Welcome to Decentral Park’s new research sub-newsletter: In The Weeds.

This weekly instalment will focus solely on key technical developments and themes within Web3, keeping you ahead of the game on upcoming trends.

Let’s get stuck into this week’s key highlights.

1: Cashtokens

What is it? Innovation atop the Bitcoin network has been paramount the past few weeks, with a narrative surrounding BRC-20 tokens and RGB releases. In case you missed it, we dived into this topic in last week’s ‘In the Weeds’.

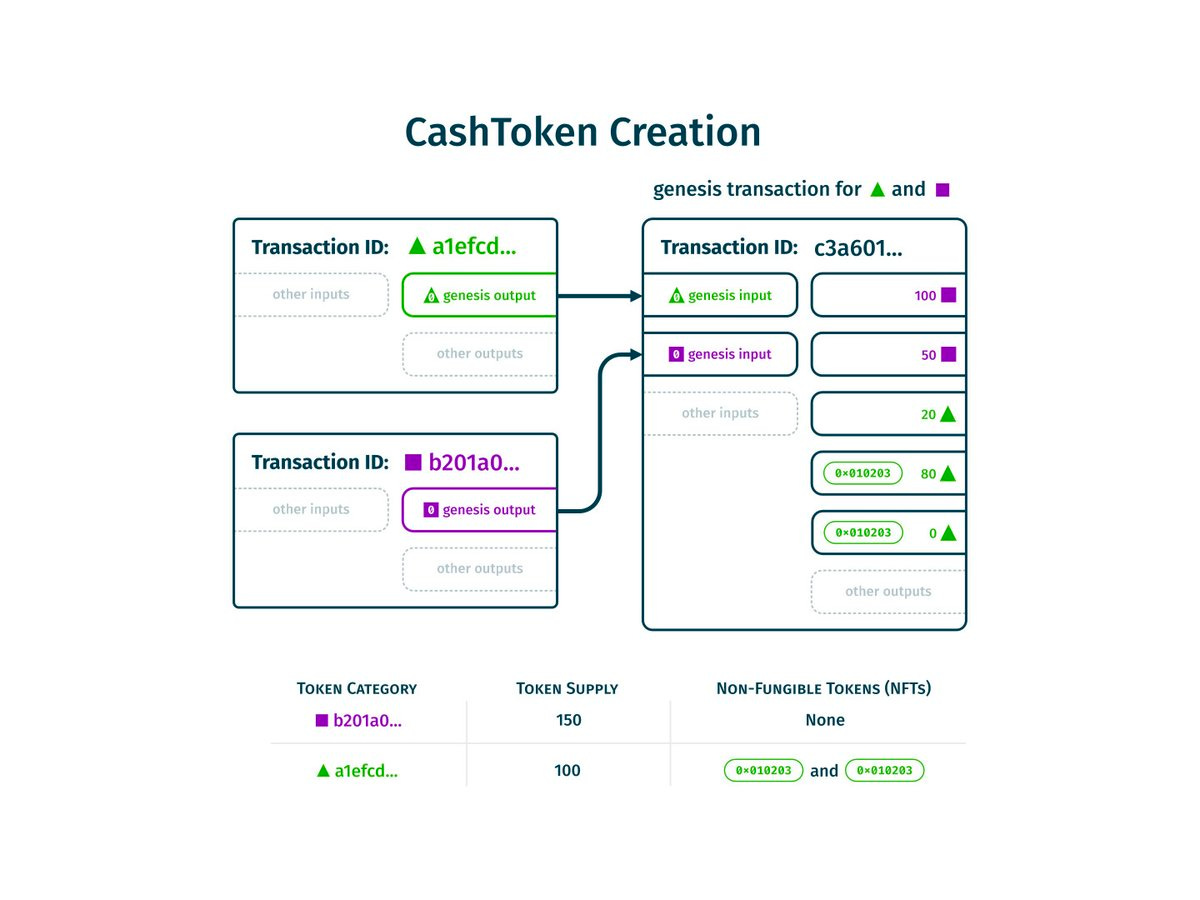

This week, however, we’ll be highlighting innovation in the Bitcoin Cash ecosystem, a hard fork of the original Bitcoin chain. Bitcoin cash enthusiasts were ecstatic to see the recent network upgrade completed on May 15th, which featured the Cashtokens CHIP.

Cashtokens can be thought of as digital assets that operate within the Bitcoin Cash network beyond the BCH token itself. In much the same way as BRC-20 tokens on the Bitcoin network, issuing Cashtokens is permissionless, and they retain all of the properties associated with digital assets, i.e. censorship-resistant etc.

So, what’s so interesting about Cashtokens? The answer is that they differ from the simplistic BRC-20 token standard on Bitcoin, in the sense that they enable UTXO-based smart contracts on the network. The result is that these tokens are programmable with logic and move beyond the simple SoV structure.

If you want to dive into the mechanics behind UTXO-based smart contracts, I recommend diving into this resource.

This moves Bitcoin Cash away from the Bitcoin Network in nature, and closer to a smart contract network such as Ethereum. We’ve seen on such smart contract platforms the potential use cases, the obvious one being decentralised applications, such as decentralised exchanges native to the Bitcoin Cash network, but importantly

Cashtokens gain the ability to represent assets, such as wBTC, or physical assets such as currencies, stablecoins etc. The upgrade even enables complex implementations such as bridged sidechains.

Why is it important? The Bitcoin Cash network is bringing features we’ve come to know and love in mainstream smart contract platforms, such as transaction-level sharding on both data and execution, account abstraction etc.

Despite this, its transactions sit at a fraction of those seen on the Bitcoin and Ethereum network, performing ~32x and ~955x fewer transactions respectively in the past 24h.

With the Bitcoin Cash network being hyper-efficient, having the capacity to execute 25k transactions per second, and the introduction of Cashtokens enabling scalability solutions akin to the Lighting Network on Bitcoin, the Bitcoin Cash network is ripe for adoption.

Cashtokens may be the catalyst needed to achieve its adoption.

Where does it go from here? I believe with the introduction of UTXO-based smart contracts, we will see an application-based ecosystem develop on the Bitcoin Cash network over the next 12 months. This should translate to gains in fundamentals such as transactions and users on alternative networks.

With the much larger, though slower moving, Bitcoin network failing to establish utility outside of SoV tokens to date, holding the ‘Bitcoin name’ could work in Bitcoin Cash’s favour. This is particularly true with the introduction of Cashtokens given the ability to hold a wrapped version of BTC on the chain, and even pay fees on the chain utilising this token leveraging account abstraction. BTC maxis may have their solution to utilising DeFi while retaining BTC as a base asset.

Decentral Park Market Pulse

Want real-time updates and analysis on the digital asset market? Join Decentral Park’s Market Pulse group by clicking the link below:

2: Gravita Protocol

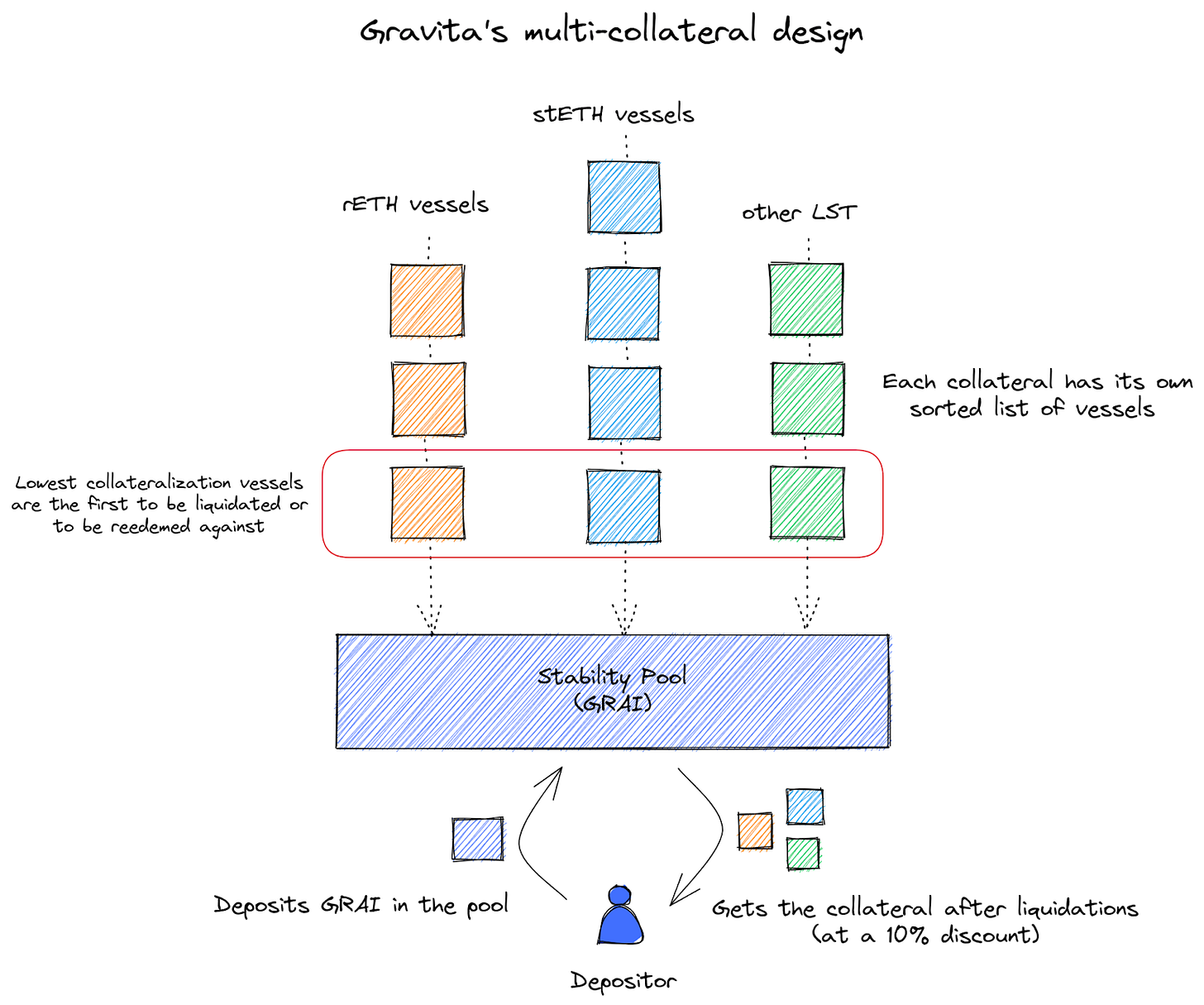

What is it? Gravita Protocol is the latest material development in the world of LSTFi, which refers to the growing ecosystem of DeFi legos built upon the LST ecosystem. Being a fork of the well-known Liquity protocol, Gravita is a decentralised borrowing protocol built on Ethereum that offers interest-free loans secured by LSTs such as stETH and rETH.

This takes the structure of Liquity a step further, by allowing users to borrow $GRAI, the protocol’s USD-pegged stablecoin while retaining their staking yield on the underlying ETH asset. Of course, this comes with the added risks (i.e. smart contract risk etc.) associated with the underlying LST protocol.

My personal framing for Gravita, similar to my framing of Liquity, is that it acts as a utility protocol within DeFi, as opposed to a profit-focused protocol. This is based on the fact that loans are interest-free, with protocol revenue being derived only from a 0.5% borrowing and redemption fee. This framing is strengthened by the fact that Gravita is governance-minimised, striving for pure immutability.

You may be wondering where the liquidation revenue accrues… that would be to the depositors of the stability pool. These depositors will provide $GRAI to the pool and receive liquidation assets at a 10% discount in return. To dive into the mechanism behind peg stabilisation for $GRAI, I’d recommend diving into this resource.

Why is it important? LUSD, the Liquity-based stablecoin, has grown to command $285.24m in TVL. This is insignificant compared to centralised stablecoin TVLs, such as USDT’s $82.77b market capitalisation.

I believe the halting factor for LUSD has been the trade-off for users between earning yield on their ETH, at ~6%, and instant liquidity. This is particularly true given ETH holders are predominantly long-term aligned with the Ethereum network, and thus the value of its native token, and so opt to increase their share of the network's native token over instant USD-pegged liquidity.

Gravita Protocol acts to remove this trade-off.

Given how comfortable the DeFi ecosystem has become with LST exposure (Total MCap is $16.425b) I see no reason for the use of LSTs as collateral to deter users from a risk perspective. The implications of this trade-off removal potentially being that the vision of Liquity is realised through Gravita, with $GRAI becoming the defacto ETH-based stablecoin borrowing protocol.

Where does it go from here? Gravita is yet to launch, though has been gaining traction both in terms of publicity and integrations. I would expect given the ramp up in coverage that the protocol will launch before EOY.

I believe Gravita will ultimately overtake its older brother Liquity in terms of TVL based on the ability to retain ETH staking yield while borrowing against the asset. Further than this though, I believe a material portion of the $16.435b LST MCap will ultimately be deposited to Gravita. For context, should this portion be 5%, Gravita, and therefore $GRAI will command $821.25b in TVL at current levels. This would place $GRAI in the top 8 stablecoins by TVL behind FRAX.

We could potentially have a new significant decentralised USD-pegged stablecoin competitor on our hands.

Decentral Park’s Latest Market Research

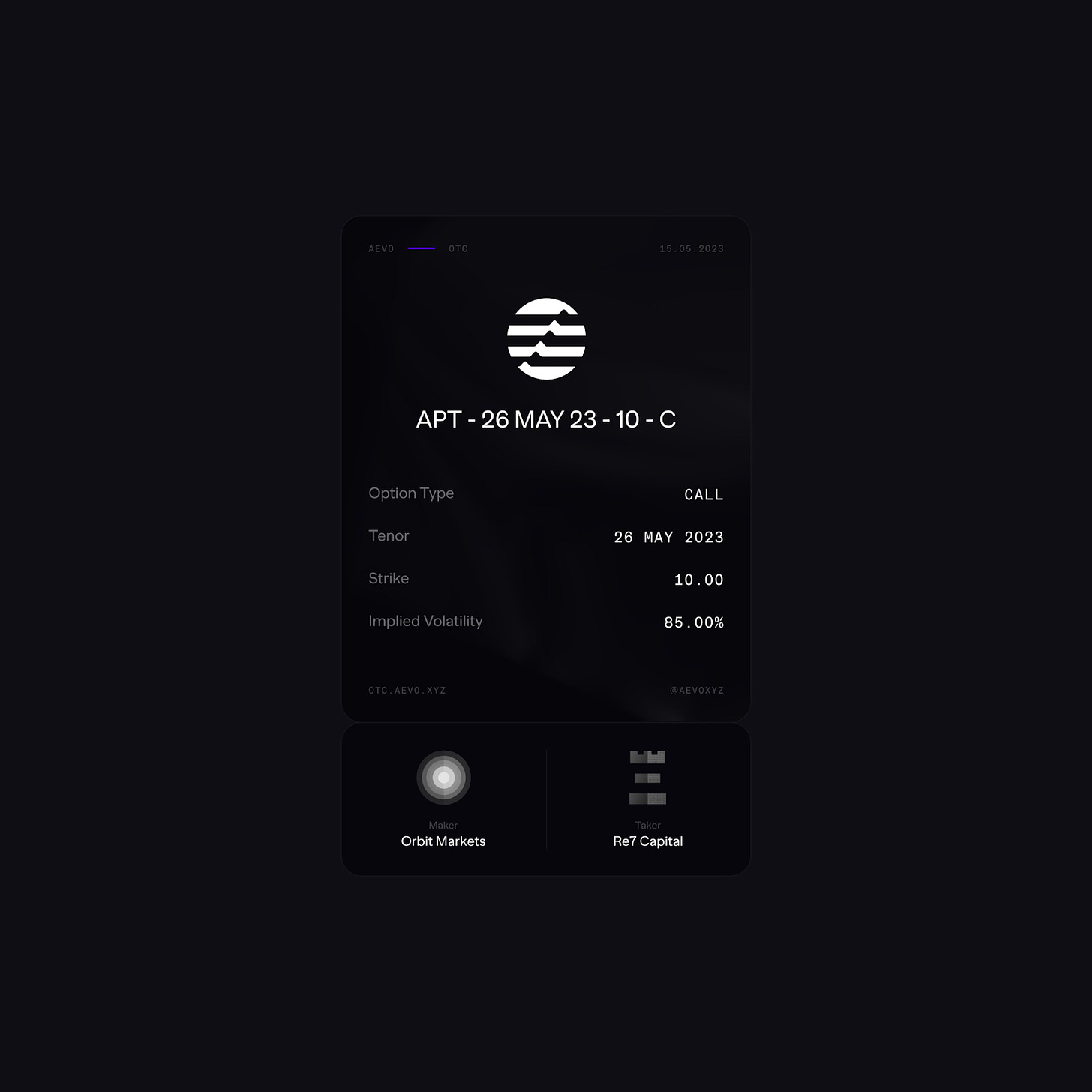

3: Aevo OTC

What is it? Aevo is an onchain options trading protocol deployed to Ethereum that launched on the 10th of April 2023. In the month the protocol has been active they’ve accumulated $2.5m in TVL, considered to be impressive without the help of liquidity mining incentives.

On the 15th of May Aevo announced its upcoming product release, Aevo OTC. This will be the first platform that allows DeFi users to trade altcoin options onchain with institutional-grade liquidity providers. This fills a gap in the onchain options market, currently geared towards high-cap names such as wBTC and ETH.

Previously, users looking to trade altcoin options would be required to onboard with multiple market makers and OTC trading desks, taking the process entirely offchain. Aevo is looking to remove these inefficiencies by leveraging existing DeFi mechanisms and the underlying efficiency of onchain interaction.

Aevo OTC leverages a margin system that’s secured entirely onchain. This system requires a 30% initial margin in USDC from liquidity providers, in conjunction with a dynamic variation margin system that automatically prompts market makers should additional margin be required.

By posting collateral onchain it is fully transparent and auditable. While this may seem trivial, it is an element that has become increasingly important given events with FTX and similar entities over the past 12 months.

Upon launch, users have the ability to trade across weekly, biweekly and monthly maturities across a variety of tokens. While the tokens offered are primarily altcoins, ranging from Alt. L1s such as SOL and DeFi protocols such as LDO, down to meme coins such as DOGE.

A minimum notional value per trade of $10k has been coded into the Aevo OTC smart contracts, although it is expected that as the protocol grows this will be adjusted to cater for a wider range of trade sizes. This is true also of the maximum limits per trade placed on ETH and BTC of $2.5m and for altcoins $1m.

Why is it important? While a complete options market is taken as standard within TradFi, the options markets within the digital asset space, particularly those onchain, are limited. Typically onchain markets offer exposure only to high-cap names such as ETH and wBTC.

In my opinion, the introduction of Aevo OTC acts as a crucial step in the development onchain options markets. Tokens outside of ETH and BTC are growing, with a market capitalisation of $352.5b at the time of writing. Users are calling out for alternative financial products to speculate on these assets, and Aevo has finally delivered one that leverages onchain efficiencies.

This is another step in the development of the onchain financial products suite as the DeFi infrastructure matures.

Where does it go from here? An obvious direction in which I expect this to head is that we will see further assets listed on Aevo OTC, along with competition rise in the form of alternative altcoin option trading venues.

Beyond this, Aevo OTC has plans to build out its simplistic options trading venue by introducing a secondary market in which users are able to sell their options, as well as the flexibility to choose counterparties and customise margin requirements.

As aforementioned, I see this as a step in the maturation of the DeFi ecosystem as a whole, and as such the introduction of an onchain altcoin options platform acts to enhance the value proposition of the DeFi ecosystem.

Key Decentral Park Links:

> Decentral Park Research Hub

> Decentral Park Market Pulse

> Decentral Park Website

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.