The Weekly 246

The Attraction from TradFi to DeFi Endures, but the Market is Hesitant to Factor in Potential Gains

The market – calm before the boom or the storm?

BTC and ETH markets have been relatively flat for the past two weeks, with implied volatility for both having declined to YTD low levels. This is due to thin liquidity and summer slowdown. Compressed volatility is typically followed by large price impulses, the direction of which we believe will be primarily driven, in the near term, by the macro outlook and regulatory developments around crypto.

The broader macro market is also muted, with VIX ranging between 13 and 18 since the Q2 earnings report season started last month. As of 8/11/2023, Fed fund futures is pricing in a 90% chance that the Fed will not raise interest rates for the next FOMC meeting in September, although the rising energy prices since July might create upside pressure on inflation. We are not out of the woods yet.

The exciting news of PayPal launching their own stablecoin, PYUSD, and Base getting $200M in TVL in the first week of launch hasn’t moved the market - not even the PayPal stock price - and for a good reason. Market participants have matured to expect more than the initial buzz and now need to see sustained growth to evaluate the real potential.

Notable CeFi Developments

There is a lot of excitement for PYUSD. If the largest regulated payment company in the US is issuing a stablecoin on Ethereum, with no restrictions on transfers to external wallets, and an on-off ramp to fiat, that must be a big deal right? In theory, yes. It showcases large institutions’ willingness and effort to bring crypto into compliant rails and the potential for crypto to gain mainstream adoption by accessing all their clients.

However, PayPal’s move is generating regulatory heat, especially it times the PYUSD launch before the stablecoin bill, with some regulators strongly arguing for federal rather than state-level regulation for stablecoins. In reality, challenges in adoption still remain for the three mainstream use cases:

P2P payments: the existing domestic payment infrastructure works very well. Although PayPal makes buying PYUSD easy and free, users still need to buy PYUSD, transfer it, and sell PYUSD if they want to off-ramp to fiat. PYUSD is currently not available for international payments yet, but could be an attractive option if the fee is competitive (although at PayPal’s own risk of cannibalization). P2B payments is also an interesting area to watch if PYUSD is enabled and whether the fee is competitive to existing options.

Fiat on and off ramp: this is the biggest advantage PayPal brings in enabling mainstream access to crypto in a regulatory compliant fashion, as users on PayPal are all KYCed. Paypal has established a crypto currency hub that currently supports BTC, ETH, LTC, BCH and PYUSD. The cost of purchasing and selling crypto other than PYUSD is not competitive vs. other CEX options, though.

Connect with broader crypto ecosystem: PYUSD is built on Ethereum, rather than a private blockchain. This is very encouraging compared to how other TradFi institutions are adopting blockchain. PayPal lets people send PYUSD to external crypto wallets, so it could be deployed in DeFi legos, although it won’t be a “regulatory friendly” move for PayPal. It’s also unclear if the crypto-native community wants to. So far, only Huobi has announced the support for PYUSD trading pairs.

What does PayPal gain from this? Their main way of making money is by creating a worldwide network for payments and charging people to use it. Using blockchain could make this network faster and cheaper to run, and it could even change how PayPal operates. They can't ignore this big opportunity. PayPal must figure out how to use blockchain for the greater good without losing their role in the process. Plus, since stablecoins like PYUSD don't pay interest, any interest earned from backing PYUSD could mean extra money for PayPal if interest rates stay high.

Given its use of the Ethereum network, the growing adoption of PayPal USD would ultimately benefit Ethereum by driving additional activity to the chain. This would result in direct value accrual to ETH the token, in the form of an accelerated reduction in ETH supply via the EIP-1559 implementation.

The SEC has once again postponed the decision on the 21Shares/Ark Bitcoin ETF. This is the first response from the SEC in reaction to the recent wave of Bitcoin ETF filings, but it’s not surprising, as they’ve done this with all previous requests. This delay doesn’t seem to affect BTC price much, and the GBTC discount remains at its lowest YTD level. The market is waiting for more information on SEC feedback for other ETF filings to adjust their expectations on when, or if, any Bitcoin ETF might be approved. The next SEC decision date for the Blackrock and a few other ETF issuers’ filings is due in early September.

While much of the focus is on Bitcoin ETFs, it’s worth noting that new filings for ETH futures ETFs started coming in August. The SEC approved Bitcoin futures ETFs in 2021, based on CME’s surveillance sharing agreement with the ETF listing exchange. Within the first two weeks of launch, close to $1B USD flow into BITO, the first Bitcoin futures ETF. Some issuers have previously filed for ETH futures ETF but withdrew, thinking approval was unlikely. They’ve started filing again, encouraged by recent optimism around Bitcoin ETFs. The SEC might resist these due to ETH’s CME trading volume and potential categorization as an unregistered security.

An approval of an ETH futures ETF might not directly lead to more demand in ETH, but it could increase interest and desire for ETH among regular investors. If a Bitcoin spot ETF is approved, an ETH spot ETF might follow soon, leading to more investments in ETH. This potential growth opportunity might not yet be reflected in ETH price as optimistically as it is with BTC, or the discount of ETHE vs. GBTC. It’s also worth noting that retail investors can already buy BTC and ETH through regulated entities such as Fidelity, using a special crypto account linked to their brokerage account. However, a Bitcoin or ETH ETF would make the process much simpler and user-friendly.

Notable DeFi developments

Base, the new layer-2 developed by Coinbase using the OP stack, has gathered over $200M in TVL and $2.4M in fees since becoming available on Aug 9th. DeFi Llama shows 42 dApps built on base, with DeFi applications taking the majority of the TVL. For example, BaseSwap has captured $52M TVL by offering very high LP reward rewards to bootstrap liquidity. It’s worth watching the continued growth of the base ecosystem.

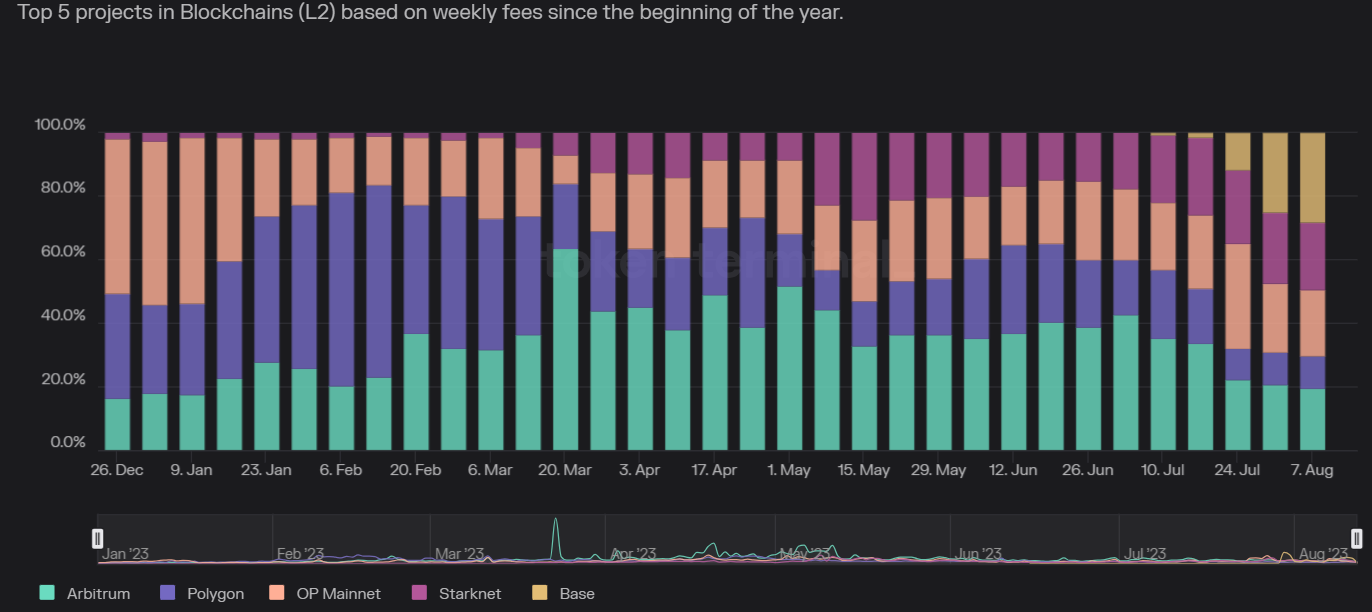

Base chose the OP Stack for its roll-up implementation. This could be seen as a win for Optimism in terms of brand building. Its closest competitor, Arbitrum, still holds more than 50% of the TVL market share but has seen its fee market share decline from a YTD high of 64% to 20% currently. Bankless has mentioned a 15% revenue share between base and the OP collective, although the exact percentage is not shared on official documents.

The OP token has been moving in tight bands in August. The price hasn’t moved this week despite positive development on base. It has given up more than half of the rally it experienced in February when base was announced.

Trends to Watch

With the rapid growth of L2s and the upcoming Ethereum Cancun update, we can draw an analogy between blockchains and the apps built on them to a country’s economic system. L1s act like countries, providing a foundation and security for all economic activities. Transaction fees can be likened to taxes paid to support the public good. L2s function like states, offering additional infrastructure and incentives to attract companies, and charging a fee similar to state taxes. dApps are like companies that create products or services and earn money from clients, paying taxes and cost of resources.

Using this analogy, investors might consider questions such as:

For L1s, could Ethereum be the only dominant “country” in this ecosystem?

For L2s, which “state” will have the best set up to support businesses, and how will that translate into the state’s tax revenue?

For dApps, which “company” has the most growth potential? Also, what is the best country and state to start their business?

Lastly, how can this alternative “country/state/company” structure coexist with the current system to help drive crypto’s mainstream adoption?

Weekly Gainers and Losers

Meme coins are among the top performers this week where some of last week's top performers have given back.

Top 100 (7d %):

THORChain (+44.16%)

Pepe (+21.49%)

Toncoin (+19.89%)

Shiba Inu (+12.26%)

dYdX (+7.97%)

Bottom Top 100 MCAPs (7d %):

XDC Network (-17.78%)

GMX (-14.51%)

Bone ShibaSwap (-11.6%)

Mantle (-9.13%)

Optimism (-8.86%)