The Weekly #226

Macro environment and on-chain data remain as mixed as ever...and that's OK.

Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

A Reset Prior to Powell’s Speech

Crypto markets traded largely sideways over the past week with the global MCAP index printing a -1.5%, topping out at the $1.063T mark. This comes as strong labor market data beat expectations weighing on risk sentiment as traders consider the possibility of higher-than-expected terminal rates by central banks.

Jerome Powell is expect to speak on Tuesday afternoon where the Fed chair may reiterate or tweak his narrative to the market. This speech may very well help decide this week’s direction as well as the medium-term.

Majors like BTC lost steam towards the end of the week, effectively reversing the early week gains. BTC declined 5.4% from its week high where its bearish regular divergence was starting to take effect on price action.

We still see $24.2k as the interim resistance target with a breach of $25,212 as being the technical confirmation of bear thesis invalidation.

BTC also looks to be putting in its golden cross (50d > 200d MA crossover) which occured before both bull runs in 2020 and 2021. Favourable returns, at least in the medium-term, have ensued after this signal print.

BTC has historically risen 22% in the 60 days after a golden cross print.

For ETH, the battle has been to reclaim $1.7k which it failed to do last week. ETH now trades slightly below at $1,632 with the zone acting as a sticking point for investors.

The similar bearish regular divergence seen for ETH has yet to weigh on price in the same way than with BTC. ETH/BTC gained +2.5% off from its 0.0679 support where traders may be positioning more strongly towards ETH on a relative basis as we head closer to Shanghai anticipated in ~March.

The ETH to BTC realized vol spread continues to fall towards annual lows.

Shanghai May Be Putting Eth Back on the Radar for Traders

We see the Shanghai upgrade as fuelling volatility in a classic buy the rumour sell the news dynamic. Fears around staked ETH supply being unlocked with be short-lived with any forced selling likely only driven by tax purposes (30% solo home stakers).

We forecast ~1.01m ETH being unlocked over four days (or 0.84% of circulating supply) where stakers with then be able to withdraw their principal at a max rate of 50.4k ETH per day, corresponding to ~15% annualized emissions rate.

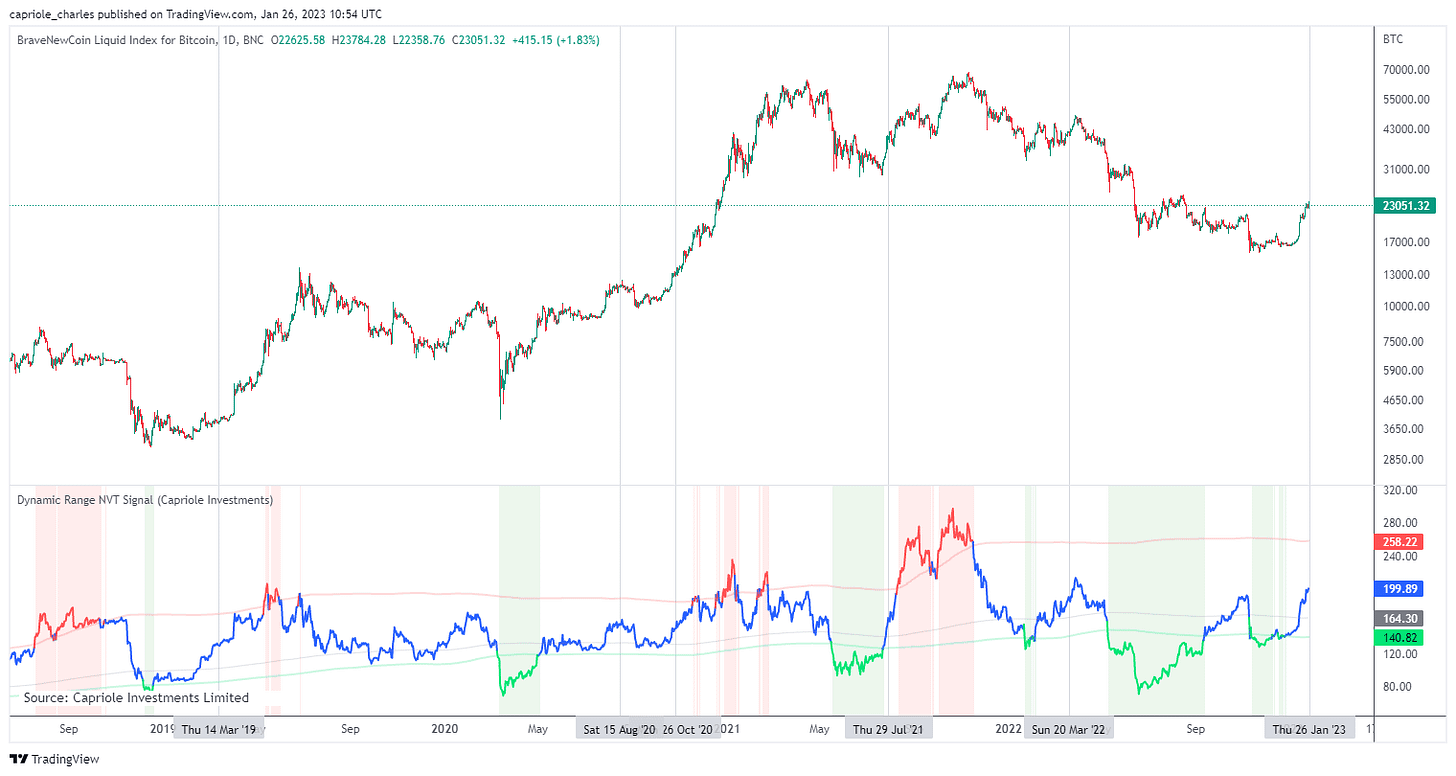

The on-chain data is somewhat mixed for how price action may play out. Traditional valuation methodologies like NVT suggest Bitcoin is overbought relative to the value of the transactions facilitated on the network. A drawback with this model is that it is hard to estimate what a fair value in the NVT peak should be as this appears to dynamically changes over time.

On-Chain Signals Are Still Mixed but Suggest a Regime Change Maybe Underway

More modern takes on valuation methodologies like Dynamic NVT suggest that Bitcoin’s price is normalizing based on the relative value of the transactions facilitated on the network. This zone typically sees higher volatility but equally marks a regime change for price action over a longer time period.

Long-term MVRV suggest that Bitcoin has coming out of deep-value territory where long-term holders were experiencing acute financial stress (holding increasingly higher unrealized losses).

Moves above 1 after reaching levels seen for 2022’s has more often than not marked a more constructive bullish period for BTC.

On the other side, short-term holders, who can often impact price in the nearer-term, are to decide whether they are wanting to realize profit before reaching back to their aggregate cost basis. STH-SOPR will fall back to 1 where is will either be supported (now selling at profit) or broken through (selling at losses).

Liquidity Is Everything. It Always Will Be….

Crypto’s rally last week was really only be an extension of the equity rally in response to an anticipated 25BPS rate hike by the Federal Reserve (deceleration).

The weakness if risk assets was largely driven by strong US labor market released on Friday. The US job market added 517k jobs in January with unemployment falling from 3.5% to 3.4%.

NDX fell 2.76% from its 2022 peak with futures appearing to extend losses further on Monday by a further 1.2%.

The tricky part for investors is now weighing up the likelihood of a recession (deep or shallow) against central banks’ need to do more work by becoming more restrictive than anticipated.

After all, it is hard to see a recession as likely when GDP rises above expectation and unemployment is at decade lows. The employment sector remains a key factor in the Federal Reserve’s decision-making process.

Goldman and MS doubling down on their bearish equity theses from current levels citing market reflecting a better-than-expected economic growth and a drop in bond yields.

Leading economic indicators like ISM are forecasted to show significant weakness but that may still be a few quarters down the line. Financial conditions have eased since November 2022 and central banks are unlikely to turn on the liquidity taps if there is no fall in economic momentum.

However, the liquidity cycle (rate of change) seems to suggest liquidity may start to accelerate over the coming months.

The question then becomes: “At what cost when it comes to sticky low end inflation?”.

We continue to measure liquidity conditions in real time with measures dropping over the last few weeks. It is unclear if this marks a resumption of the down trend from 2021 or a short-lived move that is conducive to the rate of change model above. Liquidity is king - for equities and well as crypto.

When it comes to investor positioning, traders are still heavily short with the pain trade still looking like it’s for a move higher. Therefore, the equity rally has reflected the sniffing out of looser liquidity conditions and that a recession was priced in during the November-October 2022 period.

For now, Powell’s speech will be key in aiding direction for the markets in the near-term. Zooming out, we see reasonable moves as likely capped on either end: 1) A healthy level of bids places by patient and opportunistic investors on the downside and 2) more cautious profit taking that speaks to the current restrictive policy by central banks on the upside.

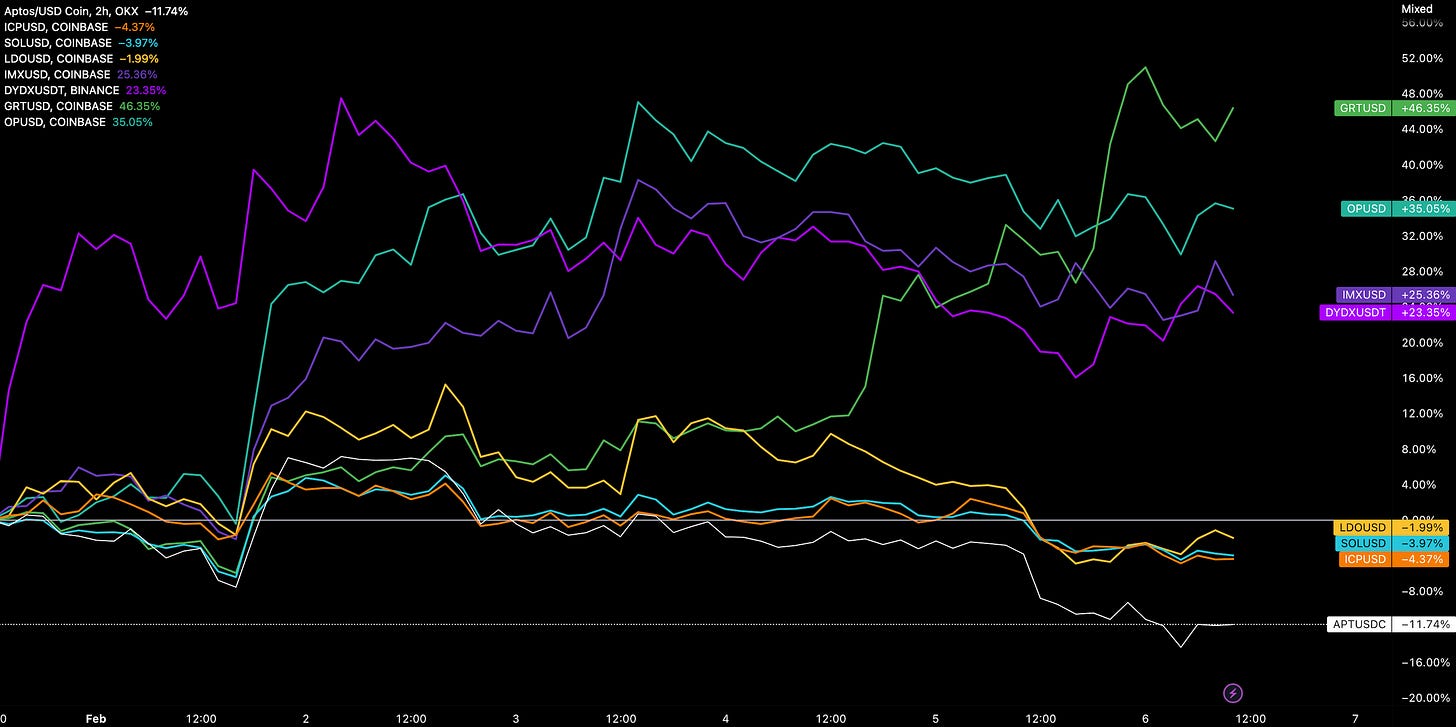

We still see dispersion within the crypto markets with prices ranging anywhere from -18% (Aptos) to +127% (SingularityNET). Assets that have been underperforming and outperforming are concentrated around in the 30-70 rank by market capitalization.

Assets that performed well in previous weeks such as Aptos (liquidation-driven) or Lido (high-beta ETH play) are now the under-performers suggesting a good level of profit-taking is taking place by opportunistic investors. The dispersion may also reflect a dominance of rotation (relative value) plays in the market. One explanation is that investors have low conviction that more sustained rallies can continue in the medium-term.

Uniswap has also been the centre of attention over the past week with several discussions and voting taking place to launch Uniswap V3 on Binance Smart Chain.

Uniswap has several bridge options (e.g. Wormhole, LayerZero, deBridge, and Celer). With Wormhole coming out on top of off-chain voting, A16z decided to vote 15m UNI tokens against the proposal as the bridge selected was not their portfolio company - LayerZero.

Any concerns around anti-competition have so far not impacted price action with UNI down 1.7% over the past day - inline with market beta. UNI appears to be oscillating around its 200d MA for now.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$1.01T; The Global MCAP index has fallen 5.4% from its 2023 peak, moving in line with the broader equity market. May have yet to see the bearish regular divergence play out on the daily as the index bounces off its $1T resistance mark.

DeFi MCAP

$47B; The DeFi sector managed to find strength over the past week but was rejected off its 200W MA (~$51B). The sector broke out of its descending wedge to the upside on the 20th January 2023.

Trader Positioning

Aggregate funding rates for BTC and ETH remain positive (+0.007%) indicating traders are taking a predominantly bullish stance.

Open interest is increasing to new highs since November 2022. BTC USD denominated OI has increased to $9.97B while ETH’s has risen to $5.5B.

On the options side, open interest put/call ratio for BTC continues to trend down since November 2022 as BTC edged higher towards $24k.

Falling STH-SOPR also indicates that short-term spot traders are realizing profits where trading conditions are getting less profitable.

Grayscale Trusts

GBTC

GBTC’s discount to NAV kept relatively flat over the past week standing at 42% as BTC consolidates at its 2023 highs.

ETHE

ETHE’s discount to NAV increases to 53% indicating muted interest by traders over the past week.

Aggregate Order Books

Order books look slightly heavier on the bid side. Heavier resistance up to $23.3k.

Miners

Bitcoin miners have reduced their resource commitment over the past week after hash rate climbed to new all-time-high levels (7d MA). This comes as price cooled off below $24k.

Hash price continues its decline from its local peak but its direction will be dependent on resource commitment relative to BTC’s volatility. The risk to the miners is a spike up on hash price once again.

Top performing assets in the market have been mainly concentrated in the mid-small cap range and cross-sector. The rally of meme coins indicates strong speculative appetite in he market.

Top 100 (7d %):

SingularityNET (+136%)

Baby Dogecoin (+86.3%)

Fetch.ai (+52.6%)

Render (+40%)

The Graph (+40.8%)

DeFi Top 100 MCAPs (7d %):

Augur (+54.7%)

Injective (+40.5%)

Numeraire (+40.4%)

Covalent (+38.9%)

The Graph (+35.4%)

> The Chopping Block #452 [Unchained]

> On the Importance of Permanent Storage [On The Brink]

> Will Solana Make It [Bankless]

> Why Crypto Fundraising Could Be in for a Painful Winter [The Breakdown]

> Resurgence of ‘degenerate behavior’ is behind 2023’ crypto rally [The Scoop]

> Crypto Governance and Politics [Abdullah Umar]

> Shanghai Quant Analysis [Data Always]

> Size of Derivative Markets [DeFiSurfer808]

> South Korea Issues Guidelines for Regulating Security Tokens as Legislation Looms [Coindesk]

> StarkWare to Open Source Its Ethereum Scaling System [Coindesk]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.