The Market

BTC ended its 3-week winning streak of over 5% weekly returns last week, closing down about -1.5%. The price dropped from $99K to as low as $90K last Tuesday, before rebounding above $98K after Thanksgiving. This level of volatility is expected as BTC enters the price discovery mode after achieving new ATHs.

Despite BTC’s decline, the altcoin market showed resilience. The Total3 market index posted gains of over 3%, while the Others market index rose by more than 5% last week. Since the election, the altcoins market has outperformed BTC, signaling the onset of altseason.

BTC’s market cap dominance level peaked at around 61% on Nov 20th before rapid declining, coinciding with a sharp increase in altcoin market cap.

Meanwhile, the net position change for long-term BTC holders has accelerated its downward trend, approaching levels near the market peak seen in March 2024, but still halfway to the extremes seen in previous bull market cycles.

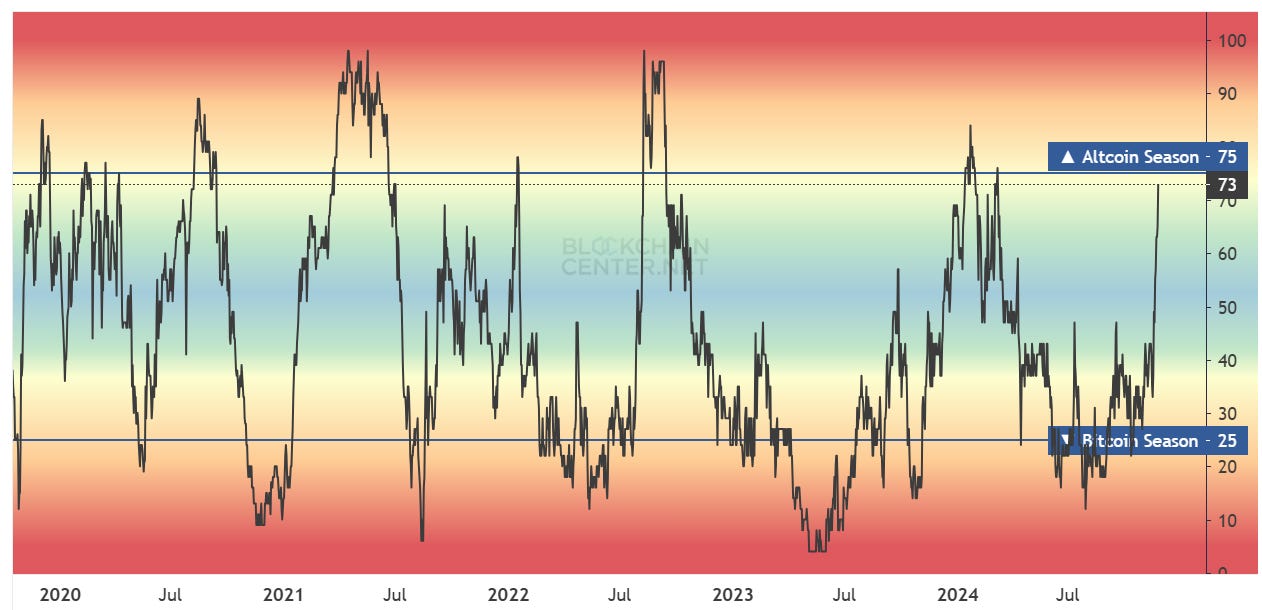

The Altseason index climbed sharply last week, nearing the critical 75 level, signaling broad outperformance of the top 50 coins relative to BTC.

Supporting this trend, the ETHBTC ratio has shown a strong upward trajectory since bottoming on November 19. Notably, ETH ETFs saw a record-breaking single-day inflow of $333M last Friday, surpassing BTC ETF inflows on that day.

Source: Coinglass

Hyperliquid–the largest perp DEX–conducted one of the largest airdrops in history, distributing 300 million HYPE tokens (31% of its total supply) to the community. Unlike other popular projects launched in this cycle that experienced 20-50% selloffs shortly after TGE due to profit taking, the HYPE token surged 155% one day after its TGE. With a FDV exceeding $8B, Hyperliquid has become the third largest DEX by FDV, trailing only Uniswap and Jupiter.

The combination of Bitcoin achieving a new ATH, declining Bitcoin dominance, a recovering ETHBTC ratio, the Altseason index reaching the pivotal 75 level, and HYPE’s successful post-TGE price action despite the large-scale airdrop all underscore the rapid development of altseason.

DeFi Update

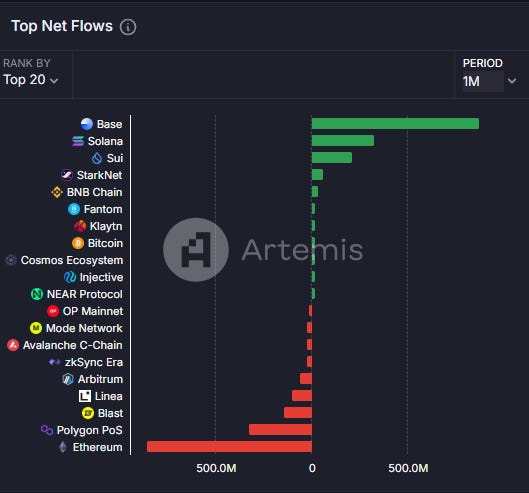

The Base ecosystem has attracted the highest inflows this month, surpassing Solana and SUI. Instead of competing with Solana on memes, Base is emerging as a hub for AI agent development, thanks to platforms like Virtuals. Virtuals enable users to create AI agents with distinct personalities or functionalities. These agents can interact with real-world applications such as X and Roblox to perform specific tasks. Additionally, each agent is tokenized, allowing both the owner and future developers to share its success. Similar to pump.fun, once an agent token reaches a certain size, it will be “launched” into a DEX pool to gain further liquidity and traction.

We believe AI agents present one of the most compelling product-market-fit opportunities for Crypto X AI applications. Blockchain technology excels at coordinating resources and incentives, lowering barriers for large scale resource and funding requirements.

The first generation of Crypto X AI applications primarily focused on crowdsourcing computing resources to support AI model training and execution. While the token incentive model has been successful in ramping up cheap supply of GPUs, demand remains limited due to lack of high-quality service level agreements. Additionally, open-source AI model development faces challenges in competing with Web2 tech giants for top-tier talents.

In contrast, AI agents are less resource-intensive and less dependent on model sophistication. Instead, they are driven by specific use cases and user preferences, making them well-suited to crowdsourced agent creation. While creating a LLM model like ChatGPT demands immense resources, effectively using ChatGPT simply requires asking the right, context-specific questions. Similarly, just as social media platforms like youtube and tiktok empower regular users to achieve stardom, open-source AI agent platforms could enable the creation of popular AI agents that rival those produced by Web2 giants.

The journey of AI agents in crypto is still in its infancy, with many current examples offering more memetic than practical utility. However, in the short term, the growing narrative and increased trading volumes surrounding AI agents are poised to benefit the Base ecosystem. Key DeFi infrastructure projects on Base, such as Aerodrome and Moonwell, could also see indirect gains from the burgeoning AI agent boom. Notably, even the AI agent aixbt, which is trained on X sentiment data to make crypto recommendations, reflects this optimism.

Top 100 MCAP Winners

ENS (+88.15%)

CORE (+70.26%)

SAND (+59.10%)

Theta (+55.70%)

Algorand (+54.42%)

Top 100 MCAP Losers

RAY (-9.82%)

Popcat (-9.18%)

SOL (-6.48%)

BONK (-6.44%)

FLOKI (-6.23%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.