The Weekly #178

Profit-taking investors continue to weigh in on crypto. As we head into the new year, all eyes will be on the potential re-deployment of investor proceeds in providing fresh momentum to the markets.

To Rally or Not Rally, That Is The Question

Heading into year end, we continue to see a relatively soft market across the board with BTC and ETH looking to test the $45k and $3.6k support levels respectively.

Global daily exchange volume continue to sink, falling ~44% from its early-December peak of $53B. It has been clear for the past few weeks that the vast majority of cryptoassets have been lumped together as one broad risk-on market.

A general negative sentiment has meant we have been unable to identify specific sectors that have benefited from this wider market structure. Investors have likely taken annual profit/ positioned to pay taxes at a time of great wider uncertainty, amplified with Omicron.

Analysts have pointed to historically choppy early-December periods before a subsequent new year rally. But it hard to extrapolate those data points to the present given we are in an unprecedented environment.

Bearish sentiment is not isolated to just crypto. J.P. Morgan note high de-risking moves from equity and macro hedge funds are in play and momentum can quite easily swing the other way:

“There is a paradox that on average US stocks are down 28% from highs and the median stock is down ~21%, while the market is up ~22% for the year (Russell 3000). Such a divergence in unknown to us, and indicates a historically unprecedented overshoot in selling smaller, more volatile, typically value and cyclical stocks in the last 4 weeks.

…For short-selling campaigns to succeed, there have to be positioning, liquidity and often systematic amplifiers to succeed. We believe these conditions are not met, and hence this market episode may end up in a short squeeze and cyclical rally into year-end and January.”

But there is not clear consensus. Morgan Stanley took the most bearish position effectively forecasting stocks being negative even throughout 2022. The mainstream bear market narrative continues to be a raised interest rate environment which The Fed may first establish as early as March. Again, not all agree we see 2-3 hikes next year.

The Fed will likely strike a balance between hawkish policies and recession avoidance with a relatively low rate environment being reasonable outlook over 2022.

For now though, leverage has become more constructive with evidence that bulls now balancing out the bears once again - BTC funding rates keep positive. BTC-denominated OI has increased 8% since December lows with whales absorbing the long side.

ETH Pressures

Ethereum paints a slightly different picture with traders taking a predominantly bearish stance in the futures market. Long liquidations have recently trickled in (~$12m). However, bears could quickly find themselves caught out with new year buy inflows.

Positioning on the bearish side for ETH is not completely baseless. We’ve see the second highest peak in USD-denominated exchange net inflows for ETH. That said, there have been times of strong net inflows preceding both positive and negative price action and we will see if the market can absorb these flows.

Altcoins and the wider DeFi market are in clear distribution mode.

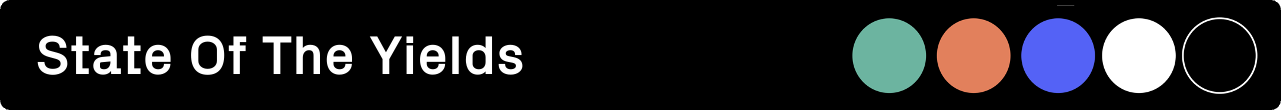

DeFi has now come off ~45% from its November peak with the sector becoming increasingly oversold relative to high cap L1 names. Further weakness is not out of the question - we have some runway to cover if we were to hit the drawdown severity seen in May 2021.

At the same time, the removal of significant market froth make current prices attractive for long-term time horizons especially if we are to expect buy-flows from investors re-investing proceeds in January onwards.

There is merit in distinguishing between 'tech crypto’ and ‘money crypto' groups. While we focus on the macro piece and headwinds of factors like increased rates, groups focussed on tech crypto just care about building. As always, fundamentals matter.

The big question is when crypto can become decoupled to the wider macro forces.

To paraphrase Raoul Pal:

Crypto won’t follow macro. Crypto will become the macro.

As we highlighted in Weekly #177, we equally make the case that productive ecosystem assets like SOL and ETH will garner attention over non-productive assets. Core ecosystem assets have been, and will likely continue to be, good proxy plays for overall utility growth in the market. Multi-billion ecosystem funds will clearly play a key role in fuelling this growth in 2022.

Divergences In The Market

Despite the soft market, we can still point to divergent and interesting data points. Aurora, NEAR’s EVM platform, has seen its ecosystem bootstrapped with the advent of Uniswap-like exchange dApps like Trisolaris and WannaSwap.

As we’ve seen time again, incentive programmes (e.g. Trisolaris’ TRI-AURORA) can help drive liquidity and early user attention to emergent dApps on alternative L1s.

And there’s clear room for growth. NEAR has yet to deploy its sizeable $800m ecosystem fund.

We are also seeing the DEX to CEX spot volume ratio climb to yearly highs (>12%).

It is reasonable to see this trend continue throughout 2022 with continued proliferation of exchange dApps coming to market, sizeable incentive programmes, and capital deployed down the risk curve for long-tail assets.

Top performing assets have centred around DeFi with performance often being tied to headlines/event-driven catalysts.

Global:

yearn.finance (+60%)

Anyswap (+50%)

Wrapped NXM (+25%)

DFI.money (+25%)

Arweave (+24%)

DeFi:

yearn.finance (+60%)

Anyswap (+50%)

Wrapped NXM (+25%)

DFI.money (+25%)

Spell Token (22%)

Gnosis Protocol V2 (CowSwap)

Gnosis Protocol has seen thanks to the CowSwap DEX aggregator. CowSwap now facilities ~$40m in trading volume daily with new trader (~500) and returning trader (~600) count steadily increasing.

This illustrates a level of user stickiness which is all the more important for dApps like CowSwap. Higher user count makes it more likely trades can be matches against each other (see coincidence-of-wants).

Yearn.finance

Yearn has completed its YFI buyback of 0.77% of the total supply. Yearn will now distribute the protocol’s earnings to stakers. Yearn has generated ~$123m in revenue over the last 180 days with higher revenue prints generated at higher TVLs.

Yearn has a ‘low’ P/E ratio of 6.3 and the introduction of xYFI could act as a clear tailwind for the YFI asset.

OpenSea

OpenSea has printed its 2 biggest daily volumes on its NFT marketplace since mid-September. This comes at a time when global NFT sales continue to to descend from their August highs.

Interest in collectibles generally might be falling but new while NFT lines like RTFKT's #CloneX add fuel to the market in consistent pulses. Marketplace infra like OpenSea stand to benefit from this dynamic.

Gearbox, a generalized leverage protocol, is expected to launch on Ethereum this week. LPs will be able to take leveraged positions in WETH, WBTC, USDC, DAI on Uni v2/v3, Sushiswap, Yearn and Curve 3Pool (voting in progress).

Yearn finance is undergoing massive tokenomics change. Yearn has begun to use protocol fees accrued to the treasury to purchase YFI tokens from the market. These tokens will be used to reward YFI stakers under an new xYFI model. Curve vote escrow model and Vault Gauges are expected to be implemented next. More details here.

Tokemak's VISR reactor is now live with 40% APR, 7 other reactors from Core 2 program are expected to launch this week.

Uniswap community has voted to deploy v3 on Polygon, details TBA. Popsicle Finance will likely follow with their V3 optimizer.

The reckoning is nigh in Europe as rhetoric points to a coordinated regulatory floor, institutional adoption, and banking infrastructure setting in:

IMF advocates for ‘coordinated’ crypto policy among the world’s governments (The Block).

Aussie regulatory body backs government’s plan to regulate crypto (CryptoNews).

Revolute given nod to push into credit with European banking license (The Block).

There is a downer in every group, and with this lot, the powers at be in mother England are sounding more and more like their drinking buddy Mr. Gensler:

The SEC is staffing up with a new enforcement head in preparation for early 2022 enforcement waves

Global market cap: $2.26T; Global market cap has fallen 4% over the past week.

DeFi: $137B; DeFi market cap has increased slightly at 2%. Such growth is divergent to the wider market meaning DeFi dominance has increased 7%.

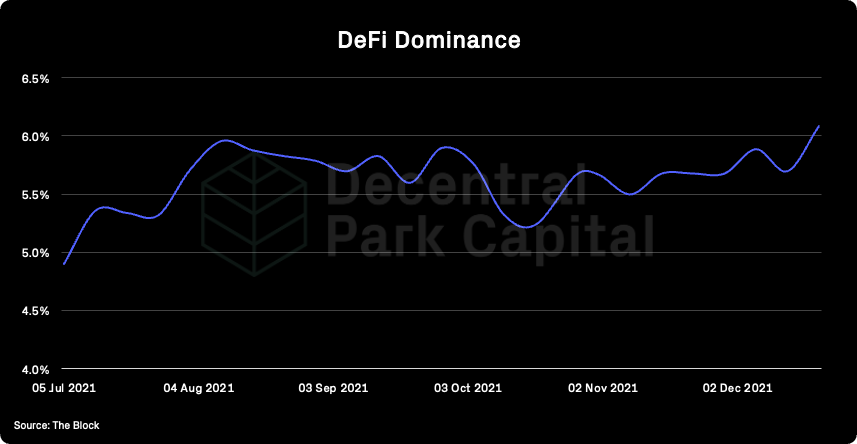

Market shares; Bitcoin dominance continues to fall closer to 2021 lows (45.6%). Growth in both high cap and mid-cap names.

BTC/USD and ETH/USD (D)

ETH/BTC (W)

Price action; Soft markets. BTC finding support at $45.8k and ETH $3.6k. BTC broken below its longer-term momentum indicator (200d MA) with RSI in oversold territory. ETH/BTC continuing to pullback failing to gain ground above its high on the 9th December.

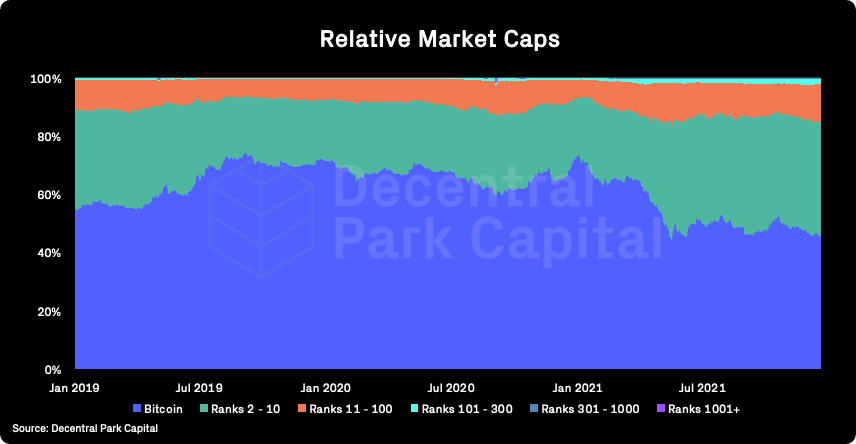

Volatility (BTC & ETH); BTC and ETH 30D vol has fallen slightly over the week. 3-month implied volatility for ETH and BTC have also fallen over the same period to Q3 lows.

Combined order books; Order books look heavier on the bid side. Heavier resistance up to $47.5k (Source: Bitcoinity).

BTC vs. SPX and Gold; BTC becoming negatively correlated to risk assets (equities) since early December.

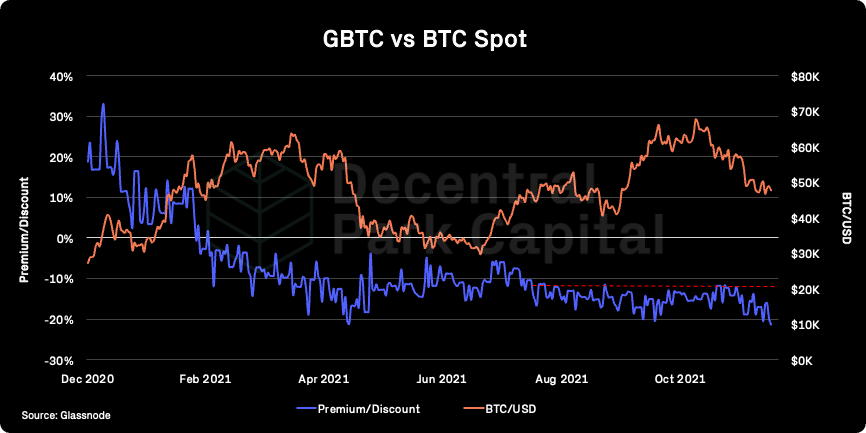

GBTC premium; GBTC discount dropping to yearly low (21.3%). 30D volumes also flat (5.85m) indicating overall limited demand on secondary market for GBTC.

ETHE premium; ETHE discount falling to all-time-high (15%) last week. 30D volumes have kept relatively flat on the secondary markets. We could be seeing net selling of ETHE from institutions to lock in annual profits.

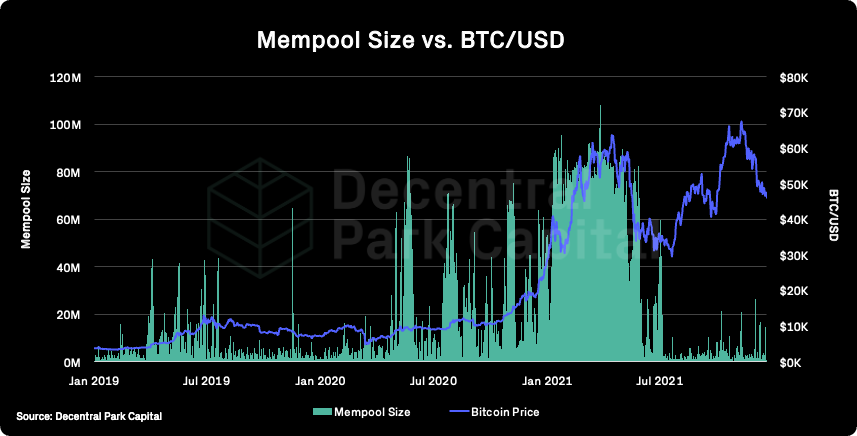

Bitcoin Mempool activity (Size in MB); The mempool size for the Bitcoin network still spiked over the weekend but remains low overall. This is notably different to May 2021 when selling congested the network to significant levels.

On-chain real (BTC) & off-chain volume; BTC on-chain volume increased ~3% over the past week. BTC and ETH spot volumes (7d MA) have decreased 9% and 12% respectively.

Hashrate & Difficulty; Bitcoin hashrate has come off its 2021 ATH and comes shortly after the indicator recovered from China’s mining crackdowns. This could be the result of unprofitable miners moving offline against a weakened BTC price.

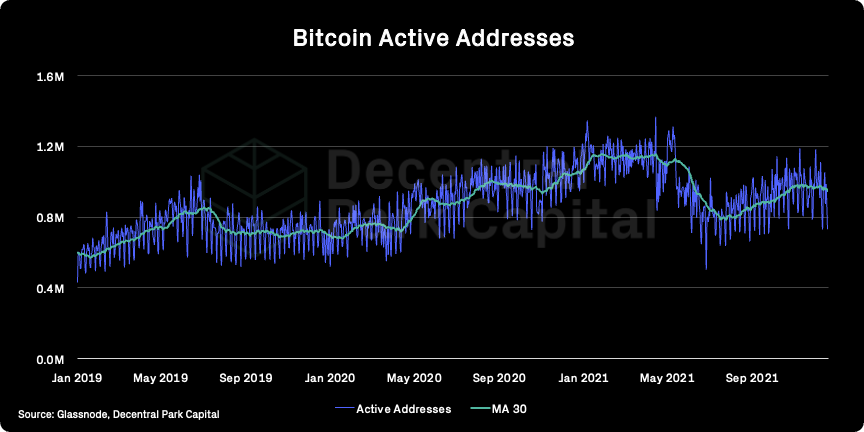

Active addresses (BTC); Active addresses (30d MA) has fallen slightly over the past week (-1%).

Trader positioning; Overall bearish positioning. Perpetual funding rates stay slightly positive for BTC while rates have kept firmly negative for ETH. Bitcoin-denominated OI increased 8% since December low with ETH-denominated OI increasing to the same degree.

CME Bitcoin futures slipping into backwardation last week potentially indicating weaker institutional demand. Put/Call ratio for options fallen over the past week.

Omenics Sentscore (BTC); Sentiment score around BTC hitting annual lows as markets continue to be soft.

Exchange inflow/outflow (BTC, ETH); Net inflows to exchanges for ETH while BTC continues to see net outflows. This may reflect stronger profit taking by investors and paints a bearish picture in the near-term.

USD-Pegged Stablecoin Flow; Continuation of net outflows for USD-pegged stablecoins pointing to limited opportunistic buying by investors at current price levels.

📚 Hubble Investment Thesis [Decentral Park Capital]

📚 Messari 2022 Themes [@pastryETH]

📚 Polygon Web3 Fund [TheBlock]

📚 What To Expect in 2022 [Larry Cermak]

📚 Top Podcast of 2021 [@MichadaVinci]

🎙️ Superfluid [Delphi]

🎙️ Hasu Gets STARK-pilled [Uncommon Core]

🎙️ Market Opportunities in 2022 [Between2Chains]

🎙️ The Biggest Stories In Crypto and Macro in 2021 [The Breakdown]

🎙️ Weekly Roundup 12/17/21 [On The Brink]

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.