The Market

BTC extended its weekly winning streak, delivering a ~9% return last week. This marks the third consecutive week of BTC returning more than 5%. Historically, there are very few instances where BTC has achieved more than 3 consecutive weeks of returns above 5%, all of which occurred during the bull market phases.

BTC’s price movement trajectory (Black) in this cycle closely mirrors the 2018-2022 cycle (Green), with a notable acceleration after the election. If this trend continues, as it did in the previous cycle, the market could reach a local peak by the end of January. As mentioned before, this period may represent a “honeymoon phase” before the pro-crypto administration formally takes office. Whether the momentum persists after January 20th will depend on the success of forthcoming crypto policy changes and the broader economic balance between growth and inflation.

Source: TradingView, Decentral Park Capital

The regulatory landscape for crypto continues to evolve in the positive direction Pennsylvania recently passed the Bitcoin Rights Bill in the house with overwhelming support. This bill seeks to legalize Bitcoin payment and protect self-custody. Additionally, the Pennsylvania Bitcoin Strategic Reserve Act has been introduced, this act could set a precedent for similar initiatives at the federal level.

The BTC perp funding rate remains healthy, significantly below the peak levels observed in the last cycle and lower than the elevated levels seen in March 2025. This suggests that the recent price appreciation is not driven by speculative excess.

Global digital asset ETP flow data reflects sustained trends of inflows over the past month. The filing of multiple Solana ETFs in the US has sparked renewed interest in Solana and other Alt L1s, as these assets gain greater mainstream investor attention.

While Solana futures are not yet available on any regulated US exchanges, the approval of a SOL ETF approval would likely require substantial regulatory updates. Nevertheless, SOL reached a new ATH last week. The SOL/ETH ratio also hit a record high, while SOL/BTC ratio remains just below its ATH from Q1.

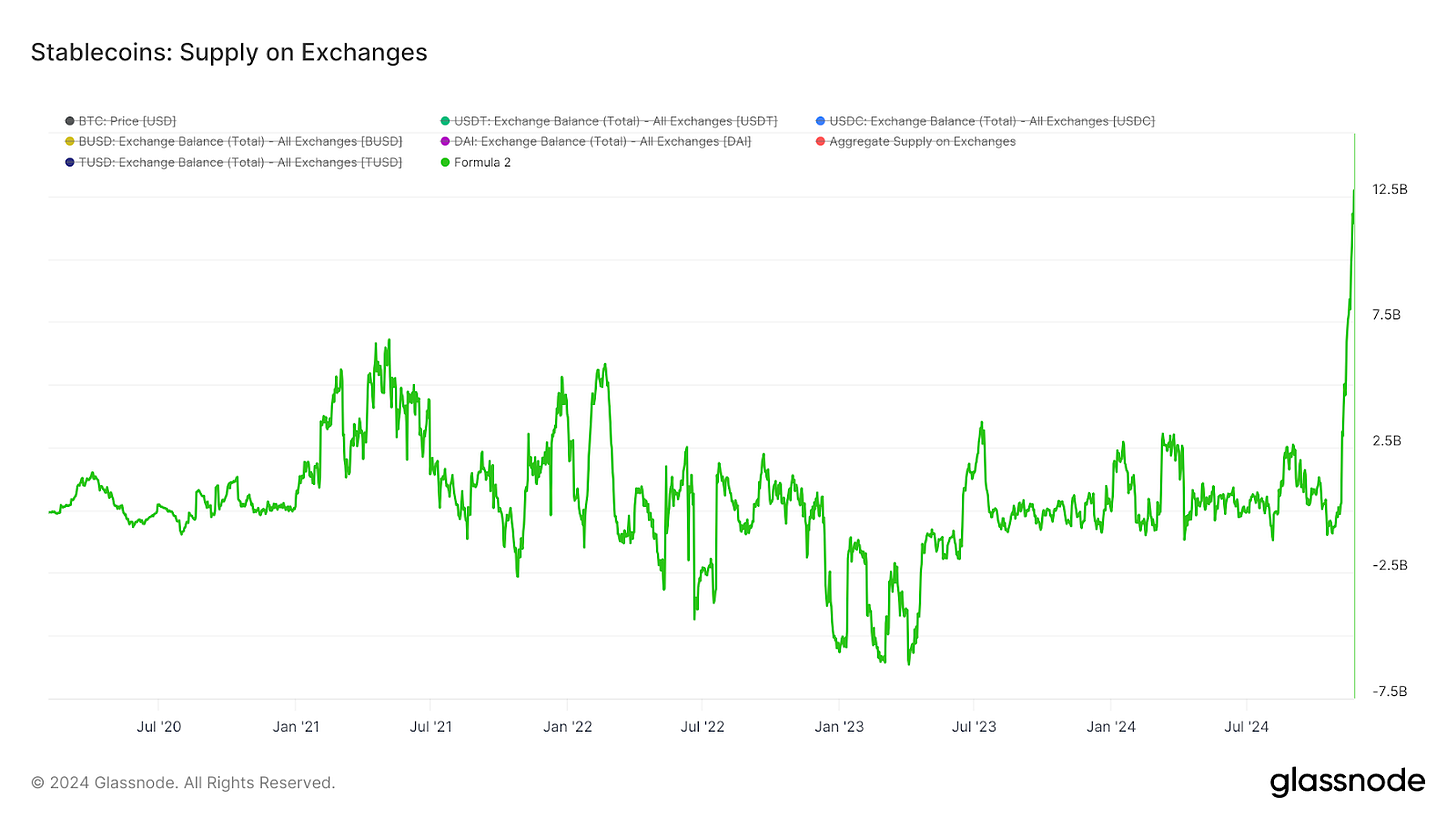

The total stablecoin supply on centralized exchanges has returned to levels seen in the last cycle’s peak. Additionally, the velocity of inflows, as measured by the 30-day change on stablecoin supply, has reached new highs–indicating strong resurgence of crypto investor activity.

DeFi Update

Last week, Solana’s DEX trading volume surpassed Ethereum’s by a wide margin. For the first time, Its fees and revenue also exceeded Ethereum. Just one year after the dramatic FTX collapse, Solana has staged a remarkable recovery, establishing itself as the leading DeFi playground.

Raydium continues to grow its dominance in Solana DEX volume, solidifying its position as go-to trading venue for most meme tokens graduating from Pump.fun. This success is largely due to its AMM v4 model, which facilitates permissionless listing and ensures deep liquidity by integrating both AMM and CLOB mechanisms.

While memes contribute to Raydium’s popularity, it doesn’t depend on memes to thrive. The DEX’s largest trading volumes still come from Solana majors..

Source: Topledger

Since the election, Raydium has delivered impressive returns of over 83%, outperforming leading DEXs on other chains as well as its own competitors. Its 7-day trading volume has recently flipped Uniswap, yet its FDV remains just ⅓ of UNI, indicating further room to grow.

Top 100 MCAP Winners

Stellar (+142.97%)

Hedera (+64.34%)

MANTRA (+63.23%)

Polkadot (+49.19%)

Quant (+48.99%)

Top 100 MCAP Losers

Penut the Squirrel (-31.43%)

Popcat (-12.45%)

dogwifhat (-4.57%)

SUI (-0.89%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.