The Market

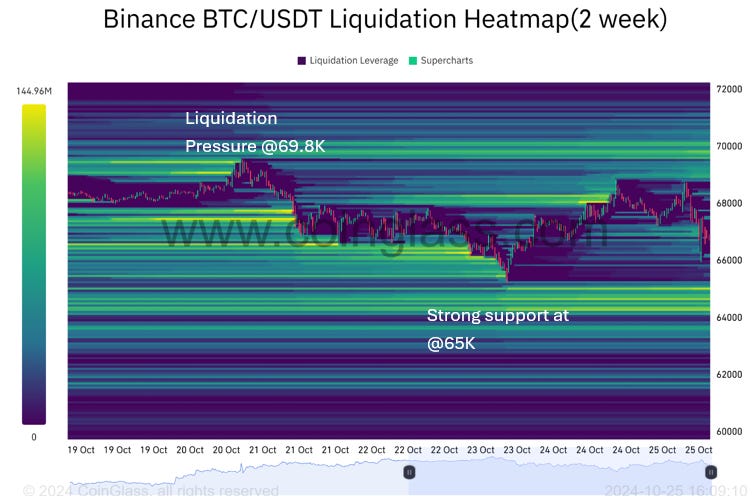

It’s been a volatile week for crypto and traditional assets, with just one week until the election. BTC failed to cross $70K after reaching a local high of $69.8K last Sunday, facing strong selling pressure as investors monetized gains close to BTC’s ATH. However, it also found solid support as the price dipped close to the $65K, ultimately ending the week making higher lows near $67K.

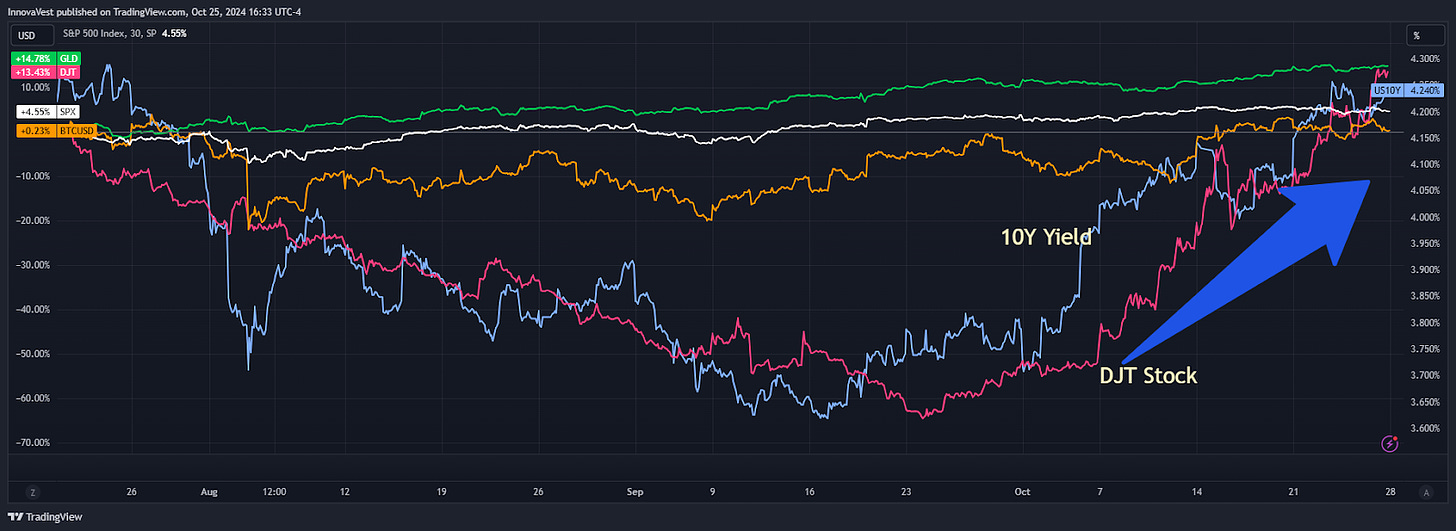

The two biggest Trump trade indicators – the 10Y yield and the DJT stock – have staged a substantial rally this October. As the election nears, both indicators show no signs of slowing down. DJT surged 28.3% this week, while the 10Y yield rose by 10 bps, reflecting the market expectations of increased inflation pressures under Trump’s tariff policies.

Global crypto ETP flow data has shown encouraging recovery signs, with inflows of more than $2B returning since Q3.

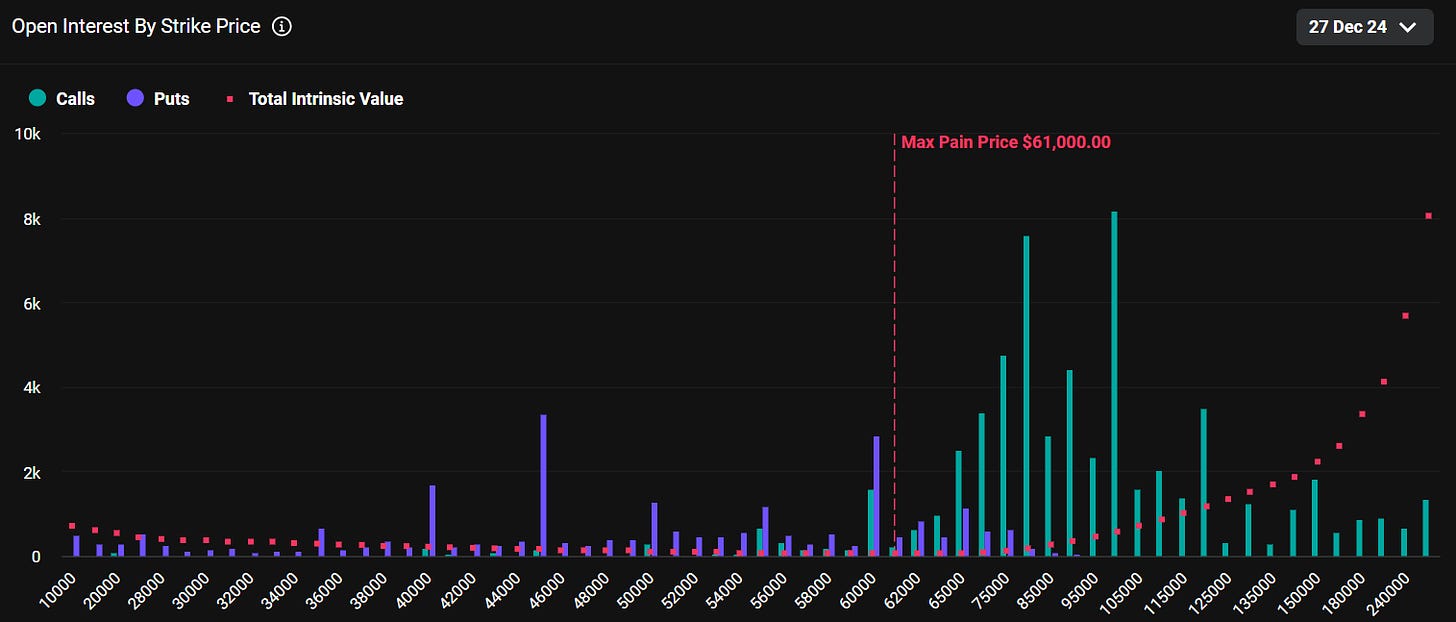

In the option market, some optimism surrounds BTC’s price post-election. The Dec27 expiry options have the highest open interest on Deribit among other tenors, with $5.7B open interest on calls and $1.7B open interest on puts. The largest concentration of open interest for calls is around $100K, reflecting market expectations of BTC’s year-end price.

Source: Deribit, 10/26/24

We can expect volatility to persist until the election settles. As mentioned before, crypto’s future doesn’t hinge solely on the next US president. However, one thing is certain: democracy thrives when we participate. So, dear readers, please remember to vote!

Source: Photo taken from World Trade Center, New York City

DeFi Update

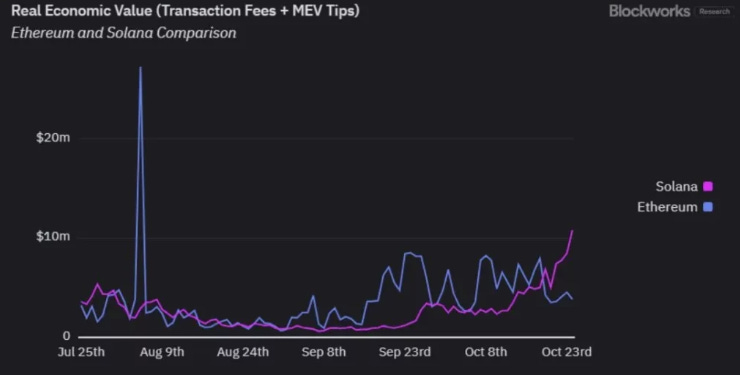

Solana’s network value is rising with the market’s recovery from the August low, reaching an ATH last week. Its economic value has again surpassed Ethereum, a feat last achieved in May of this year.

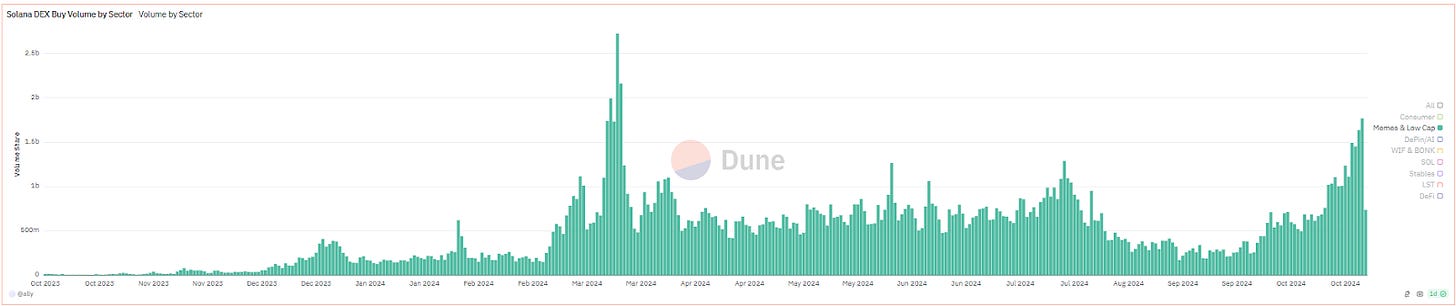

A significant driver of Solana’s network value increase is the higher trading volume on DEXes, with Raydium capturing a lion’s share. Raydium is well-positioned to capitalize on meme coin growth, as popular meme tokens launched on Pump.fun graduate to trade on it. Meme token trading volume has surged again, fueled by the recent launch of the popular GOAT token.

With this uptick in trading volume, Raydium has emerged as the top-performing Solana DEX, doubling its price since the August 5th market low. Despite the price rally, Raydium’s 7-day trading volume is comparable to Uniswap’s $10b but its market cap is less than one-fifth of UNI’s market cap. Unlike UNI token, which hasn’t activated a fee switch, RAY token holders participate in Raydium’s revenue through a token buyback mechanism and staking.

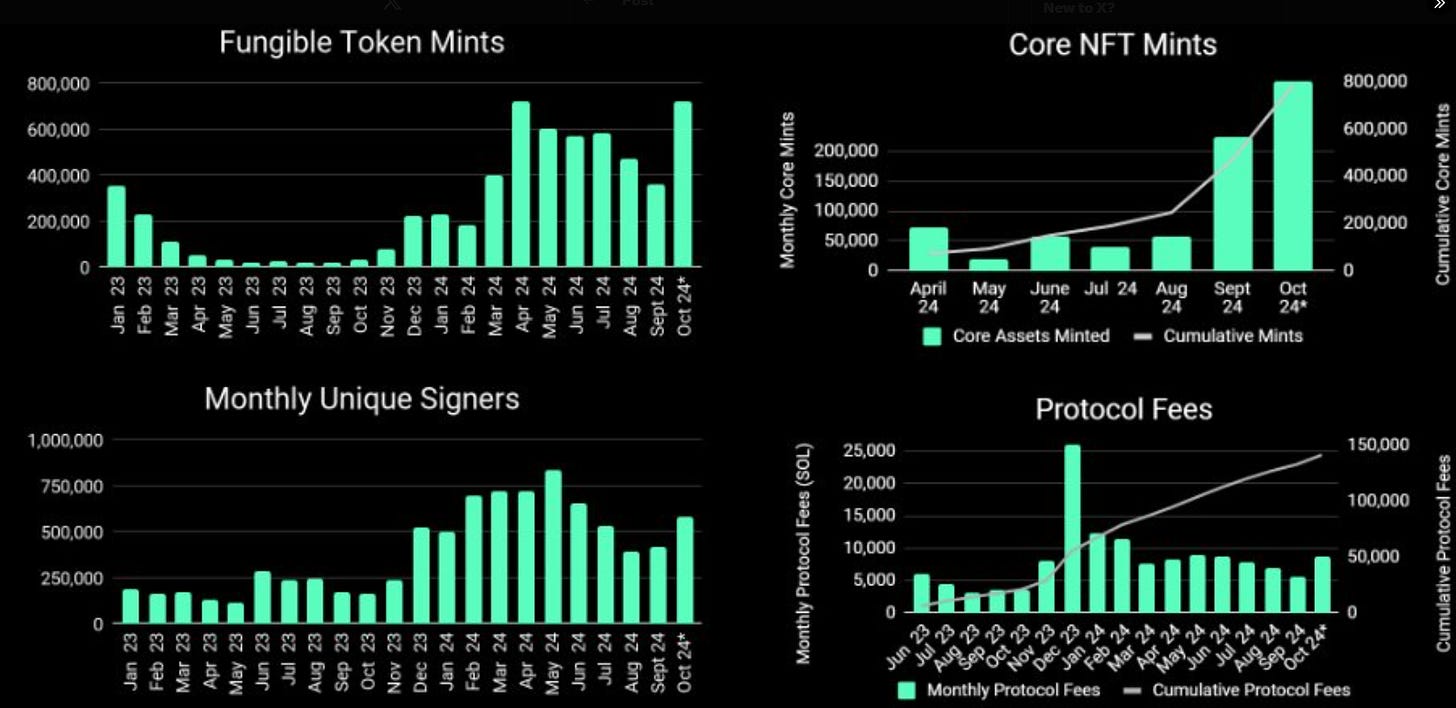

Metaplex is another beneficiary of Solana’s trading volume boom. Creators on Pump.fun use Metaplex’s Token Metadata standard to mint memecoins. As the meme frenzy returns, Metaplex’s fungible token mints have also reached a new ATH. In fact, Metaplex powers over 90% of all Solana fungible token issuance. Metaplex’ revenue is more diversified than just memes. As noted in our previous weekly, the launch of Metaplex Aura has positioned it as the infrastructure platform for all Solana dApps, offering a one-stop shop solution for token issuance, indexing, and data-availability.

The impressive growth of Metaplex's Core NFT mint, launched in April, is also noteworthy. Core simplifies and optimizes NFT structures on Solana, reducing the need for multiple accounts by storing all relevant data in a single account. This innovation leads to an 85% improvement in minting costs and computational efficiency.

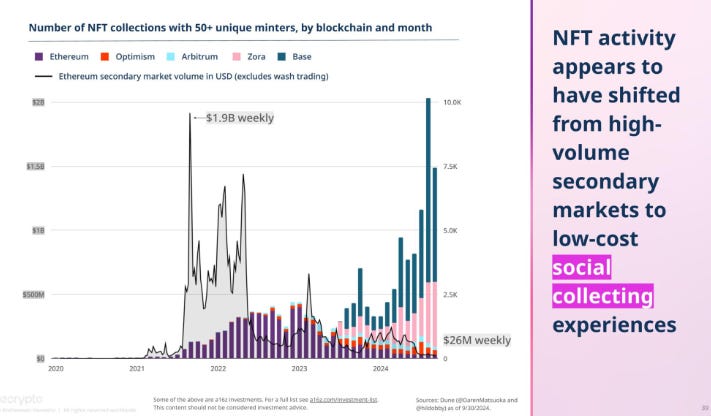

As a16z mentioned in its Stake of Crypto 2024 report, NFTs are shifting from one-off art collections to large-scale social collecting experiences. Metaplex’s Core NFT standard enables new experimentation with NFT’s utilities, such as user profiles for questing campaigns, on-chain domain names, on-chain subscriptions, and more. While memes might be a short-term driver of Solana’s growth, long-term innovations are progressing with teams like Metaplex, Helium, etc., further cementing Solana’s position as a leading consumer chain.

What can meme be

Top 100 MCAP Winners

Goatseus Maximus (+76.75%)

Safe (+53.38%)

Raydium (+44.06%)

ApeCoin (+41.86%)

Cat in a dogs world (+18.51%)

Top 100 MCAP Losers

Aerodrom Finance (-19.80%)

Notcoin (-17.99%)

Worldcoin (-17.60%)

Injective (-16.84%)

Floki (-16.14%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.