The Weekly #182

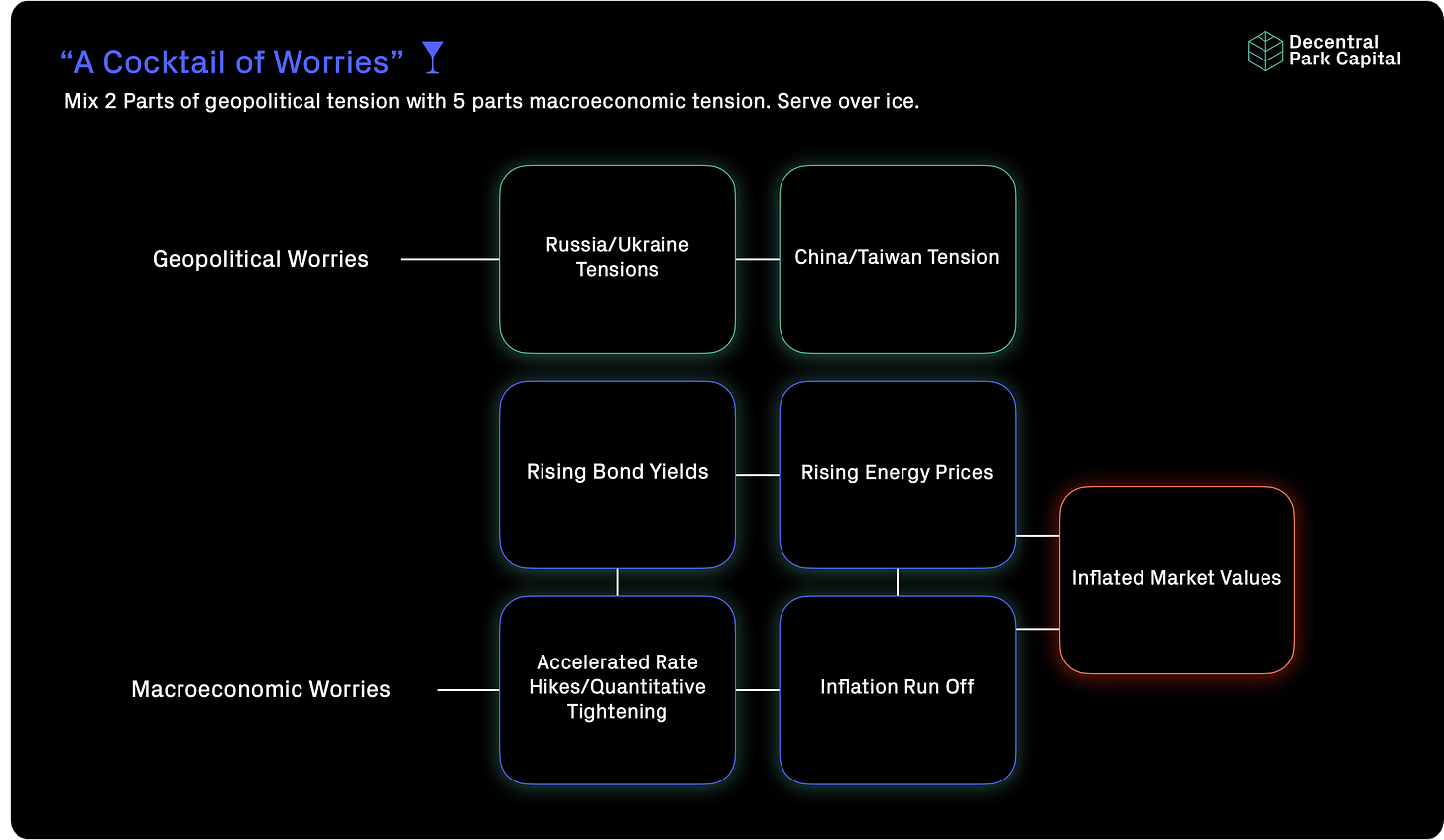

Markets continue to feel the pressure from a cocktail of macroeconomic and geopolitical worries. Risks of unwinding leverage and further short-term holder capitulation remain.

There Will Be Blood

Cryptoasset markets have had their worst performing month since November 2018, falling 29% YTD. Sentiment is severe lows and you don’t have to look beyond the headlines to see why.

“Bitcoin heads for worst week in 8 months.”

“Bitcoin, Ether, Memecoins Steady After Tumbling in Crypto Rout.”

“OpenSea bug lets users buy NFTs at old listing prices.”

The list really does go on. However, as always with The Weekly, we want to focus on what happened, the data that really matters, and what the outlook is from all of this.

A Cocktail Of Worries

We are now seeing a ‘cocktail of worries’ globally - both from a geopolitical and macroeconomical standpoint that is weighing on markets including crypto. In short, tensions in Ukraine and China have compounded the nerves of investors as they eagerly wait to hear from the Fed later this week.

Equities globally (including Europe) continue to be stress tested amid concerns over the Fed’s imminent rate liftoff. The Fed is expecting to raise rates three or four times in 2022. For the Fed, time is not on their side.

High (but in line with expectations) CPI prints have accelerated plans to address runaway inflation. The first rate hike may occur as early as March with the shrinking of their balance sheet by September 2022.

Risk assets like high growth tech stocks continue to be affected by rising bond yields and profit potential. Crypto has followed suit now falling nearly 50% from ATHs in November 2021.

But there is another side to the coin.

As highlighted in previous editions, the Fed will likely strike a balance between hawkish policies and avoid increasing the cost of credit too much whereby they step into recession territory.

2022 may not be bearish for crypto if we also consider that depressed prices in equities and cryptoasset are seen more towards the end of the rate hike cycle, not before. That said, new times call for new perspectives.

Analysis of sector performance over the past week shows two key takeaways:

No sector has been spared indicating a more global trend with sentiment/reaction to the macro backdrop

Slight dispersion in performance with more speculative sectors like NFTs/Metaverse coming off worse

On-Chain Drivers

The first starting point is to look at supply of the supply/demand equation. BTC on exchanges has oscillated around 2.6M BTC since September.

As a proxy measure for potential sell pressure, there is little evidence of any major inflows of BTC to exchanges have been the key driver in lower prices.

Liveliness, which measures the age of coins moving on-chain, indicates continued HODLing behaviour over ‘coin day destruction’.

Long-term hands are continuing to hold strong despite falling prices since last November.

We then have to look at short-term holder metrics. Bitcoin’s STH-MVRV is now approaching (but not yet entered) the multi-year support zone of 0.75 and below.

In edition #180, we highlighted the risk of further short-term holder capitulation over the coming weeks which seems to have partially played out.

Bitcoin’s STH-NUPL paints a very similar picture to the above indicating further capitulation near-term to achieve that ‘max pain’ level.

Off-Chain Drivers

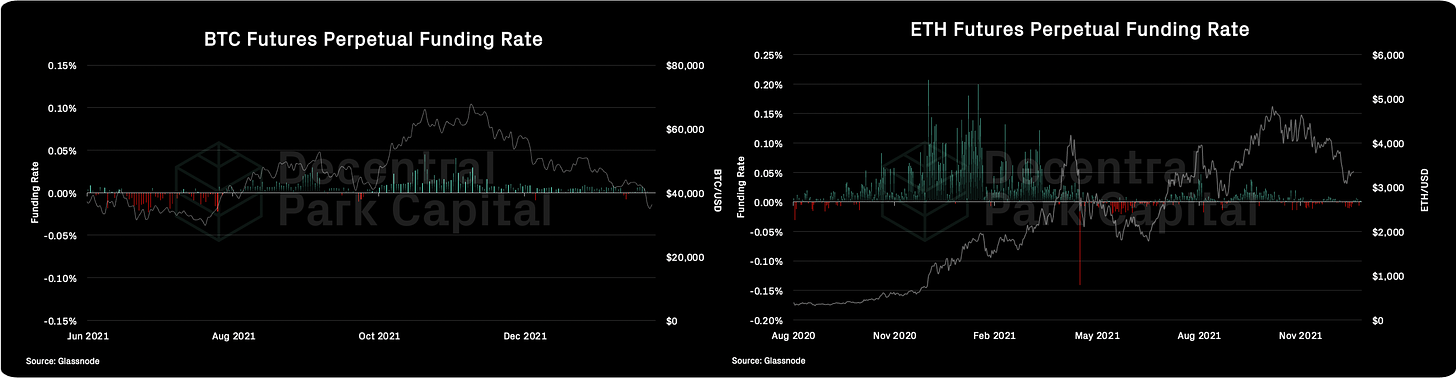

Looking off-chain in the futures market, open interest (OI) for Bitcoin and Ethereum futures denominated in their respective cryptoassets show a flat or even upwards trend. This is despite over $1.5B in long liquidations occurring due to margin calls.

There is some concern here as once OI reaches elevated levels (~360k and above) we typically see some major correction. The points to the possibility of a further leverage flush where we see more convincing signs of a complete positioning reset.

The risk is further highlighted by a slight positive funding rate seen over the past 3 days with traders taking a predominantly bullish stance. While notably lower than October-November levels, long traders can still get caught out due to weak overall demand.

Demand-centric metrics like active entities points to this, falling 10% since November 2021 highs and 36% from Jan 2021 ATHs.

Therefore, together with short-term holders likely creating the supply pressure, it appears that demand is simply not high enough to counter pressure from capitulating short-term holders.

Taken all together, we can still see continued risk of further capitulation by short-term holders and unwinding of leverage in the derivative markets.

All eyes will be on the significant macro events this week while analysts should pay close attention to on/off-chain indicators to asses whether there is enough demand to help steady asset prices at their next key support levels.

LDO

The total value committed to Lido has fallen 30% YTD due to asset price fluctuations. Under the hood, Lido Finance has seen a 9% increase in the number of ETH deposited for ETH2 staking YTD. Lido has its 3rd highest daily deposit amount on Sunday with the average deposit amount also ticking up to 65 ETH.

This indicates a growing level of trust in Lido as well as potential ETH holders capitalising on low prices to buy/stake their assets through Lido.

Exchanges

Aggregate trading volume on decentralised exchanges is ramping relative to spot volume on their centralized counterparts. January is on track to be the 3rd highest month for the DEX/CEX ratio after September-October 2020 (15%).

This comes amid Uniswap now printing higher ETH/Stablecoin volume than both Coinbase and Binance.

Arguably the key difference between today and these past periods is the organic-driven volume not reliant on pure token incentives.

CowSwap (Gnosis V2)

Gnosis’ DEX, CowSwap continues to go from strength to strength with daily trade volume surpassing $160m over the weekend (2x since November).

Average trade size is increasing in line with trade volume (>$50k) indicating higher utilization from larger traders. This creates a positive flywheel effect for CowSwap whereby more volume across a growing number of traders makes it more likely for batchers to find ‘coincidence of wants’.

Votium, a bribing service for vlCVX holders, is entering the last day of the current round with $16.5m in rewards for CVX lockers ($0.95 per locked CVX).

With the ongoing ve(3,3) wars on Fantom Network, Yearn Finance updated their APYs. Currently YFI can be deposited for 82%, ETH for 28% and FRAX for 27%.

Pika. a perpetual swap exchange on Optimism, is expected to launch on January 24th. Pika vault capacity will be increased (maxed out now). The vault made 34% on USDC for the last two months (207% APY).

Sushiswap launched farms and limit orders on Fantom network, LPs are rewarded with SUSHI and FTM, USDC / MIM stable farm has 335 APY.

FINRA considers changes to crypto regulations in an attempt to better protect investors. FINRA’s primary area of concern is advertisement and disclosures but does not seek to make fundamental changes to the regulatory structure.

The UK’s government follows suit to FINRA in strengthening rules on misleading advertisements while placing an emphasis on encouraging innovation.

Bank of Korea completes its first phase of CBDC testing successfully. This comes amid a flurry of central banks globally exploring and testing the use of CBDC. The most recent being Switzerland which completed its wholesale CBDC trial earlier in January.

Global market cap: $1.7T; Global market cap has decreased 23% over the past week and 32% over the past 30 days.

DeFi: $152B; DeFi market cap has fallen 25%, slightly more than global MCAP. DeFi dominance pulled back to 6.6%.

Market shares; Bitcoin dominance has increased to 46% as the orange coin holds relative value to its peers.

BTC/USD

ETH/BTC

Price action; BTC/USD broken below $40k with next support line $30k. ETH/USD next support at $2k, then ~$1.8k. ETH looking weaker on its BTC ratio with ETH/USD death cross forming. Daily RSIs printing oversold while prices continue to head lower indicating overall very low spot demand.

Volatility (BTC & ETH); BTC and ETH 30D vol has spiked upwards in recent days past week in line with implied volatility measures (30D, 60D).

Combined order books; Order books heavier on the bid side. Heavier resistance up to $34.86k and heavier support at $32k and $30k levels (Source: Bitcoinity).

Crypto vs. SPX; Correlations between crypto and equities spiking to 1 with weakness in stocks (particularly high growth tech) carried over to crypto more widely. Cause for concern for crypto investors given ‘cocktail of worries’.

GBTC premium; New all-time-high for GBTC discount plummeting to 30%. Volumes (30D) have kept relatively flat since December (6M) which together with GBTC price action indicates a very low level of demand by individuals and institutions for GBTC.

ETHE premium; New all-time-high for GBTC discount plummeting to 28% and like GBTC being driven by spot action. Volumes (30D) at lows since August 2021 with low demand clearly not just isolated to just GBTC/Bitcoin.

Bitcoin Mempool activity (Size in MB); The mempool size for the Bitcoin network remains relatively low despite turbulent price action. Congruent to other on-chain metrics that point to weak network activity (e.g. active entities).

On-chain real (BTC) & off-chain volume; BTC on-chain volume has increased 40% over the past week. BTC and ETH spot volumes have increased 34% and 55% respectively over the past week (7d MA) as prices plummet.

Hashrate & Difficulty; Bitcoin hashrate and difficulty jumps to new ATHs. Lower BTC prices will squeeze mining profits while mining BTC has become increasingly harder. Reasonable to expect a reset from miners that are making less than $10 with a $0.12 per kWh assumption.

Active addresses (BTC); Active addresses (30d MA) has fallen 2% over the past week and 5% YTD and, as a proxy measure, indicates lower overall network usage.

Trader positioning; Perpetual funding rates remain slightly positive for BTC and neutral for ETH. Futures OI has kept flat (370k BTC and 2.9M ETH) and are at levels often coinciding with leverage flush outs.

Options OI increases steadily with put/call ratio increasing for both assets over the past week.

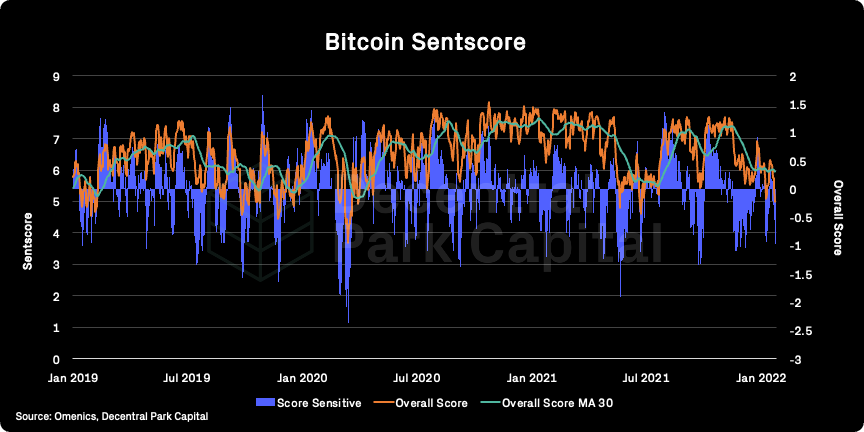

Omenics Sentscore (BTC); Sentiment score around BTC has fallen to significant lows. Hitting extreme negative sentiment levels (e.g. March 2020) will be at the whim of wider price action.

Exchange inflow/outflow (BTC, ETH); Divergence in net flows for ETH and BTC. Ethereum having ~$250m daily net inflows while Bitcoin ~$730m worth of net outflows on Sunday. Could indicate a greater demand/lower supply dynamic for BTC relative to ETH.

📚 Pocket Investment Thesis [@Decentral Park Capital]

📚 Addressing The Crypto Twitter Paranoia [@LordTylerWard]

📚 What to Watch In 2022 [@mariogabriele]

📚 Starknet Roundup #1 [@Swagtimus]

📚 Speeding Up The EVM [@sxysun1]

🎙️ Vitalik Buterin On Ethereum And Immortality [UpOnly]

🎙️ On Crypto Asset Management [On The Brink]

🎙️ Infrastructure Bill’s Impact On Crypto [The Scoop]

🎙️ The Future of DAO Tooling [Delphi Digital]

🎙️ The Fed shares Its Thinking About A US CBDC [The Breakdown]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.