The Market

We received mixed macro data this week with the release of September inflation figures. The CPI rose by 0.2% month-over-month and 2.4% year-over-year, slightly higher than expected, but cooler from the 2.5% YoY rise in August. Meanwhile, the PPI remained flat, falling short of the 0.1% increase anticipated by forecasters.

On the growth front, there remains a divergence between the manufacturing and servicing sectors. The manufacturing PMI dipped below 50, signaling contraction, while the service PMI stayed above 50, indicating expansion.

With these mixed signals, the market is no longer pricing in any likelihood of more than a 1% rate cut for 2024. There is an 83.76% probability of a 1% rate cut, and a 16.24% chance of a 75bps rate cut over the course of the year.

Risky asset were largely undeterred by the mixed data, with S&P500 ending the week up 1.44%. BTC sold off as much as 6.4% during the week but recovered by the weekend. Meanwhile, the Chinese stock market has declined approximately 10%, erasing half of its recent gains as the market recalibrates expectations surrounding the impact of the stimulus package following the initial excitement. At a highly anticipated press conference this Saturday, the Chinese Finance Minister reiterated the government’s intention to significantly increase debt to revive the slowing economy, though the exact size of the stimulus package will not be confirmed until the National People's Congress (NPC) standing committee meeting in late October. Current estimates suggests a 7.5 trillion RMB stimulus package, which would surpass the 4 trillion RMB stimulus from the 2008-2009 global financial crisis. If delivered, this could significantly boost global liquidity, potentially benefiting crypto markets.

On the election front, Trump’s lead is widening, partly due to questions surrounding Kamala Harris’ 60 minutes interview. With less than a month until Election Day, we still anticipate a tight race. A Republican victory could give the crypto market a short-term boost in confidence, but given the substantial work done by the crypto super PAC – now the largest among all industries – we expect more crypto friendly policies from the new administration, regardless of who wins.

So where are we in the crypto cycle? If BTC’s post-halving performance serves as any guide, we may be on the cusp of an uptrend. If BTC follows a similar pattern to the 2016 or 2020 halving cycles, the price could reach ATH or more in the next quarter.

Source: CryptoQuant

DeFi Updates

Uniswap drew significant attention after announcing its plan to become an Ethereum L2 by joining the OP superchain ecosystem as “Unichain”. As an appchain, uniswap can lower transaction costs and achieve interoperability across all L2s within the OP superchain. Additionally, the UNI token gains new utility, as it will be used to secure the decentralized sequencer. Following the announcement, the token price surged by 10% within 24 hours.

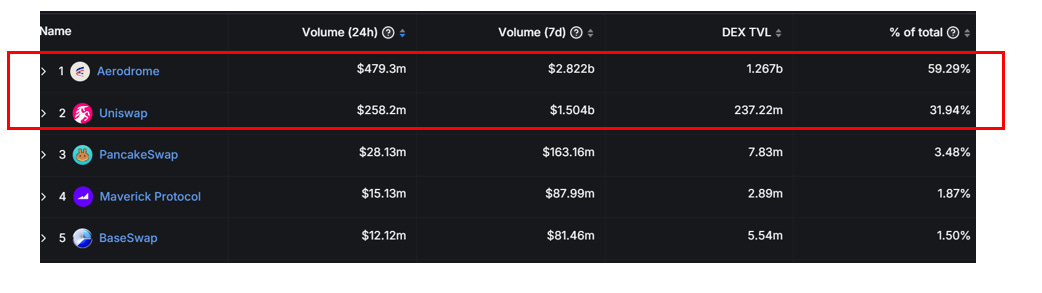

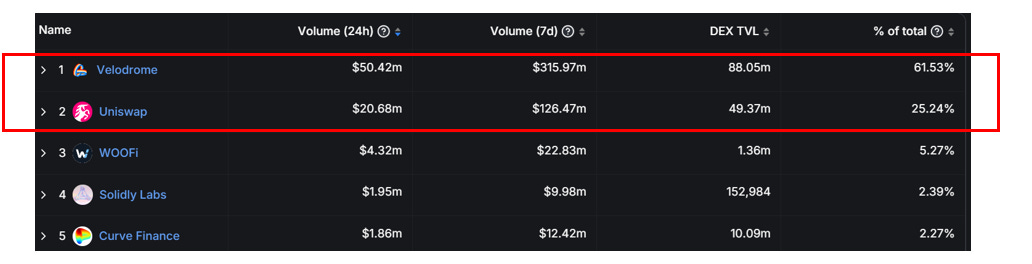

However, the leading DEX on the OP superchain is not Uniswap. Velodrome and Aerodrome, both developed by the same team and using the same trading mechanisms, have dominated trading volume and TVL on Optimism and Base, respectively, despite Uniswap’s early mover advantage and brand recognition.

Top 5 DEX on Base

Top 5 DEX on Optimism

Source: DeFiLlama

The main difference between Aerodrome/Velodrome and Uniswap lies in their economic incentive design. Taking Aerodrome as an example, token holders receive all trading fees by staking $AERO tokens, while LPs earn token emissions governed by an inflation schedule determined by locked AERO holders. Locked AERO holders can also assign their voting power to specific pools to boost AERO emissions, providing higher yields to incentivize LPs. In contrast, Uniswap passes on all the trading fees to LPs, while UNI token holders do not have a direct claim to these fees. Although the UNI token has governance power, discussions about fee switch have faced regulatory scrutiny and resistance from large VC stakeholders, given concerns that UNI token could be classified as a security by the SEC. Aerodrome and Velodrome avoid these regulatory challenges, as their tokens were launched without VC funding. Aerodrom’s incentive design aligns token holders’ interests, as they not only own the economics but also determine how to incentivize the liquidity providers.

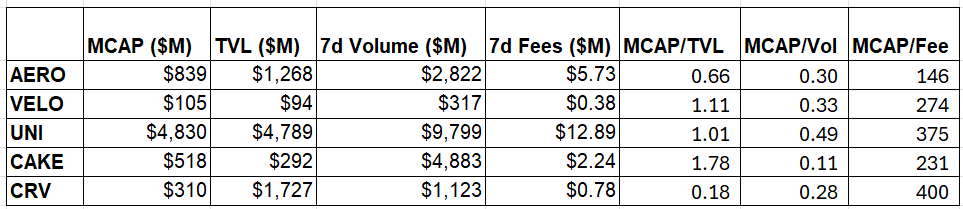

From a valuation perspective, $AERO looks attractive compared to other Ethereum based DEXes when comparing market cap to metrics like TVL, trading volume and fees generated.

Given Coinbase’s vision of bringing mainstream users on chain through Base, we believe Aerodrome is well-positioned to capture Base’s growth. With the launch of cbBTC by Coinbase, uSOL by Universal, and the availability of USDC and EURC on base, we see a clear path for Aerodrome to become the top platform to trade anywhere, anything on chain. With Coinbase Wallet’s powerful smart wallet interface and seamless on/off-ramp experience, trading on DEXs could become as smooth as CEXs, with the added benefit of self custody. We believe Aerodrome’s TAM could exceed that of Coinbase, as the latter faces stricter regulatory scrutiny. In fact, Aerodrome’s total trading volume reached ~$10B in September, while Coinbase’s spot trading volume was $46B, not a big gap to close, especially as Aerodrome operates with a much leaner cost structure compared to Coinbase.

Top 100 MCAP Winners

First Neiro on Ethereum (+119.98%)

SUI (+27.04%)

Popcat (+21.90%)

Dogwifhat (+19.10%)

Mog Coin (+18.80%)

Top 100 MCAP Losers

FTX Token (-20.33%)

Kaspa (-9.33%)

Wormhole (-7.55%)

Cosmos (6.35%)

Maker (-5.83%)

About Decentral Park

Decentral Park is a founder-led cryptoasset investment firm comprised of team members who’ve honed their skills as technology entrepreneurs, operators, venture capitalists, researchers, and advisors.

Decentral Park applies a principled digital asset investment strategy and partners with founders to enable their token-based decentralized networks to scale globally.

The information above does not constitute an offer to sell digital assets or a solicitation of an offer to buy digital assets. None of the information here is a recommendation to invest in any securities.

About the Author

Kelly is Portfolio Manager and Head of Research at Decentral Park Capital. Investing across sectors with a thesis driven, deep research approach.

Prior to this, Kelly has led research and product efforts at CoinDesk Indices and Fidelity Digital Asset Management. Kelly has been a TradFi investor for 15 years before joining the crypto space.

You can follow Kelly on Twitter and LinkedIn for more frequent analysis and updates.