The Market

Welcome back from the summer! The market has been challenging for risky assets since Powell's Jackson Hole speech. The S&P 500 is down approximately 3.83%, Bitcoin (BTC) is down 15.91%, and altcoins have dropped 19.49%.

There are valid reasons for the market's caution. In August, the yield curve un-inverted, meaning the 10-year yield is now higher than the 2-year yield. Historically, when the yield curve un-inverts, a recession often follows within 6 to 18 months.

As Powell clarified the Fed's intention to begin cutting rates starting in September, how quickly the Fed can adjust monetary policy will be critical in navigating an economic slowdown. The expectation of a 50 basis point rate cut in September peaked around August 5th but stayed below 50% for the remainder of the month. The probability of a 1% rate cut by year-end has stabilized around 40%, indicating the market is still pricing in a higher likelihood of a 75 bps cut this year. We expect market volatility to persist as we observe how the Fed manages the delicate balance between aggressive stimulus and gradual easing, especially as we approach election season..

According to the August Bank of America Fund Manager Survey, TradFi managers are reducing equity exposure in favor of bonds, signaling a strong risk-off sentiment in the market.

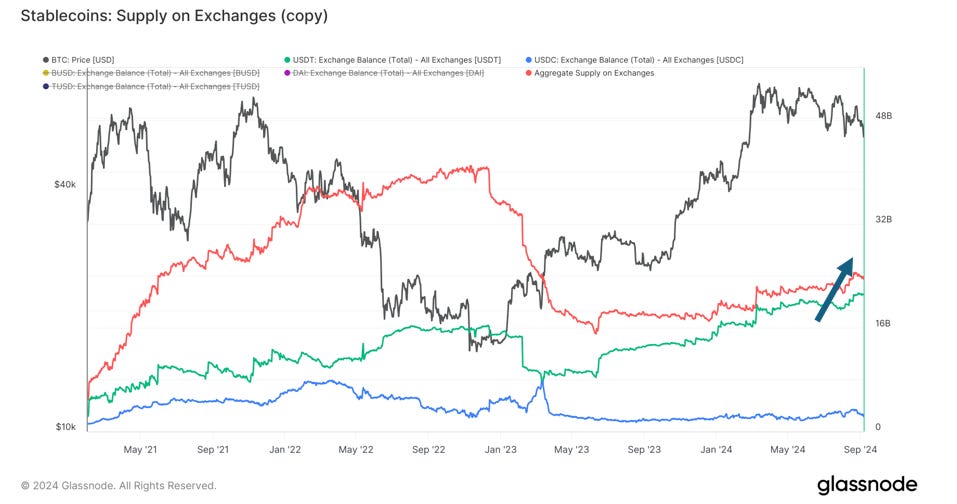

However, there are a few potential positive catalysts to watch for in Q4. As Artemis pointed out, stablecoin P2P transfer volume is reaching all-time highs, and stablecoin supply is nearing its peak, signaling increased adoption of crypto payment rails and continued fiat money onramps into crypto. Aggregated stablecoin supply on exchanges has been accelerating since early August, although it's still halfway down from the peak prior to the FTX collapse. The FTX settlement will likely bring around ~$13B in cash to its creditors, many of whom are crypto investors. This could provide substantial dry powder to the crypto market if risk sentiment improves.

Moreover, DEX volume relative to CEX continues to rise, and DEX trading volumes have held up relatively well despite the selloffs in Q2 and Q3.

Trump’s odds of winning the election climbed above 50% again in September, with the nation anxiously awaiting the first presidential debate next week. Recent regulation tightening around crypto has further reinforced investors’ expectations that a Republican win could be more favorable for the market.

Lastly, with mounting debt in the U.S. and other developed economies, the debt-to-liquidity ratio, adjusted for maturity profiles, has dipped to levels not seen since the 1980s. Liquidity conditions are expected to improve from here, potentially averting a debt crisis.

DeFi Update

While fundamentals may not matter in a risk-off market, they are crucial for the long-term survival and success of a project. Which fundamental metric matters most depends on the nature of the business. For established sectors, profitability often matters more than topline growth, as the market may not be willing to pay a high premium for customer acquisition costs. For newer sectors, topline numbers are more important, as network effects and being the first and largest player provide a natural advantage. The recent manager survey by Crypto Insights Group supports this view.

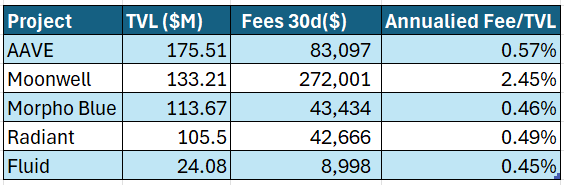

Using lending protocols as an example, TVL, a topline metric, indicates the borrowing power supplied to the protocol. The higher the TVL, the more borrowing power the protocol provides. Fees are a function of TVL, as projects earn a cut from the interest borrowers pay to lenders. To attract TVL, projects often use incentives, sometimes paying above-market interest rates out of pocket to draw in lenders. The table below shows the top 5 fee-earning lending protocols on Base, according to DeFiLlama. Although AAVE leads in TVL, Moonwell has the highest profitability, earning roughly three times the fees AAVE does.

Source: DeFillama as of 9/7/2024

Since Base emerged as the fastest-growing L2 on Ethereum, competition to build DApps has intensified. AAVE’s recent proposal to include Base in its Merit program has contributed to its TVL growth on Base, though at the cost of revenue. We believe short-term incentives are effective for boosting topline metrics, but a project’s long-term success hinges on its ability to provide the best user experience and build a sticky community. Moonwell’s early alignment with the Base ecosystem and its close partnership with Coinbase would position it for long-term success.

Competition in DApps is beneficial for users within the Base ecosystem. Even better, Base’s ability to attract developers is growing. According to Token Terminal, there are now 10-100 times more builders on Base than on other L2s. While the market might be down, the number of builders is up, which we see as the most bullish long-term sign for the industry.

Top 100 MCAP Winners

Starknet (+21.15%)

SATS (+15.26%)

Helium (+15.22%)

SUI (+14.75%)

Uniswap (+8.58%)

Top 100 MCAP Losers

DOGS (-19.04%)

Beam (-18.51%)

Cosmos (-18.29%)

Bittensor (-15.59%)

Toncoin (-14.11%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.