Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

A Turning of the Tide

After what seemed like a positive start for crypto in 2023, the market sentiment has appeared to change towards the negative. Before last week, crypto was recovering 42% from the December lows as prices reached very overbought levels by just mid-January.

Crypto MCAP indices climbed to our resistance target of $1T which acted as sticking point for several weeks. Markets kept above the 200d MA for 23 days and optimism was gaining momentum.

Fast forward to today and we now see a 10% decline from the January highs. So what’s changed?

A Correction Overdue

One simple explanation is we’re simply seeing a necessary correction from prices becoming overbought. However, we’ve often seen high conviction rallies in previous cycles as neutralising as much higher RSI prints (50+). A continued falling RSI <50 would suggest a lack of buyers aiming to capitalise on minute corrections.

We also wait to see if the 200d MA for Global MCAP will be used as support, where a break back below would likely confirm a false breakout to the upside.

Regulatory Clouds Are Darkening and There No Umbrellas and There Are No Umbrellas in Sight

Another explanation is the slurry of stateside regulatory headlines that suggest a coordinated effort by virtually every US financial regulatory to deny crypto firms access to banking services or offer key cryptoasset products. This is known colloquially as Operation Choke Point 2.0.

“…the breadth of this plan — spanning virtually every financial regulator — as well as its highly coordinated nature, has even the most steely-eyed crypto veterans nervous that crypto businesses might end up completely unbanked, stablecoins may be stranded and unable to manage flows in and out of crypto, and exchanges might be shut off from the banking system entirely.”

- Nic Carter

Recent regulatory developments last week included Kraken’s settlement with the SEC ($30m) in relation to the offering of unregistered securities, The G20 exploring a uniformed regulatory approach to cryptoassets, and Paxos being sued by the SEC over Binance’s BUSD stablecoin.

Markets started to slide 5% on Thursday as headlines started to come in thick and fast. This would appear that such regulatory developments were not effectively priced in by the market.

BTC, which has slide below $22k, locked in its first weekly death cross (50w > 200w). This comes as BTC also printed a golden cross (50d > 200d) on the 7th Feb. Longer-term prints may hold more weight where at the very least the bulls should move with caution.

$21.4k is likely to act as support for the orange coin (November 2022 peak).

As market beta, ETH is also facing the 200d MA test, slipping back to $1,472. ETH was a the major part of the Q1 consensus bet (e.g. combination of hard money, scaling, liquid staking derivatives) but the returns are being wiped over the past 5 days.

As we noted in the past several weeks, bearish divergences on RSI suggest a pullback was necessary. It appears regulatory headlines was the catalyst and where there is clear consensus in the market, it often pays to take the opposite side.

Regulators Show Show Little Love on Valentines Week

On Monday, the NYDFS has ordered Paxos Trust to cease the issuance of Binance’s BUSD stablecoin. BUSD is the 3rd largest stablecoin and the 7th largest cryptoasset overall by market capitalization. The stakes are certainly high.

Paxos is reportedly still allowing redemptions until at least Feb 2024 but we expect the initial reaction to be an exodus away from the stablecoin into other alternatives (or cash).

BUSD’s peg has fallen to 0.9979 on Monday indicating that holders are limiting custody risk despite redemptions being allowed.

We expect this de-pegging to be a shorter-term dynamic as BUSD remains fully-backed and redeemable to allow arb profits to be realized.

Binance Smart Chain’s native cryptoasset, BNB, has dipped below $300 (-4% 24Hrs) but remarkably is not in the top 10 largest losers by day or week as of Monday morning following the headlines.

More decentralized offerings like Liquity, which has been largely gone ignored by the market, have surged off the back of the news released last Thursday. LQTY has surged 63% since Friday after a initial correction in line with the broader market.

Protocols like Liquity allow users to draw 0% loans using collateralised debt positions using ETH.

The supply of the 3 leading stablecoins are each showing unique trends:

BUSD’s supply has stayed flat over the past week after declining 30% from its peak of $24.3B.

USDC’s supply has continued to fall as users have sought to convert the stablecoin to fiat in record breaking numbers. This arguably reflects concerns that Coinbase/Circle may be in the cross hairs next. A possible outcome being the delisting of USDC and all USDC pairs.

Tether’s supply has been increasing since December by 4% - an indication that the momentum if shifting away from the west to the east.

Looking ahead, the concerns will grow specifically in relation to Binance’s ability to operate with stability which it has proved several time before. However, none of the previous challenges to Binance to date has been this direct from US regulators:

Over 90% of BUSD is held on Binance ($14.4B)

BUSD accounts for 21.7% of Binance’s token holdings

The SEC has effectively cut off the onshore ‘IV drip’, Paxos, in order to paralyze the offshore pest, Binance.

Stablecoin Contraction Risks Market Stagnation

DeFi dominance looks to be coming under pressure too after facing resistance at the 5% mark. The sector has caught a bid as the narrative around regulation defensibility for decentralized infra has gain momentum.

This may continue if investors build further conviction behind the consensus names like LDO, RPL, and Frax Share. However, we also noted the divergence on technicals as well as the reasonable likelihood of a market-wide drawdown in the face of further regulatory pressure.

Net, we see a more likely outcome for DeFi being a return back to the 4% level during a re-pricing event.

To explore this view further, we can also double click on individual names where prices are cooling off around levels we were expecting.

LDO has failed to break out above its key $2.7 level but yet remains buoyant above the $2 mark. LDO/ETH remains in the multi-year overbought zone. We see the path of least resistance as being downside than upside. This is until we clearer confirmation that the multi-year momentum trend is showing signs of reversal.

Stablecoin dominance analysis also shows that a broader risk-off move may ensue.

Last week, we noted that stablecoin dominance was approaching key historical levels that either marked a local peak or a more persistent bull market. The ratio has now rebounded off this very level to the upside suggesting a local peak outcome is a likely scenario under this framework.

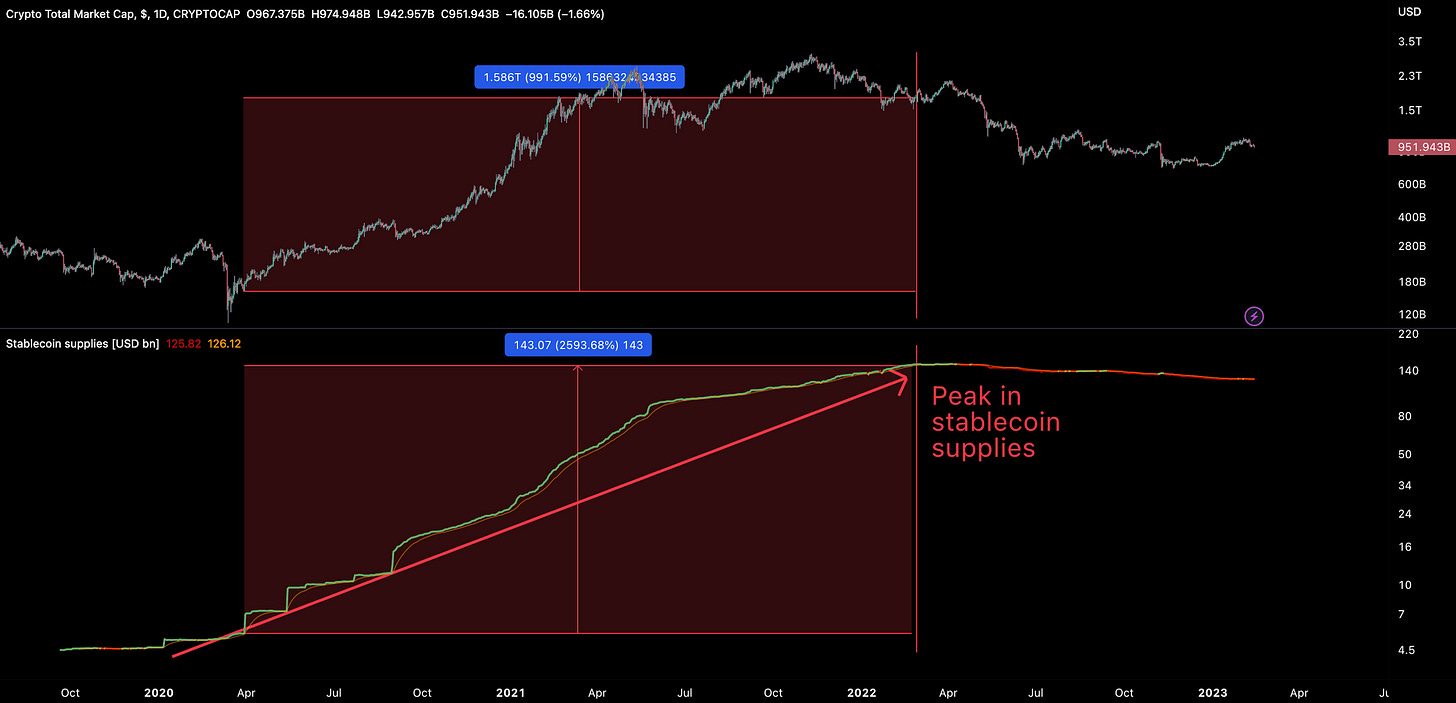

Finally, if we see restrictions around on/off ramps as being significant hindrance for broad ecosystem growth.

The rapid growth of stablecoins marked new inflows into the crypto sphere that played a key part in boosting market size and reach. Besides this, stablecoins exhibit clear product-market-fit and are used as key assets within the DeFi sector.

It is now unclear how stablecoin supply can grow from here (particularly with regulatory clarity). It is more clear how they can shrink. The key question being: “How can asset prices and product development be supported if stablecoins are being cut off?”.

Short-term holders are also looking to sell out of their position when conditions are becoming less profitable.

This can be seen in metrics such as STH-SOPR which has sharply fallen over the past week. A break below 1 means short-term traders are, on average, now selling at a loss.

SOPR keeping below 1 marks more prolonged bearish periods as traders take every opportunity to realize their position at a loss when capitalising on every market rally.

Equities Weighed on Crypto but They Are Now Diverging

The other factor driving price action has been broader risk-off moves in other risk assets like equities.

Strong labor market data and the impact of ‘higher rates for longer’ on the economy in the future has caused fresh concern for investors. Crypto’s correlation to the S&P 500 kept positive as the index declined 3.4% off its February highs. Sentiment in equities are now more buoyant ahead of US CPI data on Tuesday.

Core reading is expected to increase 0.4% (prev. +0.3%) while the headline drops to 6.2% (-0.3% than in December). Core staying sticky will add fuel to the Fed’s higher for longer stance.

Monday is now showing another case of bearish divergence for crypto against equities. Analyst often forecasted a positive ‘decoupling’ for crypto against equities for 2023 but we think these analyst have got the dynamic the wrong way round.

Correlations are more likely to remain positive for negative performance days for the S&P 500 than for positive performance days for the index. Moves on both Friday and Monday seem to confirm this further.

For now, it seems that the equity market is refusing to accept the reality of prolonged high rates.

Market liquidity is also likely to be flat leading up to the CPI print so a liquidity rally doesn’t appear likely. We do note a slight uptick later this week but we see the broader trend as being the key dynamic to watch.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$951T; The Global MCAP index fallen 10% below 2023 highs and the $1T mark. Bearish divergence played out with the index looking to its 200d MA as initial support.

DeFi MCAP

$44B; The DeFi sector has shaved off $8B in value since The Feb highs but is still up 45% YTD. The $52B mark appears to be key resistance for the sector which has struggled to break through since Q2 2022.

Trader Positioning

Funding rates for BTC flipped negative on Sunday for the first time since January 13th as traders take a predominantly bearish stance (-0.001%). FRs have flipped bullish in recent hours as BTC finds support at its key level of $21.4k - traders expecting a bounce / correction played out.

Long liquidations totalled $42B on February 9th that aided in the FR neutralisation.

ETH funding rates remain more neutral but are declining more steadily as investors have a harder time to flip bearish heading into key events like Ethereum’s Shanghai upgrade.

Grayscale Trusts

Significant widening of GBTC discount relative to NAV - the highest discount since the 3rd of January 2023. Souring sentiment within crypto due to regulation has driven the underperformance of GBTC relative to spot.

Widening of ETHE discount to NAV (54.68%) - the highest discount since the 5th of January 2023.

BTC/USD Aggregate Order Books

Order books look much heavier on the ask side. Heavier resistance up to $22k.

Miners

Bitcoin miners are facing mounting pressure. Weaker BTC price action is coinciding with strong hash resource commitment. Bitcoin hash rate is at ATHs.

A risk we have highlighted over the past 2 months is the complacency of miners hoping to see a sustained rally in market prices that would support the continued resource commitment to the network - mining difficulty also stands at ATHs.

Core Scientific, Riot, and CleanSpark all increased BTC production in January which was supported by favourable weather conditions and more stable electricity prices.

We see Bitcoin’s 2024 halvening event (~May) as a target date for miners who are looking to outcompete each other for larger block rewards while they last.

Top performing assets in the market are largely unknown names indicating a high degree of speculative activity within the market. Underperformers are those undergoing corrections from their market outperforming rallies YTD.

Top 100 (7d %):

BinaryX (+84%)

Bitget Token (+53%)

Baby Dogecoin (+40%)

Mina Protocol (+18%)

Hedera (+18%)

Bottom Top 100 MCAPs (7d %):

Optimism (-26.1%)

Fantom (-23.4%)

SingularityNET (-17.2%)

Render (-15.4%)

Trust Wallet (-15.4%)

> Governments Go Cold on Bitcoin [Real Vision Crypto Daily Briefing]

> Every Brand Will Have a Web3 Strategy [Empire]

> Will Solana Make It [Bankless]

> Weekly Roundup [On The Brink]

> Are Ordinals Sneakily a Boon to Bitcoin Security [The Break Down]

> SEC Did Not Consult Industry Before Kraken Crypto Staking Charges: Commissioner Peirce [Coindeks]

> Coinbase Hits Back At SEC Over Staking as a Service [Blockworks]

> 2023, the year of tokenized public securities [Sebastien Derivaux]

> Superbowl NFT Mints [NFTgators]

> Uniswap Coming to BNB Chain? Governance Says Yes [Blockworks]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.