The Market

The market in the first week of fall remains incredibly flat. BTC is down 0.05% to $25,852 over the 7-day period, still holding above the ~$26K support level. ETH is exactly flat at $1,634. The ETH/BTC ratio is right at its 90-day average and has seen a local uptrend of higher lows. This local uptrend could result in a wedge pattern breakout from the previous descending wedge, especially considering the pending launch of the ETH futures ETF in October.

While the aggregated capital flow continues, we do see a net decrease in stablecoin positions and a net increase in ETH positions. This is an encouraging sign of a potential comeback in risk appetite.

This trend aligns with the flow trends in traditional financial products investing in crypto. According to Coinshares, the outflows have subsided, and Bitcoin ETPs have started to experience inflows..

We have observed a pickup in derivative trading volume compared to the spot market. Deribit, the largest crypto derivative exchange, experienced a 17% increase in trading activity during August, while spot volume declined by 12%. The increase is especially strong in the ETH options market, with the August volume at the highest since March 2023.This increase is particularly pronounced in the ETH options market, with August volumes reaching their highest levels since March 2023. When analyzing the open interest at different strike levels for ETH and BTC options expiring on September 29th, the market displays a stronger bullish sentiment toward ETH than BTC for September, as evidenced by an ETH put/call ratio of 0.44 compared to a BTC put/call ratio of 0.59.

On the macro front, the dollar has climbed to its highest level since March, reflecting the market's expectation of a 'higher for longer' environment. Interestingly, Bitcoin has remained stable during the DXY rally this time. As Noelle Achson pointed out, Bitcoin is being supported, albeit not necessarily in dollar terms.

Notable CeFi Developments

Since Grayscale won the ruling against the SEC on August 29, the GBTC discount has reduced from 25% to 17%, and the ETHE discount has shrunk from 34% to 25% in two weeks. There are still significant gaps to close. The SEC has delayed its response to the batch of Bitcoin ETF applications filed in July, including those from Blackrock, Fidelity, and Bitwise, among others. The next response deadline to watch is mid-October.

The first ETH futures ETF is poised to launch on October 11 by Volatility Shares, with a slew of similar ETFs to follow. While investors may argue that the futures ETF may not be as game-changing as the spot ETF, the race for ETH spot ETF filings officially began on September 6 when CBOE filed two 19-b4s on behalf of VanEck and Ark. It’s not hard to extrapolate that BTC spot ETF approval might open the floodgates for ETF innovation on ETH and other blue-chip digital asset ETFs. According to CryptoCompare’s August asset management report, the total AUM in BTC, ETH and Basket based ETP or Trust products globally is at $21 billion, $7 billion and $1 billion, respectively. Most of them are outside of the US except for GBTC and ETHE. Given the current size of the US ETF market at $6 trillion, a mere 0.5% of allocation to crypto ETFs will generate $30 billion inflows.

There are several notable instances of TradFi adoption of blockchains across various financial service firms. Visa has announced last week that they are expanding their Stablecoin Settlement Pilot to Solana, in addition to Ethereum. They have initiated a pilot program for USDC settlement on Ethereum in collaboration with Crypto.com. The goal is to allow Crypto.com visa card holders to settle transactions directly with USDC rather than relying on traditional banking rails. According to the published case study, utilizing USDC settlement reduced the pre-funding requirement from eight days to four and lowered fx fees by 20-30bps. While this doesn’t represent the real-time, low cost, peer-to-peer transaction solution, it’s encouraging to witness TradFi companies embracing blockchain for practical use cases. The expansion to Solana holds significance as it aligns with the multichain thesis. Visa’s research on modular vs. monolithic blockchain demonstrates their thoughtful process behind selecting Solana as the top monolithic chain, following recent support from Maker and Shopify. Visa has also expanded its on-chain capability with new partners like Worldpay and Nuvei, both of which are acquirers that will help Visa provide on-chain services to more merchants.

LSE, Europe's largest stock exchange, unveiled plans to offer blockchain-based trading for traditional assets last week. They acknowledged the benefits of blockchain to make transactions cheaper and more transparent, although they do not intend to position it as direct competition to their existing business. The question remains regarding potential disruption to Euroclear or DTCC if trades can be settled on-chain.

On the regulatory front, just as we celebrate the victories against the SEC, the CFTC seems to be tightening its stance against DeFi by issuing orders against three DEXes: Opyn, 0X and Deridex. These actions revolve round the following issues:

1. Registration as an eligible facility to offer derivative transactions.

2. Lack of KYC procedures.

3. Offering levered and margined retail commodity transactions.

It's important to note that these issues are not unique to just these three DEXs. All derivative exchanges face similar challenges. Interestingly, the largest derivative exchanges, dYdX and GMX, have not been impacted yet, possibly due to geofencing measures. However, given that the crypto derivatives market is significantly bigger than the spot market, regulatory decisions regarding derivatives DEXs could have significant implications.

Notable Developments in DeFi

The much anticipated ”Sell” feature in Metamask has finally arrived, allowing crypto to fiat offramp. Currently, it’s only available for ETH on the mainnet, but they plan to add more tokens in the future. Metamask enabled the ”Buy” feature for fiat to crypto onramp in February 2023. However, it's worth noting that the cost to sell crypto for fiat can be as high as 9%, according to one user. The majority of this fee seems to result from the bid/ask spread imposed by the fiat withdrawal provider.

Lido’s market share in ETH staking has reached an alarming level of 32.37% at present, raising concerns of a theoretical 33% attack. Lido’s market share peaked at a 30-day average level of 45% in March 2023, although no incidents have occurred. Lido’s dominance has become a big concern for Ethereum’s centralization. The community is divided on Lido’s impact on Ethereum's future. On one hand, some members advocate for a 22% cap for any staking provider, while others want to adhere to the purest principles of the free market. The essential question is whether we can maintain Ethereum’s decentralization while adhering to the values that make it unique. Lido is taking steps both on the technology front, by examining decentralized validation technology (DVT), and the governance front, by exploring a dual governance model involving both LDO token and locked stETH. This approach creates opportunities for DVT providers, but the dual governance model might diminish the value of LDO tokens since their sole purpose now is governance.

Base experienced its first outrage last week, which lasted for half an hour and took another 30 minutes to fully resolve. Fortunately, no funds were at risk, but this incident underscores the early stage nature of many L2 projects; none of them have undergone sufficient battle testing. In fact, Optimism is still developing its fraud-proof system, which means users must currently trust that the data synchronized to Ethereum through Layer 2 is accurate..

Trends to Watch

We have mentioned in past weekly reports that the market has matured, and good news on partnerships or product development efforts have failed to drive sustained positive price movements. Investors may attribute this to uncertainties in macroeconomic and regulatory environments, but Ethereum gas fees are far below the levels we saw during DeFi summer in 2020 and the NFT summer in 2021. While lower gas fees are beneficial for users, they also indicate a lack of strong demand. The last notable peak we observed was driven by PEPE, a meme coin, which is unlikely to generate sustainable blockspace demand.

Meanwhile, we are entering the “broadband era” for blockchains as infrastructure developments make them faster and cheaper. The question is, which applications will drive the next phase of sustainable growth? In our view, centralized companies might play a bigger role in blockchain adoption for the following reasons:

Increased adoption by traditional companies using blockchain for real-world use cases such as payments, tokenization and NFTs:

To convince mainstream users to overcome the inertia and learning curve required to adopt blockchain, it must either introduce significant improvement in existing processes, or create new use cases that were previously impossible. We are seeing both of these happening with increasing examples of Web2 companies entering the space. Payment companies such as Paypal,Visa and Shopify have recognized the benefits of stablecoins for cross-border transactions. TradFi companies such as Franklin Templeton, Fidelity and JPMorgan are using blockchain to enhance operational efficiency, expand their product offerings and target new clients. Large consumer companies and influencers are also using NFTs as a better way to engage with consumers and monetize their brand.

Given the centralized nature of traditional companies, increased adoption would most directly benefit the infrastructure layer such as L1, L2 and interoperability solutions that connect different chains or bring real-world data on chain (oracles) through increased usage and transaction fees.

Web2 platforms serve as a gateway to onboard the next wave of Web3 users:

While crypto enthusiasts may prefer to eliminate intermediaries, Web2 companies still serve as a preferred gateway for mainstream to access Web3, particularly due to the lack of good UX in web3. For example, base has been the most successful L2 in attracting TVL thanks to Coinbase. Web2 platforms can leverage their user base and resources to rapidly adopt new technology if there is potential for revenue growth or cost savings. They also have an incentive to protect their moat and avoid being replaced or disintermediated. Having them as a short-term solution for onboarding users to Web3 might be the most practical solution.

Regulation also plays a crucial role in how blockchain will be adopted in the mainstream, especially for financial applications. A walled garden or gated approach may be necessary for some time to protect consumers from bad actors.

We see centralized platforms with strong network effects that can gain additive benefit from blockchain usage (rather than being disrupted) as the ones benefiting the most from this trend. Examples include Coinbase, Twitter and Telegram. Wallet and UI/UX solutions that create a smooth Web2-like experience, particularly with the development of account abstraction, would also benefit from this trend.

dApps that can devise creative ways to utilize Web2 platforms for user acquisition could also benefit significantly from this trend. Recent examples include Unibot+Telegram, TIP+Twitter and OP+Coinbase.

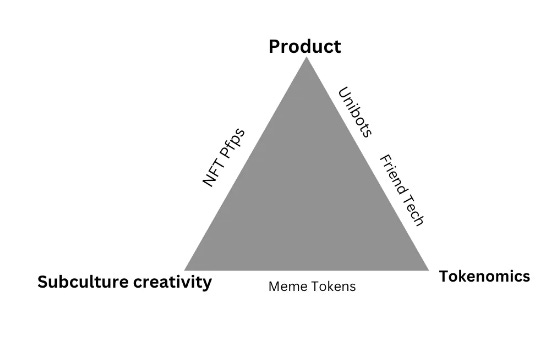

JX from OFR has an interesting perspective on three key aspects of a dApp token's success: Product, Tokenomics, and Subculture creativity. Having two out of the three may drive short-term success, as demonstrated below. However, achieving sustained growth requires the synergy of all three features. Subculture is the most challenging aspect to evaluate, yet it often possesses the most enduring demand. Depending on the type of application, the subculture community size may also be limited.

I would take a step further and assert that a successful dApp must incorporate a “Gamification” component that taps into the basic human desires for rewards, enjoyment and recognition. DeFi directly caters to our desire for monetary rewards, but it can be a precarious path due to regulatory concerns. SocialFi holds promise for influencers in terms of rewards and recognition but must also be engaging and rewarding enough to entice a broader user base away from Web2 incumbents. GameFi is poised to create a golden triangle of rewards, entertainment, and recognition, once it becomes cost-effective enough to make on-chain games as enjoyable as their Web2 counterparts.

Top Gainers and Losers

Stellar has a magnificent rally this week, potentially driven by a vague announcement on X about an announcement related to their brand on September 12. Some suspect it’s RWA related. It’s possible as Stellar is the first chain Franklin Templeton chose to issue its tokenized money market fund.

GALA had a -14% selloff last week as the CEO sued the co-founder about a $130million theft in GALA tokens.

Top 100 MCAP Winners

Stellar (+17.21%)

Synthetix (+11.21%)

IOTA (+9.37%)

RNDR (+8.48%)

Astar (+6.54%)

Top 100 MCAP Losers

Gala (-14.17%)

Mantle (-8.27%)

Flare (-6.11%)

Toncoin (-6.08%)

ApeCoin (-5.31%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.