Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

An eventful week for an eventful market

It has been one of the more eventful weeks in recent memory for the crypto markets.

Only 8 days ago did CZ tweet his intention to sell $500m of $FTT tokens. Fast forward to today and the markets have completely changed.

There is a tremendous amount of noise out there right now and so, for this market rundown, we will focus on pure signal.

Crypto markets too an expected hit over the past week, declining 20% overall.

Support was found at the 2018 peak of $750B which may assure the bulls that the damage can be contained.

That said, a break below here (as it’s such a clean psychological level) would equally indicate more pain is to come.

We also saw one of the largest daily volumes for major coins like BTC which could be taken as a bullish signal. Highest volume days have often coincided with capitulation events that have been close to major bottoms:

March 13th 2020

March 12th 2020

June 13th 2022

May 19th 2021

BTC declined 22%, wicking down to a $15,632 low last week. This level is below the 2018 peak (unlike the broader market) which may be telling itself.

The declines we see in the market may not be from remaining bag holders - there are probably not many left now. Rather, it’s the forced selling of assets that can be offloaded into the market where there are limited bids.

The ‘irony’ of the situation is that high cap liquid names like BTC and ETH have been affected worse than their mid-cap counterparts.

Take ETC on its ETH ratio. The pair actually rallied 7% from the 6th November to Thursday meaning the fork of Ethereum was holding up better than Ethereum itself. This is not what you would expect in a distressed market environment unless there was an element of forced selling of ETH.

Note now that the ETC/ETH ratio is on its decline and means there is now more bids for ETH as the initial dust from last week is starting to settle.

ETH has also been holding up well vs. BTC. The ratio has almost recovered all of its losses since the 6th of November. With BTC under $16k, a 0.0752 ratio is impressive. BTC making new lows hasn’t equated to ETH making new lows.

But the outlook remains uncertain for the pair. DeFi is likely in for a long winter and ETH/BTC may feel the pain as a result. Fund redemptions, insolvent market makers pulling liquidity, and no new inflows may drive this.

For DeFi itself, market capitalisation fell below the $40B mark - support held since summer, showing the extent of the forced selling within the sector. Note, the liquidity heading into FTX’s saga was already incredibly low as we’ve noted throughout 2022.

Assets connected to the FTX franchise have been hit the hardest. SOL found support at $11.4 and recovered back above $20 in line with market towards the end of last week. However, the asset is eyeing new lows once again with news that many aspects of the Solana ecosystem was orchestrated by SBF and doomed to fail:

Formula = same low float + high FDV networks + same 3-4 VCs in every project

The use of larger cap names on balance sheets / loan agreements may also mean they are at risk just as much as lower liquidity DeFi names when it comes to contagion.

DeFi assets are down ~21% for the week vs. smart contract platforms which are down 21.3%. Performance as well as sentiment towards certain names will likely be determined by their ties with Alamaeda/FTX.

Finding the winners

There have been winners in this market too. Those that put on a DEX thesis in light of declining sentiment towards CEXs have been paid in spades. Names like dYdX and GMX are up 35% and 18% respectively over the past week and diverging from the broader market.

These are also supported by fundamentals where higher trade volumes on those platforms has translated to higher fees. For example, GMX fees hit new ATHs last week.

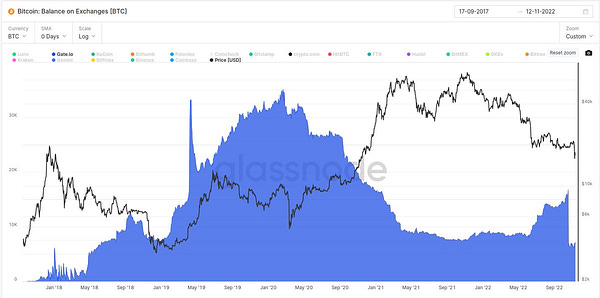

Their performance may extend further if CEX sentiment continues to decline and there are plenty of reason why it might. Certain exchanges are showing unusual flows for particular assets like BTC.

On-chain data revealed that exchange Crypto.com ‘accidentally’ sent 320k ETH to Gate.io before Gate.io illustrated their ‘proof of reserves’. This ETH was then sent back to Crypto.com shortly after. Questions around OKX deposits are also being asked.

There are now early signs that a bank run on Crypto.com is in motion with 90k Ethereum transactions occurring on Sunday (22,449 outgoing addresses vs. 2 incoming addresses).

Concerns are also emerging over in the stablecoin space where Tether supply has declined by 3B while the stablecoin peg has been missed for several days now. Perhaps the collateral damage from FTX is causing individuals/institutions to find the off-ramps.

This comes at a time when demand for USD liquidity is skyrocketing - stablecoins are flowing out of Ethereum smart contracts at the highest rate since the LUNA collapse.

There is evidence that Bitfinex is levering ETH to maintain the Tether peg. The incentives, however, are unclear. They may be acting to prevent a sustained Tether bank run or just simply making money by arbing the price delta on the market (knowing everything is OK).

A trip down macro lane

The broader markets have become full risk-on with equities seeing their biggest daily percentage gain in more than 2.5 years as annual inflation slipped below estimations.

The S&P 500 rallied 5.9% for the week and touching the key 4000 mark.

The index is approaching its 40W MA which has been a good area of resistance for bear market rallies this year. This could indicate limited upside for the bulls where the move upwards may be driven by short covering vs. new incremental buyers.

The 40W MA was also the resistance zone for SPX from 2000-2002.

What may limit risk asset upside is the reaffirmation by central banks that a single inflation print means very little. Two points a line, three dots is a trend.

Equity futures are starting the week mix as a result of that very point. Fed governor Waller warns that the market has got “waaaa-aaay out in front…I just cannot stress this is one data point. We’ve still got a ways to go.”

We’ve also seen dollar gauges plummet as the end of the rate hike cycle nears for investors. Yet, it seems the market is still in denial mode and acting prematurely.

What investors should realise is that recession seems inevitable now and severe earnings deterioration may mean a Fed pause will not be sufficient to revive animal spirits. The US 10-02 yield curve remains very inverted and at extreme levels.

A key ongoing risk for equities is earnings. Wall street’s outlook for Q4 earnings is becoming more negative while Morgan Stanley’s Mike Wilson sees the S&P 500 discounting the 2023 earnings risk sometime in Q1 2023 “via a ~3,000-3,300 price trough.”

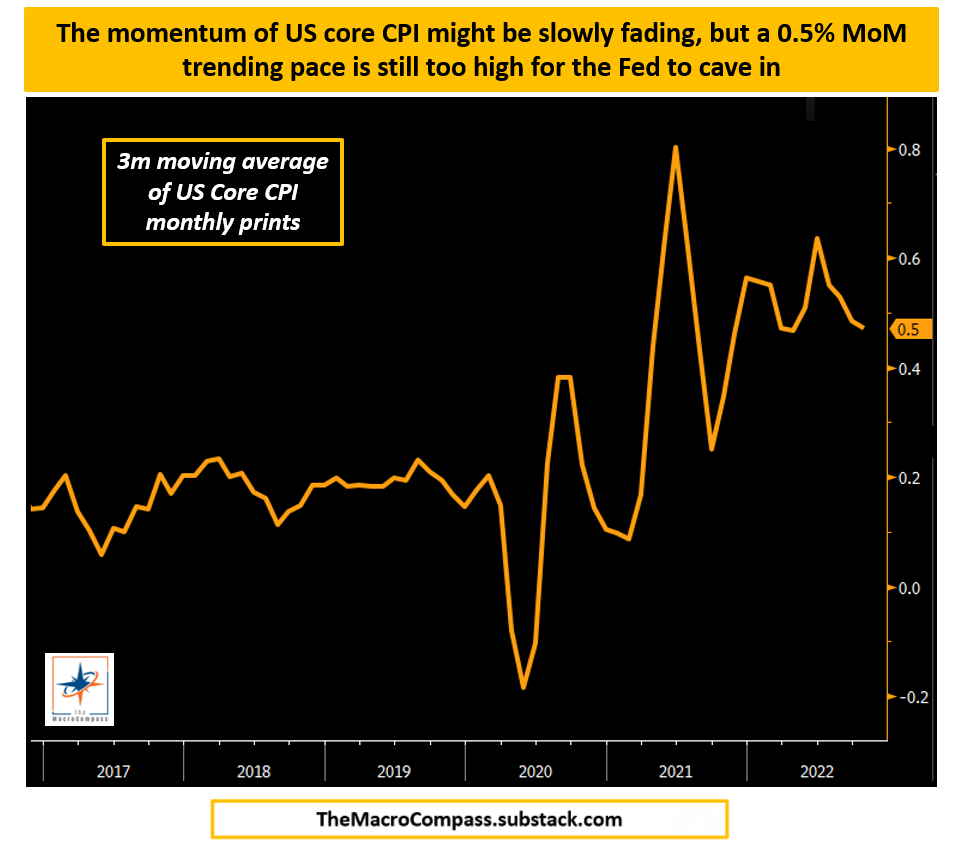

Just like the prospect of a double-dip recession, we may also see a double ‘hump’ in inflation. Even then, a 0.5% MoM trending pace in core CPI is still far above the Fed’s longer-term inflation target with 70% of core CPI components still running above 4% annualized rates.

As Alfonso Peccatiello summarises: “Inflationary pressure are still broad.”

So equities may extend their run from here but the further they go, the more challenged they arguably become.

When it comes to crypto’s relative performance, the sector needs some ‘catching up’ do to vs. its equity counterparts. Further rallies in equities may bode well for crypto’s recovery from distressed levels (technician’s take).

However, the reality is the contagion risk overhang on the market will likely weigh on investors for some time.

The expectation from here on in is crypto will be the slowest mover on the upside but a faster move on the downside.

For now though, we’re just recovering from what feels like the 2nd knock down.

We’re down 5 rounds with 7 more to go.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$800B; Global market cap declined 20% last week but recovering slightly on Monday. Markets are now down 73% from ATH, lower than the 2018 peak-to-trough.

DeFi MCAP

$35B; DeFi market cap firmly rejected by the 200d MA. Unclear what support level will be formed for the sector given contagion risk/forced selling.

Bitcoin Dominance

40.2%; BTC dominance trending closer to 40% as stablecoin dominance climbs higher (demand for USD liquidity).

Trader Positioning

BTC-denominated futures OI has fallen 15% from its peak. Funding rates have been negative likely for these reasons:

New shorts to hedge existing long exposure prior to FTX fallout

New shorts as part of FTX withdrawal trade (short same asset held on FTX)

Bearish sentiment from contagion risk

ETH-denominated futures OI has fallen 38% from its peak where aggregate funding rates are noticeable more negative than for BTC.

Hihgest OI by strike for calls is $24k (4226 BTC) and $16k for puts (2500 BTC). Puts OI noticeably more spread from $10k to $20k.

Grayscale GBTC

GBTC discount to NAV making new highs (42%). Alameda is supposedly exposed to ETHE and market participants may be looking to sell shares as a result.

Grayscale ETHE

ETHE discount to NAV widening to 35.5%. Alameda supposed exposure to ETHE likely accentuating drawdowns beyond market declines.

Volumes

Exchange volumes spiked to $37B.

Could be taken as a bullish indicator as the days with the largest volumes in history have often been capitulation events.

Aggregate Order Books

Order books looks heavier on the bid side. Heavier resistance up to $17k.

Miners

Bitcoin’s hash rate stays at all-time-highs (271m TH/s) despite price drawdowns over the past week. Bitcoin miners were distressed heading into the FTX saga and are facing further pressures from an operational cost perspective.

Bitcoin miners’ balance is declining to a 10-month low and could mean the asset faces idiosyncratic sell pressure over the coming weeks.

Canaan Q3 net income drops 88%.

However, the relationship between miner balances and price is unclear.

Very few names printing positive perforamnce over teh past week. Winning themes have been tokens associated with self custody wallet infra and decentralized exchanges.

Top 100 (7d %):

Trust Wallet (+106%)

GMX (+10%)

PAX Gold (+3.7%)

Tether Gold (+1.9%)

The Open Network (-2.6%)

DeFi Top 100 MCAPs (7d %):

DFI.money (+63.1%)

dYdX (+25.4%)

Ampleforth (+11%)

GMX (+9.9%)

Nest Protocol (+1%)

Synthetix launched a proposal to incentivize sUSD bridging from/to Optimism and Ethereum Mainne via Hop. LPs of hsUSD/sUSD pool will be rewarded with OP tokens if it passes. SNX Optimism pool is online with 35% APR in OP and HOP tokens.

Aura has become one of the leading places to deposit rETH and stETH liquidity with rETH/ETH APR at 10.5% and wstETH/ETH APR at 7.1%.

Beethoven X, official fork of Balancer on Optimism, is incentivizing rETH/ETH liquidity with OP and BAL rewards, current APR is 14.5%.

Gearbox launched a proposal adjusting GEAR LM rewards, the plan is to cut emissions for wstETH and wBTC and redirect tokens to DAI, WETH, USDC and FRAX markets.

📚 Market structure changes [Cumberland]

📚 Market tops [Michael Kramer]

📚 DEX trades at ATHs [Nansen Intern]

📚 Goldman on Core PCE [Bloomberg]

📚 Proof of Reserves [Cobie]

🎙️ Marc Cohodes & Keith McCullough | Hedgeye Investing Summit Fall 2022 [Hedgeye]

🎙️ FTX wallets drained while we’re on air with FTX team member [UpOnly]

🎙️ Weekly Roundup 11/10/22 [On The Brink]

🎙️ Inside the Cosmos Ecosystem [The Scoop]

🎙️ Binance Starts Recovery Fund for Crypto Projects Facing Liquidity Crisis [CoinDesk]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.