggest reserve assets will continue to dominate so long as they are the core assets people always end up selling back into.

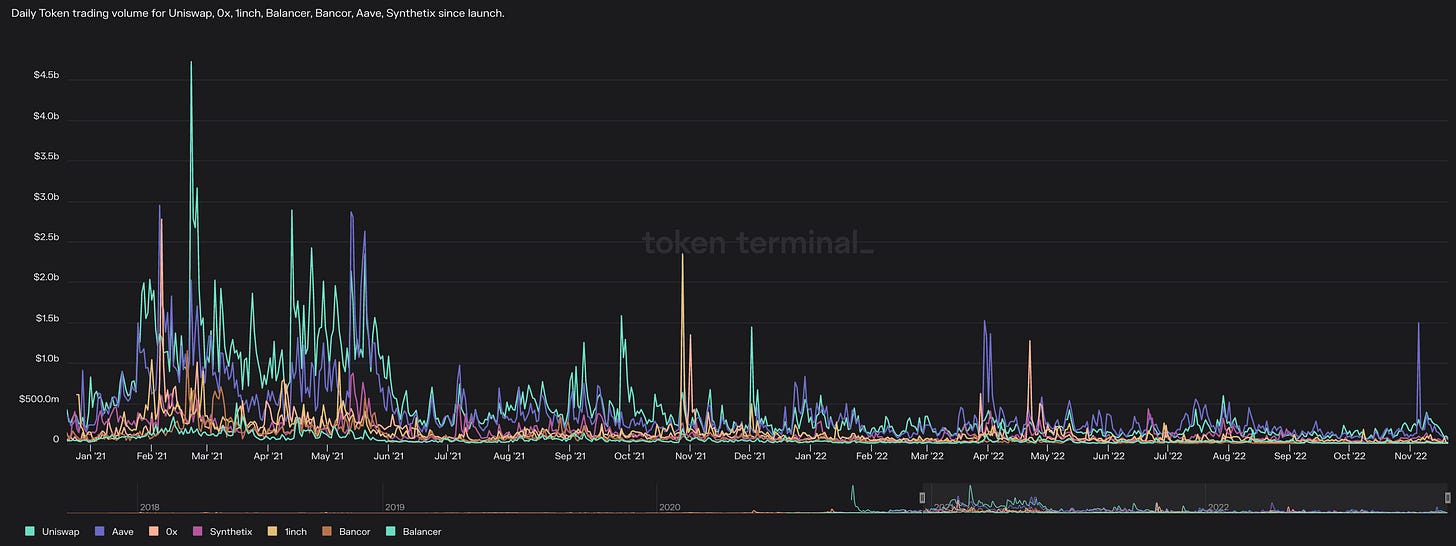

Finally, DeFi liquidity problem continues. Daily trading volume for crypto stands at ~$60B while DeFi is $3.5B. With a market captilization of $33B, the sector is just too small for institutional investors today. Daily trading volume rarely exceeds $100m for top projects.

This may not be just a DeFi problem but rather a broader problem with the crypto market.

DCG: Distressed, Capitulation, Gamble

Aside from the FTX ’hacker’, the markets are paying attention to Digital Currency Group (DCG) - the parent company of Genesis. For context, this this tweet thread.

Genesis likely used GBTC and ETHE shares as large size collateral for loans throughout 2022. However, GBTC’s discount to NAV is widening to new ATH levels as sell demand outstrips any potential buy demand.

The GBTC trust raises questions given its size - $10.53B or 3.24% of BTC’s market capitlization. The problem is neither DCG (which owns >4% of total shares outstanding) and Genesis can sell into a very illiquid market and heavily discounted market.

If DCG can’t plug the whole for Genesis (raise at HoldCo level), an acquisition by another party is the only way forward to prevent an organized bankruptcy for Genesis’ lending arm.

To make matters potentially worse, it is unclear whether DCG *owes* Genesis $1B. If they do, the whole framework changes.

Either way you cut it, the picture is murky, bleak, and likely impactful on the current ‘fragile’ market.

Macro

While crypto seems to be moving in her own way, broader risk markets have been transitioning to optimism to pessimism once again.

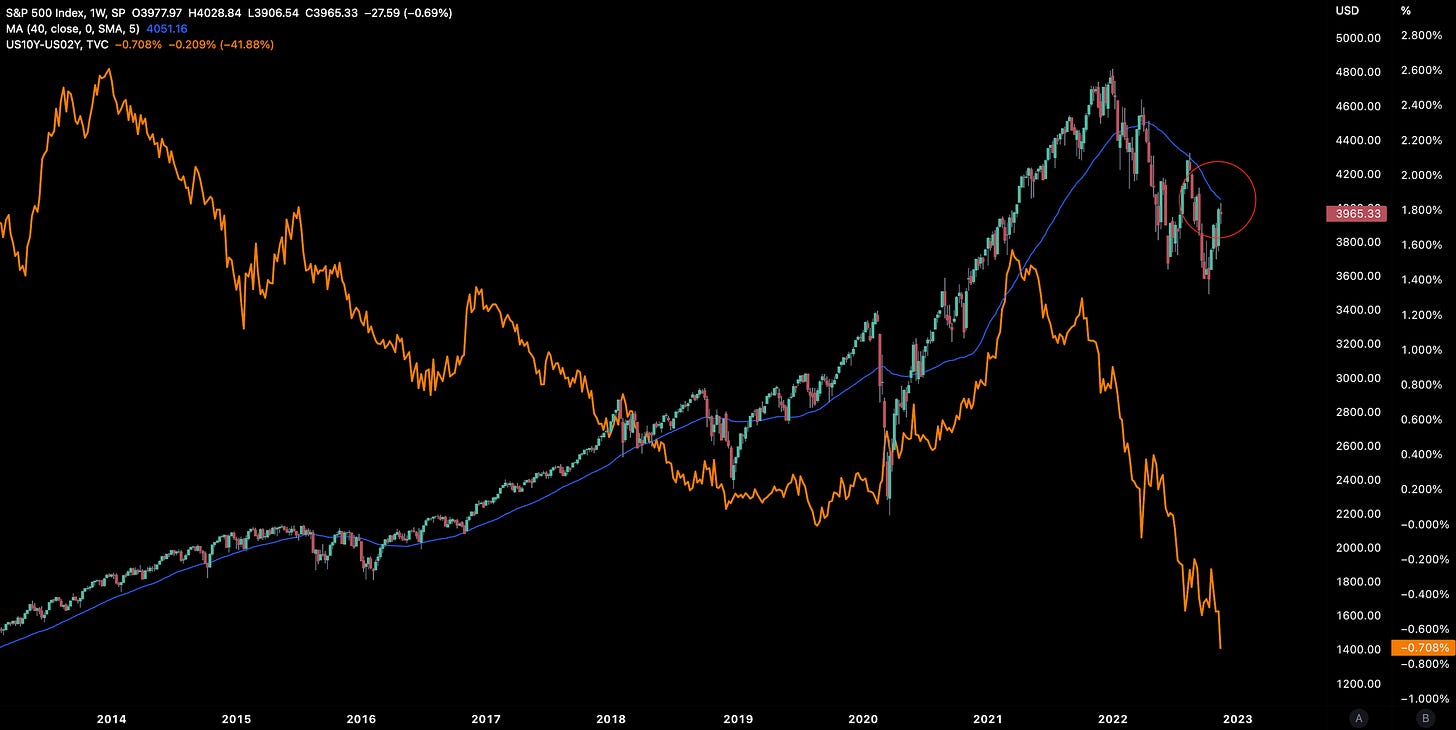

Equity futures have fallen amid concerns around tighter restrictions in China and hawkish fed speak. This also comes as $SPX hones in on its 40W MA - a typical top zone for bear market rallies over 2000-2002 as well troughout 2022.

Historically, the S&P 500 tops always coincided with the persistent inversion of the yield curve (e.g. ‘69, ‘73, ‘81, and ‘00). More strategists seem to be calling the obvious now with Peter Openheimer noting that a peak in interest rates and lower valuations reflecting recession are necessary before sustained stock market recoveries can occur.

Traders will gather any insight from this week’s fed minutes regarding the potential pace of rate hikes.

Dollar is becoming the safe haven for many investors once again with DXY coming back with a vengeance. As we’ve noted over the past few weeks, the market appeared to have been acting prematurely and discounted the idea that the dollar is still structurally strong heading into a global recession. All we have seen is dollar undergoing a large correction.

Perhaps a correction that is overstretched given the fall in the implied Fed funds rate given its a shadow of a move compared to dollar.

Crypto therefore has little to lean on from a macro perspective. With inflation expectations rising and a weaker dollar only fuelling the potential for higher prices. Weaker dollar, high equities remains a double-edged sword.

This may increase the likelihood of more direct hawkish speak by central banks to ensure all of the work done so far is not to be unwound.

For crypto itself, it appear a turbulent week is shaping up.

Capitulation Signal of the Week

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$753B; Global market falling 1.4% so far this week, fuelled by forced selling fears and hacker offloading moves. Looking to potentially break below key support at $760B. Daily RSI signalling near oversold at 34.

$35B; DeFi market cap firmly rejected by the 200d MA. Unclear what support level will be formed for the sector given contagion risk/forced selling. Daily RSI also signalling near oversold conditions at 34.

40.95%; BTC dominance gaining ground with BTC relative strength strategy still in play. Every bounce from sub 40% lows has resulted in dominance climbing to 45%+.

Trader Positioning

No notable change in BTC futures OI which stands at ~$8.5B. Aggregate funding rates mixed indicating a level of high contention or low conviction (more likely due to flat OI) between bulls and bears.

ETH funding rates showing similar picture as futures OI keeps flat at ~$4.3B.

ETH puts becoming expensive with 120% IVs being printed. High premiums as traders look increasingly to downside protection strategies.

Grayscale GBTC

Sharp increase in discount to NAV (45.08%) and new ATH. Trusts are structurally broken. Daily volumes are ~$46.8m vs. DCG’s holdings worth ~$200m at present.

Grayscale ETHE

Sharp increase in discount to NAV (44.65%) and new ATH. Trusts are structurally broken. Daily volumes are ~$26m.

Volumes

Daily volumes falling to $15.3B but could be on track to make new annual lows as we see further market inertia post FTX.

Aggregate Order Books

Order books look heaver on the bid side. Heavier resistance up to $16.3k.

Miners

Bitcoin hash rate looks to have topped out for now and maybe in the process of rolling over. Bitcoin hash price looking to make new highs as market valuations are put under further pressure. Meanwhile, Bitcoin mining difficulty taps a lifetime high.

Miners are in a world of hurt.

Convex is live on Arbitrum, USDT / WBTC / WETH pool APR is 15.5%, WBTC / renBTC pool offers 12% APR.

Abracadabra's MIM is expanding on Optimism, USDC / MIM pool on Velodrome offers 11% APR.

Balancer introduced sfrxETH/wstETH/rETH pool, the first staked ETH 3 pool from Frax, Lido and RocketPool, APR is 9%-24%.

Kyber partnered with Lido to increase wstETH liquidity, wstETH / USDC pool (25% - 157% APR) is allocated 100,000 LDO + 180,000 KNC in rewards, wstETH / LDO (19% - 36% APR) will receive 8,000 KNC.

No clear trend across the high performing assets. Generally lower liquidity have made moves more pronounced in the DeFi sector.

Top 100 (7d %):

OKB (+12.8%)

NEM (+10.8%)

Arweave (+9.3%)

GMX (+7.8%)

Trust Wallet (+5.1%)

DeFi Top 100 MCAPs (7d %):

Serum (+62%)

DeFi Kingdoms (+22%)

Raydium (+14.2%)

Covalent (+10%)

Nest Protocol (+9%)

🎙️ Crypto Venture Capital Series Ep. 8 [Delphi Digital]

🎙️ Travis Scher on the FTX impact on Crypto VC [On The Brink]

🎙️ Behind the Scenes of JP Morgan’s First DeFi Trade [Defiant]

🎙️ Ventures Round with Meltem Demirors and Vanessa Grellet [The Scoop]

🎙️ Okay Proof of Reserves, But for Real This Time? [The Breakdown]

📚 On Silvergate Concerns [Data Innovation]

📚 Hacker movements [The Block]

📚 Coinbase 2028 bonds [Dylan LeClair]

📚 Federal debt [Lyn Alden]

📚 Uniswap's new privacy policy says it collects data tied to user wallets [The Block]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.