The Weekly #177

Wall street edges higher after inflation data hit estimations while renewed risk appetite in crypto appears to be waning over the past few days.

The Big Inflation Surge

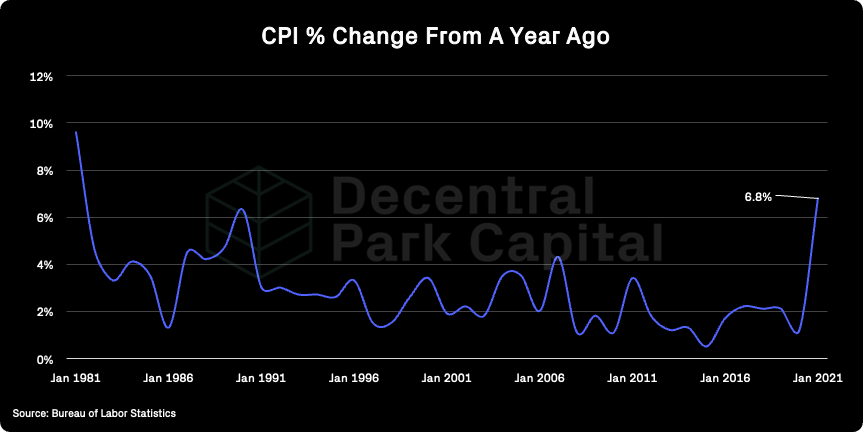

The main macro headline last week was the 6.8% CPI annual change in November. Inflation accelerated at its fastest pace since 1982 with surging food, energy, and shelter accounted for much of the gains.

World stocks gained in the wake of the news with the S&P 500 printing a record closing high. The 6.8% change was in line with expectations and so the equity market reaction may reflect relief in inflation not ending up above those expectations - despite percentage itself being statistically high.

Meanwhile Gold rallied higher but performance was limited by a strengthening dollar and prospect of tightening monetary policy.

This week the Fed is expected to double the pace of tapering of its asset purchases to $30B a month starting in January. This would enable the Fed to start raising interest rates as soon as next spring.

A Muted Crypto Response

BTC, an investor’s choice as a hedge against inflation, initially rose 2% to the $50k level shortly after the CPI data was released. However, BTC reversed its gains later that day and became divergent again equities once again (orange line).

As concluded in last week’s edition of The Weekly, it was still unknown whether renewed appetite in risk assets by investors would translate to buying power in the crypto markets. So far, this has not played out.

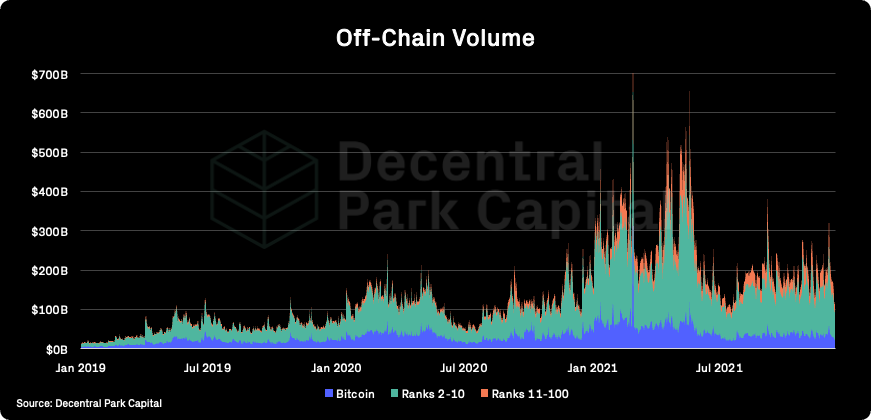

Even simple metrics like global spot volumes paint a similar picture. Since November’s volume peak when asset prices were hitting ATHs, spot volumes have fallen over 38%.

On-chain metrics also point to challenges ahead. The Bitcoin STH-MVRV indicates a potential bearish period over the coming weeks if the metric fails to sustain itself above 1. This is because the 1-line has often worked as a resistance/support line and breaking through has been a good indicator for market reversals.

Core Ecosystem Assets

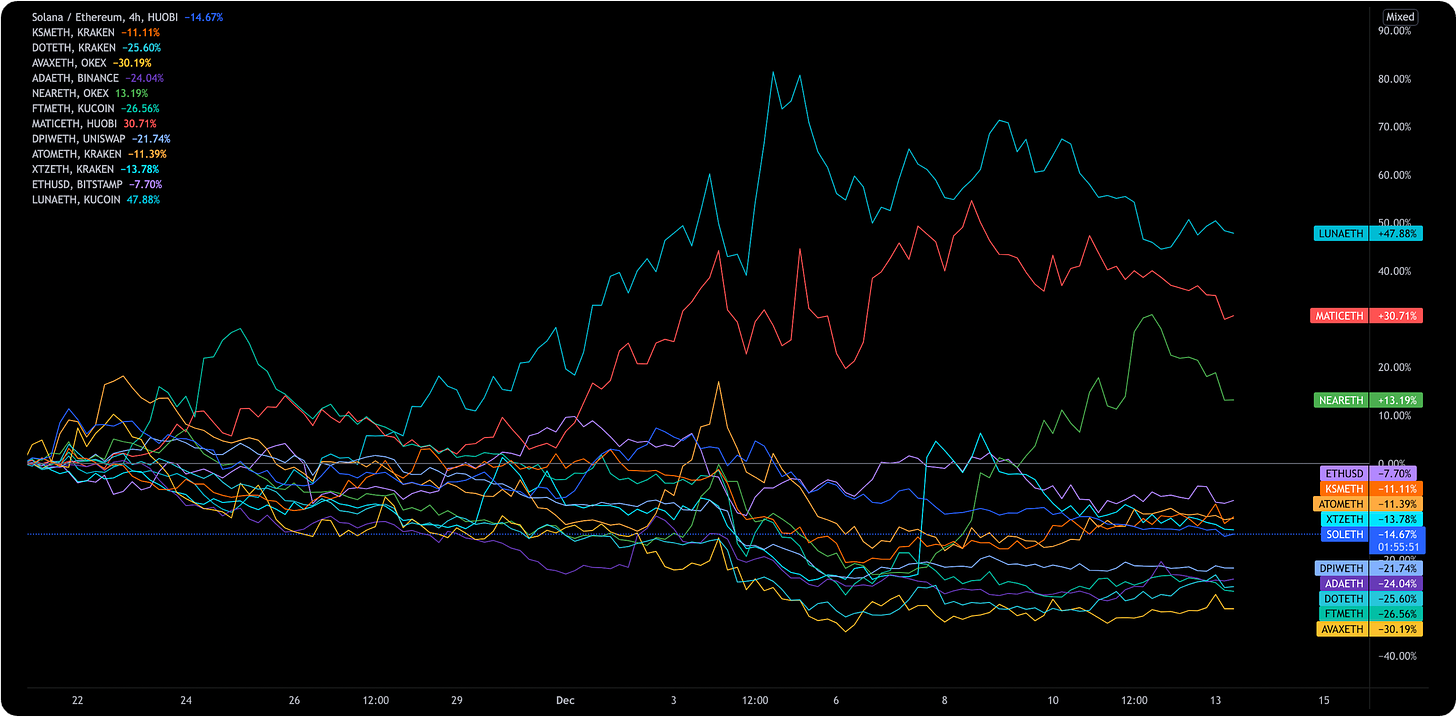

Lower demand has put pressure on prices. However, it hasn’t been all doom and gloom for Layer 1s. Assets like NEAR have posted positive returns for the past 7 days (35%).

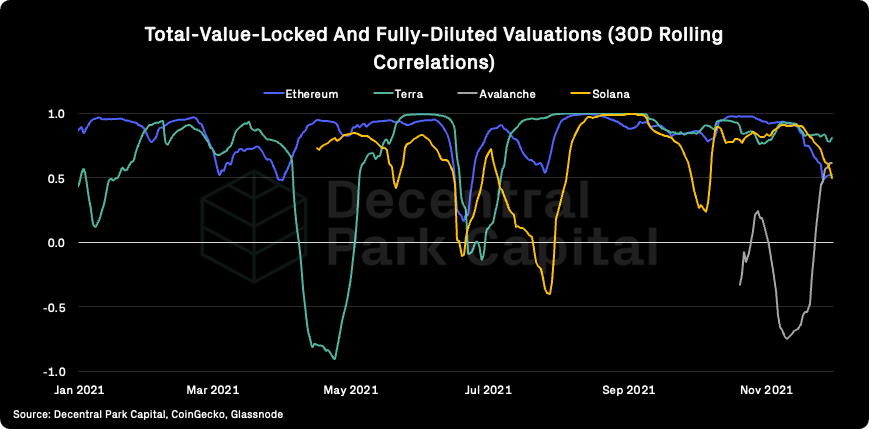

Zooming out over the last few weeks, only LUNA, NEAR, and sidechain-related assets like MATIC have outperformed ETH. This highlights the benefit of a creating a diversified basket of ‘core assets’.

If accelerated tapering and/or raised interest rates put pressure on the crypto market, the more liquid L1s where price is often correlated to growth of the underlying chains may outperform the wider market. ‘Core ecosystem’ assets have been, and will likely continue to be, good proxy plays for overall utility growth in the market.

For now though, it appears alternative L1s will have a hard time leading against Ethereum. A dominant narrative that will evolve over the coming weeks will be ‘zk-Rollup season’. dApps built natively on zk-Rollups are seeing accelerated adoption.

ZigZag, a DEX on ZKSync, is already seeing over ~$10m daily trading volume. On December 9th, Polygon bought ZK-based startup Mir protocol for $400m as part of its product line build out.

DeFi

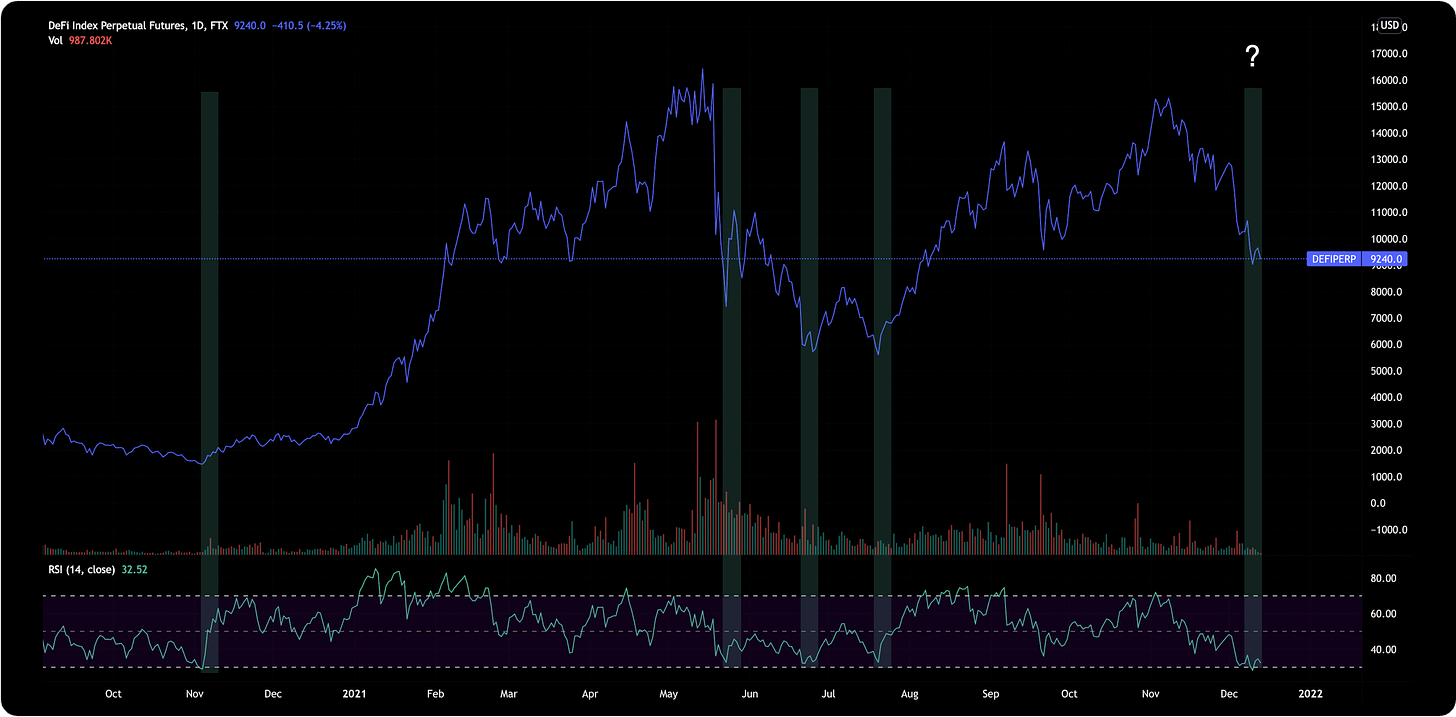

The Decentralized Finance sector is also under strain. FTX’s DeFi Index Perpetual futures has broken their September support with its RSI at rock bottom (32). Near-term recovery is on the cards as has been the case historically when its RSI has hit similar levels.

Top performing assets have been L1/sidechains assets while ‘DeFi 2.0-related’ assets continue to outperform the sector.

Global:

Terra (+31%)

Polygon (+11%)

Stacks (+7%)

LEO Token (+6.5%)

OKB (+4.3%)

DeFi:

Tribe (+10%)

Anchor Protocol (+4%)

Gnosis (+1.3%)

Magic Internet Money (+0.7%)

FRAX (-1.9%)

FRAX

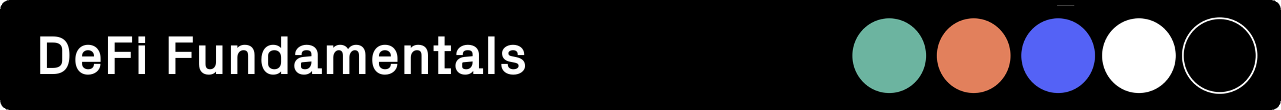

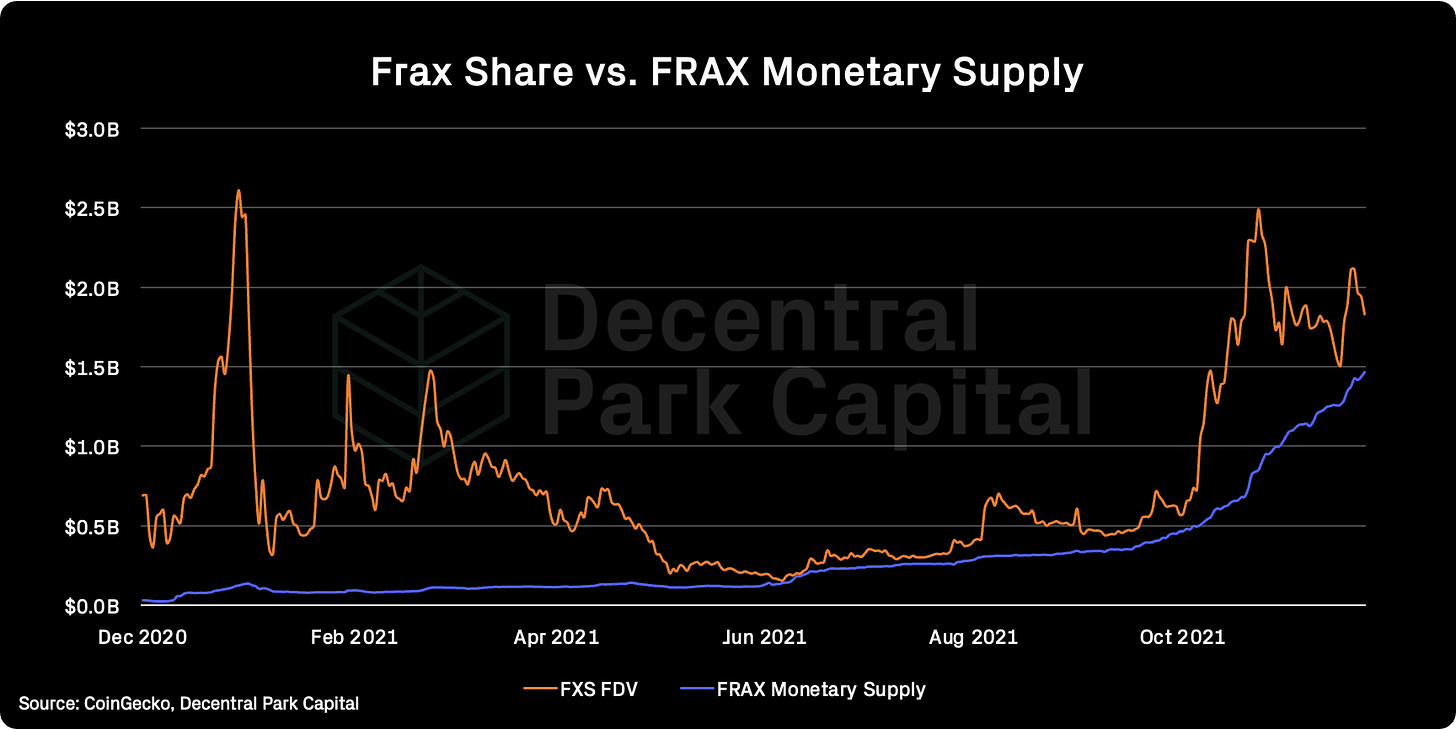

FXS has been a top performing asset within DeFi over the past week (+20%). Frax’s monetary supply has had the biggest weekly percentage change relative to competitors.

Frax’s monetary supply continues to act as a support level for the governance token.

BENQI

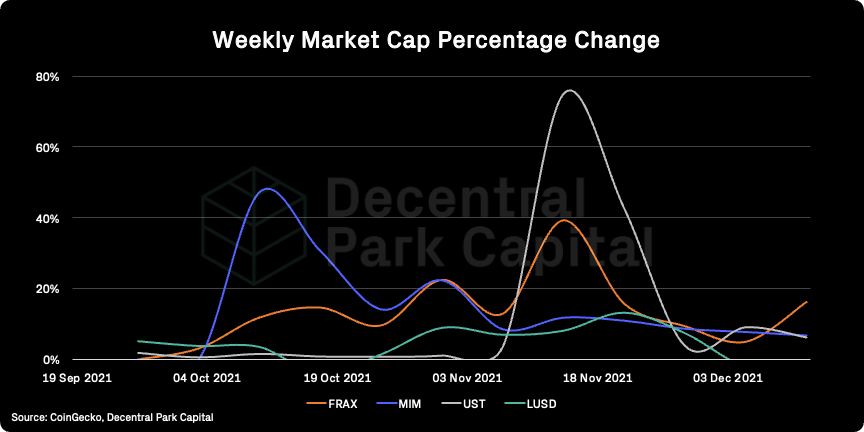

The Avalanche-based lending protocol has now taken nearly 9% market share for borrow volume against long-standing lending protocols (Aave, Compound, and MakerDAO).

BENQI borrow volume is now consistently over $2.1B with protocol 30D revenue up 58% ($16m). QI will be listed on FTX on December 13th.

NFTfi

NFTfi is a marketplace for collateralized loans. NFTfi has facilitated over 2.5k loans and over $35m in cumulative loan volume. Just last month, NFTfi had its largest-ever loan approved in November $1.42M.

ZigZag, the first order book DEX on zkSync, in search for additional liquidity. Since zkSync 1.0 doesn't support smart contracts, all deposits and withdrawals have to be done manually by the team, so it is trust based right now. LPs can provide ETH, BTC, stables for 20% APY and potential retro active airdrop in the future.

Lyra, an open protocol for trading options on Optimism, is launching LYRA token this week. LPs can provide USDC to security module for 1.36 LYRA per $1K per day.

Perpetual Protocol v2 is live, LPs now can deposit USDC on Optimism with Uni v3 price range feature, detailed guide can be found here.

Curve launched CVX (Convex Finance) / ETH pool, gauge is not live yet, CRV rewards TBA.

Celer's cBridge liquidity mining program is launching on December, 15. LPs can provide ETH, USDC, USDT on Ethereum, Avalanche, Arbitrum, Optimism, BSC, Polygon and Fantom and receive CELR rewards.

Crypto firms spent $5 million lobbying the Senate in the first three quarters of 2021 (Decrypt). Lobbying dollars are accumulating led by the largest firms and publicly traded players in crypto, driving a strong push to educate legislators and bring smart legislation to the table in 2022.

What we learned at Congress’ much-anticipated summit of crypto execs (The Block). The lobbying dollars are working and congress is warming up to crypto. Stablecoins will be the first asset class to see broad regulatory oversight with active dialogue towards frameworks for other asset types.

US is ‘unquestionably’ behind the curve on crypto ETFs, says Brian Brooks (Cointelegraph). Brooks pointed directly at the SEC for the lack of a spot BTC product in the US, further supporting the offshore flight of capital flows seeking exposure. “Crypto is just a step function improvement in the system,” and adding regulators to a multi-agency framework further confuses oversight.

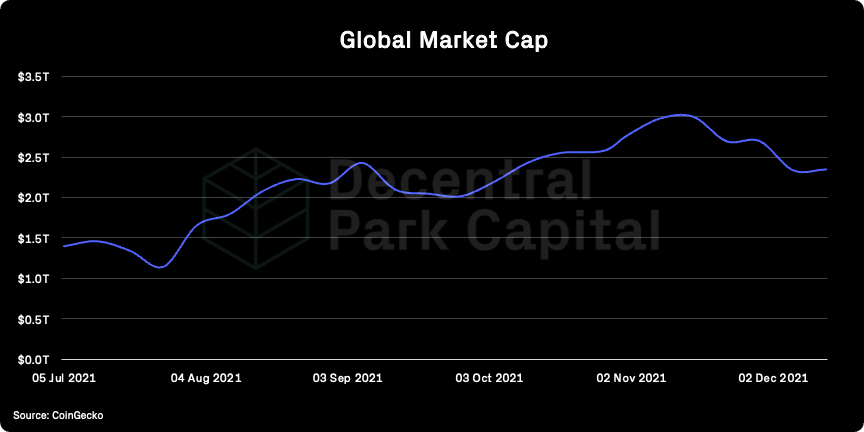

Global market cap: $2.71T; Global market cap has been flat over the past week.

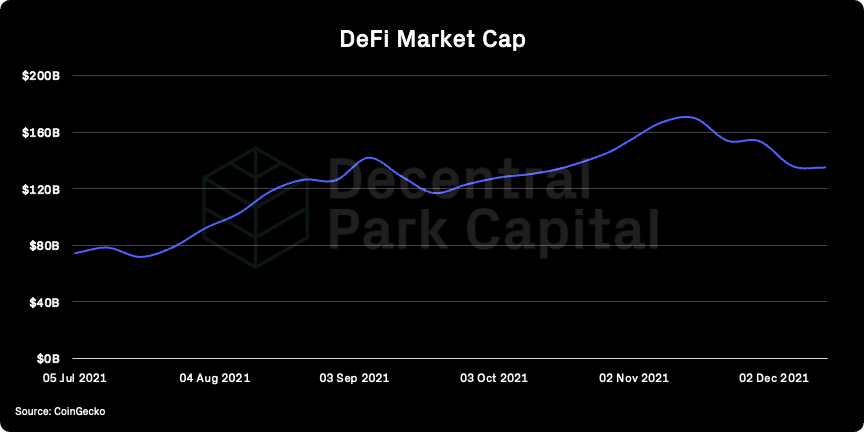

DeFi: $135B; DeFi market cap has fallen 1% over the past week with DeFi dominance decreasing by ~3%.

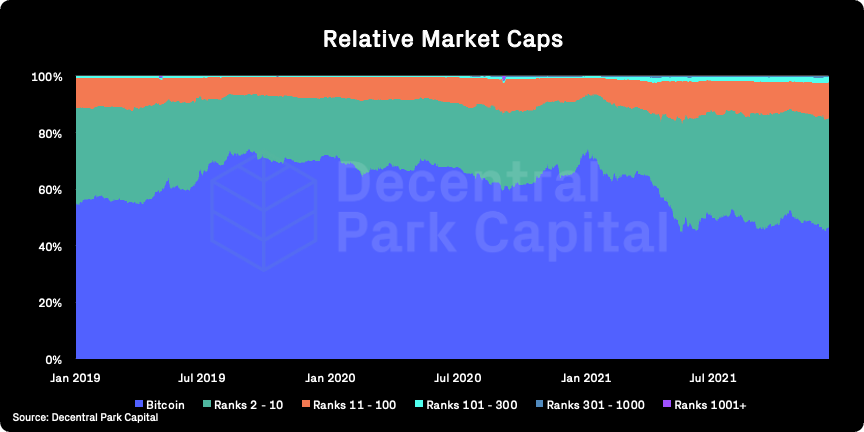

Market shares; Bitcoin dominance has increased slightly over the past week to 46.56% as most high-cap alt L1s print double digit drawdowns.

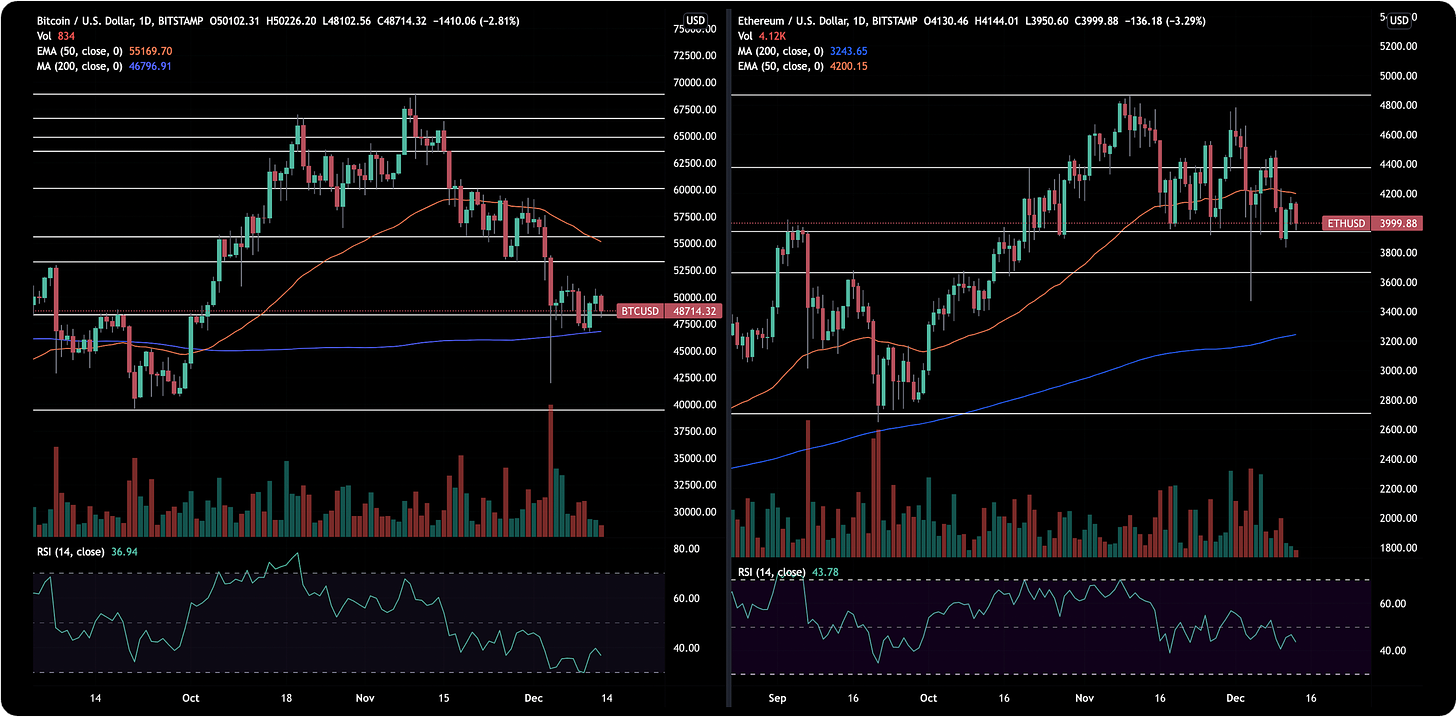

BTC/USD and ETH/USD (D)

ETH/BTC (W)

Price action; BTC range-bound between $51.1k and $46.8k with initial support found at the 200d MA. ETH still finding strong support at $4k although remains slightly weak against the orange coin. ETH/BTC may need more of a reset with support found at ~0.0814.

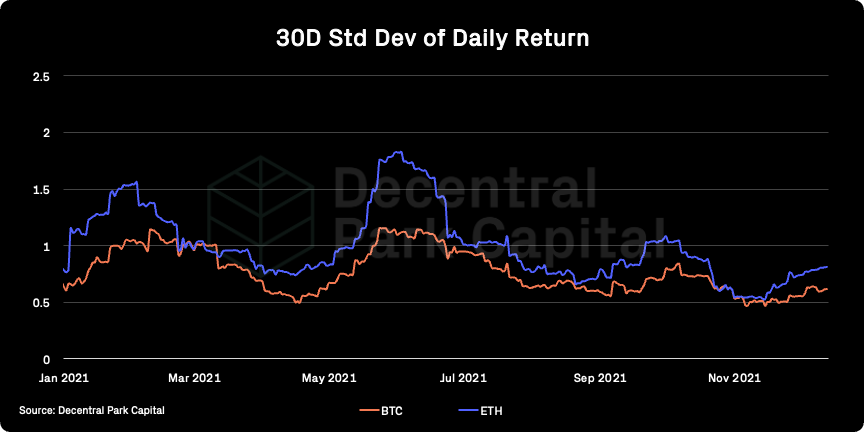

Volatility (BTC & ETH); BTC and ETH 30D vol has increased over the week. 1-month implied volatility for ETH and BTC have increased 7% and 6% respectively.

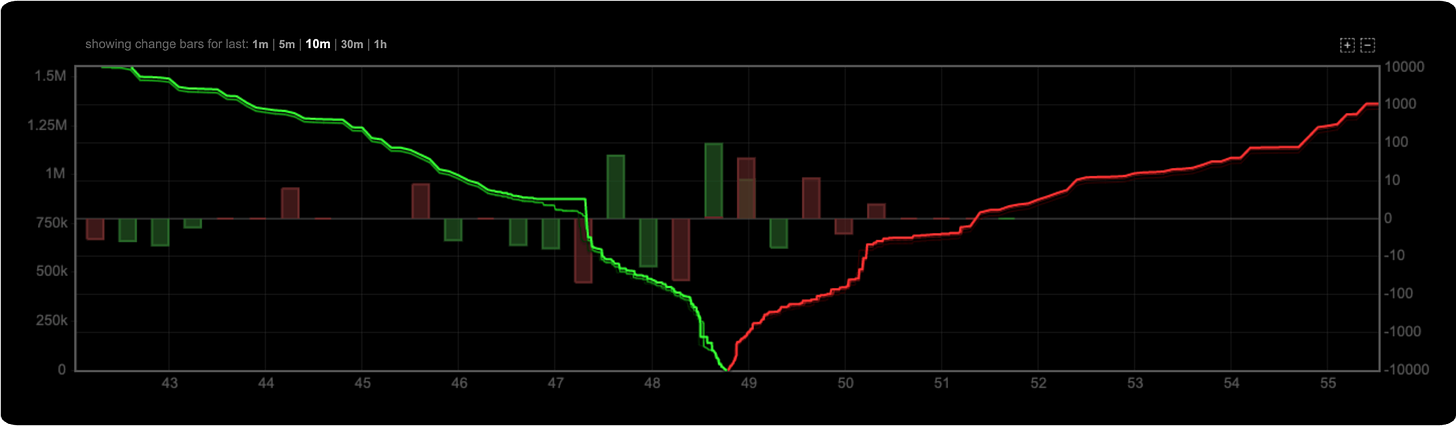

Combined order books; Order books look slightly heavier on the bid side. Heavier resistance up to $50.2k (Source: Bitcoinity).

BTC vs. SPX and Gold; BTC becoming less correlated with equities since the 6th December and more recently with gold. Increased risk appetite is so far not translating to buy demand in crypto.

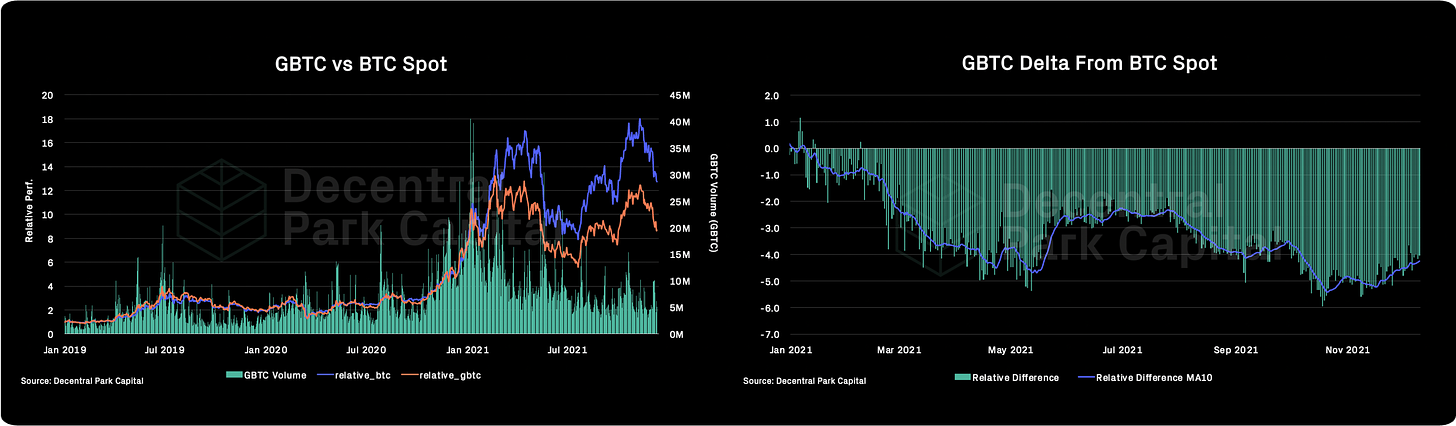

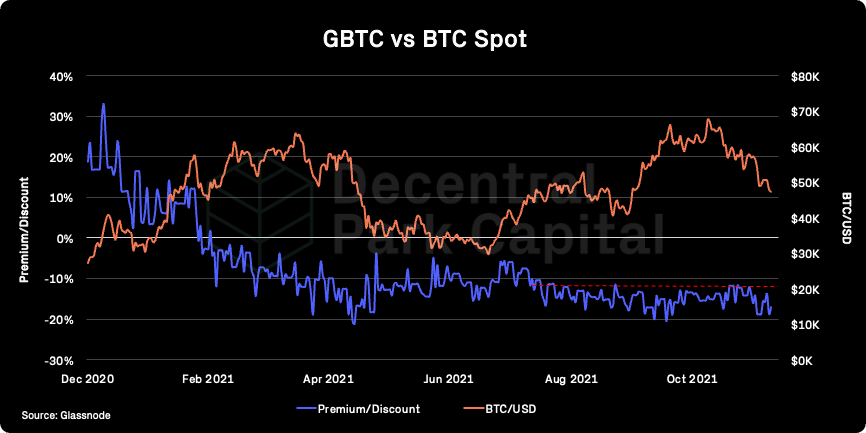

GBTC premium; GBTC discount approached yearly low (18.8%) with 20% forming the discount floor. 30D volumes also dropping to yearly lows with recent trends in line with spot.

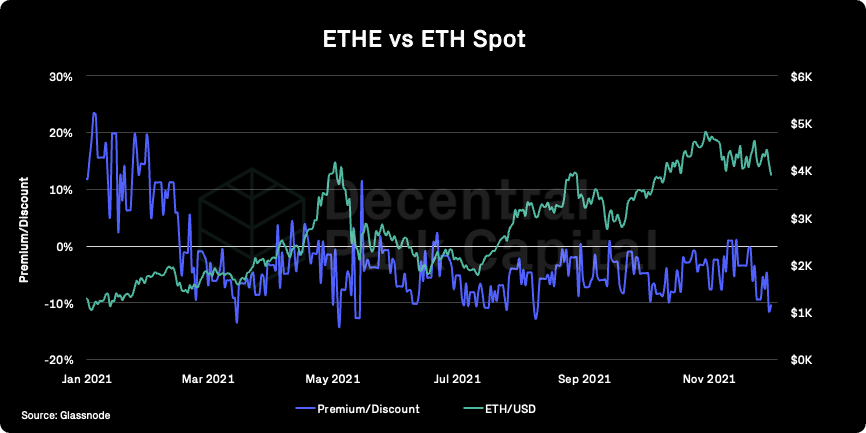

ETHE premium; ETHE discount also affected by spot market, plummeting to 11.5%. 30D volumes are increasing slowly, up ~3% over the past few weeks. Discount dynamics appear to still be at the whim of spot action.

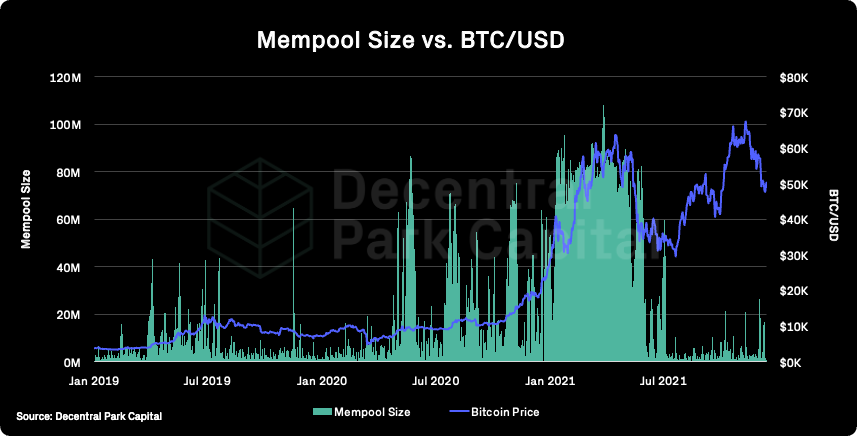

Bitcoin Mempool activity (Size in MB); The mempool size for the Bitcoin network spiked remains high relative to Q3 but no where near Q1/Q2 levels.

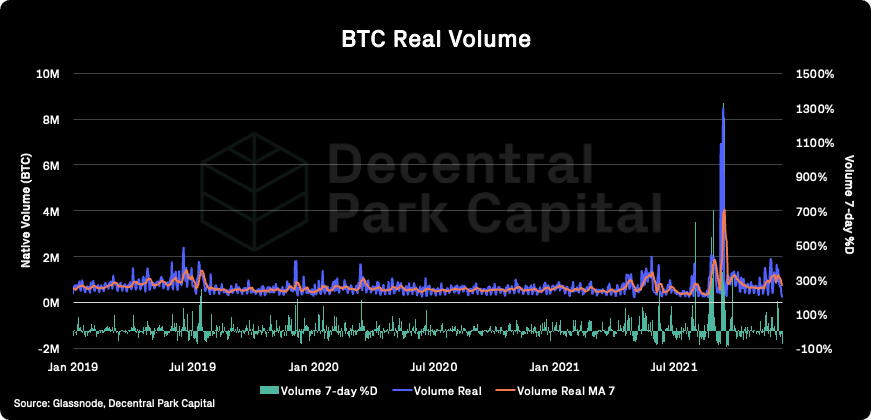

On-chain real (BTC) & off-chain volume; BTC on-chain volume has fallen ~35% over the past week. BTC and ETH spot volumes (7d MA) have fallen 36% and 32% respectively pointing to muted interest by investors.

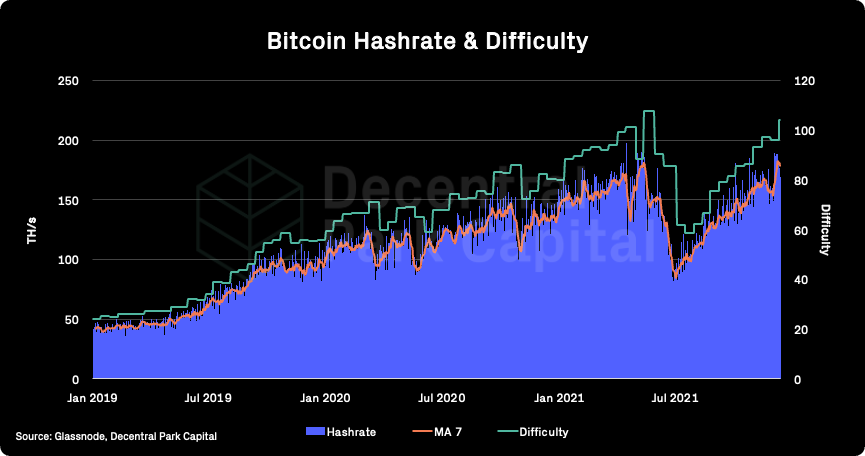

Hashrate & Difficulty; Hashrate hits an all-time-high despite Bitcoin being 8.3% harder to mine since December 11th. Speculation that next-generation mining rigs purchased by large mining players are starting to come online. The net effect is Bitcoin becoming relatively more secure.

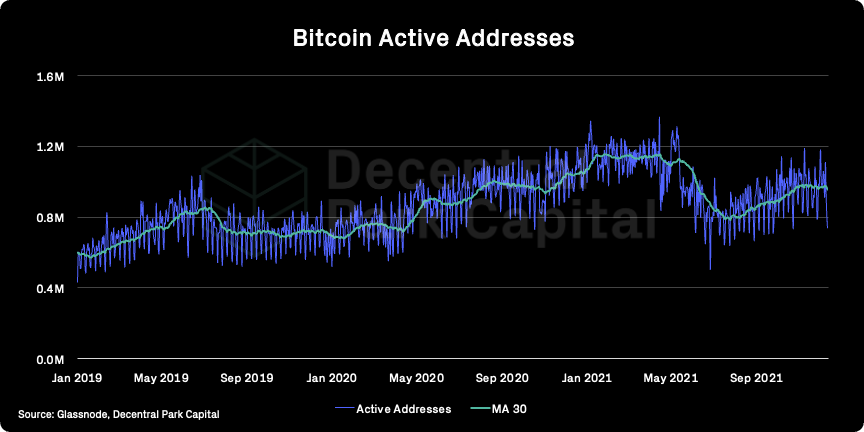

Active addresses (BTC); Active addresses (30d MA) has fallen 4% over the past week.

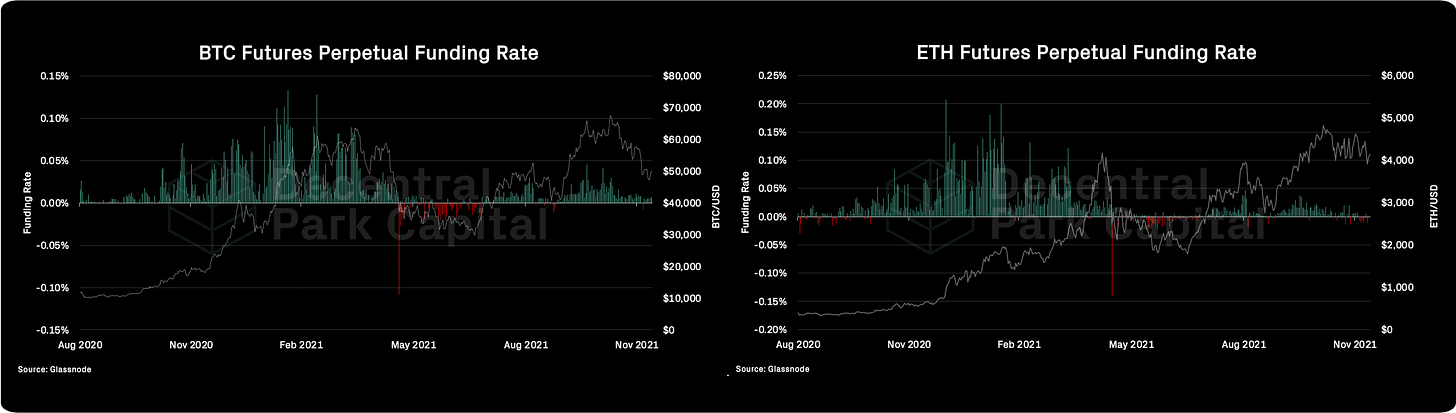

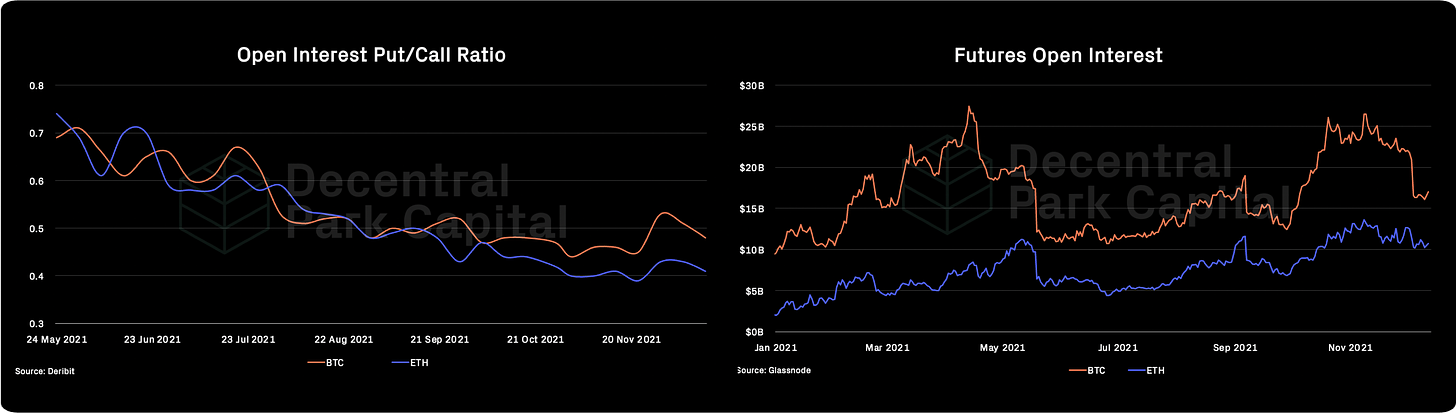

Trader positioning; BTC funding rates have increased over the past few days despite range-bound price action. ETH funding rate is more neutral. Open interest for BTC has increased 4% while ETH markets have seen just a 1% increase.

BTC futures volume remains $25-30B daily with no sign of muted activity like with spot.

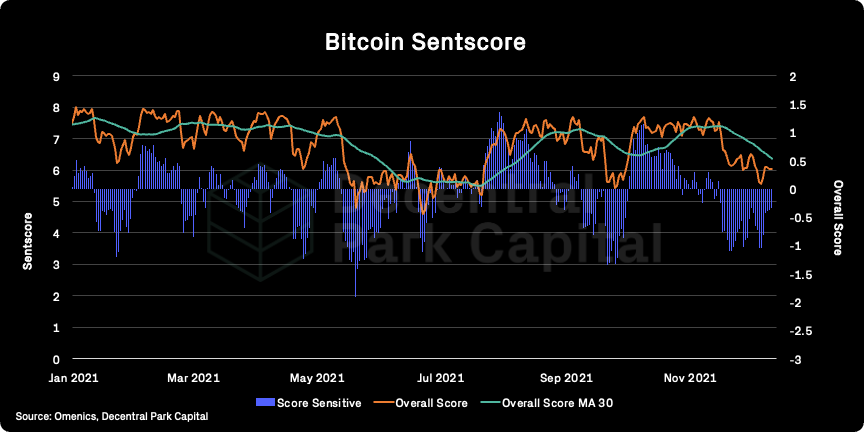

Omenics Sentscore (BTC); Unsurprisingly, sentiment around the orange coin has been falling as interest in the asset wanes.

Exchange inflow/outflow (BTC, ETH); Moderate net outflows ($300-$400m) continue for BTC on the 7d MA. ~100k ETH net inflows printed since last Thursday which is concerning but periods of net inflows does not always precede negative ETH price action.

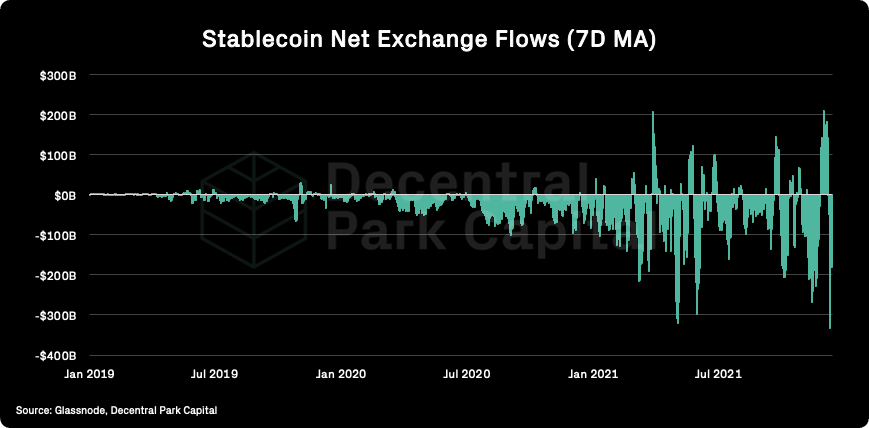

Exchange inflow/outflow (stablecoins); Very strong net outflows of stablecoins from exchanges. ~333m net outflows printed on 9th December. Could indicate investors moving to stability and being less opportunistic at current prices.

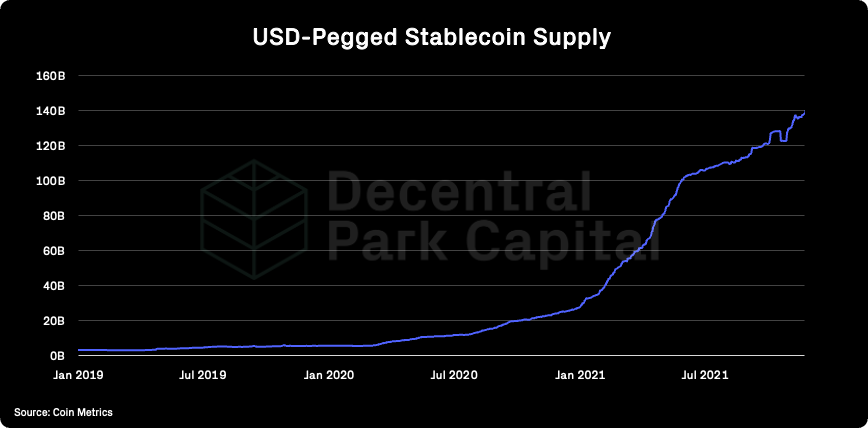

USD(b) supply; Total stablecoin supply reaching new ATHs (140.5B).

📚 An Explanation of DeFi Options Vaults (DOVs) [QCP Capital]

📚 UST On Ethereum [Jeremy Ong]

📚 Web Tokens Network Effects [Li Jin]

📚 A Morgan Stanley Sea Change [ZEROHEDGE]

📚 Crypto Themes 2022 [Tascha]

🎙️ Liquid Staking with Lido and Chorus One [Zero Knowledge Podcast]

🎙️ NFTs And Collectibles [Between2Chain]

🎙️ Li-Finance: all Thing Cross-Chain Bridging [BlockCrunch]

🎙️ The Highest Inflation Since 1982 [The Breakdown]

🎙️ Why We Won’t See A Big Bear Market [The Scoop]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.