It’s that time of year where Decentral Park takes a step back and reflects on the crypto market and Web3 developments over the past 12 months.

2022 has been quite the year for crypto.

Following on tradition (and by popular demand), we have compiled key trends that represented the year, why we think they were defining, as well as our thoughts on what it all means looking forward.

So without further ado, we bring you: 2022: 22 Graphs That Defined the Year for Crypto.

Happy holidays and a happy new year!

- Decentral Park Team

1: Daily Exchange Volume

The what: Global daily exchange volume on crypto exchanges (USD) since January 2020. This headline metric has always acted as a good proxy measure for market interest and liquidity. Troughs in volume coincide with troughs in sentiment.

Why it was defining: We can see a continued decline in the metric over the course of 2022, with lower peaks and lower lows (now at $11.7B). Macroeconomic factors and several capitulation events in 2022 meant that both market interest and liquidity were set on a road downwards.

Where do we go from here? Volumes to remain correlated with price action. With the reasonable likelihood of a global recession in 2023, volumes are unlikely to sustain much above $20B in H1. A change in momentum to the upside will likely come as markets anticipate a reduction in interest rates.

2: Crypto Market Capitalization vs. Fed Net Liquidity

The what: Global crypto market capitalization vs. the Fed’s net liquidity. Net liquidity is defined by taking the Fed balance sheet, less the TGA account and overnight reverse REPO agreements. Larger changes in TGA and RRP since 2020 has meant factoring these have been important to actually measure the available liquidity that can circulate in the economy.

Why it was defining: The theory is that market liquidity cycles (and M2 supply) have always driven cryptoasset markets since their genesis. Tighter monetary policies to cap price (e.g. QT) by central banks has negatively impacted net liquidity over 2022.

The correlation between the crypto markets and net liquidity is startling, implying that a key driver in cryptoasset performance over the year has been the market liquidity cycle - at least on the US side. The recent divergence since November reflects the FTX contagion overhang on the cryptoasset market.

Where do we go from here? Fiercer competition for funding (through the combined effect of QT and higher rates) may mean more dollars are drained from the Fed’s reverse repo facility. However, over $2T reflects excess liquidity in the system that the Fed may look to do more. Fed will continue to trim $95B/month from its balance sheet for the coming months meaning skew is to the downside. Fed net liquidity should revert back to trend with crypto facing an uphill battle into a recession.

3: Crypto vs. Nasdaq 100

The what: Crypto market cap remaining positively correlated with growth tech stocks indices like NDQ throughout the majority of 2022 - but not always.

Why it was defining: The Terra/Luna/3AC collapse helped drive crypto markets to decline 23% in the month of May. NDX declined 8% when LUNA collapsed from $82 in mid-May demonstrating the relatively close relationship between both markets.

It also showed that crypto had a negative skew - there are clear instances when the crypto markets would fail to gather steam post a LUNA or FTX collapse while NDX would recovery with more bullish macro sentiment (see breakdown in positive correlation). Down days for NDX would also likely mean down days for crypto.

Where do we go from here? A continuation of the same pattern into 2023. Any crypto black swan events or high contagion-style events from here on out will drive more negative correlations after the event given the negative sentiment is more sticky within crypto than outside of it.

4: Crypto Funds Global Flows

The what: The total dollar flows into crypto funds globally since 2011. Total fund flows was $85.8m (up until December 8th) - marking a 99% decline from 2021’s total flow amount.

Why it was defining: It reflects the collapse of market interest in crypto more broadly from investors as risk assets took an allocation ‘back seat’. This also shows how popular the cash & carry trades of Grayscale Trusts were that ended in 2021. Still, a large number of ETPs took in cash despite their market drawdowns.

Where do we go from here? Fund flows will tick higher ($1B+) in 2023 if the market anticipates interest rate cuts. It will take several years to reach back to 2021 levels if an extended recession ultimately plays out.

5: Binance Volume Dominance vs. BUSD Supply

The what: Binance’s BUSD supply growing to new ATHs of 22.2B while Binance exchange volume dominance rose to new ATHs of 60%+.

Why it was defining: The growth of BUSD supply speaks to Binance’s continued blitz scaling and out-side-the-box product strategy in 2020. These included auto-conversion of USDC to BUSD for users to ‘enhance capital efficiency’ in September. At the same time, Binance continued to dominate in the CEX market by volume. The collapse of its main competitor, FTX, certainly helped but the uptrend was already being printed.

Where do we go from here? Binance’s strategies are coming into question as USDC withdrawals are now at the whim of slow legacy banking infra (needing BUSD to sell into cash and buying USDC). Lack of sufficient audits, regulatory pressure, and a much more skeptical market may lead to Binance’s dominance finally easing off in 2023.

6: BTC Realized Volatility

The what: Bitmex’s 7D BTC realized volatility index remaining low in H2 2022.

Why it was defining: BTC (beta) vol remained relatively elevated for the first half of 2022 and extended the same pattern seen throughout 2021. The intense deleveraging events from May onwards (incl. LUNA, 3AC) drove down speculative activity. Account balances being wiped out for users (e.g. FTX) likely suppressed volatility further in an already concerned market.

Where do we go from here? Realized vol has fallen to a near yearly low (13.5) and remains in a zone that has often preceded high vol action. The skew is to the downside given the continued macroeconomic, regulatory, and fallout pressures on the cryptoasset market.

7: UST/USD vs. LUNA Supply

The what: Terra’s UST peg to USD vs. LUNA supply. UST began to lose its peg on the 7th-8th of May as large volumes of the stablecoin began to leave Curve. On May 9th, the Luna Foundation Guard were seeking to protect the UST peg by deploying $1.5B. With LUNA acting as the ultimate back stop for UST, we saw new issuance of LUNA soar to <16T units.

Why it was defining: It represented the final nail in the coffin for ‘pure’ algorithmic stablecoins experiments. The ‘pure’ aspect meant that in just 4 days, it was all over for Terra.

It also grabbed the attention of regulatory as much as investors. Just 4 months later, the House Committee drafted legislation to regulate stablecoin that put a two year ban on algorithmic stablecoins like UST.

Where do we go from here? A market that becomes ever more hungry for fully collateralized stablecoins. Companies like Circle will lean into this momentum by doubling down on existingTradFi relationships. As for Terra - nothing but a distant memory. We also find evidence of FTX’s role in the network’s collapse.

8: L2/Ethereum L1 TVL Ratio

The what: Total-value-locked (TVL) on L2 outpacing TVL on Ethereum L1. L2 dominance climbed to new ATHs (7.8%) despite USD-denominated TVL declining (in line with broader market direction).

Why it was defining: It demonstrated that L2’s were retaining more locked value than their L1 counterpart in 2022. The launch of new L2 network tokens (e.g. Optimism) and their liquidity incentive models were key drivers in 2022’s continued growth. L2’s are becoming the future of Ethereum.

Where do we go from here? L2/L1 TVL ratio that climbs to new ATHs in 2023 (>15%) driven by organic desire to transact on more scalable foundations despite potentially low gas costs on the L1 (as has been the case for a number of periods throughout 2022).

9: L2 TVL/Alt L1 TVL Dominance

The what: The dominance of L2 total-value-locked vs. alternative L1 growing from 3% to 10% over 2022.

Why it was defining: The technological and philosophical battle between Ethereum L2s and alternative L1s has intensified over the past 12 months. 2022 marked the first real liquidity growth of L2s relative to alternative blockchains thanks to the continued development around rollups. This graph would imply that, based on current trend, all roads lead back to Ethereum.

Where do we go from here? The proliferation of rollups and incentive schemes that drive this ratio higher throughout 2023. TVL outside of L2s to start consolidating around app-chain structures like Cosmos where alternative data availability layers like Celestia can support the growth of both market segments.

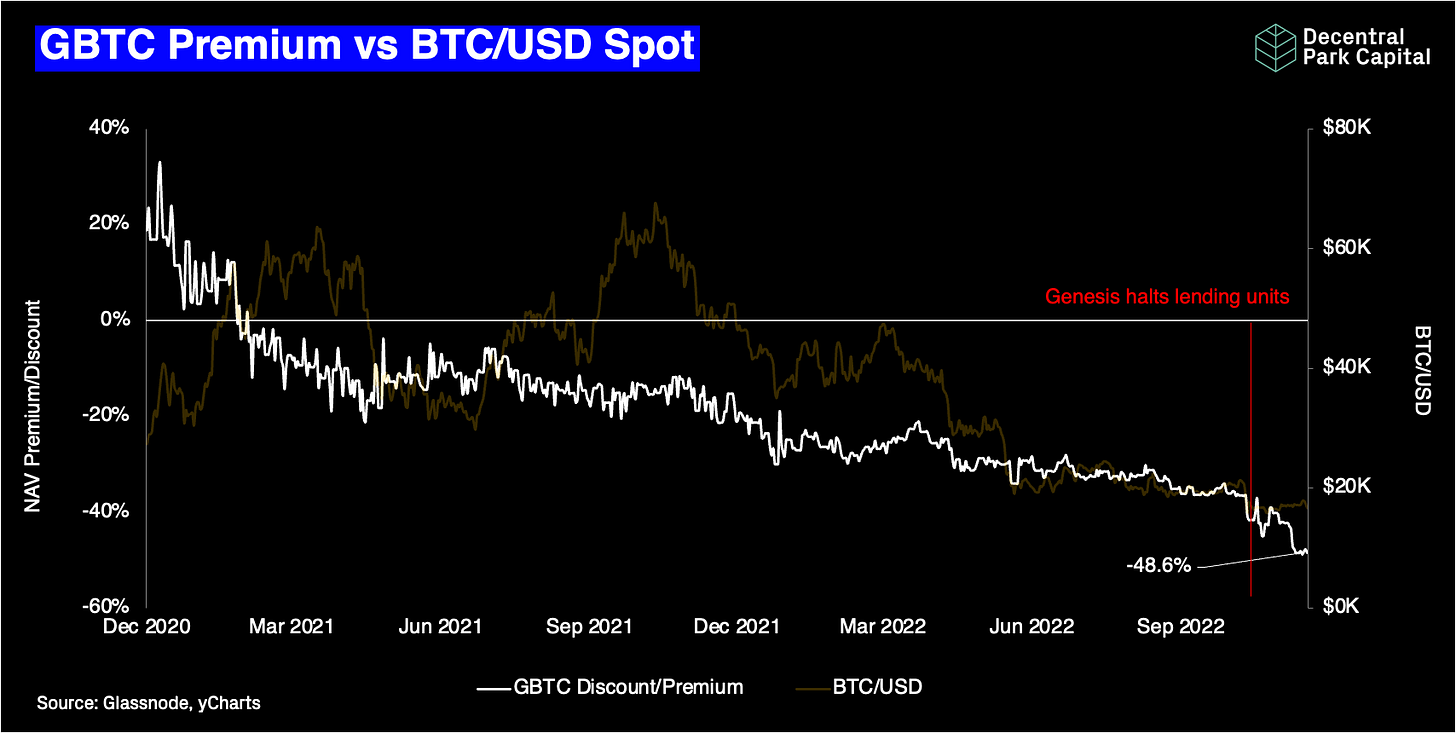

10: GBTC Premium vs. BTC/USD

The what: Grayscale’s GBTC premium to NAV making new ATLs throughout 2022.

Why it was defining: The Grayscale cash & carry trades were no longer viable in early 2021 as supply outstripped demand for the first time. The bear market deterred net new investors who could access better alternatives for crypto exposure while private placement investors continued to sell their shares.

2022 was also the year it was revealed that a significant number of GBTC shares were used as collateral for larger funds (e.g. 3AC) that declined 85% in value from their peak in February 2021. Widening of the discount accelerate after Genesis halted its lending business where investors feared forced selling ($600-800m of crypto collateral) by DCG/Genesis may ensue to raise cash. The reality is, these events only accelerated the prior discount trend.

Where do we go from here? Lack of public information makes it difficult to predict outcomes. If GBTC collateral are with Genesis (vs. DCG) then there is greater risk of the lender being forced to sell shares over 2.5 years+ in order to pay creditors. Reg M or unwinding of Grayscale Trusts would result in up to ~$11.2B of BTC being sold on the market. Oh, and the SEC will not approve of a spot ETF transition anytime soon.

11: DEX/CEX Volume Ratio

The what: Global decentralized exchange volume outpacing centralized exchanges in from 9% in September to 11.7% in November.

Why it was defining: After a bearish period for DEX activity, growing concerns around centralized players and asset security drove a reversal in the DEX/CEX ratio with the largest jump occurring in the month when FTX collapsed. The shift in the ratio towards the end of 2022 reflected the shift in sentiment around user self custody.

Where do we go from here? A market that re-addresses the question of exchange safety. DEX/CEX ratio may remain suppressed below 15% for some time but with the ratio unlikely to break to new lows since 2020. Regulatory pressure on DEX teams and users would be a likely driver for the latter if it occurred.

12: BTC STH-SOPR

The what: Bitcoin’s short-term holder spent output profit ratio (SOPR) being suppressed under 1 for 2022. The metric reflects the degree of realized profit for all coins moved on-chain.

Why it was defining: Using short-term holders for SOPR gives us insight into traders who have just entered the market and therefore their sentiment and behaviour. SOPR uses 1 as resistance for prolonged bearish periods while using 1 as support for more bullish periods. Every rejection of 1 in 2020 indicates that, on average, short-term traders were selling BTC close to their cost basis or at a loss at every opportunity - every market rally the year had to offer.

Where do we go from here? A STH-SOPR that stays suppressed below 1 until a more constructive market forms which will likely start at the first market ‘whiff’ of more accommodating monetary policies.

13: Global Stablecoin Volume vs. Supply

The what: Aggregate stablecoin volume vs. total free float supply. Aggregate volume has 2x over 2022 to new ATHs ($35B; 14d MA) while global free float supply of stablecoins has fallen 14% over the same period.

Why it was defining: 2022 was the year that stablecoins showed they had achieve true product-market-fit even during a bear market. We saw a higher transaction volume despite severe deleveraging events and the collapse of Tier 1 exchanges. Higher transacted volume vs. a lower supply means fewer stablecoin units are being transacted more regularly (higher velocity).

Where do we go from here? Maintaining the current trend into 2023. A $40B peak in daily aggregate stablecoin volume with lows keeping above $20/daily.

14: DeFi/ETH Ratio

The what: DeFi market capitalization/ETH’s market capitalization ratio making lower highs and lower lows over 2022.

Why it was defining: It highlights the struggle that the $35B DeFi sector has had over 2022 relative to the broader crypto market. DeFi saw an 82% decline in its market capitalization from its ATH level in November 2021 ($200B), falling at a faster rate than ETH (beta).

Terra’s collapse and contagion from 3AC and centralized lenders in summer paved the way for the single largest drop in the ratio. However, regulatory headlines like the leaked CFTC bill mid-October equally made an impact causing the ratio to fall 4% despite the sector growing $10B over the same period. Therefore, investors were starting to allocate relatively less to the sector due to the growing regulatory pressure.

Where do we go from here? A DeFi/ETH ratio that struggles to break above 25% in the near-term. Market deleveraging has likely completed meaning the high rate of decline may level out. That said, investors allocating to majors as more liquid proxy plays for the next adoption cycle may put continued pressure on the ratio near term.

Still, the sector keeps pushing ahead with many household brands embracing this blcokchain like Disney and Starbucks. DeFi also has everything to gain from CeFi’s consolidation.

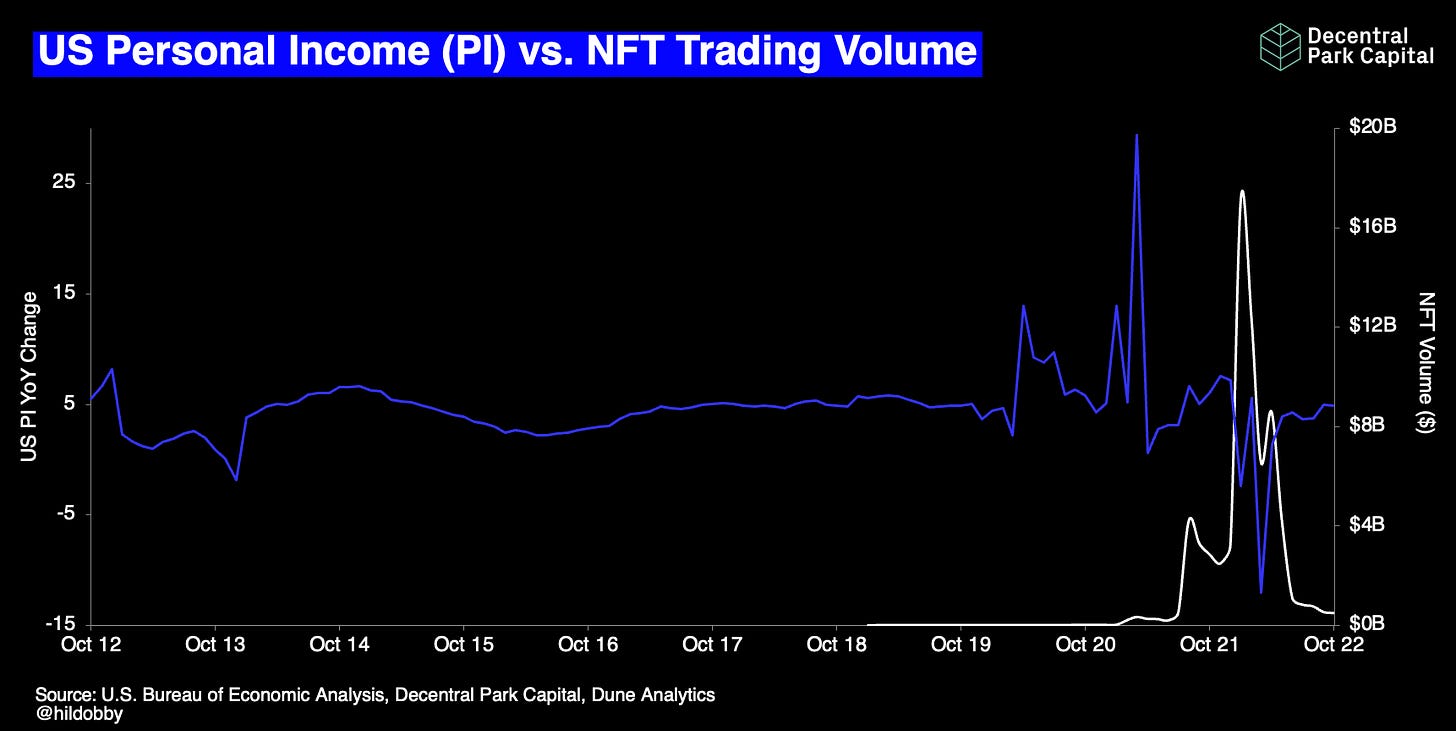

15: US Personal Income vs. Global NFT Trading Volume

The what: The US personal income YoY rate of change vs. global NFT trading volume.

Why it was defining: NFTs, representing a high risk sub-sector within a high-risk market, should be susceptible to the rate of change of personal income. Higher inflation and muted real wage growth has been the perfect cocktail for lower disposable income.

There is some evidence of this with US PI often leading NFT trading volume by 4-6 months. Stimulus checks and QE meant more money was spent on higher risk assets.

March 2022 also printed the lowest rate of change in US PI on record just as the NFT monthly volumes were surging to new ATHs ($16B+).

Where do we go from here? This model implies that a low or negative PI rate of change may hinder significant NFT adoption. Weakness in the consumer sector is weakness for NFTs. We are unlikely to see new NFT monthly volumes ATHs in 2023 if a global recession plays out.

16: FTX Hot Wallet Withdrawals

The what: Scatter plot of USDC and USDT withdrawals from an FTX exchange hot wallet from the 7th-8th November 2022.

Why it was defining: Data revealed an initial rush to the exit doors for high-value USDC transactors on the 7th of November. This came to an abrupt stop while lower value transactors continues to pull out dribs and drabs on the 8th. The last higher value cluster was for ‘certain customers’ which some have defined as Bahamian users.

FTX paused withdrawals for the final time on midday, November 8th, 2022.

Where do we go from here? A multi-year bankruptcy process.

17: FTX/USDT Binance Order Book

The what: Order sizes for FTT/USD at different price levels on Binance from the 2nd-8th November 2022.

Why it was defining: It provided on-chain evidence (contextualised with off-chain data) that at least one market participant wanted to support the price of FTT - the native cryptoasset of the FTX exchange. Strong support came in at $23.50 prior to Caroline (Alameda CEO) offering to buy FTT at $22/unit. It was a damning collection of evidence - you don’t tell someone a price level publicly unless you have a lot of confidence that you need that price.

Where do we go from here? FTT trades in an asymptotic line to 0 over time with limited venue access outside of decentralized exchanges.

18: Solana Asset Performance Post-FTX Collapse

The what: Solana and Solana-based ecosystem assets vs. market beta (BTC, ETH, Total MCAP). Solana-based assets fell more than 50% off the back of FTX’s collapse with SOL itself declining 60%.

Why it was defining: The cluster of Solana asset performance vs. beta highlighted the FTX/Alameda vulnerability Solana and its ecosystem had all this time.

Where do we go from here? A slow recovery of trust and investment back into Solana where a number of Solana assets will be tied up in several bankruptcy proceedings.

19: Bitcoin Hashprice vs. Mining Difficulty

The what: Bitcoin’s rising hashprice (hash rate/price) vs. a suppressed BTC/USD ratio and climbing mining difficulty.

Why it was defining: The Bitcoin mining market became distressed to extreme levels. Bitcoin hash rate surged 61% from Jan to its ATH peak (273m TH/s) while BTC/USD fell 62% (divergence).

The higher hashprice ratio rallied to levels last seen in 2020 and entered a zone that coincided with local market bottoms (miners finish capitulating). Yet, the convexity of the mining market has meant unprofitable miners are forced out to bankruptcy.

The big difference from then to now is tighter market conditions and a harsher macroeconomic environment.

Where do we go from here? A consolidation of Bitcoin miners to 3-5 major (and profitable) players, potentially guided by increased M&A activity. New BTC/USD lows likely to mean new ATH is hashprice and a more extended miner capitulation period.

20: Ethereum vs. Ethereum Classic Hash Rate

The what: Ethereum 1 hash rate trend vs. Ethereum Classic’s hash rate trend since March 2021. Red area signifies the ETH merge.

Why it was defining: The ETH merge marked the first mainnet network switch from Proof-of-work (PoW) to proof-of-stake (PoS) ever in history.

This upcoming transition for Ethereum during summer meant miners were soon to be out of a job. Ethereum Classic which uses the same mining algorithm was the next best choice and began moving several months prior to the merge event in September.

The only problem was ETC’s market cap was just ~2.5% that of ETH1’s and trivial network activity that couldn’t bring in tx fees or sustain interest by exchanges. Ethereum 1 shed off its mining skin and overburdened Ethereum Classic’s mining environment by creating an overly competitive mining landscape relative to the USD rewards gained by those USD-denominated operators.

Miners began to unplug unprofitable machines with the network mirroring Ethereum 1’s falling hash rate trend throughout 2022.

It also highlighted the self-sufficient nature of PoW including for a mid-flight consensus layer switch.

Where do we go from here? A continued decline of hash rate for Ethereum Classic where resource commitment falls back to pre-merge range of 200 TH/s (all else equal).

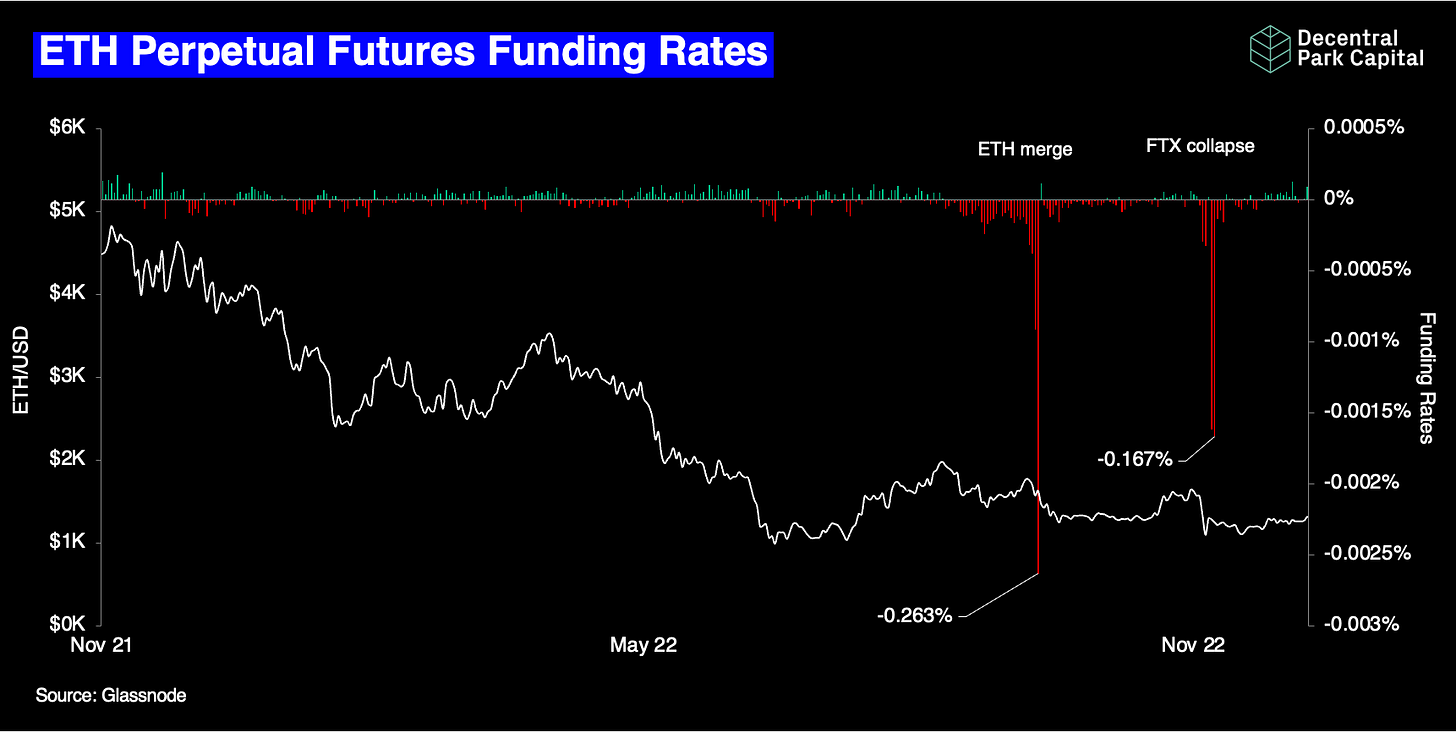

21: ETH Perpetual Futures Funding Rates

The what: Aggregate funding rates vs. ETH/USD. ETH perpetual markets saw their most negative funding rates periods in 2022 on two distict occasions.

Why it was defining: The first extreme prints occurred during the ETH merge leading up to September. Traders became opportunistic in their positioning by perceiving the ETH POW token as a free call option. By hedging out the underlying but holding physical ETH, they could claim these units in a delta-neutral way.

The second was much less predictable. Traders who were unable to withdraw their assets from FTX also became opportunistic by shorting ETH outside of FTX while being long ETH on FTX to construct a ‘synthetic FTX withdrawal trade’.

These perfectly captured the growing role of the futures market within crypto - whether it was for anticipated events or more ad-hoc. Investors became more sophisticated.

Where do we go from here? A normalization of funding rates for ETH barring any negative events (e.g. further exchange downfalls).

22: Newly Listed Cryptoasset Performance Since Launch

The what: High profile cryptoasset launches benchmarked to 1st day of listing. Regardless of the token launch strategy or valuation, all tokens are on track to finish the year in the red.

Why it was defining: A broadly risk-off environment meant investor allocations wasn’t enough to offset supply hitting the market (low free float in early days).

But it also speaks to the continued ineffectiveness of launch strategies. Tokens like OP, HOP, and AP were all example of high profile airdrops but research into prior airdrops have concluded airdrop strategies are largely ineffective at retaining users and their respective network contribution.

Where do we go from here? Developers taking this growing list of failed airdrop use cases to iterate of subsequent models with the focus being on how better incentivise the community to participate and continue to participate in network contribution.

BONUS: Web3 Exploit Count & Value

The what: Total number of exploits vs. total USD exploited for Web3 protocols since 2020. Total exploits for 2022 declined 39% (38) while total amount exploited grew by 16% ($2B).

Why it was defining: One take is that we have done little to prevent exploits - it speaks to the nascency of the space.

However, a more interesting take relates to Web3’s multi-chain infra. 2022 was the year that we saw bridge activity rally. They also represented the clearest honeypots as large amounts of value was locked and represented on their non-native chain. 2022 saw Nomad and Wormhole bridge be exploited for a combined $526m. In other words, we saw larger exploits on single-high value corners of the Web3 ecosystem.

Where do we go from here? Similar levels of exploited amount in 2023, despite best efforts by developers. As we’ve often heard many times before - these things take time to mature.

DISCLAIMER: This does not constitute legal, tax, or accounting advice of any kind and should not be relied upon as such. All links are open source and property of the respective creator, not the author of this material. This is for discussion purposes only. You should consult your own legal counsel and independent advisors with respect to any and all matters. The ideas and concepts are presented here by the author and are views of his own and not that of any other person or entity.

Although the material contained in this material was prepared based on information from public and private sources that the author believes to be reliable, no representation, warranty or undertaking, stated or implied, is given as to the accuracy of the information contained herein, and the author who prepared this material and the information herein expressly disclaim any liability for the accuracy and completeness of information contained in this material.

This material is distributed for general informational and educational purposes only and is not intended to constitute investment advice. The information, opinions and views contained herein have not been tailored to the investment objectives of any one individual, are current only as of the date hereof and may be subject to change at any time without prior notice. Nothing contained in this material should be construed as investment advice. Any reference to an asset’s past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit.

Any ideas or strategies discussed herein should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal objectives, needs and risk tolerance. The author who prepared this material and the information herein expressly disclaims any liability or loss incurred by any person who acts on the information, ideas or strategies discussed herein.

The information contained herein is not, and shall not constitute an offer to sell, a solicitation of an offer to buy or an offer to purchase any assets or securities, nor should it be deemed to be an offer, or a solicitation of an offer, to purchase or sell any investment product or service.