After a short period of consolidation, we have seen a significant market-wide sell-off in recent days. This weekly will breakdown only the absolute key details of what happened, where we stand now, and where we go from here.

Get the signal from the noise.

What Happened?

Crypto markets reached ATH levels in mid-November and following a brief cooling-off we saw prices consolidate until early December.

However, we saw ~$500B wiped off the crypto markets since last Friday, printing an overall market drawdown of -20%.

Macro

As highlighted in previous editions of The Weekly, crypto remains positive correlated to other risk-on assets like equities. Any turbulence in the wider market like equities will therefore trickle over here.

Equities sold off from lower-than-expected November job growth and growing uncertainty of the new COVID variant, Omicron.

Initial analysis of Omicron’s threat is largely positive but this has so far done little to ease concerns. The markets were starting to take risk off. The S&P500 closed the week 1.22% down.

November saw low levels of liquidations and leverage traders were not cleared out with BTC-denominated OI remaining above 365k BTC for over 1 month.

Soft spot markets eventually lead to $468m total BTC liquidations over Friday and Saturday.

Cascading liquidations drove BTC down 13% over the 2 days breaking below the key $50k support level.

The most crucial data point of all was the outperformance of ETH - The ETH/BTC broke above May’s highs at a time when overall markets were buckling. ETH’s outperformance here is actually just an extension of what we’ve seen since mid-November.

BTC continues to show poor upside capture and poor downside capture.

Where Do We Stand Now?

Prices

BTC and ETH recovered 0.46% and 1.8% on Sunday.

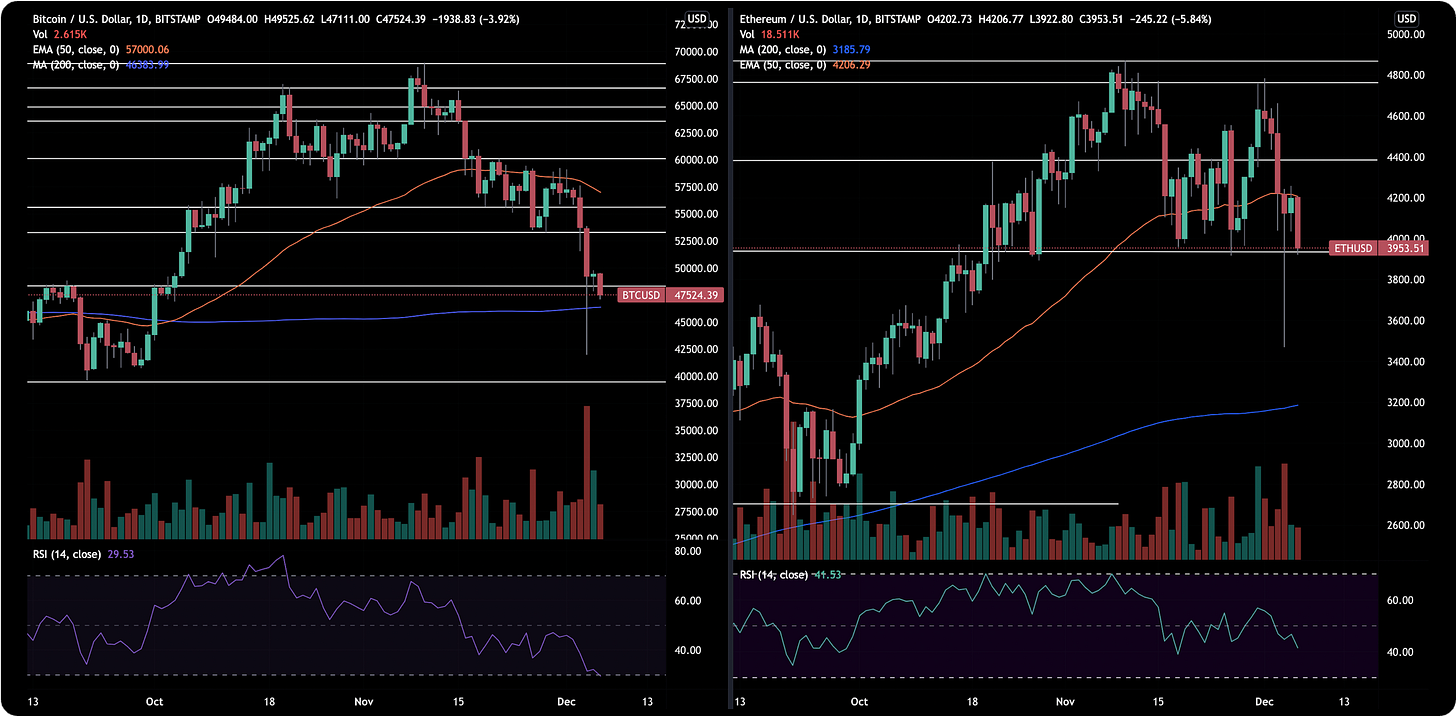

BTC has failed to break back above $50k and is down 4% today. All eyes will be on BTC’s 200d MA as next support. Daily RSI severely oversold at 29 - second lowest print in 2021.

ETH initially held above $4k but soft markets has driven the asset below the key level. Daily ETH/BTC RSI is cooling off from its high of 72.

A bull case for BTC over ETH medium-term is how the asset can lean further into the very salient inflation narrative. But this is not that clear. One take is Ethereum is becoming a ‘harder’ asset with 1.23m ETH (~$4.3B) now burned since EIP-1559 went live.

The ‘harder asset’ narrative is becoming powerful within crypto too with investors turning their backs to the orange coin. Alt-L1s like LUNA has seen a 13% reduction in its total supply from dApp deployments and has been the top performing asset for the week.

Sector Performance

Market sectors were all negatively impacted as correlations converge close to 1 with market drawdowns.

Web3 and NFTs/Gaming have come off worst over the past week with DeFi being a notable outperformer (-6.34%). Larger cap and more liquid assets are holding up better over the past 24Hrs.

Where Do We Go From Here?

Macro

The macro environment likely remains the single largest driver of price short-term. S&P futures are up 0.5% on Monday where assets linked to economic recovery are outperforming. However, more general de-risking over the weeks will be bearish for cryptoasset prices.

Omicron will likely be less significant headwind while tapering and higher rates being the major risk factor for risk assets. We are now seeing divergence of outlooks from banks: JPM reiterated its base case for the equity rally until year end while Morgan Stanley predicted valuations trending lower.

There is a larger question of whether cryptoassets will be in scope for investors that are increasing risk.

Price Action

Momentum indicators like RSI point to cryptoasset prices being severely oversold. Average performance of BTC and crypto is positive when we see such low RSIs with recovery clearly more pronounced during bull market phases.

However, this analysis crucially relies on one’s market cycle outlook medium-term. During the 2018 bear market, weakness persisted even with such low RSI prints.

History doesn’t repeat but can rhyme. December performance for BTC is mixed but equally has not been historically bearish like March and September months.

Off-Chain

Funding rates for BTC and ETH are moderately negative with traders taking a predominantly bearish stance. Probability of sharp drawdowns from here are lowered if maintained. BTC Futures open interest (OI) has fallen 15% since Thursday back to September’s levels. Leverage still persists.

There is very slight increase in Put/Call OI for both BTC and ETH since Friday.

Bitcoin is also unlikely to get any bullish momentum from spot Bitcoin ETF launches. Last week, the SEC rejected WisdomTree’s application with regulators dragging their feet on the ground for over a dozen applications placed on indefinite hold.

On-Chain

BTC’s market value has now dipped below its short-term holder total cost basis (STH MVRV now below 1). Fewer holders have unrealized profits.

STH-MVRV did not peak at levels coinciding with historical macro tops and is fast to historical buy zone (<0.75).

We haven’t seen significant net inflows for either ETH or BTC. Periods of sharp exchange balance increases can precede market weakness. Recent trends provide a more supportive outlook where opportunistic traders may be capitalizing on lower prices while also flocking to stability.

There is evidence of Bitcoin whales moving large BTC positions to exchanges. Meanwhile, an overall declining average inflow/outflow exchange volume points to the opposite - average size of outflows are becoming increasingly larger relative to inflows.

Overall

Macro drivers will continue to weigh in on risk assets like crypto. Assets may regain some good ground in the near-term with fundamentals largely unchanged from just a week ago.

However, we are clearly not out of the woods yet and technicals so far support this view.

As always, sentiment, will be key. Equities linked to economic recovery are set to perform well this week. More importantly, it remains to be seen if a rotation back into risk will translate to fresh buying power for cryptoassets.

Top performing assets have been L1/sidechains assets while ‘DeFi 2.0-related’ assets continue to outperform the sector.

Global:

Terra (+31%)

Polygon (+11%)

Stacks (+7%)

LEO Token (+6.5%)

OKB (+4.3%)

DeFi:

Tribe (+10%)

Anchor Protocol (+4%)

Gnosis (+1.3%)

Magic Internet Money (+0.7%)

FRAX (-1.9%)

LDO (-67% FDV/TVL)

Lido has benefited from ETH’s outperformance in the wider market with fair value only 4% from ATH levels. This coincided with LDO weakness has meant the cryptoasset has become oversold relative to its fair value by nearly the widest margin.

Lido now has an 18% ETH deposit market share and will be supporting Polygon staking.

SPELL

Abracadabra.money TVL hit an ATH on Friday ($5.03B) while SELL continues to be sold hard on the secondary markets.

This also comes at a time when MIM supply is also at an ATH (3.71B) which is now expanding to alternative L1s like BSC and Avalanche. MIM’s market cap is now 42% of DAI’s.

zkSync

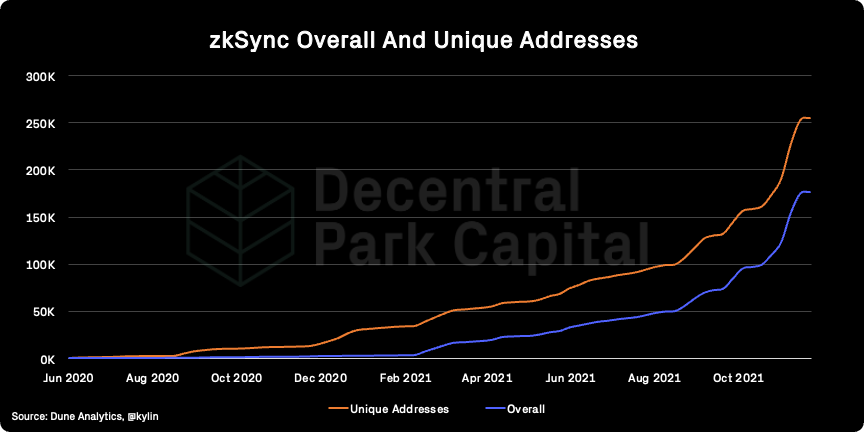

zkSync has now seen over 250k addresses (176k unique) be created. Address count has 2x since November with growth accelerating in recent weeks.

Over 68k ETH has now been deposited from these addresses (~$270m) which would make zkSync the 6th largest L2 by TVL alone. This growth coincides with heightened anticipating of the zkSync token launch.

Abracadabra is turning off SPELL LM rewards for Curve MIM/3pool and moving it all into veCRV bribes. Holders need to time-lock CRV in order to receive veCRV and be eligible, bribes can be accessed here (SPELL, MTA, FRM and ALCX bribes currently available).

Futureswap, a perpetual protocol on Arbitrum, introduced FST rewards for trading, open interest, and liquidity provision to Futureswap and Uniswap pools. Details can be found here.

Lemma Finance, the first basis trading protocol, launched on Arbitrum mainnet. Protocol allows LPs to deposit ETH and mint stable USDL, which can be staked in vault for 12% APY.

Terra's Astroport DEX moved ASTRO lock drop to December, 14. Token will be airdropped to LUNA stakers and Terraswap LPs and other eligible groups, details can be found here.

Alpha Homora started ALPHA and AVAX reward program on Avalanche, AVAX and stables lenders will be rewarded with $3M in AVAX and $3M in ALPHA.

Crypto executives to face house lawmakers at Dec. 8 hearing (Bloomberg). Next year is shaping up to be the formative year for digital asset regulations as legislators, regulators, and exchange CEOs accelerate dialogue and regulatory framework proposals this month heading into the holiday.

Morgan Stanley sees crypto-banking regulation arriving faster than expected (CoinDesk). In a research note, the investment bank thinks that the Fed, FDIC, and OCC interagency “policy-sprint” will develop rules for crypto firms quickly in 2022.

Yellen says some non-custodial entities won’t be subject to FATF standards (The Block). In written responses to crypto-friendly Senator Pat Toomey, the Treasury Secretary confirmed existing US regulations are in line with FATF guidance that was issued and affirmed in November.

Global market cap: $2.71T; Global market cap has been flat over the past week.

DeFi: $136B; DeFi market cap has fallen 11% over the past week but DeFi dominance has increased to nearly 6%. Note - DeFi dominance from CoinGecko is now used for better accuracy.

Market shares; Bitcoin dominance has fallen to near 2021 lows (43.6%). Indicates BTC has become less defensive as an asset during drawdowns.

BTC/USD and ETH/USD (D)

ETH/BTC (W)

Price action; BTC momentum failing to push back above $50k level despite RSI in oversold territory. ETH/BTC cooling off as it hits May 2018 highs with weekly RSI high at 66.

Volatility (BTC & ETH); BTC and ETH 30D vol has increased over the week. 3-month implied volatility for ETH and BTC have also increased slightly for the same period.

Combined order books; Order books look fairly even. Heavier resistance up to $50k (Source: Bitcoinity).

BTC vs. SPX and Gold; BTC becoming more correlated to equities since the start of December.

GBTC premium; GBTC discount approaching yearly low (18.8%). 30D volumes also dropping to yearly lows (5.9M shares) indicating low demand on secondary markets.

ETHE premium; ETHE discount also affected by spot market, plummeting to 9.4%. 30D volumes have kept flat on the secondary markets.

Bitcoin Mempool activity (Size in MB); The mempool size for the Bitcoin network spiked over the weekend but has since declined despite overall volatility. This is notably different to May 2021 when selling congested the network to significant levels.

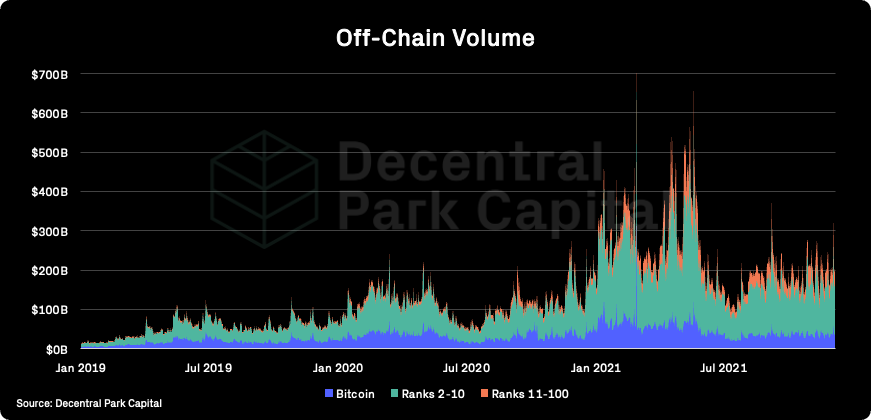

On-chain real (BTC) & off-chain volume; BTC on-chain volume increased ~3% over the past week. BTC and ETH spot volumes (7d MA) have increased 14% and 15% respectively.

Hashrate & Difficulty; Healthy uptick in hashrate likely driven by a combination of reduced difficulty and subsequent lower overall hash power committed to the network.

Active addresses (BTC); Active addresses (30d MA) has kept flat over the past week.

Trader positioning; Perpetual funding rates flipped negative. BTC OI down 25% since 2nd December ($16.3B) while ETH OI is only down 18% (10.1B). Severe deleveraging in the market overall leverage still persists.

Omenics Sentscore (BTC); Sentiment score around BTC hitting annual lows as the asset fails to break above $50k.

Exchange inflow/outflow (BTC, ETH); Resumption of net outflows for BTC and ETH. The temporary (and statistically significant) net inflows printed in the end of November before the ensued volatility was a key data point.

USD-Pegged Stablecoin Flow; Near ATH levels of net exchange flows for USD stablecoins. This could indicate opportunistic traders stepping in and/or margined traders covering their positions during the volatility.

📚 DeFi Audits And Bug Bounties [The Block]

📚 Crypto Theses 2022 [Messari]

📚 Trends in Banking For Digital Assets [BCB Group]

📚 Solana NFTs [turkmmtz]

📚 How The Merge Impacts The Application Layer [trent_vanepps]

🎙️ Scalability and Cross-Chain Bridges [The Solana Podcast]

🎙️ Weekly Roundup #263 [On The Brink]

🎙️ LayerZero [BlockCrunch]

🎙️ Goldman Looking Into Bitcoin-Backed Lending As Jobs Report Disappoints [The Breakdown]

🎙️ Will Solana Be The Execution Layer And Ethereum The Settlement Layer? [Unchained]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.