The Market

Happy Labor Day Weekend! Summing up the final week of summer: I grew weary of BTC lingering around the $26,000 support level, so I took a break. While I was heading for the beach, some exciting news broke—Grayscale triumphed over the SEC in a legal ruling. By the time I reached my hotel, the market had returned to its original level again.

On Aug 29, U.S. Court of Appeals Circuit Judge Neomi Rao ordered Grayscale's petition for review be granted and the SEC's order to deny the GBTC listing application be vacated. The market responded with excitement about the Grayscale case, resulting in a one day rally of 5% for BTC. ETH and other bluechip digital assets also experienced smaller rallies, but these gains were short-lived as the market relinquished the gains by the end of this week. BTC's performance over the 7-day period ending on September 2nd saw a decline of 0.8%.

The GBTC discount has narrowed to -19.93%, marking its tightest point in a year, although it remains a significant discount that still needs to be addressed. Considering GBTC's 2% fee, the market seems to be factoring in approximately 10 years of fees before the price converges to NAV. In our view, this outlook appears overly pessimistic.

Please note that the ruling does not automatically approve Grayscale's ETF application. Instead, it instructs the SEC to reevaluate the ETF application and dismissed SEC’s argument that Grayscale’s spot ETF proposal is inadequate in preventing market manipulation. The ruling could lead to one of three possibilities:

SEC could approve the ETF conversion

SEC could provide a different rationale for rejecting the spot ETF application

SEC might withdraw the BTC futures ETF approval

SEC has a 45-day window to file an appeal. Given the presence of several Bitcoin futures ETFs with AUM surpassing a billion, the occurrence of scenario 3 is highly improbable. SEC can leverage the court ruling for a graceful exit from their anti-ETF stance or choose an extended legal struggle to explore alternative grounds for rejection. Yet, taking into account the ETF response timeline outlined below, a verdict on spot BTC ETFs is expected by January 2024 at the latest.

Another notable legal triumph occurred on Aug 29, as Uniswap emerged victorious when the court dismissed a class action lawsuit related to losses on scam tokens traded on the DEX. This is noteworthy for two key reasons:

The court recognized the decentralized nature of the Uniswap protocol, attributing the fault to token issuers rather than the smart contract executing trades.

The court acknowledged the absence of a "definitive definition" for whether a crypto asset qualifies as a security or commodity, challenging the SEC's claim and suggesting that Congress should address this matter.

However, Uniswap's price response was not positive, as it concluded the week with a 3% decline.

A looming concern for Uniswap and other DEXes revolves around the proposed broker rule by the Treasury and IRS. Galaxy Digital’s interpretation indicates that this rule has expanded the broker definition to potentially encompass CEX, trading-facilitating wallets, and DEX front ends. If enacted, DEXes would need to either seek broker designation and compliance—functionally challenging—or block access for US users altogether.

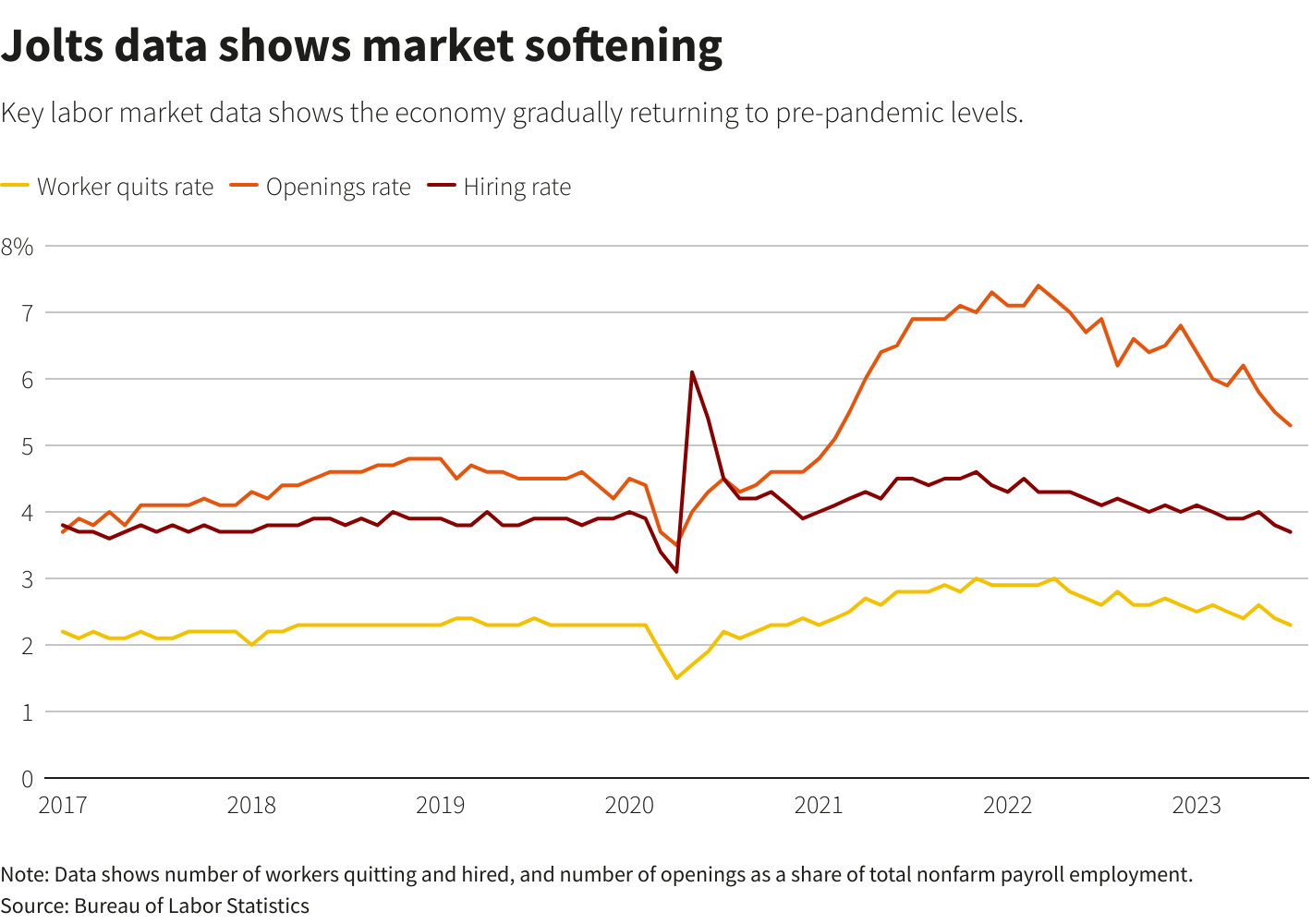

On a broader scale, the recently published Job Openings and Labor Turnover Survey revealed signs of labor market slow down. Both hiring and quitting rates have returned to pre-pandemic levels. This development bolsters the Fed's optimism about a gentle economic transition and might ease the pressure for imminent rate hikes. The upcoming FOMC meeting on September 19-20 is approaching, and the futures market currently implies a mere 6% likelihood of a rate hike, a significant decrease from the 20% probability following Powell's speech.

Notable CeFi Developments

Stablecoins have quietly ascended to the status of a "killer app," with transferred values in 2022 surpassing those of PayPal and Mastercard. While the transferred values are comparable to those of traditional payment networks, the annual transaction count remains at a modest 0.5-3% of traditional payment networks. This indicates that stablecoins are utilized less frequently and predominantly for larger transactions. With Ethereum's ongoing scaling efforts and Paypal's development of PYUSD, the adoption of stablecoins by mainstream users is poised to continue growing. As more fiat currencies find their way onto blockchain platforms, the benefits extend beyond just payment use cases. This shift could also introduce fresh capital to other onchain assets, as many mainstream users perceive fiat onramps as the most challenging step in purchasing crypto assets.

Another mainstream entity embracing crypto payments is the Colorado DMV. They announced on Aug 31 that their web portal, myDMV, will now accept cryptocurrency payments through PayPal for online transactions. This marks a positive stride for PayPal, as they are presently the sole accepted cryptocurrency provider. However, a 1.83% fee based on the total payment amount accompanies this method, which might render it less appealing compared to TradFi payment options. While we anticipate more such deals in line with PayPal's aspirations of becoming a cryptocurrency payment gateway, the relatively high fee associated with crypto payments through intermediaries could potentially contradict the concept of crypto as a more cost-effective and efficient peer-to-peer payment alternative. We regard these adoption experiments led by prominent companies as essential steps toward mainstream acceptance of crypto. Once the broader potential of blockchain becomes evident, true adoption is likely to ensue.

In addition, X (Twitter) is also advancing in its efforts to offer digital payments for crypto-related services to its users. Recently, they secured the Currency Transmitter license in Rhode Island, a mere two months after obtaining the same license in New Hampshire. It is probable that X has sought licenses across multiple states, aligning with Elon Musk's overarching strategy to transform X into an all-encompassing platform. Wechat, a Chinese counterpart to the multifaceted social app Elon wants to emulate, features integrated payment functions, facilitating peer-to-peer, peer-to-business, and business-to-business transactions, all while functioning as a social media platform. Its widespread adoption in China has reached a point where even individuals like my 70-year-old father can use it to buy breakfast from street vendors.

Notable DeFi Developments

While positive legal advancements failed to sustain the market rally, the approximately 3.5% token unlock for Optimism, Hedera and dYdX did trigger an expected selloff for these three tokens. Both OP and HBAR tokens experienced declines of over 10% last week, landing them among the worst performers within the top 100 tokens.

Within the governance forum of MakerDao, the CEO has proposed an exploration of the Solana codebase for its NewChain, a crucial part of the End Game plan. NewChain will serve as a blockchain housing backend logic for SubDAO tokenomics and MakerDAO governance security. After evaluating various blockchain options, Solana was chosen due to the high quality of its technical codebase, its resilience even during the FTX incident, and the precedent of Solana codebase forks used as appchains. While significant focus has been directed towards Layer 2 developments on Ethereum, the reality is that we're in a multichain era as different dApps have distinct preferences concerning performance, composability, and network effects.

In the Layer 2 space, Offchain Labs released a new technical implementation called Arbitrum Stylus on August 31st, aiming to facilitate smart contract development in multiple programming languages. This strategic move not only broadens the developer base for Arbitrum but also introduces the potential for enhanced cost savings at the software level, given the flexibility of codebases like Rust or C++. A simple test conducted by one developer revealed that implementing a smart contract in Stylus using Rust versus Solidity led to a 50% reduction in gas costs within a memory-intensive scenario. We will closely monitor Stylus's progress to assess Arbitrum's competitiveness against Optimism in the Layer 2 landscape.

Trends to Watch

Brian Armstrong shared ten ideas that currently excite him in the world of crypto. He encouraged builders to apply for the Coinbase Ventures Summit, which serves as an excellent way for Coinbase to attract deal flow. It also provides insight into the vision of a successful OG builder and indicates potential directions for future crypto developments. Some of these ideas are widely discussed, while others might seem overly ambitious. However, the overarching direction is to use blockchain technology to reconstruct the global order. Here's my interpretation of his ideas:

Flatcoin: Exploring the creation of a superior monetary system that combines the strengths of both BTC for value storage and decentralization, and stablecoins for stability and everyday transactions. A suitable candidate would need to resist inflation, be decentralized, and stable enough for daily use. The challenge lies in implementing a monetary policy based on real time CPI data while navigating obstacles like network adoption and regulatory aspects.

Onchain reputation: This concept holds significant promise and is entirely achievable. Traditional finance models, like credit scores, already exist. Blockchain technology could track onchain activity tracking and process data much faster than a centralized credit agency. To make onchain reputation effective, we require a greater number of users in the Web 3 ecosystem engaging in transactions. This user activity will contribute to data accumulation for reputation assessment. This positive feedback loop can allow users with strong reputations to access credit and services within Web3 at potentially lower costs and faster speeds compared to real-world alternatives.

Onchain Ads: Building onchain advertisements, especially when combined with onchain identification, presents a feasible option. Smart contracts enable more advanced monetization strategies, allowing companies to target users more accurately and pay only for successful purchases. Users, in turn, may be motivated to share preferences or referrals through a smooth smart contract payment mechanism.

Onchain Capital Formation: Blockchain technology has the potential to reduce barriers to entry in capital markets, ensuring frictionless capital movement between investors and companies. However, finding the balance between free markets and regulation is crucial to prevent imbalances and maintain market efficiency.

Job/Task Marketplace: The idea of a worldwide free labor market is attractive, as it could potentially alleviate global labor market imbalances. Utilizing Bitcoin or stablecoins as payment for labor might also contribute to increased cryptocurrency adoption, especially benefiting workers in developing economies. However, implementing this concept involves overcoming challenges tied to task intricacies, management, and dealing with diverse labor regulations across various countries.

Privacy for layer 2: Brian drew a compelling comparison between the privacy feature and the transition from HTTP to HTTPS in the blockchain context. Rather than adopting a fully privacy-focused Layer 1 chain like Monero or Zcash, which are criticized for attracting malicious actors, privacy can be incorporated as a feature within Layer 2 solutions. While the technical aspects of enabling privacy are still in early stages, there exists substantial potential for creating effective designs.

P2P exchange fully onchain: A peer-to-peer exchange could be a preferable option in regions with local corruption, where traditional centralized exchanges face challenges. However, the bottleneck remains fiat on/off-ramps, often controlled by local banks that blockchain technology alone can not solve.

Onchain Games: The crypto community holds high expectations for onchain games due to the appeal of owning and trading in-game assets. However, two significant challenges arise: the high cost of running complete games onchain and the scarcity of engaging games that attract genuine players. The advancements in Layer 2 solutions and scalability offer the potential to create more intricate onchain games. We may not need a blockbuster game to ignite the trend; a persistent virtual world hosting a simple game that users enjoy playing and trading in-game assets could serve as a solid starting point.

Tokenize Real World Assets: This is currently the trending topic for every traditional finance (TradFi) company aiming to enter the crypto space. From a technical perspective, tokenizing real-world assets isn't particularly challenging. However, establishing a liquid market with standardized protocols to enable seamless trading of all tokenized assets onchain and potentially on major exchanges presents a complex challenge. Addressing this challenge demands the coordination of established players, regulatory clarity concerning trading venues and methods for these assets, and ultimately, investor acceptance of real assets as part of their portfolio allocation. I highlighted in a CoinDesk article that tokenization holds the potential to democratize investments similarly to how ETFs disrupted the investment industry over two decades ago. Yet, reaching that stage will involve a prolonged and intricate journey.

Tools for network states: An imaginative and utopian idea, envisioning a world where people align based on shared goals through "network states." Decentralized Autonomous Organizations (DAOs) are early forms of this concept, and tools facilitating the design and implementation of governance rules could lead to true decentralized and autonomous governance. Protocols such as Maker are already thinking about the structure in their End Game.

Top 100 MCAP Winners

Toncoin (+35.03%)

XDC Network (+12.90%)

Maker (+12.52%)

ThorChain (+12.31%)

IOTA (+10.72%)

Top 100 MCAP Losers

SUI (-18.11%)

Hedera (-15.18%)

KuCoin Token (-13.76%)

Pepe (-12.26%)

Optimism (-11.19%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.