The Market

It was a macro-heavy week and the last week before the US election. On the inflation front, the September PCE showed a 2.1% YOY increase, aligning with the street estimates and getting close to the Fed target, while the Core PCE held steady at a stubborn 2.7%. On the growth side, Nonfarm payrolls reflected a significant decline in U.S. employment growth, partly due to the hurricanes in the southeast and the Boeing strike, falling well below economists' expectations and appearing as an outlier compared to the previous years. The market still anticipates the Fed to cut only 25bps in November, with the likelihood of cuts exceeding 50bps by year-end now nearly zero.

Despite strong Q3 earnings from the “Magnificent 7” companies, both the SPY and QQQ declined by ~2% this week, underscoring market concerns over slowing growth and uncertainty around when the large AI investments will bear fruit. Goldman’s chief market strategist noted the record-high concentration risk of US equities, as measured by the weight of the top 10 stocks, which contributed to his reduced long-term return expectations for US stocks.

As the election nears, Trump’s winning odds on Polymarket dropped sharply, declining from a 33% lead over Kamala to 6%. Shares of DJT fell by 30%, erasing the gains from the prior week’s rally.

The crypto market also took a hit with the rest of the risky assets. BTC reached a high of $73.5K on October 29, slightly below its ATH level of $73.9K, before retracing to $70K by Friday. However, BTC has found support at $69K, making higher lows compared to previous sell-offs.

We believe BTC remains in a strong technical position, particularly with pending institutional buying power. In the short term, dealers hold significant short Gamma positions between the $70K and $85K range. Consequently, every 1% move within this range requires dealers to hedge $15m or more. Over the longer term, Microsrategy recently announced a $42B capital raise to buy BTC in the next three years. Additionally, Microsoft’s shareholder vote on incorporating BTC into cash reserves highlights the growing interest from traditional institutions in holding BTC as a treasury asset. Lastly, BTC ETF inflows have been strong as the market recovers, a trend we expect to continue if price remains resilient.

Compared to Q1 this year, BTC’s current funding level is much lower, even as its price approaches similar levels, suggesting further upside potential if risk appetite increases.

Source: Coinalyze

DeFi Update

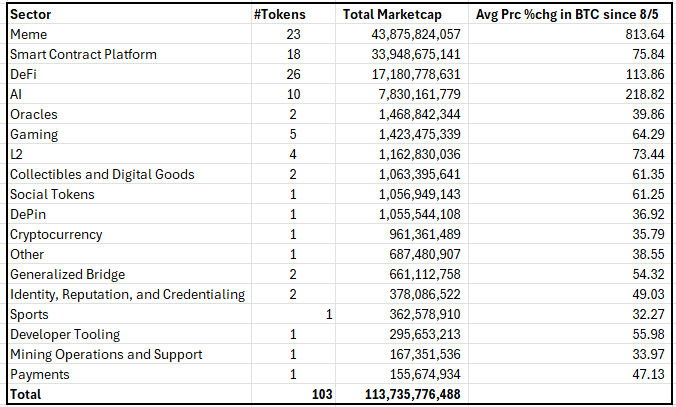

Since the market touched its YTD low on August 5th, BTC has recovered by 28.7%. According to our Messari filter, only 102 tokens with a market cap greater than $100M have outperformed BTC (excluding stablecoins and synthetic assets), totaling $114B market cap in total, or 14% of the total crypto market cap excluding BTC.

Source: Messari, 11/2/2024. Filter criteria: circulating market cap > $100M, price change in BTC terms since 8/5/2024 >0, excluding stablecoin, synthetic, or wrapped assets. Sector definitions provided by Decentral Park Capital.

The Memecoin sector has the largest number of outperformers, followed by DeFi and Smart Contract Platforms. Within DeFi, tokens from the Solana and Base ecosystems have led the pack, driven by ecosystem growth.

Source: Messari, 11/2/2024. Filter criteria: circulating market cap > $100M, price change in BTC terms since 8/5/2024 >0, excluding stablecoin, synthetic, or wrapped assets. Sector definitions provided by Decentral Park Capital.

In the Smart Contract Platform sector, tokens within the Move ecosystem and certain BTC L2s have shown some outperformance. However, high-profile Alt L1s from the last cycle, including SOL, have not yet outperformed BTC.

Source: Messari, 11/2/2024. Filter criteria: circulating market cap > $100M, price change in BTC terms since 8/5/2024 >0, excluding stablecoin, synthetic, or wrapped assets. Sector definitions provided by Decentral Park Capital.

The AI sector has shown some promise, with 10 names outperforming BTC since the August low. Interestingly, no decentralized computing protocols have made this list.

Source: Messari, 11/2/2024. Filter criteria: circulating market cap > $100M, price change in BTC terms since 8/5/2024 >0, excluding stablecoin, synthetic, or wrapped assets. Sector definitions provided by Decentral Park Capital.

In the Q1 rally, more tokens outperformed BTC (+60%), and the total market cap of outperformers was significantly larger at $296M, representing 25% of the total market cap excluding BTC. Smart Contract Platform tokens led gains more than memes in Q1 as well.

Source: Messari, 11/2/2024. Filter criteria: circulating market cap > $100M, price change in BTC terms since 8/5/2024 >0, excluding stablecoin, synthetic, or wrapped assets. Sector definitions provided by Decentral Park Capital.

We believe the Q4 rally is just beginning. Investors remain cautious about adding risk ahead of the election, as shown by the healthy funding rate market and the narrower rally compared to Q1. Next week should bring more clarity as the two biggest uncertainties – the election and the FOMC rate decision – are resolved. Regardless, stimulative monetary policies worldwide are likely to continue infusing much-needed liquidity into the crypto market.

Top 100 MCAP Winners

Dogecoin (+16.89%)

Raydium (+13.92%)

Thorchain (+9.76%)

Mantra (+9.48%)

Maker (+8.51%)

Top 100 MCAP Losers

Immutable (-20.25%)

Cat in a dogs world (-15.04%)

Beam (-14.37%)

Bittensor (-14.22%)

Celestia (-11.94%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.