The Weekly #223

Market sentiment swings more positively for both cryptoassets and equities as sellers become exhausted in the new year.

Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below:

New year, new momentum.

A fresh new year and it seems like the cryptoasset market has got off to a fresh new start. BTC has managed to break $17k for the first time since early December keeping buoyant $17,200 while ETH breaks above the $1.3k mark at $1,312.

Last week, our outlook to the year open was more positive to 2022’s year close given the combination of 1) the bearish positioning by the market 2) the technical setup on key relative pairs like ETH/BTC and 3) intra-ecosystem catalysts like Ethereum’s Shanghai upgrade estimated in March.

Total market capitalization indices show a clean bounce from the $730B lows with 7 out of 9 days of 2023 printing positive returns. Such a move was reinforced by the technical break out in the daily RSI around the 3rd January.

Note this is markedly different to the sharp vol patterns we have been so used to from 2022 and we see reasonable odds of the market re-testing the $830B key resistance ground and eventually the 200d MA in January - the ultimate battleground.

Our key focus point this month remains ETH/BTC where the ratio broke out of its multi-month wedge pattern to the upside, hitting our resistance forecast of 0.076.

We see current levels as nearing overbought but a reset coinciding with low realized vol measures (BBW) may mean further upside is to be seen heading closer to the perceived Shanghai release date.

Given the previous holiday positioning, the risk is greater for the bears where chasing the market becomes commonplace once further conviction signals are met. This ‘bears in disbelief’ rally is likely the dynamic that supports a 0.085 ETH/BTC and beyond. However, this doesn’t mean we can’t re-test lows.

For ETH/USD, the next key targets seem closer in reach with the ratio just 5.7% away from its 200d MA and descending channel (both $1,393). ETH exchange volumes are still nominally lows, falling from $1.6B to $1.1B since December.

Yet, we see illiquid dynamics as supporting the bear surprise set up where more illiquid spot moves have coincided with a pick up in ETH short liquidation over in the futures market since the new year.

Other gauges of market sentiment also highlight broader risk-on appetite including Bitcoin dominance which has dropped from its 42.4% in December to 41% today. It’s failure to reach 48% after bouncing off its cyclical lows would mark a break in the multi-year pattern.

1% nominal moves in dominance may seem small but the muted rally in dominance comes at a time of broad-based risk-off sentiment and concerns around market contagion which may not have been on many traders’ bingo cards.

We now see a more likely outcome being a year of re-testing the 42% levels where the growing adoption of stablecoins and stronger positioning around ETH as a market beta asset may prove to be the limiting factors for the gauge in the year ahead.

Alts which received the most calls for $0 are also emerging as the top performers in the market. Assets like SOL (+62%) and NEAR (+32%) have reclaimed their support on their Global MCAP ratios in December.

Both assets saw notably different dip shapes with NEAR being suppressed for an extended period while SOL was progressive selling towards the last trading day of the year.

All eyes were on the Winklevoss’ January 8th deadline for Barry Silbert (DCG CEO) to respond for how they resolve the Gemini Earn/DCG debt issue. So far, there has been no formal reply made public and any resolve will likely continue to be punted until a later date. These things take time and DCG has separate DOJ issues that it is currently dealing with.

While FTX and DCG contagion risk will keep the bulls in check, we see the potential for more constructive positioning by longer-term investors overall who look beyond the market consensus calls and double click on the the 90%+ drawdowns in those respective assets.

The Hope for a Soft Landing

Stocks rally, gold rallies, bonds rally, dollar weaker

As with crypto, equity investors cut their risk appetite to extreme levels with exposure by hedge funds falling to 5-year lows. While the pessimism explains the worst December performance in 5 years, it may also be useful inform how seller exhaustion may pave the way for a bear market bounce which has played out every several months.

Mixed data from US jobs reports highlighted higher-than-forecast payroll additions while also showing lower growth in wage earnings. The reaction by the market was positive, supporting the ‘soft landing camp’ where deflation would be met with a more robust labor market/less dour economic outlook.

We don’t see this changing the core Fed outlook of high sustained rates in 2023 but may add support for a 25 BPS (vs. 50 BPS) adjustment in the next Fed meeting on February 1.

Coupled with another softer CPI print this week and we see a constructive outlook for equities that will eventually be challenged by bears once again who highlight higher core inflation forecasts, inverted yield curve, extreme lows in the ISM survey, and more accommodative price action that only gives the Fed more reason to remain hawkish (i.e. negative skew).

Some strategists like Mike Wilson believe the 3,500-3,600 range target for the S&P 500 is still too high in the case of a mild recession with profitability likely hit in the case of falling inflation.

As it related to the cryptoasset market, we may see risk on-sentiment crossover from equities given the bearish dominance at year end as highlighted above.

Today, equities, gold, and crypto now all moving in unison (to the upside) once again and it seems that macro correlations are creeping back up.

This marks a very new market structure compared to late 2022 and comes at a time when the market’s perception of a relatively less hawkish Fed is starting to gather momentum.

Another factor is market liquidity conditions where gauges of Fed balance sheet less TGA account and Overnight Reverse REPO suggest an easing of conditions which coincided with an uplift in equity performance. Such an easing of conditions may now be spilling over the crypto, especially now that seller exhaustion has taken full effect.

Decentral Park Market Pulse

Want real time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

Global Market Cap

$812B; Global MCAP has grown by 7.5% so far YTD with $735B proving to be strong support. Reclaiming the $850B levels alongside the 200d MA will be key in determining how sustained the recent momentum reversal will be.

DeFi MCAP

$35.4B; DeFi is staging a recovery with the sector up 15.4% YTD with $42B being our next target while still keeping in line with the broader descending channel structure.

Trader Positioning

Divergences between BTC and ETH futures OI since November 15th following the collapse of FTX. ETH denominated OI has climbed from 3.3m to 3.8m (+15%) while BTC denominated OI has fallen 494k to 456k (-8%).

This has led ETH’s USD OI to become more dominant over BTC where the ratio is now climbing to new highs since November 2022 (65%).

Aggregate futures funding rates gravitated below 0% for both BTC and ETH indicating more bearish positioning by traders. This could be a combination of bulls taking profit or bears looking to double down in the price action which would be supportive of the ‘disbelief rally’ thesis.

ETH’s highest OI by JAN27 strikes are $1.4k (24.3k ETH) and $1.1k (18.3k ETH).

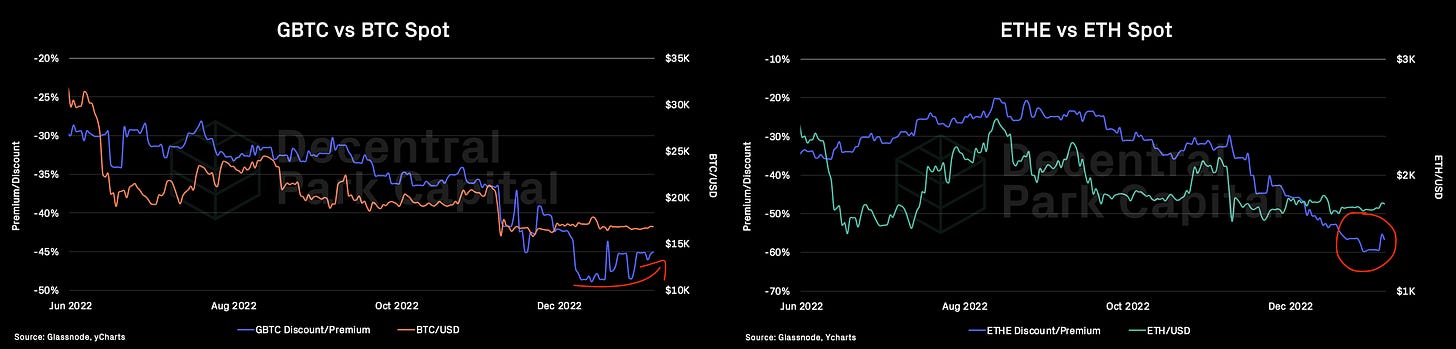

Grayscale GBTC

GBTC discount to NAV has been narrowing slightly over the past 2 weeks alongside more supportive spot action. Discount has narrowed from its ATL of 48.89% to 45%.

Grayscale ETHE

ETHE discount to NAV has been more mixed. While narrowing slightly over the same period from 60% to 56% this is more muted if we consider ETH’s stronger relative performance over the same period and may indicate sentiment around GBTC is slightly stronger than ETHE’s. This relative difference in sentiment may stem from the market’s perception of GBTC being more likely to be restructured to allow for shareholder relief (e.g. Reg M) than ETHE although this is not necessarily true.

This is because GBTC is the largest flagship trust within the Grayscale family where its shares are held by DCG who would be looking to sell these holdings at the best possible price to recapitalise.

Volumes

Volume are thinning and sustained below $10B daily ($8.9B today). These are the lowest volumes since December 2020.

Aggregate Order Books

Order books looks heavier on the bid size. Heavier resistance up to $17.6k.

Bitcoin Mining

Bitcoin hash rate continues to climb close to ATH levels (267m TH/s). Miners are being squeezed as indicated by the hashprice measure below (white) which printed a new ATH. Hash rate outpacing market valuations has put significant pressure on miners who have financed operations through debt financing.

Heavy sell pressure from miners (proxy measure using net position change) seems to have subsided despite the more challenging operational environment and could be driven by opportunistic buying (see July 2022). Note, this metric does not reliably act as a leading indicator for price action.

Some miners are even converting alts that are mined to BTC.

Higher spot prices will help miners with their top line but is directionally bullish on hash rate (all else equal). Therefore, we expect a more significant reset on hash rate to take place in order for the full miner capitulation cycle to take place.

High beta ETH plays like Lido have led the charge within the market as the liquid staking derivatives narrative picks up ahead of the Ethereum Shanghai upgrade (estimated release date March 2023).

Top 100 (7d %):

Lido DAO (+74.1%)

Zilliqa (+64%)

Solana (+62.5%)

BitDAO (+35.5%)

The Sandbox (+34.3%)

DeFi Top 100 MCAPs (7d %):

Lido DAO (+74.4%)

Redacted (+50.8%)

Alpha Venture DAO (+33.6%)

Kava (+33.4%)

Serum (+30.1%)

🎙️ Will 2023 Be the Year of DeFi [Real Vision Crypto]

🎙️ Gemini vs. DCG [Unchained]

🎙️ The Fintech Blueprint guide to designing your 2023 business model [The Fintech Blueprint]

🎙️ State of the ZK Ecosystem [Epicenter]

🎙️ What’s the Point of Securities Law? [Bankless]

📚 Crypto Options Market Has Become More 'Interdealer' Since FTX's Blowup: Paradigm [Coindesk]

📚 Warren’s Reactionary Crypto Policy vs. Dorsey’s Decentralized Social Media Gambit [Coindesk]

📚 On MEV [Dan Robinson]

📚 The Next-Generation Uniswap For Real-World Commerce? Pointswap Brings Popular Beauty and Fashion Brands To Web3 [The Block]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.