Join the 1000’s of founders, investors, crypto funds, brokerage firms, and developers in getting free cutting edge crypto research by subscribing below.

Momentum Reversal?

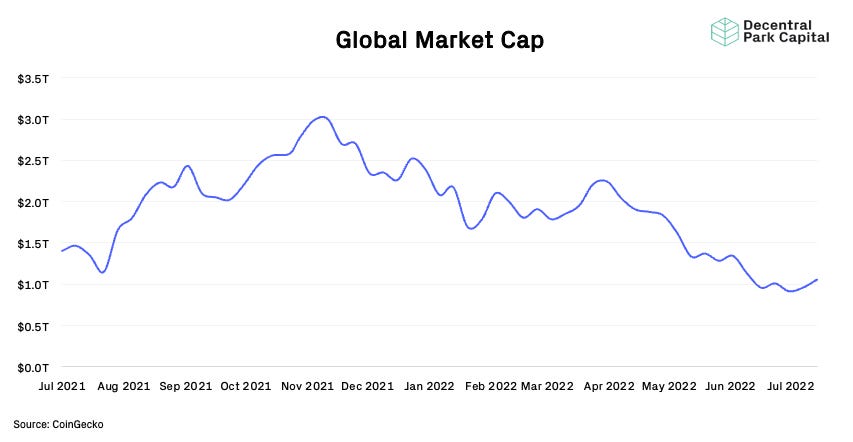

Sentiment in the crypto markets has flipped to more positive tones as global market cap keeps above the $1T mark.

Majors hover above key lines such as BTC’s $20k which is currently trading at $22.2k on Monday morning.

For several weeks, beta has been consolidating within tight channels with BTC now breaking above its own signalling potential bullish momentum medium-term.

Technicals like RSI were showing growing momentum build from oversold conditions while price chopped around.

However, it’s not clear if it’s the strength of the cryptoasset market or the (temporary?) retreat of the macro headwinds at play. Simply looking at global spot volumes paints a dreary picture with lower peaks and lower lows being flavour of the year.

We have also yet to see on-chain indicators signal medium-term price reversal including Bitcoin hash ribbons which considers the continued fall in miner hash power despite rising spot action. Once that reverses only a ‘buy’ signal indicating more sustained price action can occur.

All eyes were on the dollar index last week as high US CPI prints, potential inbound hawkish central bank moves, and global demand for the greenback pushed the indicator higher.

Now DXY is retreating from overbought levels which is giving crypto assets some breathing room - perhaps before another leg up resumes.

As earnings growth for equities is slowing, concerns more recently by the market have been centred around the ability to reach 3% terminal rates while the short-dated treasury bond yield remain high.

As the cost of providing high yields become more untenable, we would be at the point where The Fed would halt rate hikes and look to begin easing once again.

To ensure the US government doesn’t enter a debt death spiral, The Fed may soon look to issue more instruments to fund interest (and essentially pivot from current course). A change in course would be conducive for risk assets including cryptoassets.

While you could argue that macro signals like dollar weakness is likely simply boosting risk assets in general, recent moves in the cryptoasset market are notable ones. Factor in the possibility of a Fed pivot within 6 months and these moves become even more interesting.

ETH Merge

A key driver of optimism has been centred around Ethereum and its upcoming merge.

Some speculation online has been ~September 19th.

ETHUSD is fast approaching its 2001 support lines once again. The strength of ETH, which is up 26% on the week, is so strong its outperformed the wider crypto market by 21% for the past 6 days.

On its BTC ratio, ETH has already broken key resistance (0.064) and it’s likely that this relative performance may signal to both institutional and retail traders the merge momentum trade is well underway.

Search indices also indicate web traffic picking up as price picks up too and supports the idea that headline and social discussions may help drive momentum further. Of course, indicators like these are backwards looking.

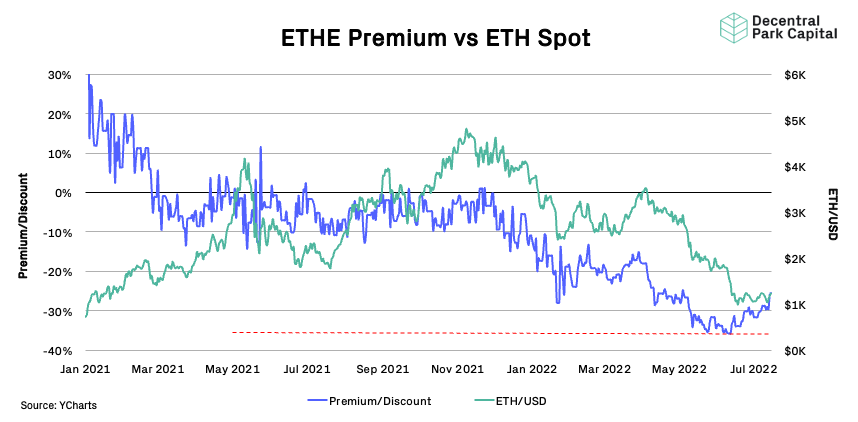

For Grayscale’s ETHE trust, the discount has narrowed significantly (-25.5%) and indicates a growing demand for ETHE shares over the past week supported by strong volumes on the secondary market. The ETHE discount appears trade in line with ETH/BTC for now.

Finally, applying a Metcalfe’s law +++ model (active addresses*on-chain volume) shows no notable increase in the model’s value over the past week. In other words, recent price rallies appear to be momentum (catalyst) driven vs. fundamentally driven.

The divergence seen between MCAP and the model value may be attributed to the launch of layer 2s where the divergence coincided with L2s seeing >$1B in ~March 2021.

It’s clear that momentum around the merge is starting to pick up but what is less clear is if this is a relief rally in the broader down market we have been so used to in 2022.

For now it, it appears likely that capital is chasing momentum after a prolonged period of market inertia and time will tell wether now marks a more fundamental structural shift.

Traders appear to be placing bets on merge-related assets like LDO and RPL but its not clear if this is short-term capital chasing momentum up until the merge.

Top 100 (7d %):

LidoDAO (+153%)

Polygon (+56.2%)

Etheruem Classic (+50.1%)

Arweave(+45.6%)

Quant (+27.3%)

DeFi Top 100 MCAPs (7d %):

Barnbridge (+204%)

Lido DAO (+153%)

Dopex (+97.7)

Rocket Pool (+47%)

Maple (+42.8%)

Stake DAO started migration to the ETH CC Option strategy V2 with optimized fees and withdrawals, users deposited ETH this week can now claim V2 shares.

Aura launched 50/50 AURA/ETH Balancer pool with BAL and AURA rewards and 101% total APR.

Balancer's UI suffered from a phishing attack, users were baited by "claim BAL" banner to sign a malicious transaction. Smart contracts are intact.

Uniswap v3 went live on Celo Network, LPs can deposit cUSD and CELO among other assets.

Global Market Cap

$1.05T; Global market cap has gained 10% over the past week.

$45B; DeFi market cap has increased by 14% over the past week while DeFi dominance has also increase by 4%. DeFi dominance has yet to break above 5%.

Bitcoin Dominance

Bitcoin dominance has fallen as assets down the risk curve outperform, in particular ETH.

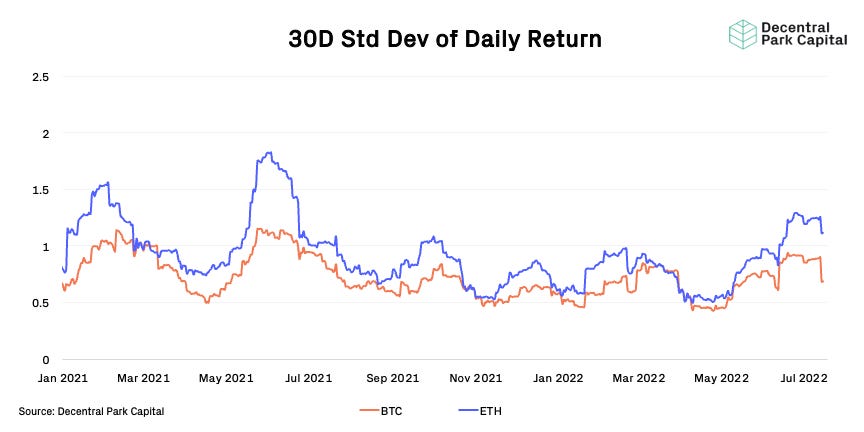

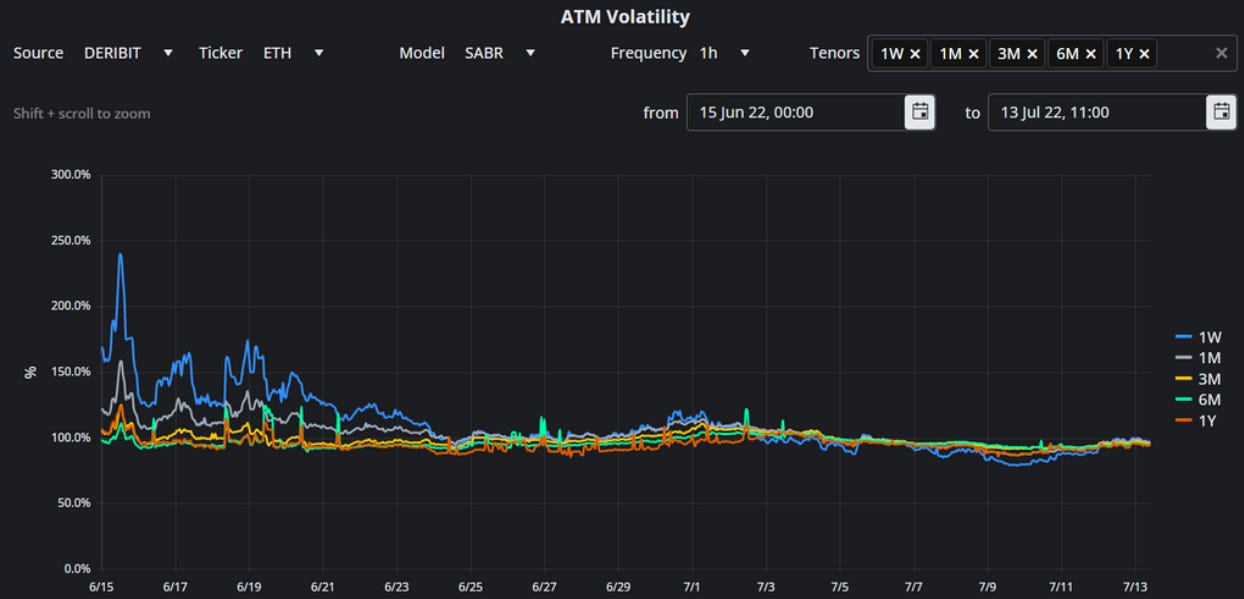

Volatility

BTC & ETH; 30D realized vol has fallen sharply for both BTC and ETH.

Trader Positioning

Put/call ratios sloping down for both BTC and ETH. Short-term BTC and ETH ATM vol is inverted meaning short-term tenors have risen above the vol of longer dated options. ETH’s annualized yields performing worse than BTC’s.

Mempool Size

Moderate uptick in mempool size as larger transactions force a growing number of smaller transactions to the pool.

Grayscale GBTC

GBTC; GBTC discount chopping around 30%. Positive sentiment may provide temporary relief for GBTC and drive the discount closer to 25%. Last week, BlockFi stops accepting GBTC shares as collateral.

ETHE Grayscale Trust

ETHE; ETHE discount narrowing even more over the past week (25.51%) as ETH momentum outshines the wider cryptoasset market. Still not clear if this marks a long-term reversal in discount expansion but is likely to still be driven by broader spot market price action.

Volumes

On-chain real (BTC) & off-chain volume; On-chain volume have picked up moderately over the past week as BTC break out above its price channel. Off-chain volume still showing an overall downward trajectory (lower peaks).

Combined Order Books

Order books appear strong on both sides. Heavier resistance up to $22.4k.

Bitcoin Hashrate

Bitcoin hash rate has now fallen 15% from ATH as evidence of coninued miner capitulation comes in. Rising BTCUSD will help miners cover overheads/capex.

Active User Base

BTC; The Bitcoin network is still seeing a less active user based. Active entities has fallen 1% over the past week.

Exchange Flows

Net outflows for BTC while less ETH is being supplied to exchanges relative to supply taken away. Likely a result of the recent spot price action.

📚 Using PE for L1s [Spencer Noon]

📚 StarkNet Becoming Decentralized [Messari]

📚 Crypto Derivatives [Deribit]

📚 Principles of Incentive Design [Sahil Bloom]

📚 The Nightmare Scenario For Central Banks [TS Lombard]

🎙️ Stocks Remain Expensive Despite Rising Rates [On The Margin]

🎙️ The Future Of Asset Management [Epicenter]

🎙️ Is This The End? [Bankless]

🎙️ Market Are Betting On A 100BPS Rate Hike This Month [The Breakdown]

🎙️Bitcoin Is Still The Most Interesting Trade | Eric Peters [Empire]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.