The Market

It was an epic week for crypto. Not only has the election uncertainty been removed, but we;ve also seen what may be the best-case scenario on the regulatory and liquidity front: a crypto-friendly president, a crypto-friendly congress, a 25 bps cut by the Fed in the November FOMC meeting as expected, and a massive refinancing package from China to revive its economy.

The crypto market responded positively, with BTC returning 11% for the week, placing this week in the top 10 percentile of weekly returns over the past decade.

Ethereum and DeFi applications on Ethereum saw an even stronger comeback, buoyed by the potential for a more favorable Congress to support a clearer regulatory path for projects to raise funding and distribute fees to token holders. Ethereum rose 23% this week, within the top 2.5th percentile of weekly returns since inception. UNI gained over 30%, and AAVE surged by 47%.

The Solana ecosystem also received a significant boost, with SOL up 22%, reflecting the top 4th percentile of its weekly returns since inception. Solana DeFi projects such as RAY, KAMO, CLOUD and DRIFT all saw gains over 50% last week.

Looking forward, if the market follows the same trough-to-peak pattern as in the 2018-2022 cycle, BTC price may peak in Q1 2025. The options market is showing the highest open interest around the $120K mark for the March 2025 expiration.

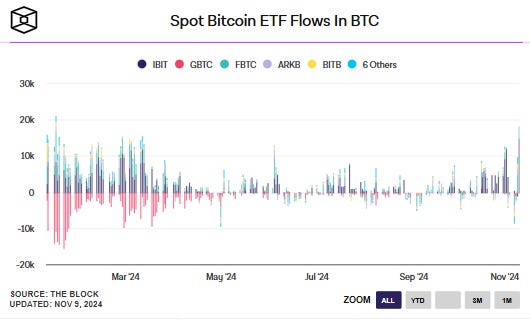

In addition to positive sentiment toward crypto, BTC enjoys unique tailwinds. First, BTC is increasingly adopted by institutions as an alternative store of value and hedge against global monetary inflation. With republicans controlling the whitehouse and Congress, the bill introduced in July supporting BTC as a US strategic reserve may gain traction. If the U.S. begins recognizing BTC’s value as a strategic reserve, other countries and corporations could follow suit. Secondly, regulated financial instruments like ETFs, futures and options have made BTC more accessible to mainstream investors, enhancing its price sensitivity to demand. Last week’s inflows into BTC ETFs were the highest since inception, and we expect this momentum to continue as more investors enter the space. The current estimated market cap of gold is around $15 trillion, over 10 times that of BTC, indicating significant room for BTC, as digital gold, to grow closer to gold’s market cap.

As BTC hit new ATH, alt-season typically follows, driven by increased risk appetite and capital rotation down the risk curve. The chart below illustrates altcoin performance relative to BTC, using the ratio of total crypto market cap excluding BTC and ETH (Total3) to BTC’s market cap within 60 days of BTC making a new ATH. In the last two cycles, the alt market cap doubled within a month of BTC reaching a new ATH. Although the BTC price peak in March didn’t trigger alt season, likely due to anticipation around BTC ETF approval, the current conditions seem favorable for alt season given the friendly regulatory and increased global liquidity.

Source: Decentral Park Capital, TradingView, 11/9/2024

Search interest in BTC and crypto has significantly increased post-election, though still below Q1 2024 and the 2021 market peak levels.

Funding rates for major tokens are rising but remain at healthy levels, indicating there is still dry powder to deploy as the market heats up.

Additionally, traders are definitely getting ready to deploy capital on-chain, with the number of new addresses on Solana–currently the most popular chain for trading memecoins–reaching ATH.

Base and Solana, two top chains for retail adoption, have seen the highest net flows in the past week, with SUI as a close third. These inflows are useful indicators of where risk capital is flowing.

The crypto market has shown great enthusiasm in the days following the election. Whether we see a “banana zone” of explosive growth or a steadier upward trajectory will depend on the pace and scale of liquidity injections and the new administration’s ability to deliver on its crypto policy promises. While short-term volatility may persist, the policy environment is now highly favorable for the crypto industry. For the median to long term, we are most excited about the following three policy developments:

Regulatory Clarity on Digital Asset Classification: Establishing clear guidelines for digital asset classification will create essential infrastructure to support crypto as an investable asset class. Builders will have defined pathways to distribute revenue to token holders, institutional-grade service providers can offer trading and custody of a broader range of digital assets, and investors will gain access to crypto’s full growth potential.

Accelerated Stablecoin Adoption in Payment Rails: Policies like the Clarity for Payment Stablecoins Act would set a regulatory framework for stablecoin issuers, enabling mainstream adoption of crypto payment and benefiting sectors focused on blockchain-based payment solutions and remittances.

Bitcoin as a Potential Strategic Reserve: Recognizing BTC as a strategic reserve asset would reinforce its “digital gold” status, opening the door for wider adoption by other large institutions and sovereign entities.

Let the crypto summer begin!

Top 100 MCAP Winners

Goatseus Maximus (+64.74%)

Neiro (+61.11%)

Raydium (+56.51%)

Ethena (+48.17%)

Cronos (+41.67%)

Top 100 MCAP Losers

Popcat (-6.72%)

Tron (-3.24%)

Mantra (-2.41%)

THORChain (-0.21%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.