2-Line Thesis

UX improvements such as Apple Pay and seamless mobile onramps are erasing the barriers to crypto adoption. This leap will drive this cycle's adoption, with the potential to reshape personal finance through superior onchain savings.

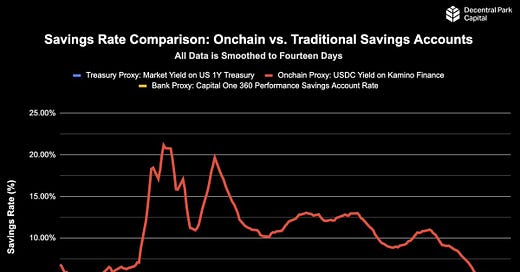

Chasing Yield: Comparing Onchain Yield to Traditional Saving Rates

The case for Solana to go to $600 rests on the assumption that its ecosystem of value and applications, analogous with services, grows by several orders of magnitude.

Without mass adoption, DeFi protocols and the DeFi ecosystem at large are in a limbo ‘science project’ state. Theoretically, it’s sound, but the underlying goal is to deliver best-in-class products to real people.

On the application side, we see material catalysts such as Firedancer and Seeker paving the way for new use cases, while Solana’s thriving DePin offerings continue to expand. On the value side, however, an influx of capital is required. Stablecoins are the primary route for this value inflow.

Savings are a necessary evil. Regular savings permit financial security and fuel investment and economic growth, it’s one of the primary functions of capital. Gross domestic savings in the US as a percentage of GDP is ~18% (World Bank), equivalent to >$1t. This is an industry ripe for onchain disruption and could achieve the stablecoin inflow necessary to release DeFi from this science project phase.

Onchain stablecoin yields have long outperformed the savings rates available in your bank or from holding treasuries. DeFi has developed arguably superior products to savings alternatives. What’s required now is the ‘real people’ to adopt these products.

For example, a thousand dollars deposited to the supply side of Kamino Finance’s lending platform at the beginning of the year would be worth $1,078 today, far meatier than the $1,037 or $1,030 it would be worth if deposited into either US 1Y Treasury Bonds or to a Capital One savings account, respectively.

This outsized yield is primarily driven by speculation, i.e. looping demand from onchain degens looking to gain leverage on their positions by continuously borrowing stables, swapping into an asset and then repeating.

In times of low speculation, optimal stablecoin yields generally default back to that of treasuries, with several stablecoin projects now offering built-in yields tied to the treasuries that underpin them. This can be seen in recent onchain yields, with the Kamino Finance yield falling to ~5% during a lull in risk-on sentiment and speculation.

What’s being demonstrated here is the potential affects of introducing peer-to-peer lending as a way of intermediating a section of the banking industry.

Lulo: The DeFi Savings Account

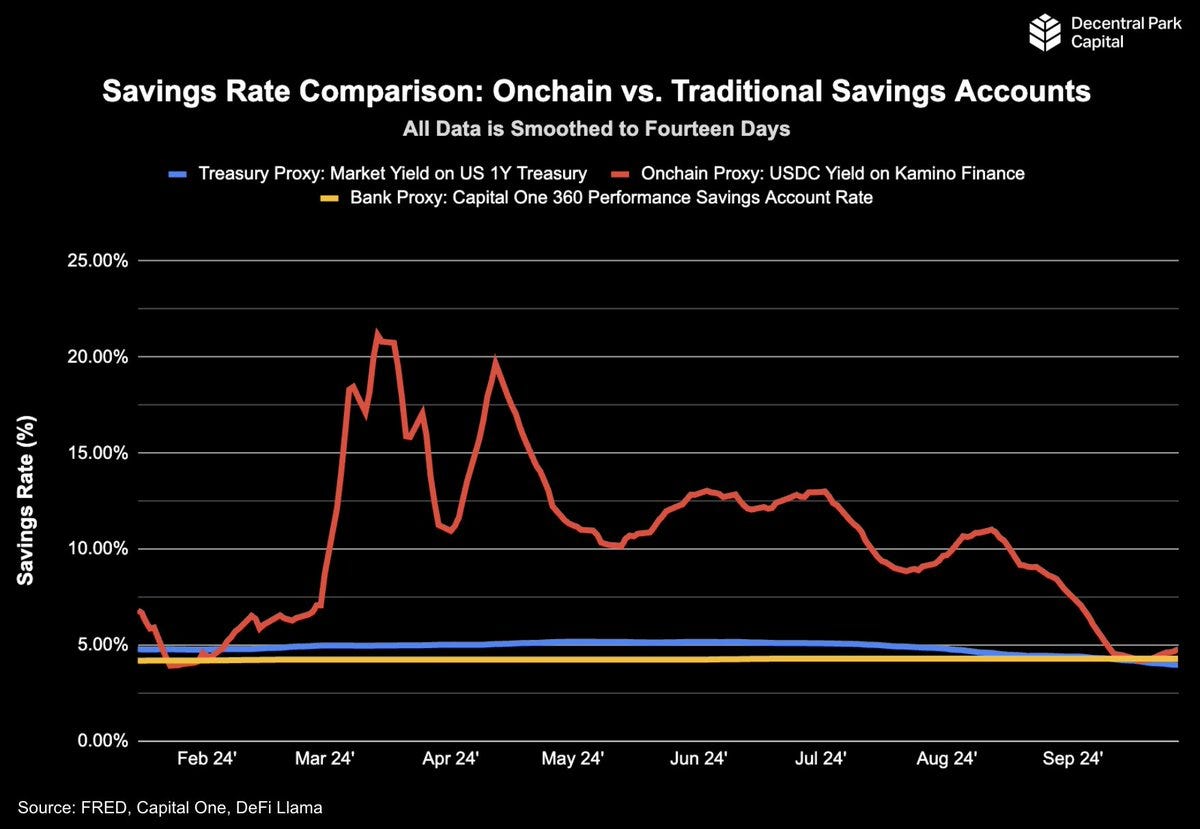

With this in mind, allow me to introduce Lulo, a Solana-based yield-aggregation platform for borrowing and lending protocols. By yield-aggregation platform, I am referring to a protocol that automatically deposits your assets into the highest-yielding protocol to optimise your yield. Or, in layman's terms, a savings optimiser.

The protocol, developed by ex-Google Daniel Garay and his co-founder Jesse Brauner, is primarily used for stables, though it also provides services for select risk assets such as SOL, BONK etc.

The magic under the hood looks like this:

On a 60-minute basis, Lulo rotates users' capital between protocols to ensure they receive the optimal yield.

Lulo eats the costs of these rotations, a long-term bet on the Solana ecosystem and a reduction in transaction fees. It’s worth noting that this concept isn’t feasible on a network that doesn’t have a fraction of a cent transaction fees.

Users can specify which protocols they’re open to having their assets deposited into, based on user-perceived risk. Users can also set a minimum yield at which their assets are returned to their wallets or a specific protocol.

The result of this optimisation is material. The one thousand dollars we referenced earlier that would be worth $1,078 if deposited at the start of the year into Kamino Finance, would be worth $1,112 if optimised by Lulo. This equates to an additional 4.5% in annualised yield.

The Big Apple Pay Unlock

Having recently returned from Singapore, a key Breakpoint theme that has stuck with me is the introduction of web2 native on-ramps to web3 protocols, specifically Apple Pay, Google Pay and credit cards.

If, like me, you heard these announcements and wondered what happened to Apple’s historic pushback on crypto-native applications, and their stubbornness surrounding their 30% in-app payments tax, here’s the development that makes these on-ramps possible: an announcement from Apple that it will begin letting third-party developers use the iPhone's NFC payment chip to handle transactions.

So, what does this actually mean?

There are a few features this unlocks that are game-changers for digital assets.

Users can use their crypto to make transactions via Apple Pay, as seen with the Fuse Pay card, a virtual Visa® prepaid card. Think holding stablecoins onchain earning yield, that are withdrawn and transferred as payment at the speed of light, all for minuscule fees.

More relevant to this article, however, is the ability to on-ramp fiat dollars into the DeFi ecosystem directly from a phone using Apple Pay. One example of this is Jupiter Mobile, set to launch soon, which allows for full onramp using Apple/Google Pay.

And what are the implications of this?

This is fundamentally groundbreaking. Gone are the days when retail users were required to learn about and understand blockchains to get involved. There’s no need for Chrome wallet extensions, writing down and frankly being terrified of losing seed phrases, or creating accounts with and transferring money to centralised exchanges.

In this cycle, retail can onboard directly from their phones, using verification methods they know and use daily, i.e. Apple Pay with face ID, all while the wallet experience is abstracted away from them. By this, I am referring to the ability to log in to an account with Google, Apple ID or email.

This is a web2 experience, with a web3 backend. This brings DeFi to everyone with an iPhone or an Android, with no bottlenecks. I think this is the start of the mass adoption of the original vision of DeFi.

How does this apply to Lulo?

I had the pleasure of interviewing Daniel, co-founder of Lulo, a couple of weeks back. He explained to me how Lulo is being used today, by DAO treasuries to extend runway and by degens who have taken profits or wish to earn a yield on their tax savings, but more interestingly, he informed me of Lulo’s ultimate vision.

That is, to not be seen as a DeFi protocol, but rather as a serious contender in personal finance. An application that sits beside your banking apps that’s used as what he referred to as ‘the modern way to grow your wealth’.

Connecting the dots between Daniel’s vision and the announcements from Breakpoint, it seems this vision is now a genuine near-term possibility.

There is a Lulo application in the not-too-distant future that allows everyone with an iPhone or Android to onramp capital in minutes, and begin earning, at current levels, 8.48% on their USDC. All while being able to check on their capital from their phone, receive notifications about their capital, or even spend their capital with Apple/Google Pay with all the bells and whistles of programmable account abstraction such as daily limits or only allowing the spending of interest rather than principal.

This offering is a genuine contender for being one of the largest fresh capital onramps to the DeFi ecosystem this cycle.

Challenges Ahead: What’s holding people back and how can we solve it?

Of course, it is not as simple as merely ‘build it and users will come’, there are various factors holding retail back, regardless of the improvement in UX described above.

The first issue is retail trust of stablecoins themselves. To crypto-natives, stablecoins, particularly well-established, audited stables such as USDC, are as good as hard dollars. To those outside of the space, however, the very fact that they’re digital, let alone issued by a non-government entity, sends alarm bells ringing.

To begin onboarding retail capital through onchain savings offerings, we must first surmount this hesitation to trust stablecoins. Thankfully, there is a stark difference between the stablecoin offerings of this cycle and those of the last cycle.

Circle, commanding 20.48% of the stablecoin market share, equivalent to $35.3b, with its flagship USDC product has taken strides to prove its trustworthiness. It’s a licensed and regulated entity with money transmitter licenses across the United States, following financial regulations set by agencies such as FinCEN.

Moreover, Circle takes reporting and transparency incredibly seriously. USDC is fully backed by highly liquid fiat reserves held separately from Circle’s operating funds at leading financial institutions. Reserve holdings are then fully disclosed weekly and audited by a Big Four accounting firm monthly to ensure that the value of USDC reserves is greater than the amount of USDC in circulation.

On paper this is about as trustworthy as a financial institution could get, perhaps even more so than the banks retail are currently opting to trust their capital with. The issue though, is getting this message across to retail.

This is where an alternative offering comes into play, PayPal’s PYUSD. PayPal has a fantastic reputation amongst retail, in fact, its reputation is built specifically around being a trusted and innovative digital payment platform.

For this reason, I see PYUSD as being a more likely candidate for retail adoption. There’s built-in trust from the offset. To date, PYUSD has grown to command a 0.4% share of the stablecoin market, equivalent to ~$700m. I believe this will grow materially over the coming cycle with retail drawn to the trustworthy brand they’ve grown to become so comfortable with.

Assuming retail users can grow to trust stablecoins, either through education of Circle’s stellar operation or by recognising brands such as PayPal, the next obstacle to superior onchain savings rates is the trust of the DeFi protocols themselves.

While lending assets in protocols such as Kamino, Drift, MarginFi and Save are done so on an overcollateralised basis, essentially removing counterparty risk, users are still vulnerable to smart contract risk. This is the risk that the protocols themselves are hacked, resulting in lost user funds.

With over $1.1b lost in DeFi protocol exploits in 2023, it’s no surprise that this remains a large bottleneck for retail users. Truth be told, there are limited ways to mitigate this risk, inherent in a system built on code.

Daniel, the co-founder of Lulo, referenced automatic responses built in to the Lulo protocol, i.e. if a pool utilisation gets too high (90%+) they automatically withdraw capital as this is seen as a leading indicator of hacks. This is a start. It was also mentioned that Lulo is exploring the potential of spreading user capital across protocols to mitigate risk while still earning high (but not optimal) yield.

There is one glaringly obvious way to mitigate this risk truly, insurance of the capital deposited. Nexus Mutual has long pioneered insurance in the DeFi ecosystem. Unfortunately, I am yet to come across a DeFi insurance protocol that offers coverage for Solana-based DeFi protocols. This seems a crucial piece to the Solana DeFi puzzle.

Imagine when logging in to this hypothetical Lulo application that it is clearly advertised that your deposit is insured against hacks, with insurance costs reduced from yield generated in an opt-out capacity. This immediately removes anxiety for users.

Please reach out if you’re building insurance products onchain within the Solana DeFi ecosystem. I’d love to get a better understanding of developments in this space.

Closing Thoughts

What if your dollars could actively work harder for you without leaving your phone?

With protocols like Lulo optimizing yields and seamless onramps like Apple Pay making access smoother than ever, the barriers between crypto and everyday personal finance are crumbling. The question is no longer if onchain savings will be a part of our financial future, but when.

That being said, we can’t ignore the hurdles still ahead. Trust, both in stablecoins and DeFi protocols, remains a fairly seismic hurdle to overcome. But with transparency from industry leaders like Circle and familiar names like PayPal stepping into the space, that trust gap is already narrowing.

Let’s Chat

If you’re building apps in the DeFi ecosystem, or have thoughts on what I’ve written, let’s chat! My DMs are open @0xbenharvey.

Disclaimers

The content in this article, including research, analysis, data, and other material, is provided strictly for informational purposes. This article is not intended to serve as financial, investment, trading, or any other form of advice. Readers are advised not to base financial or investment decisions solely on the information herein and should seek professional financial advice. The author makes no guarantee as to the accuracy or reliability of the information for any financial decision-making purposes.