Welcome to Decentral Park’s new research sub-newsletter: In The Weeds.

This weekly instalment will focus solely on key technical developments and themes within Web3, keeping you ahead of the game on upcoming trends.

Let’s get stuck into this week’s key highlights.

1: Gearbox and their V3 Upgrade

What is it? Leverage is ubiquitous in traditional finance, most commonly seen in the mortgage market, in which customers frequently borrow 6-10x their deposit collateral. This leverage is made possible by transparency and legally binding contracts. The mortgage providers hold you accountable by knowing who their customers are, and more importantly having the ability to reclaim a property should customers fail to repay their mortgage payments.

While transparency is an inherent feature of DeFi, wallets remain pseudo-anonymous, and there is a distinct lack of ability to reclaim assets if regular payments aren’t made. This is an issue for leverage within DeFi, if enabled without combating parameters there’s no guarantee that loans will be repaid.

Gearbox Finance is a DeFi primitive that enables DeFi native leverage, by this I am referring to the ability to gain leverage within existing DeFi applications, such as gaining 3x on a Yearn Finance stablecoin strategy. In this sense, Gearbox can be thought of as a composable leverage protocol, built specifically on the Ethereum network.

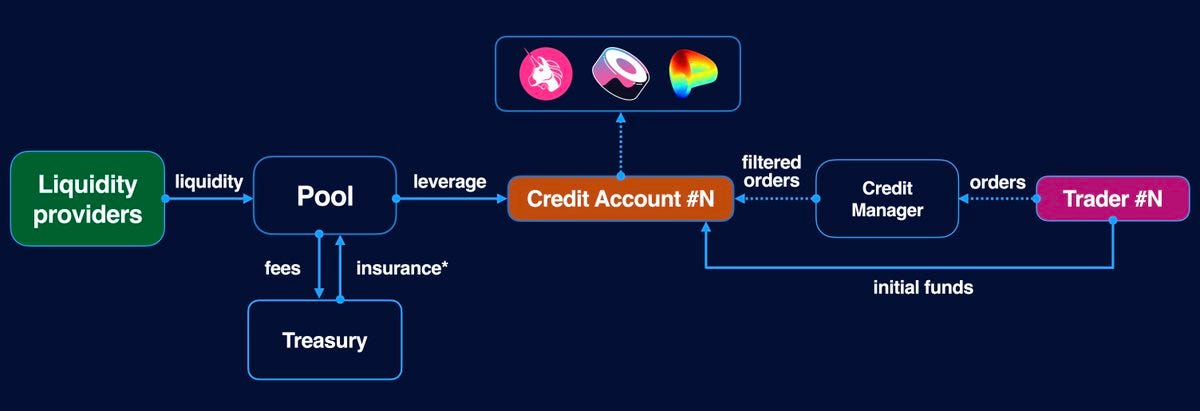

Gearbox is a double-sided marketplace, with liquidity being provided to the protocol by users opting to earn a yield on their assets as a share of protocol revenue and GEAR emissions. These assets are then provided to speculators looking to borrow with leverage on their collateral. Speculators can borrow up to 10x their collateral and can use this within whitelisted DeFi protocols or predefined strategies.

Gearbox can offer leverage through its ‘Credit Account’ feature. Users create credit accounts by depositing assets as collateral. All capital, both the collateral and borrowed leveraged assets are retained within smart contracts, meaning the capital is non-withdrawable. The speculators make decisions on how their funds within the credit account, structured as this smart contract, will be used, i.e. they can deposit to Uniswap, Yearn, Curve etc., but never actually have access to the funds from a self-custody perspective. This solves for DeFi’s inability to claw back funds if necessary, although does require users to deposit capital to Gearbox smart contracts. These smart contracts have been audited by ChainSecurity, Sigma Prime and Consensys Diligence.

Credit accounts are currently in beta, meaning only whitelisted accounts can borrow with leverage on Gearbox. As it stands there is a $100k minimum borrow (equivalent to a $10k minimum deposit) for these whitelisted addresses. Once credit accounts move out of beta, Gearbox will be fully live on the Ethereum mainnet.

Liquidations in Gearbox are permissionless, and performed by opportunistic degens. The fees associated equate to 5.5%, of which 4% goes to the liquidator, and 1.5% goes to the protocol. Total protocol fees are made up of this 1.5% liquidation fee, in conjunction with an APY spread fee of 50%.

So, now that we’ve covered the DeFi primitive that is Gearbox, what is their V3 upgrade? It’s the latest product iteration on Gearbox’s way to becoming fully functional. Interestingly though, the upgrade does not contain any edits to the core codebase of Gearbox V2, instead, V3 introduces the addition of new features to their reliable codebase.

So what are these new features? Gearbox will introduce a new passive lending pool, i.e. LPs supply assets to the protocol in return for a yield. This lending pool has been coined the ‘Alpha Pool’, and has been created for more exotic assets and protocols. For example, while Lido and Curve may be accessibly leveraging assets from the Main Pool, the Alpha Pool will provide access to less established protocols such as Beefy and Ribbon Finance. This allows Gearbox to accelerate its protocol integration initiatives, and ultimately offer greater use cases to speculative users.

As a security measure when adding exotic assets Gearbox has introduced ‘Allowed List Asset Limits’. The argument made against including exotic assets is that they’re more susceptible to price manipulation attacks, which could ultimately result in bad debt for the Gearbox protocol, or the fact that liquidity constraints may be insufficient for liquidations. As such, Gearbox has placed limits on assets within the Allowed List, spanning across all credit accounts.

Perhaps the most exciting feature addition in my opinion is the Gearbots addition. Gearbots can be thought of as immutable automation contracts that will allow owners of credit accounts to automate various actions. The only limitations to Gearbots are those of smart contracts, and the code that controls them, which leaves a wide scope of use cases as possible. Examples include stop loss, take profit, health factor maintenance, automatic strategy management etc.

Why is it important? We’ve all heard of derivative protocols such as dYdX and GMX, and understand that they’re able to provide leveraged trading on particular assets, such as BTC and ETH. While leverage in this form has proved particularly popular, before Gearbox composable leverage within the DeFi ecosystem at large, in DeFi activities such as yield farming, has not been possible.

Gearbox’s solution to composable leverage across DeFi protocols opens up a host of speculative activities, but more importantly, acts as an experiment within the DeFi ecosystem. Its primitive nature, and alignment with the ethos of degen DeFi trading, make Gearbox one of the most exciting innovations developed since the introduction of LSDs.

The introduction of V3 acts as a legitimate catalyst to strengthen the attractiveness of the Gearbox protocol. While it is not yet fully functional, the introduction of features such as Gearbots, and the integration of additional use cases, further enhance conviction in high demand for the product once credit accounts move to a permissionless model.

Where does it go from here? Gearbox V3 is expected towards the end of Q2 2023. Before this, the first step Gearbox will need to undertake is integrating as many protocols as possible, while remaining secure. The goal of providing DeFi native leverage is reliant on giving users the flexibility to explore as much of the DeFi ecosystem as possible from within their Gearbox credit account. New integrations include Balancer and Aura Finance, with support for Curve Crypto pool, MIM pools and cbETH deployments.

The introduction of their Alpha Pool feature is a direct catalyst to expand the Gearbox integrations, once launched with V3 we expect integrations to accelerate.

As evident in previous ‘In the Weeds’ and ‘The Weekly’ publications, Decentral Park subscribes to the notion 2023 is the year of L2 practical adoption, as has already been evident with Arbitrum and zkSync Era TVL accumulation pushing total L2 TVL in both USD and ETH terms to ATHs in the past week. Gearbox is currently deployed solely to Ethereum Mainnet given a requirement of deep liquidity to provide high leverage. To date, liquidity has not been sufficient on L2s to cater for Gearbox deployment.

However, the introduction of ‘Allowed List Asset Limits’ will allow for multi-chain deployments and integrations with new protocols and asset classes due to protection from low liquidity concerns. These markets and deployments will of course be lower in capacity than Ethereum mainnet until liquidity is sufficient enough on L2s. There will also be higher risk associated.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

2: Avalanche Evergreen Subnets

What is it? Institutional deployments of blockchains and participation in the DeFi ecosystem have been accelerating, with TradFi entities such as JP Morgan deploying their own blockchain, Onyx, and performing their first public DeFi transaction.

Solutions for institutions have been split into two camps to date. The first solution is private blockchains that offer permissions and controls, although these closed networks create walled gardens that reduce liquidity, interoperability and composability. The alternative is to leverage public blockchains through walled protocols such as Aave Arc. This solution to comes with downsides from a liquidity, interoperability and composability point of view.

Avalanche has developed Evergreen Subnets to offer institutions a blockchain deployment solution that offers the essential permissions and controls associated with private blockchains while enabling the liquidity benefits of interoperability.

By leveraging Avalanche’s Evergreen Subnets solution, institutions can account for company-specific and regulatory requirements. Built-in features include user and validator permissioning based on KYC/KYB standards and geofencing for jurisdictional requirements. This is all possible while leveraging AWM for interoperability. This means communication is enabled without the need to rely on third-party bridges, enabling liquidity to flow between Subnets.

Institutions can experiment with Evergreen subnets by using their controlled, out-of-the-box environment for R&D initiatives and production-ready use.

Why is it important? Historical solutions for institutional blockchain deployment have typically foregone composability, liquidity and interoperability. The result is that for enterprise blockchains, or enterprise protocols, to have sufficient liquidity to be beneficial beyond existing TradFi solutions requires the onboarding of several institutions at the size. This is not something that we’ve seen to date, nor do we anticipate it within the coming 12 months.

Avalanche’s Evergreen Subnets solution directly solves this, which could accelerate institutional participation in DeFi given those institutions more comfortable with transacting onchain are no longer required to wait until additional capital catches up for use case depth onchain.

Where does it go from here? The initial cohort of institutional partners includes T. Rowe Price Associates, WisdomTree, Wellington Management, and Cumberland. These participating institutions will be leveraging the Spruce testnet to assess the benefits of onchain trade execution and settlement across a variety of applications. Such transactions will include foreign exchange (FX) and interest rate swaps, with other areas in active research and development.

Subject to a successful launch, it is expected that this initial cohort will increase their R&D efforts into onchain participation, seen as a net positive for the space. Ultimately the goal is to increase capital allocation onchain. A successful initial cohort will also likely lead to subsequent cohorts, furthering the onchain capital onboarding efforts.

Avalanche Evergreen Subnets will ultimately have to compete with alternative solutions, such as Layer-3 blockchain deployments to the Ethereum network, which will be able to leverage both DeFi protocols and parameter customisation to replicate the Evergreen solution.

Decentral Park’s Latest Thematic Research

3: mevETH

What is it? Manifold Finance offers MEV solutions to enable protocols and users within DeFi to maximise their benefits from MEV. Products include secureRPC, an aggregated connection to endpoints like Flashbots and Eden Network, and block-building efforts.

The latest product introduction from Manifold is mevETH, a liquid staking derivative for ETH, designed from the perspective of MEV capture. mevETH captures novel and unique MEV approaches that aren’t possible given the architecture of alternative staking platforms. Manifold can offer an MEV capture maximised LSD solution since it operates the full validation stack, from block builder, secureRPC relay and the validators themselves.

mevETH is natively multi-chain since it follows LayerZero’s omni-chain fungible token standard. This means that mevETH is natively bridgeable cross-chain, without the need to wrap the token. As a result of its omni-chain fungible token standard, mevETH immediately becomes the most composable LSD in existence. A user could theoretically mint mevETH on Ethereum, use it as collateral on Optimism, or deposit it to a vault on Polygon, all without the need to use wrappers.

Why is it important? As a result of the successful Shapella upgrade that took place on the 12th of April, withdrawals are now live for Ethereum staking. Staking participation is anticipated to increase, in conjunction with a shift from solo staking to LSD providers such as Rocket Pool where validators can earn 45% higher rewards through innovations such as LEB8.

Competition within the LSD market is anticipated to increase, and mevETH acts as a novel introduction to this market that has a sufficient competitive advantage to potentially capture market share. Ultimately this will depend entirely on the APY offered by mevETH, with the MEV capture component expected to push mevETH APY above the average for LSDs. Therefore, mevETH could see large growth in TVL upon launch, and become a contender for the second-tier of LSD providers (i.e. behind Lido and Coinbase).

Where does it go from here? Upon launch, Cream Finance has committed to migrating 25k ETH from crETH2 to mevETH. This would immediately place mevETH as the 9th largest LSD provider, with ~$50m in TVL. This is key to initial growth, given liquidity in the LSD market is ultimately what gives the LSD its utility. By beginning with this initial liquidity, mevETH demand (driven by higher APY) can be matched without the need to financially incentivise users.

While there is little visibility into an exact launch date, prior to launch mevETH will need to further its utility by announcing integrations with DeFi protocols.

Manifold Finance teased in a recent tweet the potential of mevETH being used in restaking, a solution being developed by protocols such as EigenLayer.

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.