The Market

Last Friday’s PCE report has breezed some relief into the market. Both core and headline inflation are trending in the right direction for the Fed to consider a rate cut.

The market is implying a 70% chance of a rate cut by September and a 95% chance of a rate cut by November, which is starting to look optimal again.

The first presidential debate boosts the optimism of a Republican win, which could be beneficial for crypto too, given their much more friendly regulatory stance and stimulus policies. The reality is the US is spending a lot on fiscal stimulus since covid, with total deficit hitting 7% of the GDP currently. The interest rate burden is projected to be more than 50% of the total deficit from 2025 on. The high interest rate is not sustainable for the US's financial health as a country.

Zooming out over a longer horizon, Global Net Liquidity turns to run four-year cycles coinciding with the US election cycle. The liquidity summer usually starts when the new administration comes in, injecting liquidity to the market as seen in 2016 and 2020. The liquidity condition has been tight since 2024 so far. While history doesn’t indicate the future, we do expect an improvement of liquidity conditions heading into Q4, which could boost risky asset returns.

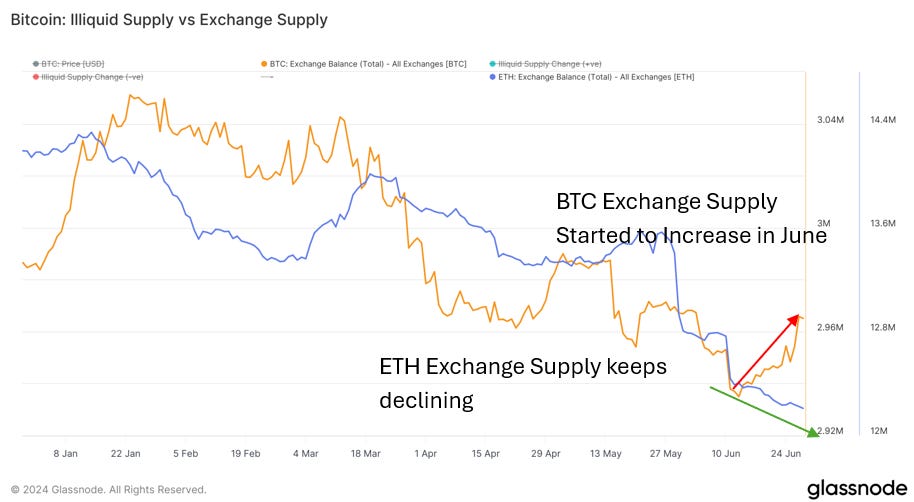

BTC price hasn’t reacted to the positive news as it dipped below $60K during the week and currently stabilized around $61K. There are some short-term selling pressures impacting the BTC price as we observe the exchange supply increased ~$2B in the past two weeks. ETH, on the other hand has seen a continued supply decline from the exchanges, which could make ETH price more reflexive once the spot ETF is launched.

VanEck just filed for a Solana ETF last week, bringing some long-overdue good news to Solana. While we do not believe Solana ETF can be approved under the current SEC regulation, which requires a “regulated market of significant size” to observe the SOL price, it is likely that a change of administration could introduce fresh perspectives. Approval or not, we believe the filing itself confirms Solana as a mainstream favorite alongside BTC and ETH. Solana's rapid rise as a preferred chain for cost, speed, and easy implementation challenges Ethereum's dominance in the Alt L1 space. Solana has gained some positive momentum as it broke its 200-day SMA and is on track to break its 30-day SMA too.

DeFi Update

Web3 and Web2 haven’t been this closely blended, with exciting developments from the leading ecosystems. We have mentioned Telegram and Coinbase efforts in creating smooth Web3 onboarding experience for their existing users in our past weeklies, as they have an advantage over other blockchains with their captive web2 audience. This is about to change with Solana launching Blinks.

Instead of relying on one Web2 planform to acquire audiences, Solana Blinks (a.k.a Blockchain Links) is bringing the solana blockchain to all. Through the Actions techstack, Blinks can transform any on-chain transaction to an URL that can be embedded in any Web2 frontend. Users can click the link to perform the transaction by signing into their Solana wallet, without having to leave the front end or jump through multiple pages. We consider it a more generalized version of frames in Farcaster, enabling developers to embed interactive transactions in any application. It’s now possible for many Web2 businesses to adopt Solana as their inroad to tap into the Web3 audience. The adoption of Solana as an additional payment rail by Stripe, Visa, Paypal, etc. is only a start.

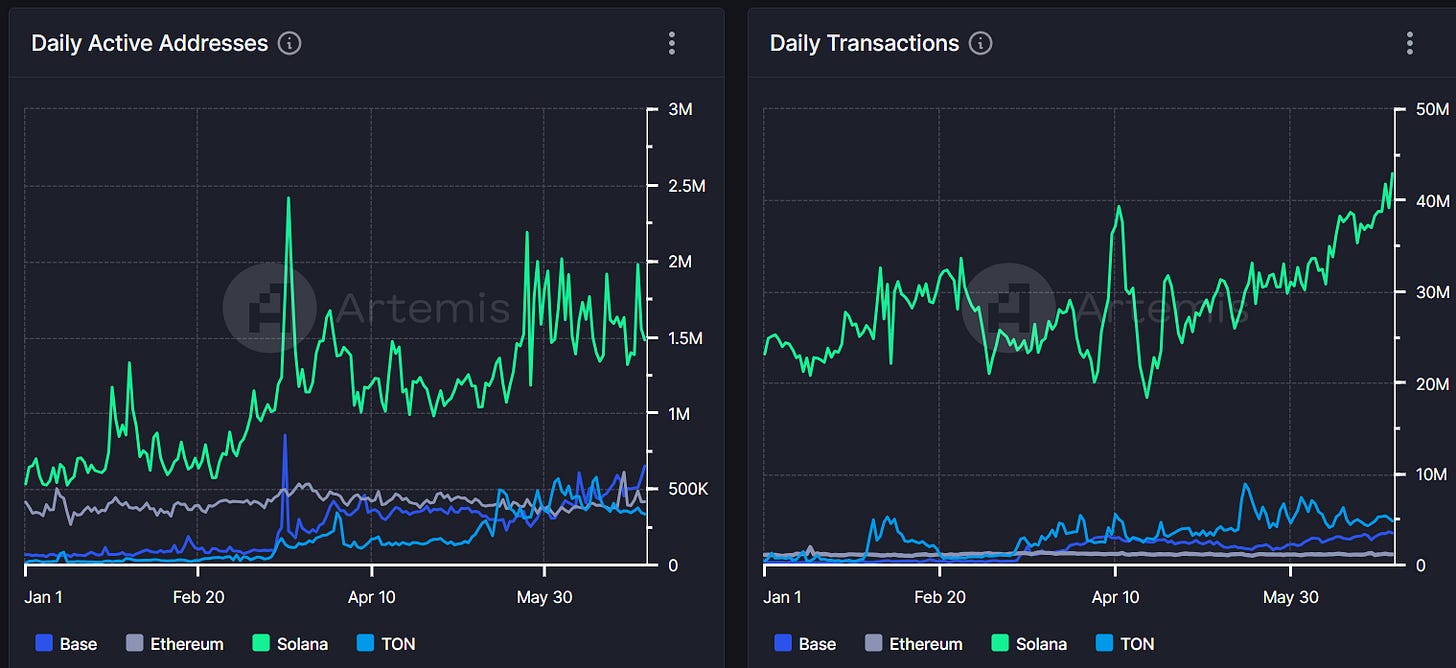

If the past Solana rally was notable for the DeFi summer and meme trading, we believe the true Solana renaissance has just begun, with real potential to onboard mainstream users. Thanks to its unified monolithic tech stack, Solana developers can focus on improving UI and building killer apps instead of building more infrastructure on the modular tech stack. With more daily active addresses and transactions than other major blockchains, Solana has a good chance of leading blockchain adoption and creating killer apps that will bring crypto into the mainstream.

Top 100 MCAP Winners

Mog Coin (+82.95%)

Kaspa (+20.44%)

Dogwifhat (+19.40%)

Akash (+17.38%)

Aave (+16.96%)

Top 100 MCAP Losers

Pendle (-18.85%)

Ethena (-15.15%)

Gnosis (-13.61%)

Worldcoin (-11.77%)

Sui (-11.23%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.