The Market

Less than 3 weeks before the US election, the Polymarket implied winning odds for Trump had staged a significant rally last week, pushing him to a 20-point lead over Kamala Harris. The main driver of that lead is his decisive advantage in key swing states with the most electoral votes.

In the meantime, various national political polls show a much closer race. There has been criticism that the polymarket's offshore nature could introduce biases that do not reflect US sentiment. Regardless, the crypto market has embraced the increasing odds of a republican win. BTC broke the $68K resistance level last Friday, making higher lows and higher highs since its August 5 bottom.

Bitcoin marketcap’s dominance has climbed to the post-FTX high of ~59%, while Solana has continued its uptrend relative to ETH since Q3 2024. ETH, on the other hand, continues its declining trend relative to BTC in this cycle.

In the past two cycles, BTC’s dominance has been a leading indicator of alt season, with the altcoin market peaking within a 1-5 month window. If history repeats itself, we may be approaching an alt season, and the US election settling down in November, coupled with Fed’s November rate decision right after the election date, could serve as catalysts for further rally as uncertainties are removed from the market.

However, there are still plenty of uncertainties that extend beyond the election. The killing of Hamas leader Yahya Sinwar could complicate the Middle East conflict, and we don’t expect the war to end anytime soon. Additionally, as the US begins the easing cycle, we saw ECB cutting rates by 25bps last week, making their 3rd rate cut and the first back-to-back cut in 13 years. While increased liquidity is generally positive for risky assets, we will continue to see the market adjust to slower growth expectations and rising monetary inflation.

DeFi Update

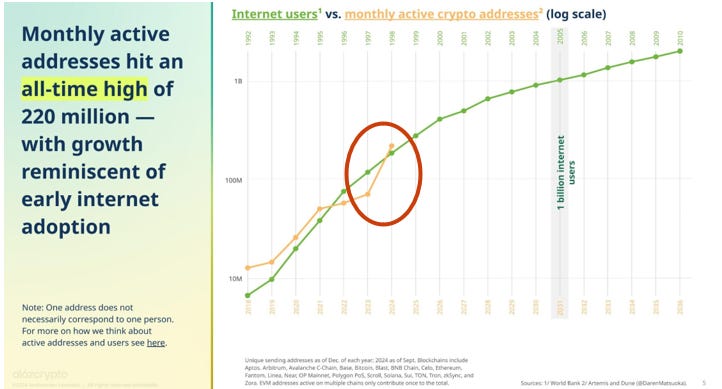

Despite the choppy market, the crypto world has come a long way, and there are exciting developments worth celebrating. According to A16z’s State of Crypto 2024 report published last week, we are on track to gain mainstream adoption at speed similar to that of the Internet, with accelerated user growth since 2023 and monthly active addresses now hitting ATH.

Improvement in Blockchain technology – such as numerous ETH L2s and Alt L1s achieving fast speed and low cost – along with significant UI improvements in smart wallets and easy fiat on/off ramps, have played a big role in this accelerated adoption. Base is a perfect example illustrating this trend. One year after its launch, daily active addresses have increased nearly 18 fold, making it the biggest Ethereum L2 by active users, thanks to Coinbase’s effort to onboard its 110M users. We wrote an article for Coindesk analyzing how Coinbase leverages its smart wallet and strong community to bring users to Base. With Base’s founder Jesse now elevated to Coinbase’s executive team and overseeing Coinbase Wallet, we anticipate further integration to propel Base’s growth.

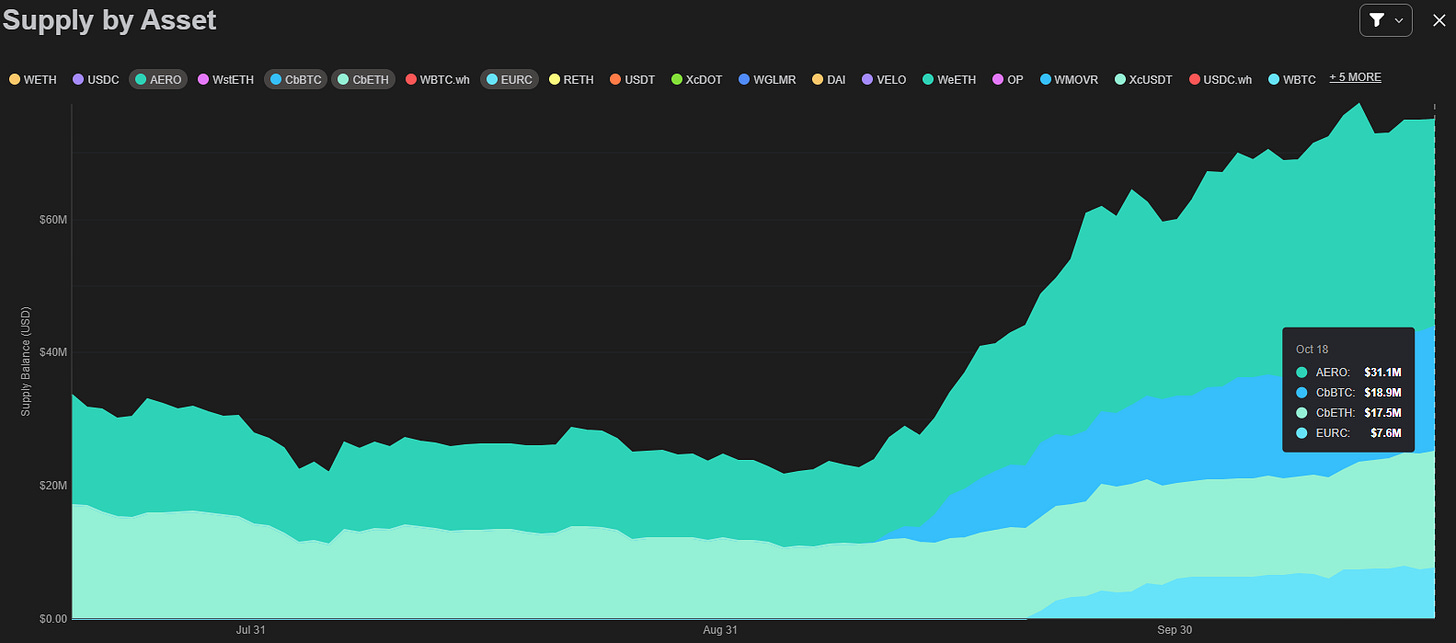

In our last weekly, we discussed how Aerodrome, the leading DEX on Base, is enabling trading anything, anywhere on-chain. Moonwell, the leading Base lending protocol, is also experiencing impressive growth, serving as the gateway for yield and lending opportunities on Base. Since launching on Base in April, the fees generated by Moonwell have consistently exceeded AAVE and Morpho, two of the largest lenders in the Ethereum ecosystem.

Moonwell is founded by ex-Coinbase engineer Luke Youngblood, who keeps every Coinbase design principle in mind. Its intuitive interface, enhanced by the simplicity of Coinbase’s Smart Wallet and the Moonwell Vaults, makes lending and borrowing as easy as a few clicks. As Coinbase brings BTC and ETH on chain through cbBTC and cbETH, Moonwell has ranked at the top in TVL and yields for the three key assets on Base: cbBTC, cbETH and USDC.

Additionally, because of Moonwell’s focus on the Base ecosystem, it supports the lending market for Base-native assets such as Aerodrome, which has seen significant growth since Q3. AERO is not yet supported by Aave or Compound. Compared to other large lending protocols, Moonwell’s focus on Base makes it the premier lending market to benefit from both the increasing bluechip assets bridged onto Base and the growth of Base-native assets. As CeFi interest rates decline, interest in DeFi yield is picking up again. Following the collapse of Celcius, Genesis and BlockFi, there is a substantial gap in DeFi lending that we believe Moonwell can fill, thanks to its simple UI, relentless focus on risk management and close partnership with the Base ecosystem. If Aerodrome is the exchange to trade anything, anywhere on Base, then we consider Moonwell the bank for every bluechip asset on Base.

Top 100 MCAP Winners

Dogecoin (+30.25%)

Cat in a dogs world (+27.47%)

Worldcoin (+20.44%)

Ethena (+18.99%)

Floki (+13.94%)

Top 100 MCAP Losers

Bittensor (-17.40%)

Popcat (-15.13%)

Maker (-12.57%)

Wormhole (10.99%)

First Neiro on Ethereum (-8.51%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.