The Weekly 248

Amidst Unfolding Catalysts, Crypto Market Seeks Stability and Awaits Clues for the Next Direction.

The Market

After the 11% sell off in the week of Aug 14th, BTC has found support at $26,000 and has held steady there for the past week. The 14-day RSI remains in oversold territory on the indicator from last week, although it has rebounded to 29. Implied volatility has returned to the levels observed before the selloff.

ETH has maintained its price around the $1650 support level for the past week, although the implied volatility remains elevated, suggesting that the market anticipates more volatility in the near term.

The ETH/BTC ratio has been following a descending wedge pattern year-to-date, indicating an appealing valuation of ETH relative to BTC. The volatility of the ratio has declined to the lowest level this year, as we await the catalysts that could lead to a decoupling of ETH’s performance from that of BTC.

So what catalyst should we be watching for? On the macro front, J Powell’ speech this Friday revealed Fed’s ongoing concern on inflation. In comparison to last year’s Jackson Hole Fed meeting, both the 2s10s and the 3m10s yield curves are currently inverted, and the Odds of at least one more rate hike this year have just reached a new 2-month high of ~58%. Aside from BTC and ETH, risky assets have held up well so far. We continue to monitor the ongoing decline in Global Net Liquidity and increase in dollar strength—both of which have historically had negative impacts on BTC’s price. We anticipate that tighter financial conditions will persist. However, as long as the economic growth remains on or above trend and inflation follows a stable declining trajectory, risk appetite will come back.

On the market structure front, FTX has enlisted Galaxy to liquidate its $3-4B liquid token portfolio. They are relying on Galaxy’s expertise and network to minimize market impact, a logical approach given the diminishing liquidity in the market. While it was anticipated that a ruling of Grayscale vs. SEC lawsuit would be issued before September, no news has yet emerged. Additionally, there has been no pushback from the SEC regarding the ETH futures ETF filings set to launch in October. In this context, no news is good news.

Notable CeFi Developments

Consolidation is taking place among crypto-native centralized companies as key players strive to strengthen their competitive position. Securitize, the leading tokenization platform that pioneered the issuance of the first US tokenized private equity funds in collaboration with KKR and Hamilton Lane, is in the process of acquiring Onramp, a digital asset investment platform. The acquisition will provide them with access to Onramp’s RIA clients, enabling them to issue securitized funds on the Securitize platform. Additionally, Coinbase is making an investment in Circle, further solidifying their partnership in the realm of USDC. Circle, with its NYDFS license, will serve as the sole governance body for USDC. This investment will facilitate USDC’s expansion to six new chains. Given USDC’s substantial lead and widespread adoption, it will likely take some time for Paypal’s PYUSD to catch up.

While regulated crypto companies based in the US are expanding, offshore crypto companies are working to enhance their compliance measures in anticipation of the forthcoming regulatory pressures. OKX, Bitget and Kucoin are bolistering their KYC requirements in alignment with Singapore’s MAS directives. Bitstamp is ceasing its staking service for US clients, following Kraken’s previous action.

Visa and Mastercard are disassociating themselves from Binance by discontinuing their card partnership. Despite this move, Binance’s market share is unlikely to be significantly affected due to its extensive global network. Amid these challenges, Binance is persisting its product expansion efforts, having introduced a copy trading feature in their futures platform this week. This offering caters to younger retail clients who are interested in emulating trading strategies employed by popular traders.

Notable DeFi Developments

Friend.Tech, the new SocialFi App built on Base, continued to generate impressive fees this week. According to Token Terminal, Friend.Tech was ranked as one of the top 5 fee-generating projects last week, with $6M in weekly fees, placing it just behind Uniswap. While the crypto native community remains divided on whether it represents a new business model that will rejuvenate Web3 social, or another potential ponzi scheme that makes the rich richer, it’s invigorating to witness new dApps gaining traction and serving as an examples of the possibilities that cheaper and faster transactions on Blockchain can enable.

Another encouraging development is emerging with EigenLayer. After lifting its staking cap on August 22nd, its TVL surged from $78.46m to $236.77m (+202%) within a matter of hours. The restaking protocol now holds 1.20% (99K stETH), 3.96% (20K rETH) and 1.76% (21K cbETH) of their respective supplies. Future caps will be adjusted based on governance proposals. Additionally, Binance Labs announced an investment in Pendle Finance this week, an emerging DeFi protocol that enables sophisticated yield strategies on LSD. Following the Shapella upgrade, staked ETH has risen from $18.6M to $26M, reflecting an almost 120% annual growth rate. Currently only around 20% of the ETH supply is staked, a figure significantly lower than the staking ratio observed in other major PoS chains. Anticipating further growth in staked ETH, we foresee an increasing desire for yield and liquidity, which will drive expansion in the LSDS and LSDFi sectors.

Solana has achieved a notable institutional partnership milestone, with their payment protocol, Solana Pay being integrated into Shopify. Businesses operating on the Shopify platform now have the option to utilize Solana Pay as a payment method. Furthermore, Shopify can leverage Solana Pay as a gateway for Web3 commerce experience, including cross-border payments, token-gated offers and NFT-based loyalty programs.

Trends to Watch

Since the FTX fiasco in November, the market has struggled to find its footing in the next phase of growth. Are we still in a bear market? YTD BTC’s price has risen 57%, yet it remains 60% below the last ATH level reached at the end of 2021. Are we on a steady path to recovery? It appears that BTC loses momentum when it approaches the $32000 resistance level, and the ETH/BTC ratio—an indicator of risk preference—continues to linger at subdued levels. The market is waiting for clearer signals on macro conditions to gauge risk appetite and regulatory guidance to substantiate the future growth of a blockchain-based economy.

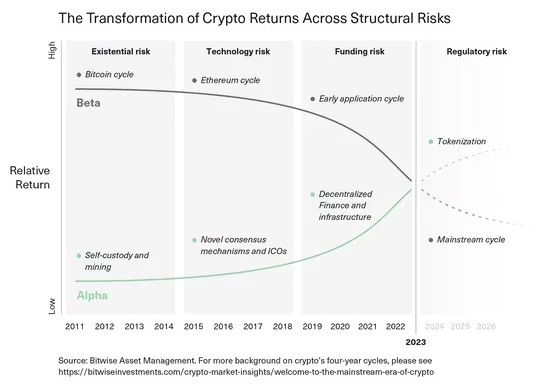

Bitwise has published an insightful article summarizing the catalysts of past cycles. During 2010-2014, the catalyst was Bitcoin’s survival, transitioning from a technology experiment to a viable alternative payment system. From 2015-2018, Ethereum demonstrated the power of smart contract platforms, culminating in the DeFi summer that showcased how decentralized applications could compete with their centralized counterparts. The period from 2019-2022 was fueled by VC money, highlighting the capitalists’ acknowledgement of crypto. However, this phase ended with challenges due to excessive capital fooding an early stage technology susceptible to bugs and fraud.

Now, we find ourselves in a more sober rebuilding phase. Major players have entered the scene, institutions have moved beyond proof-of-concept to develop tangible blockchain-based products, and regulators are under pressure to provide clarity on legitimate protocols fundraising and how institutions can offer crypto products and services to mainstream investors. We are climbing up the steep S-curve of technology adoption. However, brace yourself; this might be our last cycle before crypto goes mainstream. The exact timing remains uncertain, but it’s reassuring to observe the unwavering dedication of builders who have weathered previous cycles. They continue to contribute, whether by enhancing the blockchain infrastructure to facilitate cheaper and faster transactions, or by honing the product-market fit to promote broader adoption of dApps.

Top Gainers and Losers

Two DeFi names have emerged as top losers this week. Thorchain’s RUNE experienced a near 100% rally since its launch of streaming swaps at the end of July, it’s now retracting nearly 23% from its ATH due to profit-taking from certain investors. The price of CRV has fallen below 0.5, the lowest level last seen right after the Vyper exploit. Notably, the decision by DWF labs to transfer CRV to Binance for trading purposes could suggest that the adverse impact of CRV price decline on its use in the DeFi borrowing and lending ecosystem may not be over yet.

Top 100 MCAP Winners (7d %):

Bone ShibaSwap (+15.73%)

dYdX (+6.78%)

Toncoin (+5%)

APENFT (+3.86%)

Quant (+3.33%)

Top 100 MCAP Losers

Thorchain (-22.86%)

Pepe (-20.78%)

ApeCoin (-12.80%)

XDC Network (-12.65%)

Curve DAO (-9.59%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.