The Weekly #230

Investors take a more cautious approach as they evaluate the central bank's potential bias swing from price stability to financial stability.

Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

Technical Challenges

The crypto markets largely chopped sideways last week with global MCAP index closing around the $1.34T mark - still above its 200d MA.

The ongoing banking crisis appears to have injected optimism the week before with crypto jumping 16% but fizzled in what appears to be cautious investing in the face of what appears to be a reasonably likely sharp economic slowdown.

The highs in crypto printed last week reached the exact same levels as those seen in August 2022 ($1.18T). Getting the market to breach these levels over 7 months has been the number one challenge.

BTC broke out of its ‘cone’ pattern on March 17th, peaking at $29,380 7 days later. Zooming out we can see the resistance line matches up with the 2021-2022 support.

BTC’s own challenge is to break out of its consolidation pattern and breach this very strong resistance. Conversely, there are less historical evidence to suggest why $27k should hold as a support level.

The current banking crisis is a perfect set up for BTC but market liquidity is getting in the way

For many, the banking crisis is the ‘perfect set up’ for risk assets, especially those that were born out of previous banking crises like BTC. Others call out a lack lustre 38% jump in BTC since the unravelling of banks like SVB.

For the latter, it’s important to remember the banking choke point put on crypto by regulators means net inflows is even more challenging to see.

And it appears a coordinated effort by G7 countries to tighten regulation is underway.

Stablecoin supply growth prior to 2022 was a key reason for crypto performance - the it represented the injection of USD liquidity that flowed down the risk curve (in classic QE fashion).

With stablecoin supplies now down 21% from their highs, investors should be concerned about the potential cap in upside in performance. In other words: “where are the net new buyers coming from if the pool of stablecoins is nominally falling while USD-denominated trading itself is now impractical?“.

Just like we see a 150 day lag with the peak of the bull market vs. the decline in stablecoin supplies, should we expect a similar lag from a market bottom with an increase in stablecoin supplies? Unclear.

Fed net liquidity and the rising tide lifting all boats

Perhaps it doesn’t matter as Fed Net Liquidity is now spiking up due to the Fed providing banks with special lending facilities. The Fed has now reversed 11 months of QT in less than 2 weeks - a ~$430B injection.

Banks are borrowing at an accelerated rate - around $163B in the week through March 2022…

Now major banks have tapped swap lines provided by 6 major central banks in order to improve dollar liquidity. The market does not work with this much liquidity tightening.

What this means for risk assets looking ahead is positive with equities now trading at implied market liquidity fair value.

SPX may look to hold 3850 level too with the % of stock above their 50d SMA falling below 20% last week.

The question remains whether crypto will follow suit given its unique banking choking mentioned above.

Of course, BTC’s lower market liquidity means less flows from within the market can make an sizeable impact on performance but this works both ways. High liquidity enables those larger players to use it as a USD hedge bet.

The reason to be more constructive for crypto’s outlook is due to the ‘rising tides lifts all boats’ dynamic with market liquidity. Capital starts to flow down the risk curve. SPX performance well. NDX performs relatively better to SPX. BTC performance relatively better than NDX…

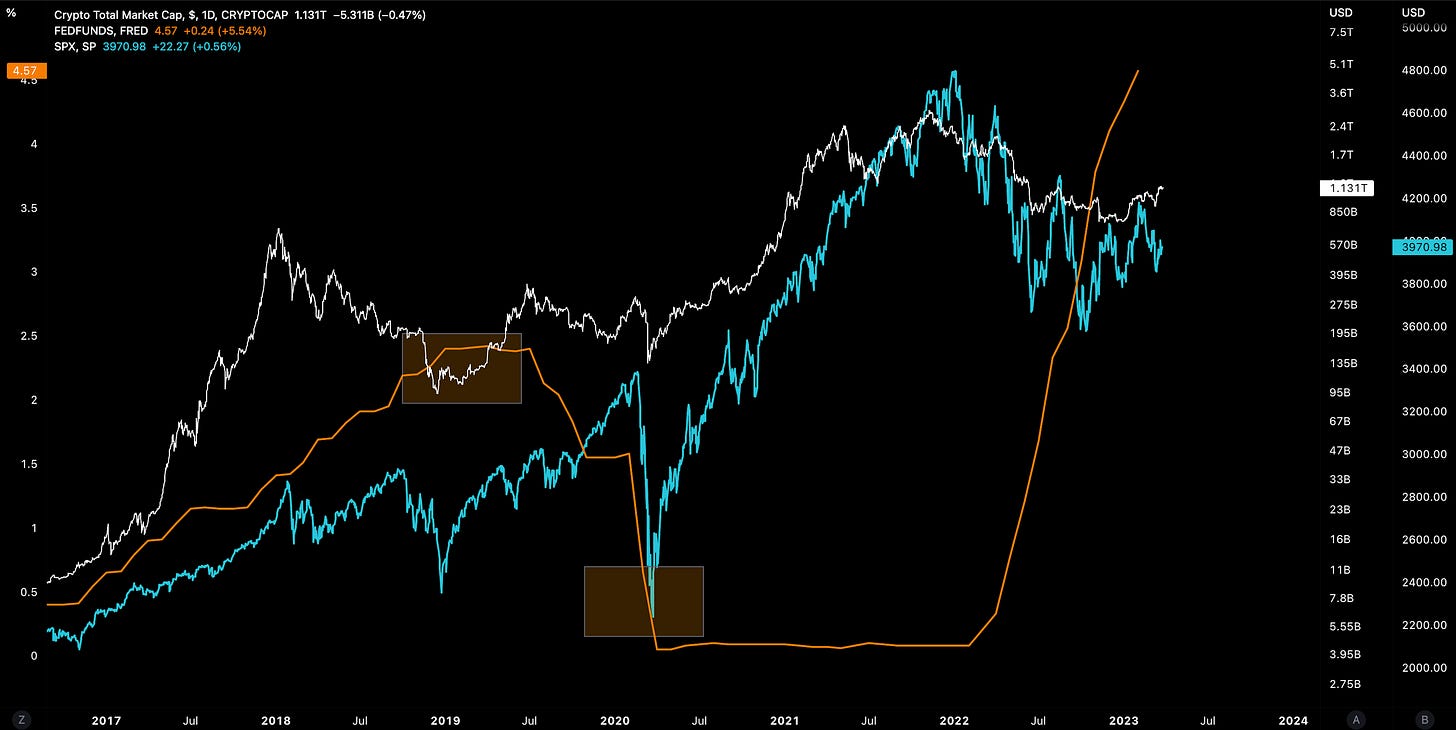

Even though one data point, crypto has sniffed out the rate hike cycle ending months before its occurs…

Unlike crypto, the equity collapse was near the end of the rate cut cycle.

We think crypto has, and will continue to be, a forward-looking market liquidity measure. Crypto may actually be more resilient this time around even if equities comes under further pressure from the liquidity/credit crisis which is still not clear.

The question then becomes:

Is the nominal interest rate of 4.75% to 5% sufficiently high as a peak range?

The Fed’s 25 BPS rate hike last week indicates the central bank’s resolve at combatting inflation which remains far above the Fed’s 2% target. This came at a time when UK inflation provided a surprise reversal to 10.4%.

A large part of the reason we find ourselves in this banking crisis is due to the higher nominal rates so raising further runs counter to the financial stability resolve.

We see good evidence that suggest CPI is set to decline over the next 3-6 months.

What matters here is that central banks will be forced to evaluate their bias towards inflation vs. financial stability.

Debt levels and demographics means the banking industry and economy buckles at both higher nominal rates and positive real rates.

Flight to quality is flavour of the month

While the outlook over a longer time horizon appears more constructive for risk assets, there are nuances at play within the crypto market to analyze.

BTC dominance is at 9 month highs at 47.7% and pushing towards its 11 month resistance area. A break above here indicates a new market regime of flight to safety.

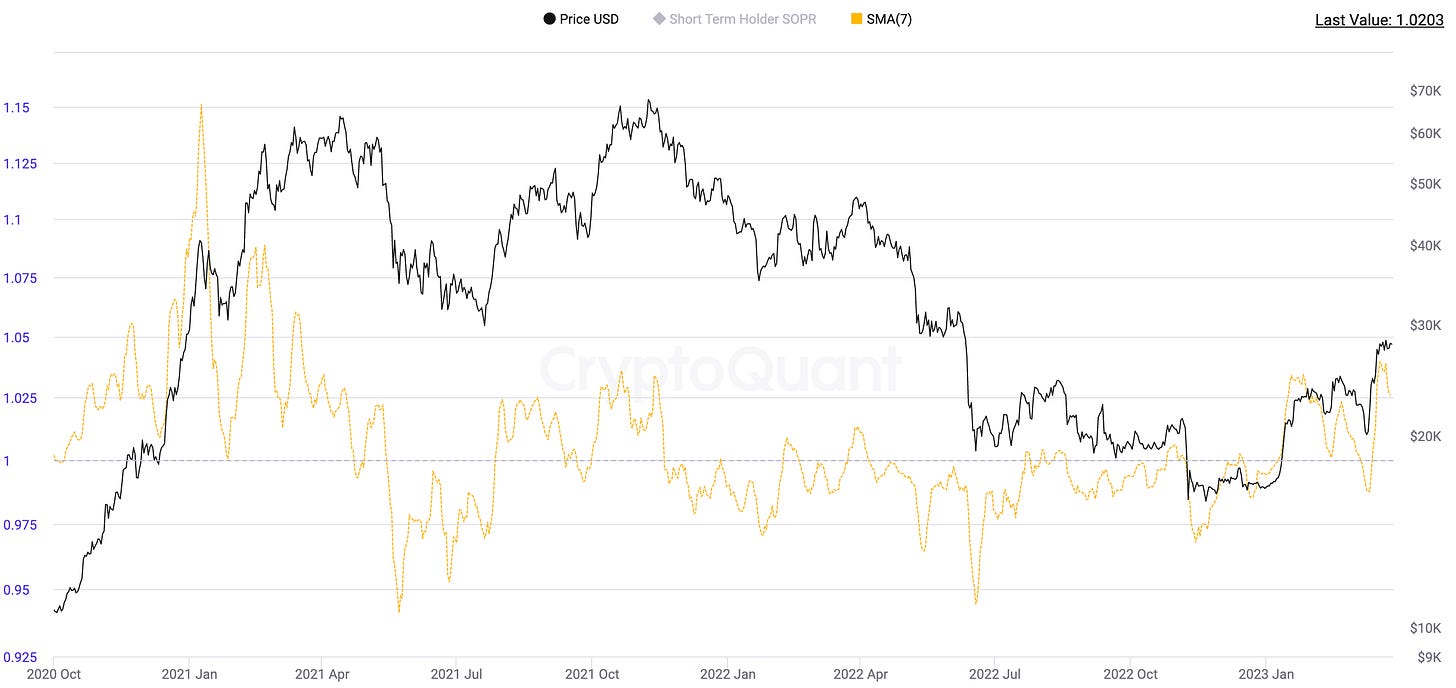

Short-term holders (who often dictate price in the near-term) have remained largely constructive YTD with the measure largely keeping above 1.

ETH/BTC is also extended its losses in March, falling 25% from its September 2022 highs of 0.08467.

The rate of change in ETH/BTC performance shows further distress in the pair is possible but the more this extends the more it becomes likely ETH puts in a recovery against BTC.

The DeFi/ETH ratio is also being challenged at critical levels.

Relative altcoin index paints the same picture. The index remains at 2 year lows at 23%. The nominal and relative performance in BTC and ETH is coming at the expense of alt coins - no longer are they moving in unison.

High cap L1 names put into deep value territory like SOL are putting in lower highs in 2023 against their USD ratios while their ETH ratios looks more challenged (failing to break out above its 0.016 level).

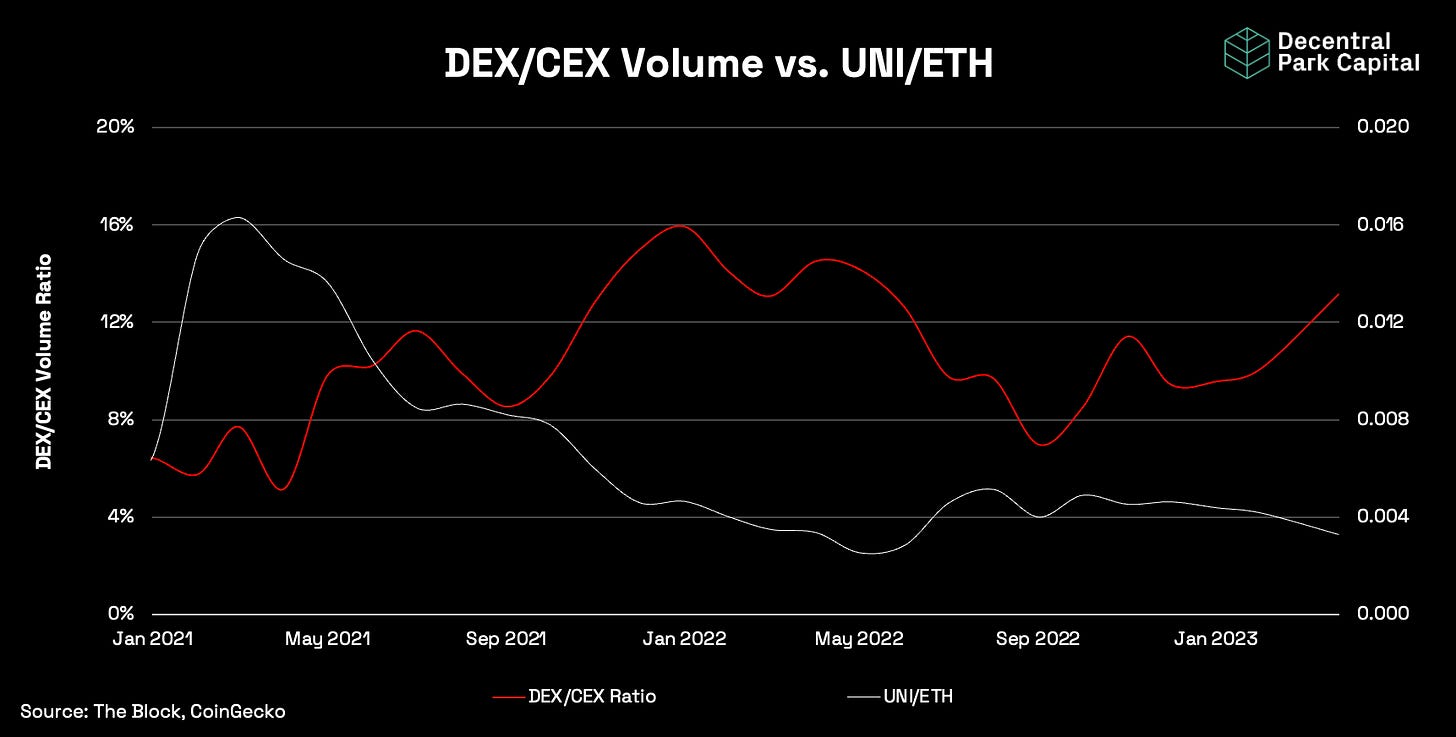

How are fundamentals doing? Let’s take exchanges. The DEX to CEX volume ratio is spiking up to new highs not seen since May 2022. Has this positively impacted the performance of Uniswap that continues to take >60% DEX volume market share? No.

When we chart this vs. UNI/ETH we see a widening divergence between the two lines. Fundamentals for select DeFi may not be the guiding north star for investors - at least right now.

So how do we reconcile this to the flight to quality narrative that is dominating investor minds right now? It may be that only a select few assets (BTC and ETH) make the cut for now. But that’s ok. The continued injection of liquidity into the market and the eventual bias swing towards financial stability vs. inflation by central banks is the remedy crypto needs.

Having the former without the latter is providing relative stability in very large cryptoasset names but once the second is introduced into the macro reality, quality assets down the risk continuum have a clearer direction.

And that clearer direction appears to be looming fast.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$1.13T; Crypto markets have remained flat over the past week and a good level of resistance at the $1.15T level.

DeFi MCAP

$45.8B; DeFi sector remains above its 200d MA which may act as next support if the market fails to break above its long-standing $53B-$60B resistance zone.

Trader Positioning

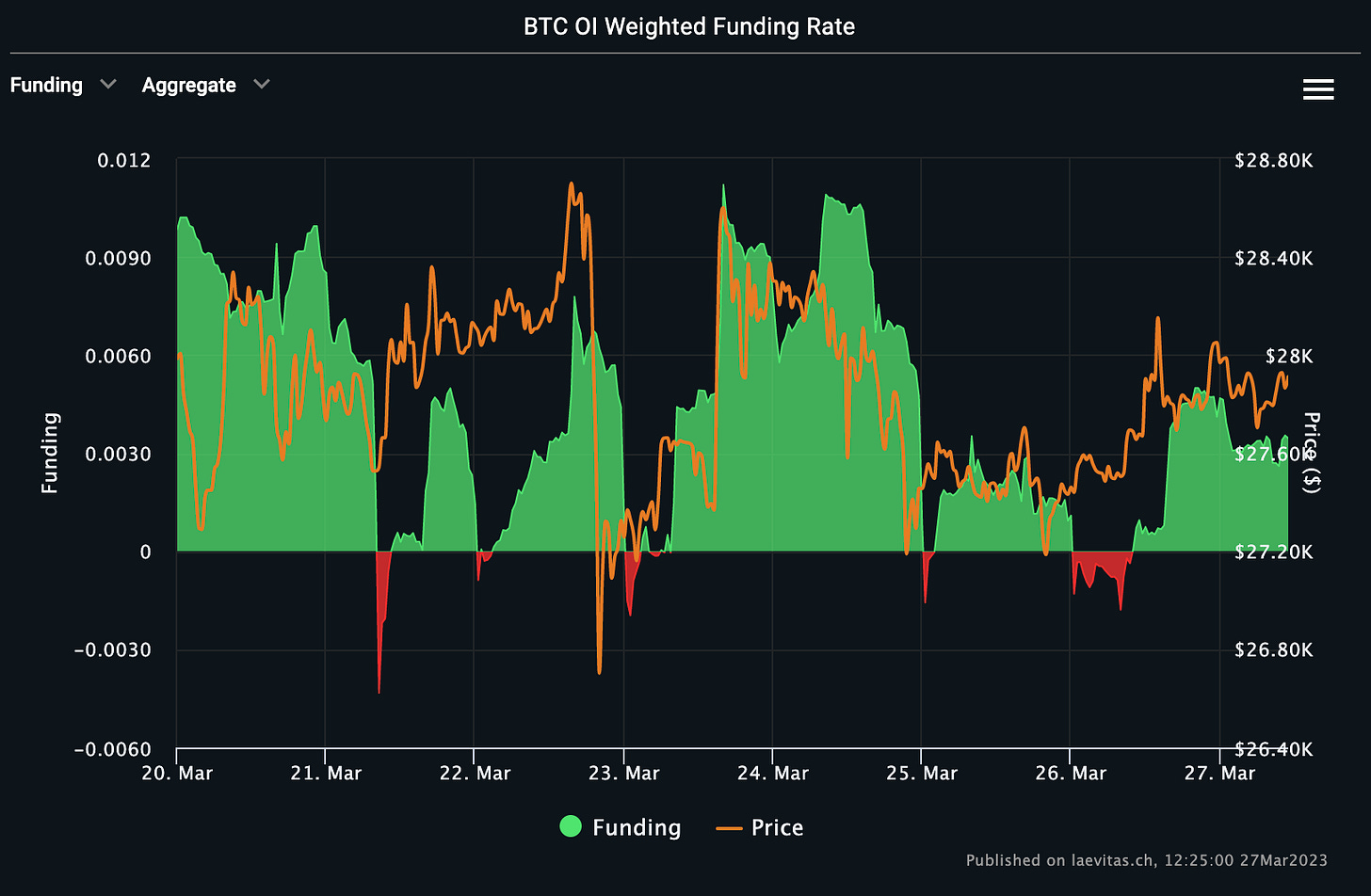

BTC OI weighted funding rate remains moderately positive at 0.003 as BTC holds above the $27k mark.

Limited liquidation volume on either side ($6m BTC and $2.6m ETH).

ETH OI weighted funding rate flipped negative earlier on Monday as traders became predominantly bearish. This has already been neutralised over the last few hours.

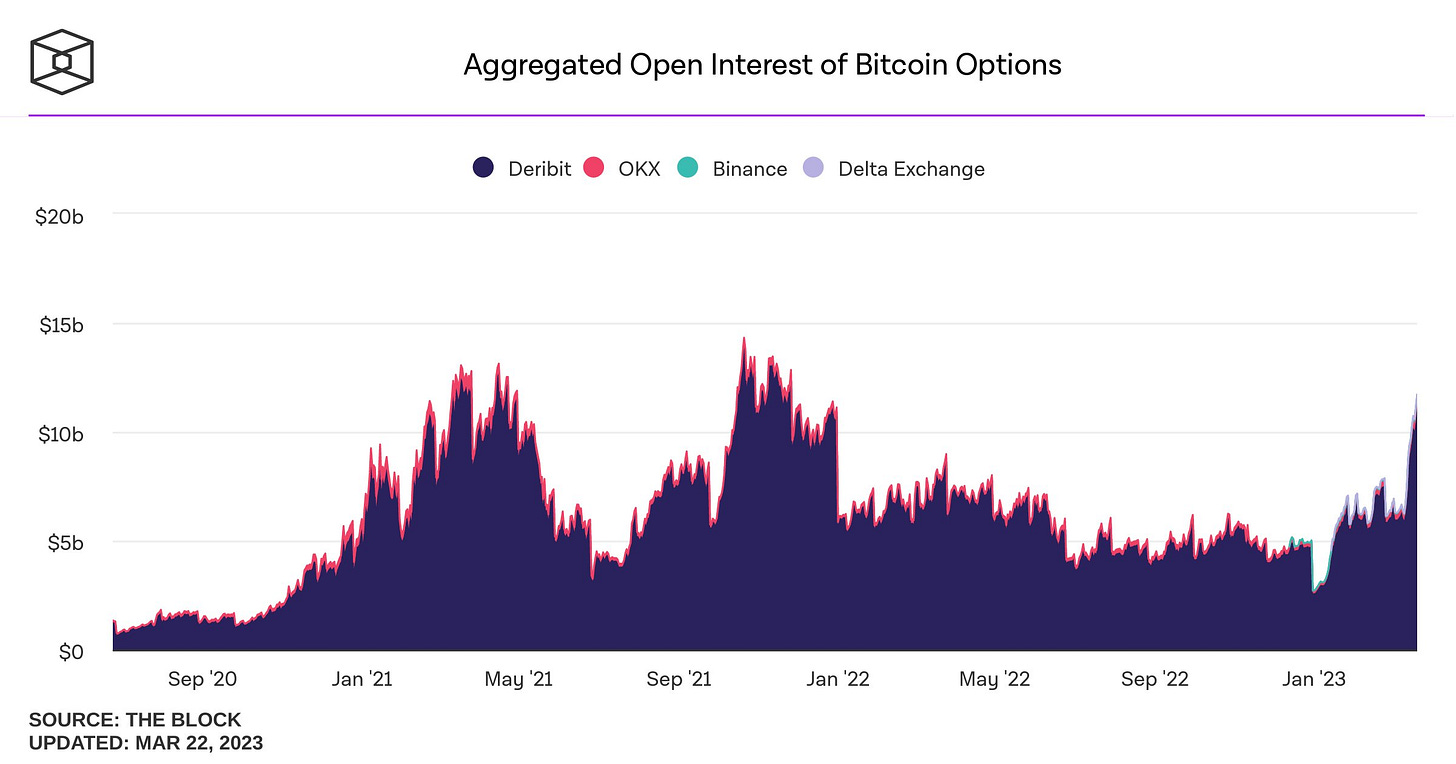

Deribit OI for BTC options spiked to $11.7B vs. $7.1B for ETH.

BTC and ETH 7d ATM IVs spiking to 76% and 73%, respectively. General increase across durations.

Grayscale Trusts

Narrowing of the GBTC discount to NAV (-36.7%) although not much progress has been made generally over the past week. The narrowing of GBTC’s discount comes as the oral arguments hearing on March 7th was largely favourable for Grayscale.

A decision may come as soon as Q2 2023 but even if Grayscale wins, the SEC does not have the approve the conversion.

ETHE discount to NAV has remained largely flat at ~50%. Stronger investor focus behind GBTC/BTC which is illustrated in the divergence in the discount dynamic between the two trusts.

BTC/USD Aggregate Order Books

Order books look much heavier on the ask side. Heavier resistance up to ~$29k.

Miners

Bitcoin hash rate (7d, 30d MAs) climbs to new all-time-highs despite muted price action.

Miners continue to double down while miner profitability is at 3-year lows (0.072 USD/day for 1 THash/s). The possible expectation by operators is that miner profitability as a function of hash rate cannot go significantly lower from current levels.

Hashprice appears to be falling from its cycle highs. Peaks in this measure correspond to market bottoms (local and cycle). This comes as mining difficulty climbs to new all-time-highs.

Few gainers in the market over the past week with the largest losers being concentrated in the centralized exchange bucket.

Top 100 (7d %):

XRP (+20.1%)

XDC Network (+12.9%)

Litecoin (+8.3%)

Monero (+6.6%)

Stellar (+6.4%)

Bottom Top 100 MCAPs (7d %):

ImmutableX (-26.7%)

Conflux (-25.4%)

Render (-20.1%)

Optimism (-19.8%)

SinguarityNET (-17.9%)

> Nasdaq’s digital asset strategy revealed [The Scoop]

> Coinbase Top Lawyer Calls SEC Wells Notice a ‘Massive Overreach’ [Unchained]

> Navigating Chaos as a Crypto Trader [The Blockcrunch Podcast]

> Chaos Fuels BTC’s Fire [Empire]

> Balaji’s BTC Bet, Macro Chaos and Coinbase vs. SEC [Bell Curve]

> Metamask analytics [@subinium]

> Crypto Asset Flow Weekly Report [@cryptounfolded]

> Tracking Unclaimed Airdrops For Arbitrum [Dune Analytics]

> On LayerZero bridges [@l0_Corner]

> Bitcoin Has Benefited From U.S. Dollar Liquidity to Support Banks: Morgan Stanley [Coindesk]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.